The time horizon of risky choice: Effects of delayed outcomes

advertisement

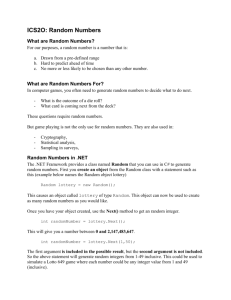

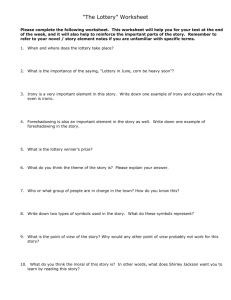

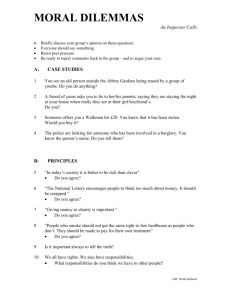

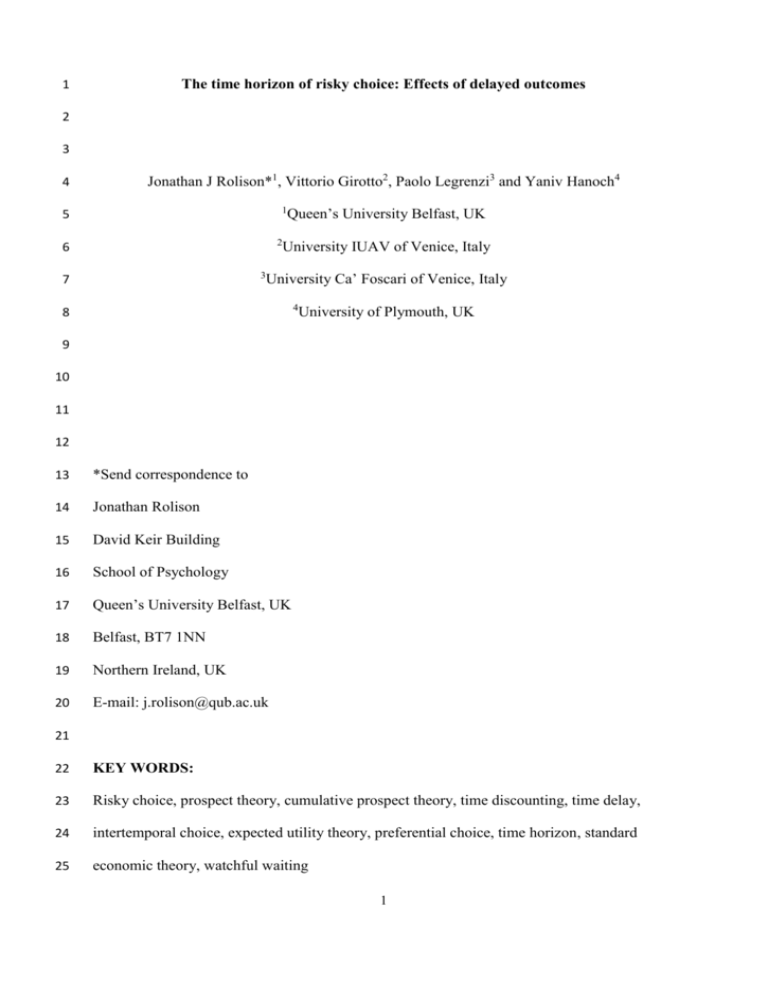

1 The time horizon of risky choice: Effects of delayed outcomes 2 3 4 Jonathan J Rolison*1, Vittorio Girotto2, Paolo Legrenzi3 and Yaniv Hanoch4 1 5 2 6 3 7 Queen’s University Belfast, UK University IUAV of Venice, Italy University Ca’ Foscari of Venice, Italy 4 8 University of Plymouth, UK 9 10 11 12 13 *Send correspondence to 14 Jonathan Rolison 15 David Keir Building 16 School of Psychology 17 Queen’s University Belfast, UK 18 Belfast, BT7 1NN 19 Northern Ireland, UK 20 E-mail: j.rolison@qub.ac.uk 21 22 KEY WORDS: 23 Risky choice, prospect theory, cumulative prospect theory, time discounting, time delay, 24 intertemporal choice, expected utility theory, preferential choice, time horizon, standard 25 economic theory, watchful waiting 1 26 27 ABSTRACT 28 Studies of risky choice centre on the decision maker’s evaluations of choice options at the 29 neglect of their time horizon. We demonstrate the importance of time horizon for risky choice 30 behavior by manipulating the delay of choice outcomes. Two hundred fifteen participants 31 made hypothetical choices between a sure amount and a lottery, offering either gain or loss 32 prospects. The sure amount, lottery outcome, both, or neither was delayed by one year to 33 investigate effects of time horizon on risky choices. Delaying a lottery outcome with respect 34 to a sure outcome reduced risk taking for gains and increased risk taking for losses by 35 reducing participants’ sensitivity to values and probabilities of outcomes, whereas delaying a 36 sure outcome with respect to a lottery outcome had opposite effects on choices by instead 37 increasing sensitivity to values and probabilities. Our findings demonstrate the importance of 38 time horizon for choices under uncertainty, and highlight a need for further research to 39 investigate effects of time horizon on risky choice behavior. 40 41 42 43 44 45 46 47 48 49 50 2 51 Imagine finding that your life savings invested in stocks have slumped in value. 52 Your financial advisor informs you of the odds that you might recover your losses 53 in one year from now if you hold onto your investments, but warns that you could 54 stand to lose an even larger amount. Your alternative is to sell your stocks 55 immediately, realising a loss to your savings (Problem 1). 56 57 There are two key aspects of Problem 1 relevant to the study of risky choice. First, the choice 58 options differ in their potential outcomes. Holding onto the stocks avoids a sure loss but 59 exposes the risk of losing an even larger amount. Second, the options differ in their time 60 horizon. Selling the stocks means realising an immediate loss to your savings, whereas 61 holding onto the stocks defers a potential loss to some point in the future. 62 Studies of risky choice centre on the decision maker’s evaluations of choice options 63 at the neglect of their time horizon. The standard economic view proposes that the decision 64 maker, a rational agent, endorses the choice option that yields the maximum expected utility 65 (von Neumann & Morgenstern, 1947; Savage, 1954). A number of findings inconsistent with 66 standard economic theory have led to alternative accounts of risky choice. Among the most 67 influential is cumulative prospect theory (CPT; Kahneman & Tversky, 1979; Tversky & 68 Kahneman, 1992), which proposes that prospects of gains and losses are evaluated separately 69 and in comparison with a reference point, such as current wealth. According to CPT, the 70 magnitude and probabilities of outcomes undergo transformations when the decision maker 71 evaluates choice options, where evaluations depend on subjective perceptions of the values 72 and probabilities of outcomes rather than the objective amounts. 73 A key advance of CPT is the coupling of decision weights for probabilities with 74 diminishing sensitivity to gains and losses, described by a value function. The decision 75 weights cause small probabilities to be overweighted and medium to large probabilities to be 3 76 underweighted. The value function, which is concave for gains and convex for losses, is 77 steeper for losses, displaying loss aversion. As a result, in situations similar to Problem 1, 78 people show a tendency to gamble on a riskier option (e.g. holding onto the depreciated 79 stocks) to avoid a sure loss, even when the safer option has a higher expected value 80 (Kahneman & Tversky, 1979). 81 There is good reason to believe, however, that time horizon is also involved in risky 82 choice behavior. Time horizon is commonplace in our everyday risky choices. Problem 1 83 illustrates how choice options can differ in their time horizon, such that a delayed outcome 84 might by evaluated differently in comparison to one that yields an immediate result. In the 85 same way that a savings account grows at a fixed rate of interest, standard economic theory 86 assumes that a delayed reward increases in value by fixed proportions as it approaches in 87 time (Fishburn & Rubinstein, 1982). Psychological research, however, has found the 88 subjective value of a delayed reward to increase at proportionally larger amounts as it 89 approaches in time (Green & Myerson, 2004; Kirby & Marakovic, 1996), and as a result, 90 preference for a larger delayed reward can switch to an immediate smaller reward as the 91 delay of the larger reward reduces. 92 Preference reversal for delayed rewards has its parallels in risky choice behavior 93 (Green, Myerson, & Ostaszewski, 1999; Prelec & Loewenstein, 1991; Rachlin, Raineri, & 94 Cross, 1991). As the probability of a gamble increases, initial preference for a larger reward 95 at a lower probability (e.g. a lottery) switches to preference for a smaller sure amount when 96 its riskier alternative increases in probability. This tendency occurs because decision weights 97 applied to probabilistic outcomes cause small probabilities to be overweighted, and medium 98 to large probabilities to be underweighted. Loewenstein and Prelec (1992) identified a 99 number of commonalities between risky and intertemporal choice, and the striking 100 similarity between discounting of probabilistic and temporal rewards has led some theorists 4 101 to propose that a single underlying psychological mechanism is involved (Rachlin et al., 102 1991; Rachlin, Logue, Gibbon, & Frankel, 1986). Keren and Roelofsma (1995) found that 103 preference reversal was reduced by introducing uncertainty to choice options. When 104 rewards were made probabilistic participants preferred a larger delayed reward even 105 when a smaller reward was immediate. The authors concluded that delay implies 106 uncertainty that a reward may never be received, and as such, that delay and 107 uncertainty are inter-changeable1. The gain/loss asymmetry in risky choice, in which 108 probabilistic gains are discounted more steeply than probabilistic losses, also has its 109 counterpart in preferential choice. While individuals would prefer a larger delayed payment 110 than make an immediate smaller payment, and would prefer a smaller immediate reward than 111 a larger delayed reward, losses are discounted less steeply than gains as a function of delay 112 (Estle, Green, Myerson, & Holt, 2006; Mitchell & Wilson, 2010). 113 Similarities between risky choice and time discounting suggest that the time horizon 114 of uncertain outcomes may influence choice behavior, even though studies of risky and 115 preferential choice have typically studied time delay and uncertainties in isolation (e.g. 116 Green & Myerson, 2004; Green et al. 1999; Tversky & Kahneman, 1992). In the present 117 study, we present participants choices between risky options whilst manipulating the time 118 horizon of outcomes. In some sets, participants choose between a sure gain (or loss) and a 119 lottery gain (or loss) in a similar form to Problem 1, with either the sure amount, lottery 120 outcome, both, or neither delayed. If individuals discount the value of delayed outcomes, then 121 we should expect that time horizon will (a) exacerbate risk taking behavior when a delay is 122 applied to the prospect of a loss, and (b) heighten risk aversion when the prospect of a gain is 123 delayed. 124 125 5 126 METHOD 127 Participants 128 Two hundred fifteen US participants (110 males, 105 females; mean age= 37.06; SD=13.32) 129 recruited via Amazon’s Mechanical Turk completed one of four versions of an online survey 130 designed to measure their choices under risk. The reliability of the participant pool provided 131 by Amazon’s Mechanical Turk has been established by comparisons with other methods of 132 human data collection (Paolacci, Chandler, & Ipeirotis, 2010). The majority of participants 133 indicated either high school (N=62 of 215; 28.8%) or college (N=113 of 215; 52.6%) as their 134 highest educational attainment, and just under half (N=102 of 215; 47.4%) indicated an 135 annual household income above 40,000 US dollars. 136 Design and Materials 137 Participants were presented a choice between a sure amount and a lottery for 115 gambles 138 divided into five gambling sets. Two of the gambling sets presented a choice between a sure 139 gain and a lottery gain of $100 with a low probability (p=.10) for one set and a high 140 probability (p=.90) for the other set. The sure amount increased in increments of $5 for each 141 of 21 gambles from $0 to $100. Two further sets were identical with the exception that the 142 sure amount and lottery referred instead to losses rather than to gains. In a fifth set gain and 143 loss prospects were mixed. Across 31 gambles participants were offered the option of a 144 lottery with a 50% chance of losing $50 and a 50% of gaining an amount, x, that incremented 145 on each gamble in steps of $20 from $0 to $600, and the option of receiving nothing. The 146 five gambling sets were presented in a random order for each participant. 147 Participants were randomly assigned to receive one of four versions of the survey 148 that asked for hypothetical choices between a sure amount (S) and a lottery (L), of which the 149 outcomes were either immediate (I) or delayed (D) by one year. For one group of participants 150 the five gambling sets referred to a sure amount and a lottery outcome that were both 6 151 available immediately (IS:IL; N=49). For a second group, both the sure amount and lottery 152 outcome were delayed by one year (DS:DL; N=55), and for a third and fourth group either 153 the sure amount (DS:IL; N=55) or lottery outcome (IS:DL; N=56) was delayed by one year. 154 Since the survey was administered online, we included an instructional manipulation 155 check developed by Oppenheimer and colleagues (2009) as a final item of the questionnaire. 156 This item identifies unmotivated participants who failed to pay close attention to instructions. 157 The item, which followed the demographic items, explained the importance of carefully 158 reading the study instructions for the experimental manipulations to be effective (see 159 Oppenheimer et al., 2009). The final section of the item requested that participants ignore the 160 first three choice options provided below the statement (which included “never”, “once per 161 week”, “more than once per week”), and instead write “yes” in the text box that followed the 162 choice options, alongside the label “other”. Data from the five participants (of 220 163 participants recruited) who failed to enter “yes” in the text box were not included in the 164 present study, confirming that participants generally were motivated to provide diligent 165 choices on the survey. 166 Procedure 167 We used cumulative prospect theory (CPT) to model participants’ risky choices 168 simultaneously across all five sets of gambles. Details of the CPT model are provided in the 169 Appendix. For each choice made by participants we calculated the probability, L, that they 170 would choose the lottery over the sure amount, S, (or the option of receiving nothing in the 171 mixed prospects set), where 172 173 174 and V equals the subjective expected value of each choice option (Luce, 1959). In Equation 1, 175 is a consistency parameter that estimates choice consistency, and could range in value from 7 176 0 to 10 (Pachur, Hanoch, & Gummerum, 2010 ; Rieskamp, 2008). A high value for the 177 parameter would indicate that participants were switching back and forth inconsistently 178 between choice options within gambling sets. We applied the maximum likelihood 179 approach for our model fitting and used the G2 measure to assess the goodness of fit of 180 the CPT model (Rieskamp, 2008), where 181 182 In Equation 2, fiP(L,S) = P(L,S) if the lottery was chosen on choice trial i and 1 - P(L,S) 183 if the sure option was chosen, based on the CPT model parameters. The best fitting CPT 184 parameter values were those that minimized Equation 2, where smaller values of G2 185 indicate better fit. We fitted the CPT model to the data separately for each of the four groups 186 of participants. 187 188 RESULTS For the gain and loss sets we calculated the amount of the sure option that was equivalent to 189 participants’ preference for the lottery. These certainty equivalents (CEs) measure risk taking 190 attitudes and are determined by the mid-point between gambles where a participant switches 191 from preferring the sure amount to the lottery for loss sets, or vice versa for gain sets2. The 192 mean group CEs are provided in Figure 1. The expected value of the lottery for each set 193 is indicated by the dotted horizontal line. Observing Figure 1, when the expected value 194 of the lottery was a $10 gain participants switched from the lottery to the sure amount 195 at $21.94, and when the expected value of the lottery was a $90 loss participants 196 switched from the sure amount to the lottery at $70.66, exhibiting risk seeking behavior 197 for low-probability gains and high-probability losses (Figure 1). In contrast, when the 198 expected value of the lottery a $90 gain participants switched from the lottery to the 199 sure amount at $65.25, and when the expected value of the lottery was a $10 loss 8 200 participants switched from the sure amount to the lottery at $19.30, exhibiting risk 201 averse behavior for high-probability gains and low-probability losses (Figure 1). Thus, 202 participants displayed the four-fold pattern predicted by prospect theory (Kahneman, 203 2011; Tversky & Kahneman, 1992), and this was the case for all four groups (Figure 1). 204 We conducted a four way mixed analysis of variance (ANOVA) on participants’ 205 CEs, including the time horizon of the sure outcome (immediate, delayed) and lottery 206 outcome (immediate, delayed) as between subjects factors, and the domain (gain, loss) 207 and probability (low probability, high probability) of outcomes as repeated measures. 208 We reversed the negative values for the CEs in the loss sets in our ANOVA in order to 209 make group comparisons between the gain and loss sets. The certainty equivalent of the 210 lottery was significantly higher in participants’ choices when the lottery outcome was 211 likely (M=67.96) than when it was unlikely (M=20.62), F(1,155)=748.82, p<.001, but did 212 not differ between gain and loss sets (gains, M=43.60; losses, M=44.98), F(1,155)=0.73, 213 p=.394. However, the domain and probability of outcomes interacted, F(1,155)=10.99, 214 p=.001. Follow-up ANOVA’s, conducted separately for low and high probability sets, 215 revealed that the certainty equivalent of the lottery was higher for potential losses 216 (M=70.66) than for potential gains (M=65.25) when the lottery outcome was likely, 217 F(1,174)=7.20, p=.008, but not when the lottery outcome was unlikely (gains, M=21.94; 218 losses, M=19.30), F(1,179)=0.88, p=.348. This indicates that participants were more risk 219 seeking for likely losses than they were risk averse for likely gains. 220 Time horizon affected participants’ risky choices. The certainty equivalent of 221 the lottery was reduced by delaying its outcome (immediate, M=49.94; delayed, 222 M=39.06), F(1,155)=31.67, p<.001, and was increased by delaying the sure amount 223 (immediate, M=37.91; delayed, M=51.09), F(1,155)=41.37, p<.001. The time horizon of 224 the lottery outcome interacted with choice domain, F(1,155)=7.91, p=.006. Follow-up 9 225 ANOVAs, conducted separately for the gain and loss sets, confirmed that the certainty 226 equivalent of the lottery was reduced by delaying its outcome for both gain sets, 227 F(1,185)=29.99, p<.001, and loss sets, F(1,168)=8.39, p=.004. However, follow-up 228 ANOVAs, conducted separately for immediate and delayed lottery outcomes, revealed a 229 significant difference between gain and loss sets for the delayed lottery outcome, 230 F(1,86)=9.66, p=.003, but not immediate lottery outcome, F(1,69)=1.36, p=.248, 231 indicating that delaying the lottery outcome had a greater effect on gains (immediate, 232 M=51.23; delayed, M=36.39) than on losses (immediate, M=48.65; delayed, M=41.74). 233 In the mixed prospects set participants were offered the option of a lottery with 234 a 50% chance of losing $50 and a 50% of gaining an amount, x, that incremented on 235 each gamble, and the option of receiving nothing. All four groups indicated an amount 236 that was significantly greater than $50 (IS:IL, M=154.13, t(45)=4.55, p<.001; DS:DL, 237 M=125.10, t(50)=3.83, p<.001; IS:DL, M=146.40, t(49)=3.85, p<.001; DS:IL, M=139.80, 238 t(49)=4.81, p<.001), displaying loss aversion for mixed prospects. A two-way 239 independent ANOVA conducted on participants’ CEs for the mixed prospects lottery, 240 including the time horizon of the sure outcome (immediate, delayed)3 and lottery 241 outcome (immediate, delayed) as between subjects factors, revealed that the amount of x 242 at which point participants found the lottery equally attractive to the option of receiving 243 nothing was unaffected by delaying the sure outcome, F(1,193)=0.68, p=.412, or lottery 244 outcome, F(1,193)=0.27, p=.606, and there were no significant interactions. 245 Provided in Table 1 are the best fitting cumulative prospect theory (CPT) parameter 246 values for each group. In order to make comparisons between groups, we held one of the 247 parameters constant for each between-group comparison in a second round of model fitting. 248 The reduction in model fit that result from constraining a parameter indicates differences 249 between the two groups on the respective parameter, and can be tested for significance using 10 250 the chi-square statistic (Table 1). This analysis revealed that time horizon affected 251 participants’ risk taking behavior by increasing their sensitivity to changes in the payoffs (α 252 and β parameters) and changes in the probabilities (γ and δ parameters) of gains and losses 253 when the sure outcome was delayed, and by decreasing their sensitivity to changes in payoffs 254 and probabilities of gains and losses when the lottery was delayed (Table 1). This pattern is 255 illustrated in Figure 2, which plots the probability that the lottery is chosen over the sure 256 amount based on the best fitting CPT parameter values for each group. Delaying the sure 257 amount made the lottery a more attractive option when the prospect was a potential gain, but 258 reduced its appeal when it presented a potential loss (Figure 2). 259 The effects of delaying a sure outcome on participants’ choices did not mirror 260 effects of delaying its riskier lottery alternative. Figure 2 suggests that delaying the prospect 261 of a sure gain (or loss) had a greater effect on participants’ preferences for the lottery than did 262 delaying the prospect of a lottery gain (or loss). To test this, we compared the ∆G2 values for 263 each parameter—the reduction in model fit between groups when a parameter is held 264 constant—for when a sure outcome was delayed with the ∆G2 values when the lottery was 265 delayed. These comparisons revealed that delaying the sure outcome had a greater impact on 266 increasing participants’ sensitivity to changes in payoffs (gains, χ2(1)=.61.17, p<.001; losses, 267 χ2(1)=.122.47, p<.001) and probabilities (gains, χ2(1)=.86.21, p<.001; losses, χ2(1)=.12.15, 268 p<.001) of outcomes than delaying the lottery outcome reduced them. Waiting for a sure loss 269 rather than risk losing more immediately on a lottery was a more attractive option to 270 participants than paying the sure amount now rather than wait for the outcome of the lottery 271 (Figure 2). 272 DISCUSSION 273 Despite similarities between risky choice and time discounting, studies of choice behavior 274 have typically studied the uncertainty and time horizon of choice options in isolation 11 275 (e.g. Green & Myerson, 2004; Green et al. 1999; Tversky & Kahneman, 1992). We found 276 presently that the time horizon of prospects influenced participants’ evaluations of choice 277 options. Delaying a lottery outcome with respect to a sure outcome reduced risk taking for 278 gains and increased risk taking for losses by reducing participants’ sensitivity to values and 279 probabilities of prospects, whereas delaying a sure outcome with respect to a lottery outcome 280 had opposite effects on risky choice by increasing sensitivity to the values and probabilities 281 of outcomes. This innocuous sounding result has important consequences for theoretical 282 accounts of risky choice. 283 Problem 1 presented a choice between selling depreciated stocks at an immediate 284 loss, and gambling on the prospect that the loss might be recovered, if the stocks are invested 285 for a longer term. Our results suggest that delaying the outcome of a riskier option (holding 286 onto depreciated stocks) could elicit extreme risk taking behavior. We found that participants 287 were more willing to bet on a gamble to avoid a sure loss when the outcome of the gamble 288 was deferred to the future. Thus, studies of risky choice using standard economic theory (von 289 Neumann & Morgenstern, 1947) and CPT (Tversky & Kahneman, 1992) may underestimate 290 risk seeking behavior for losses and underestimate risk aversion for gains by neglecting the 291 time horizon of prospects. 292 Participants displayed the four-fold pattern predicted by CPT, exhibiting risk 293 seeking behavior for low-probability gains and high-probability losses, and risk averse 294 behavior for low-probability losses and high-probability gains (Figure 1). Effects of time 295 horizon on risky choice behavior varied as a function of both the domain and 296 probabilities of outcomes (Figure 2). Participants showed a preference for a lottery win 297 over a smaller sure amount when the lottery outcome was unlikely, and this was 298 especially the case when the sure outcome was delayed (Figures 1 and 2). When a lottery 299 win was likely participants showed a preference for a smaller sure amount, but this 12 300 preference was almost entirely eliminated by delaying the sure amount. When the 301 lottery offered an unlikely loss participants preferred to lose a smaller amount with 302 certainty, which was heightened by delaying the sure loss. Instead, preference for a 303 lottery loss over a certain loss when the lottery outcome was likely was almost entirely 304 eliminated by delaying sure loss (Figure 1). These findings imply that effects of time 305 horizon depend on both the likelihood of outcomes and whether they refer to potential 306 gains or to potential losses. 307 Our current results suggest that time horizon is a key to risky choice behavior by 308 altering people’s evaluations of risky options. Preference reversal for delayed and 309 probabilistic rewards (Prelec & Loewenstein, 1991), and the gain/loss asymmetry observed 310 for preferential and risky choice (Mitchell & Wilson, 2010), has led some theorists to propose 311 that a single underlying mechanism is involved in discounting of probabilistic and temporal 312 rewards (Rachlin et al., 1991). Our results provide a demonstration that time horizon should 313 be integrated into models of risky choice behavior. 314 Time horizon has important implications for real-world risky choice. Radical 315 prostatectomy is a recommendation made by health care professionals for men diagnosed 316 with early prostate cancer (Wilt et al., 2012). ‘Watchful waiting’ is an alternative to 317 aggressive treatment that involves monitoring cancer growth, but implies a longer time 318 horizon. Potential costs and benefits of watchful waiting over immediate treatment has 319 received much recent attention, both in the medical literature (Wilt et al., 2012) and media 320 reports (Parker-Pope, 2012). Time horizon is likely an important aspect of both patients’ 321 decisions about treatment and physicians’ recommendations. In the financial domain, time 322 horizon is important for investment strategy. Individuals who have shorter investment time 323 horizons (e.g. saving for a mortgage down-payment) are encouraged by financial advisors to 324 invest less aggressively, and it is recommended that older adults be prudent in their 13 325 investments, for a loss to savings in later life could take many years to recover (Bernard, 326 2012). Recent studies report increased aversion to financial risk taking in older age (Rolison, 327 Hanoch, & Wood, 2012), and future research may seek to understand how time discounting 328 factors in financial risk taking of older adults who have shorter life time horizons than 329 younger individuals. 330 Time horizon is also central to policy making and may be a key to the climate 331 change debate. Some policy makers advocate a “wait-and-see” strategy for dealing with 332 climate change (Yohe, Andronova, & Schlesinger, 2004), and despite strong 333 recommendations by the scientific community for immediate action, long term negative 334 consequences of climate change are low on the list of concerns for the US general public 335 (Dunlap & Saad, 2001). As illustrated in Problem 1, a wait-and-see policy defers to the 336 future a potentially much larger cost that could be mitigated by immediate action. Our 337 current findings indicate that a wait-and-see policy for climate change may be 338 appealing because of the delayed time horizon of uncertain future costs. Immediate 339 action for climate change could be made more appealing if costs of immediate action 340 were re-framed in terms of long term savings. 341 Effects of extending the time horizon of sure outcomes in our study did not mirror 342 effects of delaying its lottery alternative, suggesting that time horizon has different effects on 343 certain and uncertain outcomes. Waiting for a sure loss rather than risk losing more 344 immediately on a lottery was more appealing to participants than realizing a sure loss now 345 rather than wait for the outcome of a lottery (Figure 2). Our analysis suggests that this 346 tendency did not result from a difficulty to interpret the time horizons of risky and riskless 347 outcomes. Delaying both types of outcomes together had minimal effects on participants’ 348 evaluations (Figures 1 and 2). It appears that discounting rates for sure amounts are steeper 349 than for risky prospects, which may reflect an adversity to uncertain events in the future with 14 350 a greater tolerance of sure events. Managing finances to meet a fixed debit at a fixed date in 351 the future is easier to accommodate than an unknown lottery outcome. 352 In conclusion, time horizon of outcomes is a key to risky choice behavior. Our 353 findings demonstrate the importance of time horizon for choices under uncertainty, and 354 highlight a need for further research to investigate effects of time horizon on risky choices. 355 356 357 358 359 360 361 362 363 364 365 366 367 368 369 370 371 372 373 374 15 375 REFERENCE LIST 376 Bernard, T. S. (2012, May). Getting to retirement with minimal financial risk. The New York 377 Times. Retrieved from http://www.nytimes.com/2012/05/19/your-money/managing- 378 risk-in-your-nest-egg-your-money.html?_r=1&src=me&ref=general. 379 Chapman, G. B., & Weber, B. J. (2006). Decision biases in intertemporal choice and choice 380 under uncertainty: Testing a common account. Memory and Cognition, 34, 589-602. 381 Dunlap, R. E., & Saad, L. (2001 April). Only one in four Americans are anxious about the 382 environment. Retrieved from http://www.gallup.com/poll/1801/only-one-four- 383 americans-anxious-about-environment.aspx 384 Estle, S. J., Green, L., Myerson J., & Holt, D. D. (2006). Differential effects of amount on 385 temporal and probability discounting of gains and losses. Memory & Cognition, 34 386 914-928. 387 388 389 390 Fishbum, P. C., & Rubinstein, A. (1982). Time preference. International Economic Review, 23, 677-694. Green, L., & Myerson, J. (2004). A discounting framework for choice with delayed and probabilistic rewards. Psychonomic Bulletin, 130, 769-792. 391 Green, L., Myerson, J., & Ostaszewski, P. (1999). Amount of reward has opposite effects on 392 the discounting of delayed and probabilistic outcomes. Journal of Experimental 393 Psychology: Learning, Memory, and Cognition, 25, 418-427. 394 395 396 397 398 399 Keren, G., & Roelofsma, P. (1995). Immediacy and certainty in intertemporal choice. Organizational Behavior and Human Decision Processes, 63, 287-297. Kahneman, D., & Tversky, A. (1979). Prospect theory: An analysis of decision under risk. Econometrica, 47, 263-292. Kirby, K. N., & Maraković, N. N. (1996). Delay-discounting probabilistic rewards: Rates decrease as amounts increase. Psychonomic Bulletin and Review, 3, 100-104. 16 400 401 Loewenstein, G., & Prelec, D. (1992). Anomalies in intertemporal choice: Evidence and an nterpretation. Quarterly Journal of Economics, 107, 573-597. 402 Luce, R. D. (1959). Individual choice behavior: A theoretical analysis. New York: Wiley. 403 Mitchell, S. H., & Wilson, V. B. (2010). The subjective value of delayed and probabilistic 404 outcomes: Outcome size matters for gains but not for losses. Behavioral Processes, 83, 405 36-40. 406 Oppenheimer, D. M., Meyvis, T., & Davidenko, N. (2009). Instructional manipulation 407 checks: Detecting satisficing to increase statistical power. Journal of Experimental 408 Social Psychology, 45, 867–872. 409 Pachur, T., Hanoch, Y., & Gummerum, M. (2010). Prospects behind bars: Analyzing 410 decisions under risk in a prison population. Psychonomic Bulletin and Review, 17, 630- 411 636. 412 Parker-Pope, T. (2012, July). Choosing ‘watchful waiting’ for prostate cancer. The New York 413 Times. Retrieved from http://well.blogs.nytimes.com/2012/07/23/choosing-watchful- 414 waiting-for-prostate-cancer/ 415 416 417 418 419 420 421 422 423 424 Paolacci, G., Chandler, J., & Ipeirotis, P. G. (2010). Running experiments on Amazon Mechanical Turk. Judgment and Decision Making, 5, 411-419. Prelec, D., & Loewenstein, G. (1991). Decision making over time and under uncertainty: A common approach. Management Science, 37, 770-786. Rachlin, H., Logue, A. W., Gibbon, J., & Frankel, M. (1986). Cognition and behavior in studies of choice. Psychological Review, 93, 33-45. Rachlin, H., Raineri, A., & Cross, D. (1991). Subjective probability and delay. Journal of the Experimental Analysis of Behavior, 55, 233–244. Rieskamp, J. (2008). The probabilistic nature of preferential choice. Journal of Experimental Psychology: Learning, Memory, & Cognition, 34, 1446-1465. 17 425 426 Rolison, J. J., Hanoch, Y. & Wood, S. (2012). Risky decision making in younger and older adults: The role of learning. Psychology and Aging, 27, 129-140. 427 Savage, L. J. (1954). The foundations of statistics. New York: Wiley. 428 Tversky, A., & Kahneman, D. (1992). Advances in prospect theory: Cumulative 429 430 431 432 representation of uncertainty. Journal of Risk and Uncertainty, 5, 297–323. Von Neumann, J., & Morgenstern, O. (1947). Theory of games and economic behavior (2nd ed.). Princeton, NJ: Princeton University Press. Wilt, T. J., Brawer, M. K., Jones, K. M., Barry, M. J et al. (2012). Radical prostatectomy 433 versus observation for localized prostate cancer. New England Journal of Medicine, 434 367, 203-213. 435 436 Yohe, G., Andronova, N., & Schlesinger, M. (2004). To hedge or not against an uncertain climate future? Nature, 306, 416-417. 437 438 439 440 441 442 443 444 445 446 447 448 449 18 Table 1 Best Fitting Cumulative Prospect Theory (CPT) parameter values for each group CPT Parameters Group α β γ δ λ IS; IL 0.684 0.719 0.575 0.636 0.889 DS; DL 0.681 0.722 0.628 0.711 0.783 IS; DL 0.586 0.637 0.485 0.611 0.675 DS; IL 1.178 1.336 2.772 0.758 0.152 φ 0.199 0.204 0.367 0.012 Mean G2 97.677 92.709 91.580 101.321 ∆G2(IS; IL vs. DS; DL) 0.029 0.035 4.206 6.833 3.917 0.041 P .864 .852 .040 .009 .048 .839 ∆G2(IS; IL vs. IS; DL) 15.286 7.084 19.438 1.266 7.573 23.219 P <.001 .008 <.001 .260 .006 <.001 ∆G2(IS; IL vs. DS; IL) 76.460 129.553 105.645 13.417 67.531 140.956 P <.001 <.001 <.001 <.001 <.001 <.001 450 Note. Α, β, γ, δ, λ, and φ, are the best fitting CPT parameters values based on participants’ choices 451 when either the lottery outcome (IS:DL), sure outcome (DS:IL), both (DS:DL), or neither (IS:IS) is 452 delayed. Α and β describe participants’ sensitivity to changes in the value of gains and losses, 453 respectively, whereas γ and δ describe participants’ sensitivity to changes in probabilities of gains 454 and losses. Λ measures loss aversion, and φ measures choice consistency. G2 is the model fit, and 455 ∆G2 is the reduction in model fit for each parameter when the parameter is held constant across 456 respective groups. P is the chi-square significance test for the ∆G2 value. 457 458 459 460 19 461 462 Figure 1. Mean group Certainty Equivalents (CEs) when either the lottery outcome (IS:DL), 463 sure outcome (DS:IL), both (DS:DL), or neither (IS:IL) is delayed for low (p = .10) and high 464 (p = .90) probability gain and loss sets. Dotted lines indicate the expected value of the lottery 465 for each set. Error bars represent 1 standard error above and below the mean. 466 467 468 469 470 20 471 21 472 473 Figure 2. The predicted probability that the lottery is chosen over the sure amount based on 474 the best fitting cumulative prospect theory (CPT) parameter values for each group. The 475 observed probabilities are the proportions of participants who chose the lottery over the sure 476 amount. The probabilities are plotted separately for each gambling set and separately for each 477 group, with either the lottery outcome (IS:DL), sure outcome (DS:IL), both (DS: DL), or 478 neither (IS:IL) delayed. 479 480 481 482 483 484 485 486 487 488 489 490 491 492 493 494 495 496 22 497 APPENDIX 498 Within cumulative prospect theory (Tversky & Kahneman, 1992), the subjective value of an 499 outcome, x, is identified by its value function 500 (A1) 501 where the curvature of the value function is determined separately for gains and losses by the 502 α and β parameters, respectively. Α and β were treated as free parameters to be fitted to 503 participants’ data, and were constrained to values greater than zero and <10, producing a 504 concave function for gains and a convex function for losses when below 1. Loss aversion is 505 captured by the λ parameter applied to the value function for losses, and was constrained to 506 values greater than 0 and <10, where values greater than 1 indicate loss aversion. 507 508 509 510 511 The decision weights, γ and 𝛿, transform the probabilities, px, for gains and losses, respectively, and identify the individual’s sensitivity to gains and losses, where: ; (A2) 512 . (A3) The γ and 𝛿 parameters were constrained to values above 0 and <10. For decision weights 513 smaller than 1, probabilities of rare events are overestimated, and moderate to likely events 514 are underestimated. The transformed probabilities, px, are used to assign subjective 515 probabilities to each choice prospect, such that the probability of an outcome, 516 517 (A4) ; 518 (A5) 519 520 . Probability weights for prospects refer either to gains, π+, or to losses, π-, and in Equations 521 A4 and A5 are determined by the difference between the probability of an outcome at least as 522 good or better than the outcome for gains, and the difference between the probability of an 523 outcome at least as bad or worse than the outcome for losses. 23 524 The subjective value, V(choice option), for each choice option is determined by 525 combining the subjective values and probability weights of each prospect, such that 526 527 The decision maker then chooses the option with the highest subjective expected value. 528 529 530 531 532 533 534 535 536 537 538 539 540 541 542 543 544 545 546 547 548 24 549 FOOTNOTES 550 1Chapman 551 choices in separate blocks of trials that referred to either monetary amounts or health 552 outcomes. While participants’ choices corresponded in the monetary and health 553 contexts, preference reversal in the intertemporal choice sets did not correspond with 554 biases in the risky choice sets. The authors concluded that similar biases in risky and 555 intertemporal choice have different underlying psychological mechanisms. and Weber (2006) asked participants to make uncertain and intertemporal 556 557 2Fifteen 558 sure amount and the lottery for at least one of the five gambling sets, compared with 15 559 of 55 (27%) participants in the DS:DL group, 14 of 56 (25%) participants in the IS:DL 560 group, and 21 of 55 (38%) participants in the DS:IL group. Across all four groups, 13 of 561 the total 215 (6%) participants switched inconsistently in the low probability gain set, 562 compared with 15 (7%) in the high probability gain set, 25 (12%) in the low probability 563 loss set, 26 (12%) in the high probability loss set, and 18 (8%) in the mixed prospects 564 set. Gambling sets that contained inconsistent switching were excluded from our 565 ANOVA. All data were included in our model analysis. of 49 (31%) participants in the IS:IL group switched inconsistently between the 566 567 3In 568 immediate and delayed outcomes are equivalent for the sure option. the mixed prospects set, the sure option is to receive nothing, and thus the 569 570 571 ACKNOWLEDGEMENT The authors would like to thank Swiss&Global-Ca’ Foscari Foundation for its support. 25