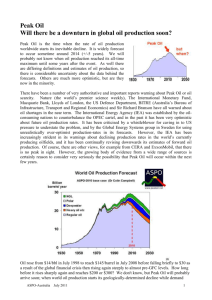

7. possible strategies of oil importing and exporting

advertisement