Donations Tax

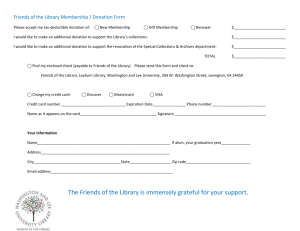

advertisement

Please Note: Version as at August 2009. Please check with our librarians help@lawlibrary.co.za if there have been any further revisions before relying on this. Applicable Regulations can be obtained from our librarians at help@lawlibrary.co.za 54. Levy of donations tax.—Subject to the provisions of section 56, there shall be paid for the benefit of the National Revenue Fund a tax (in this Act referred to as donations tax) on the value of any property disposed of (whether directly or indirectly and whether in trust or not) under any donation by any resident (in this Part referred to as the donor). [S. 54 amended by s. 37 of Act No. 85 of 1974 and by s. 20 of Act No. 103 of 1976 and substituted by s. 24 of Act No. 90 of 1988 and by s. 40 of Act No. 59 of 2000.] 55. Definitions for purposes of this Part.—(1) In this Part, unless the context otherwise indicates— “cumulative taxable value” . . . . . . [Definition of “cumulative taxable value” deleted by s. 25 (a) of Act No. 90 of 1988.] “donation” means any gratuitous disposal of property including any gratuitous waiver or renunciation of a right; “donee” means any beneficiary under a donation and includes, where property has been disposed of under a donation to any trustee to be administered by him for the benefit of any beneficiary, such trustee: Provided that any donations tax paid or payable by any trustee in his capacity as such may, notwithstanding anything to the contrary contained in the trust deed concerned, be recovered by him from the assets of the trust; “fair market value”, means— (a) the price which could be obtained upon a sale of the property between a willing buyer and a willing seller dealing at arm’s length in an open market; or (b) in relation to immovable property on which a bona fide farming undertaking is being carried on in the Republic, the amount determined by reducing the price which could be obtained upon a sale of the property between a willing buyer and a willing seller dealing at arm’s length in an open market by 30 per cent; [Definition of “fair market value” amended by s. 25 (b) of Act No. 90 of 1988 and substituted by s. 6 (1) (a) of Act No. 32 of 2005 with effect from the date of promulgation of that Act, 1 February, 2006 and applicable in respect of any donation which takes effect on or after that date.] “property” means any right in or to property movable or immovable, corporeal or incorporeal, wheresoever situated. (2) . . . . . . [Sub-s. (2) amended by s. 22 of Act No. 28 of 1997 and by s. 37 of Act No. 30 of 2000 and deleted by s. 6 (1) (b) of Act No. 32 of 2005 with effect from the date of promulgation of that Act, 1 February, 2006 and applicable in respect of any donation which takes effect on or after that date.] (3) For the purposes of this Part a donation shall be deemed to take effect upon the date upon which all the legal formalities for a valid donation have been complied with. 56. Exemptions.—(1) Donations tax shall not be payable in respect of the value of any property which is disposed of under a donation— (a) to or for the benefit of the spouse of the donor under a duly registered antenuptial or post-nuptial contract or under a notarial contract entered into as contemplated in section 21 of the Matrimonial Property Act, 1984 (Act No. 88 of 1984); [Para. (a) amended by s. 18 (a) of Act No. 90 of 1964 and substituted by s. 18 (1) of Act No. 96 of 1985.] (b) to or for the benefit of the spouse of the donor who is not separated from him under a judicial order or notarial deed of separation; [Para. (b) amended by s. 18 (b) of Act No. 90 of 1964.] (c) as a donatio mortis causa; (d) in terms of which the donee will not obtain any benefit thereunder until the death of the donor; (e) which is cancelled within six months from the date upon which it took effect; (f) made by or to or for the benefit of any traditional council, traditional community or any tribe referred to in section (10) (1) (t) (vii); [Para. ( f ) deleted by s. 32 (1) (a) of Act No. 113 of 1993 and inserted by s. 38 (1) (a) of Act No. 8 of 2007 deemed to have come into operation on 7 February, 2007 and applicable in respect of any donation made on or after that date.] (g) if such property consists of any right in property situated outside the Republic and was acquired by the donor— (i) before the donor became a resident of the Republic for the first time; or [Sub-para. (i) amended by s. 38 (a) of Act No. 85 of 1974 and substituted by s. 41 of Act No. 59 of 2000.] (ii) by inheritance from a person who at the date of his death was not ordinarily resident in the Republic or by a donation if at the date of the donation the donor was a person (other than a company) not ordinarily resident in the Republic; or [Sub-para. (ii) substituted by s. 21 of Act No. 113 of 1977.] (iii) out of funds derived by him from the disposal of any property referred to in sub-paragraph (i) or (ii) or, if the donor disposed of such last-mentioned property and replaced it successively with other properties (all situated outside the Republic and acquired by the donor out of funds derived by him from the disposal of any of the said properties), out of funds derived by him from the disposal of, or from revenue from any of those properties; or (iv) ...... [Sub-para. (iv) deleted by s. 45 (1) (a) of Act No. 31 of 2005 deemed to have come into operation on 8 November, 2005 and applicable in respect of any donation which takes effect on or after that date.] (v) ...... [Para. (g) substituted by s. 18 (c) of Act No. 90 of 1964. Sub-para. (v) deleted by s. 45 (1) (a) of Act No. 31 of 2005 deemed to have come into operation on 8 November, 2005 and applicable in respect of any donation which takes effect on or after that date.] (gA) ...... [Para. (gA) inserted by s. 33 of Act No. 89 of 1969 and deleted by s. 26 (a) of Act No. 90 of 1988.] (h) by or to any person (including any government) referred to in section 10 (1) (a), (b), (cA), (cE), (cN), (cO), (d) or (e); [Para. (h) substituted by s. 38 (b) of Act No. 85 of 1974, by s. 23 (a) of Act No. 96 of 1981, by s. 21 of Act No. 85 of 1987, by s. 28 of Act No. 141 of 1992, by s. 32 (1) (b) of Act No. 113 of 1993, by s. 38 (1) (a) of Act No. 30 of 2000 and by s. 38 (1) (b) of Act No. 8 of 2007 deemed to have come into operation on 1 April, 2007 and applicable in respect of any donation made on or after that date.] (i) ...... [Para. (i) amended by s. 26 (b) of Act No. 90 of 1988 (English only) and deleted by s. 38 (1) (b) of Act No. 30 of 2000 with effect from 15 July, 2001 and applicable in respect of any donation made on or after that date.] ( j) ...... [Para. ( j) amended by s. 26 (c) of Act No. 90 of 1988 (English only) and deleted by s. 38 (1) (b) of Act No. 30 of 2000 with effect from 15 July, 2001 and applicable in respect of any donation made on or after that date.] (k) as a voluntary award— (i) the value of which is required to be included in the gross income of the donee in terms of paragraph (c), (d) or (i) of the definition of “gross income” in section 1; or (ii) the gain in respect of which must be included in the income of the donee in terms of section 8A, 8B or 8C; [Para. (k) substituted by s. 28 of Act No. 121 of 1984 and by s. 45 (1) (b) of Act No. 31 of 2005 deemed to have come into operation on 26 October, 2004.] (l) if such property is disposed of under and in pursuance of any trust; (m) if such property consists of a right (other than a fiduciary, usufructuary or other like interest) to the use or occupation of property used for farming purposes, for no consideration or for a consideration which is not an adequate consideration, and the donee is a child of the donor; (n) on or after the seventeenth day of August, 1966, by any company which is recognized as a public company in terms of section 38; [Para. (n) added by s. 25 (1) of Act No. 55 of 1966.] (o) where such property consists of the full ownership in immovable property, if— (i) such immovable property was acquired by any beneficiary entitled to any grant or services in terms of the Land Reform Programme, as contemplated in the White Paper on South African Land Policy, 1997; and (ii) the Minister of Land Affairs or a person designated by him has, on such terms and conditions as such Minister may in consultation with the Commissioner prescribe, approved the particular project in terms of which such immovable property is so acquired; [Para. (o) added by s. 38 (c) of Act No. 85 of 1974, deleted by s. 4 (1) of Act No. 30 of 1984 and added by s. 39 (1) of Act No. 30 of 1998 deemed to have come into operation on 27 April, 1994 and applicable in respect of any donation made on or after that date.] (p) ...... [Para. (p) added by s. 31 (1) (a) of Act No. 94 of 1983 and deleted by s. 18 (1) (a) of Act No. 36 of 1996.] (q) ...... [Para. (q) added by s. 45 (1) of Act No. 60 of 2001 and deleted by s. 35 (a) of Act No. 74 of 2002.] (r) by a company to any other company that is a resident and is a member of the same group of companies as the company making that donation. [Para. (r) added by s. 35 (b) of Act No. 74 of 2002 and substituted by s. 56 (1) of Act No. 45 of 2003 and by s. 38 (1) of Act No. 32 of 2004 with effect from the date of promulgation of that Act, 24 January, 2005 and applicable in respect of any donation which takes effect on or after that date.] (2) Donations tax shall not be payable in respect of— (a) so much of the sum of the values of all casual gifts made by a donor other than a natural person during any year of assessment as does not exceed R10 000: Provided that where the year of assessment exceeds or is less than 12 months, the amount in respect of which the tax shall not be payable in terms of this paragraph shall be an amount which bears to R10 000 the same ratio as that year of assessment bears to twelve months; [Para. (a) substituted by s. 23 (b) of Act No. 96 of 1981, amended by s. 31 (1) (b) of Act No. 94 of 1983, substituted by s. 26 (d) of Act No. 90 of 1988 and amended by s. 24 (1) (a) of Act No. 30 of 2002.] (b) so much of the sum of the values of all property disposed of under donations by a donor who is a natural person as does not during any year of assessment exceed R100 000; [Para. (b) amended by s. 13 (1) of Act No. 101 of 1978 and by s. 31 (1) (c) of Act No. 94 of 1983, substituted by s. 26 (d) of Act No. 90 of 1988 and by s. 18 (1) (b) of Act No. 36 of 1996 and amended by s. 24 (1) (b) of Act No. 30 of 2002, by s. 27 (1) of Act No. 9 of 2006, by s. 2 (2) (b) of Act No. 8 of 2007 deemed to have come into operation on 1 March, 2007 and applicable in respect of any year of assessment commencing on or after that date.] (c) so much of any bona fide contribution made by the donor towards the maintenance of any person as the Commissioner considers to be reasonable. 57. Donations by a body corporate at the instance of any person.—(1) If any property is disposed of under any donation by any body corporate at the instance of any person, that property shall for the purposes of this Part be deemed to be disposed of under a donation by that person: Provided that any tax paid or payable by that person in respect of any property so disposed of under a donation by any body corporate may be recovered from the assets of that body corporate. (2) For the purposes of subsection (1) property shall be deemed to be disposed of under a donation by any body corporate at the instance of any person if, having regard to the circumstances under which that donation was made by such body corporate, the Commissioner is of the opinion— (a) that it was not made in the ordinary course of the normal income earning operations of that body corporate; and (b) that the selection of the donee who benefited by the donation was made at the instance of that person. [S. 57 amended by s. 22 of Act No. 88 of 1965 and by s. 27 of Act No. 90 of 1988 and substituted by s. 26 of Act No. 21 of 1995.] 57A. Donations by spouses married in community of property.—For the purposes of this Part, in the case of spouses married in community of property, where any property is disposed of in terms of a donation by one of the spouses and— (a) such property falls within the joint estate of the spouses, such donation shall be deemed to have been made in equal shares by each spouse; and (b) such property was excluded from the joint estate of the spouses, such donation shall be deemed to have been made solely by the spouse making the donation. 58. Property disposed of under certain transactions deemed to have been disposed of under a donation.—(1) Where any property has been disposed of for a consideration which, in the opinion of the Commissioner, is not an adequate consideration that property shall for the purposes of this Part be deemed to have been disposed of under a donation: Provided that in the determination of the value of such property a reduction shall be made of an amount equal to the value of the said consideration. [Sub-s. (1) (previously s. 58) renumbered by s. 39 (a) of Act No. 32 of 2004.] (2) Where a person disposes of a restricted equity instrument, as defined in section 8C, under the circumstances contemplated in section 8C (5) (a) or (b), that restricted equity instrument shall for the purposes of this Part be deemed to have been donated by that person at the time that it is deemed to vest for the purposes of section 8C and to have a value equal to the fair market value of that instrument at that time: Provided that in the determination of the value of that restricted equity instrument a reduction shall be made of an amount equal to the value of any consideration in respect of that donation. [Sub-s. (2) added by s. 39 (b) of Act No. 32 of 2004 and amended by s. 46 of Act No. 31 of 2005.] 59. Persons liable for the tax.—The person liable for donations tax shall be the donor: Provided that if the donor fails to pay the tax within the period prescribed in subsection (1) of section sixty the do 60. Payment and assessment of the tax.—(1) Donations tax shall be paid to the Commissioner within three months or such longer period as the Commissioner may allow from the date upon which the donation in question takes effect. [Sub-s. (1) substituted by s. 39 of Act No. 85 of 1974 and by s. 46 of Act No. 60 of 2001.] (2) Where a donor has during the year of assessment disposed of property under more than one donation in respect of which an exemption may be applicable under the provisions of section 56 (2) (a) or (b), the amount to be exempted in respect of any such donation shall be calculated according to the order in which such donations took effect. [Sub-s. (2) substituted by s. 28 of Act No. 90 of 1988.] (3) Where a donor has disposed of property under more than one donation on the same date those donations shall for the purpose of determining the tax payable in respect of each donation be deemed to have taken effect— (a) in such order as the donor may elect; or (b) if the donor fails to make an election within fourteen days after having been called upon by the Commissioner to do so, in such order as the Commissioner may determine. (4) The payment of the tax in terms of subsection (1) shall be accompanied by a return in such form as may be prescribed by the Commissioner. (5) The Commissioner may at any time assess either the donor or the donee or both the donor and the donee for the amount of donations tax payable or, where the Commissioner is satisfied that the tax payable under this Part has not been paid in full, for the difference between the amount of the tax payable and the amount paid, but the payment by either of the said parties of the amount payable under such assessment shall discharge the joint obligation. 61. Extension of scope of certain provisions of Act for purposes of donations tax.— For the purposes of the donations tax— (a) any reference in subsection (1) or (2) of section seventy-four, paragraph (c) or (d) of subsection (1) of section seventy-five or paragraph (a) or (e) of the definition of “representative taxpayer” in section one to the income of any person or to the gross income received by or accrued to or in favour of any person shall be deemed to include a reference to property disposed of by any person under a donation or to the value of such property, as the context may require; (b) the reference in subsection (2) of section seventy-four to any person entitled to or in receipt of any income shall be deemed to include a reference to any person who has disposed of property under a donation; (c) the reference in section seventy-eight to the taxable income in relation to which any return or information is required shall be deemed to include a reference to the value of any property disposed of under a donation in relation to which the return or information is required; (d) the reference in paragraphs (b) and (c) of the definition of “representative taxpayer” in section one to the income under the management, disposition or control of an agent or to income the subject of any trust, as the case may be, shall be deemed to include a reference to any property disposed of under a donation which is under the management, disposition or control of the agent or to property disposed of under a donation which is the subject of the trust, as the case may be; (e) the reference in subsection (1) of section ninety-five to the income to which a representative taxpayer is entitled in his representative capacity, or of which in such capacity he has the management, receipt, disposal, remittance, payment or control shall be deemed to include a reference to any property disposed of under a donation of which a representative taxpayer in his representative capacity has the management, receipt, disposal, remittance, payment or control, and the reference in the said subsection to income received by or accruing to or in favour of such a person beneficially shall be deemed to include a reference to property disposed of by such a person in his own right under a donation; (f) the reference in subsection (1)bis of section ninety-five to the income received by or accrued to any deceased person during his lifetime shall be deemed to include a reference to any property disposed of by the deceased person under any donation during his lifetime, and the reference in the said subsection to income received by or accrued to or in favour of a representative taxpayer beneficially shall be deemed to include a reference to property disposed of by the representative taxpayer in his own right under a donation; [Para. ( f ) added by s. 25 of Act No. 90 of 1962.] (g) the reference in section 96 (2) to the taxable income of any deceased person shall be deemed to include a reference to the value of property disposed of by such person under any donation; [Para. (g) added by s. 25 of Act No. 90 of 1962 and substituted by s. 29 of Act No. 90 of 1988.] (h) any reference in section 76 to taxable income of a taxpayer is deemed to include a reference to the value of any property disposed of by that taxpayer under a donation. [Para. (h) added by s. 57 of Act No. 45 of 2003.] 62. Value of property disposed of under donations.—(1) For the purposes of donations tax the value of any property shall be deemed to be— (a) in the case of any fiduciary, usufructuary or other like interest in property, an amount determined by capitalizing at twelve per cent. the annual value of the right of enjoyment of the property over which such interest was or is held, to the extent to which the donee becomes entitled to such right of enjoyment, over the expectation of life of the donor, or if such right of enjoyment is to be held for a lesser period than the life of the donor, over such lesser period; [Para. (a) amended by s. 8 (a) of Act No. 114 of 1977.] (b) in the case of any right to any annuity, an amount equal to the value of the annuity capitalized at twelve per cent. over the expectation of life of the donor, or if such right is to be held by the donee for a lesser period than the life of the donor, over such lesser period; [Para. (b) amended by s. 8 (b) of Act No. 114 of 1977.] (c) in the case of a right of ownership in any movable or immovable property which is subject to a usufructuary or other like interest in favour of any person, the amount by which the fair market value of the full ownership of such property exceeds the value of such interest, determined— (i) in the case of a usufructuary interest, by capitalizing at twelve per cent. the annual value of the right of enjoyment of the property subject to such usufructuary interest over the expectation of life of the person entitled to such interest, or, if such right of enjoyment is to be held for a lesser period than the life of such person, over such lesser period; [Sub-para. (i) amended by s. 8 (c) of Act No. 114 of 1977.] (ii) in the case of an annuity charged upon the property, by capitalizing at twelve per cent. the amount of the annuity over the expectation of life of the person entitled to such annuity, or, if it is to be held for a lesser period than the life of such person, over such lesser period; or [Sub-para. (ii) amended by s. 8 (c) of Act No. 114 of 1977.] (iii) in the case of any other interest, by capitalizing at twelve per cent such amount as the Commissioner may consider reasonable as representing the annual yield of such interest, over the expectation of life of the person entitled to such interest, or, if such interest is to be held for a lesser period than the life of such person, over such lesser period; [Sub-para. (iii) amended by s. 8 (c) of Act No. 114 of 1977.] (d) in the case of any other property, the fair market value of such property as at the date upon which the donation takes effect: Provided that in any case in which, as a result of conditions which in the opinion of the Commissioner were imposed by or at the instance of the donor, the value of any property is reduced in consequence of the donation, the value of such property shall be determined as though the conditions in terms of which the value of the said property is reduced in consequence of the donation, had not been imposed. (1A) Where any company not quoted on any stock exchange owns immovable property on which bona fide farming operations are being carried on in the Republic, the value of such immovable property shall, in so far as it is relevant for the purposes of determining the value of any shares in such company, be determined in the manner prescribed in the definition of “fair market value” in section 55 (1). [Sub-s. (1A) inserted by s. 36 of Act No. 101 of 1990.] (2) For the purposes of paragraphs (a) and (c) of subsection (1) the annual value of the right of enjoyment of a property means an amount equal to twelve per cent. upon the value of the full ownership of the property which is subject to any fiduciary, usufructuary or other like interest: Provided that— (a) where the Commissioner is satisfied that the property which is subject to any such interest could not reasonably be expected to produce an annual yield equal to 12 per cent on such value of the property, the Commissioner may fix such sum as representing the annual yield as may seem to him to be reasonable, and the sum so fixed shall for the purposes of paragraphs (a) and (c) of subsection (1) be deemed to be the annual value of the enjoyment of such property; [Para. (a) amended by s. 8 (d) of Act No. 114 of 1977 and substituted by s. 23 (1) of Act No. 28 of 1997 and by s. 33 (b) of Act No. 53 of 1999.] (b) where the property which is subject to any such interest consists of books, pictures, statuary or other objects of art, the annual value of the right of enjoyment shall for the purposes of paragraph (a) of subsection (1) be deemed to be the average net receipts (if any) derived by the person entitled to such right of enjoyment of such property during the three years immediately preceding the date on which the donation took effect. [Sub-s. (2) amended by s. 8 (d) of Act No. 114 of 1977.] (3) Where for the purposes of subsection (1) any calculation is required to be made over the expectation of life of any person, such calculation shall, in the case of a person who is not a natural person, be made over a period of fifty years. (4) If the Commissioner is of the opinion that the amount shown in any return as the fair market value of any property is less than the fair market value of that property, he or she may fix the fair market value of that property, and the value so fixed is, subject to the provisions of section 63, deemed for the purposes of this Part to be the fair market value of such property. [Sub-s. (4) substituted by s. 7 (1) of Act No. 32 of 2005 with effect from the date of promulgation of that Act, 1 February, 2006 and applicable in respect of any donation which takes effect on or after that date.] (5) In fixing the fair market value of any property in terms of subsection (4), the Commissioner shall have regard inter alia— (a) to the municipal or divisional council valuation (if any) of such property; (b) to any sworn valuation of such property furnished by or on behalf of the donor or the donee; and (c) to any valuation of such property made by any competent and disinterested person appointed by the Commissioner. 63. Objection and appeal.—The decision of the Commissioner in the exercise of his discretion under section 57 (2), section 62 (1) (c) (iii), the proviso to section 62 (1) (d) or section 62 (2) (a) or 62 (4), and any determination by the Commissioner under section 55 (2) (g) of the value of the mineral rights attaching to any property, shall be subject to objection and appeal. [S. 63 substituted by s. 34 of Act No. 53 of 1999 and by s. 47 of Act No. 60 of 2001.] 64. Rate of donations tax.—The rate of the donations tax chargeable under section 54 in respect of the value of any property disposed of under a donation shall be 20 per cent of such value. [S. 64 substituted by s. 30 of Act No. 90 of 1988 and amended by s. 19 (1) of Act No. 36 of 1996 and by s. 17 (1) of Act No. 5 of 2001 applicable in respect of property disposed of under a donation which takes effect on or after 1 October, 2001.]