A. Residential Rates - Southern California Gas Company

advertisement

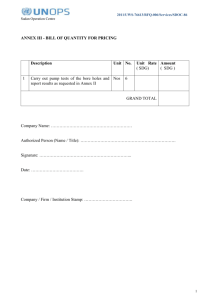

1 Application No: A.08-02-001 Exhibit No.: 2 Witness: Jason Bonnett 3 4 ) 5 In the Matter of the Application of San Diego Gas & ) 6 Electric Company (U 902 G) and Southern California ) Gas Company (U 904 G) for Authority to Revise ) ) 7 Their Rates Effective January 1, 2009, in Their Biennial Cost Allocation Proceeding. ) 8 ) A.08-02-001 (Filed February 4, 2008) 9 10 11 12 13 PREPARED DIRECT TESTIMONY OF JASON BONNETT 14 15 SAN DIEGO GAS & ELECTRIC COMPANY 16 AND 17 SOUTHERN CALIFORNIA GAS COMPANY 18 19 20 21 22 23 24 25 26 27 28 BEFORE THE PUBLIC UTILITIES COMMISSION OF THE STATE OF CALIFORNIA October 6, 2008 1 TABLE OF CONTENTS 2 Page 3 I. QUALIFICATIONS .................................................................................................. 1 4 II. PURPOSE .................................................................................................................. 1 5 III. SUMMARY ............................................................................................................... 1 6 IV. COST ALLOCATION ............................................................................................... 4 7 A. B. 8 9 10 C. 11 12 V. CORE RATE DESIGN .............................................................................................. 6 A. B. C. D. E. F. 13 14 15 16 17 Overview .......................................................................................................... 4 Non-Margin Costs ............................................................................................ 5 1. Regulatory Account Amortizations ........................................................ 5 2. SoCalGas Costs....................................................................................... 5 3. Other Operating Costs............................................................................. 5 4. Core De-Averaging ................................................................................. 6 Completed Revenue Requirements .................................................................. 6 G. Residential Rates .............................................................................................. 6 Residential Baseline Allowances ..................................................................... 6 Submeter Credits .............................................................................................. 7 Liquefied Natural Gas Service Rates ............................................................... 7 Residential NGV Rates..................................................................................... 8 Core C/I Rates .................................................................................................. 8 1. Consolidation of customer charges ......................................................... 9 2. Elimination of seasonality in rates ........................................................ 10 NGV Rates...................................................................................................... 10 18 VI. NONCORE RATE DESIGN ................................................................................... 11 19 Separate Rates for Transmission and Distribution Services ........................... 11 Noncore C/I Distribution Rates ...................................................................... 11 1. Replacement of Noncore Transmission service .................................... 11 21 2. Consolidation of customer charges ....................................................... 11 3. Elimination of seasonality in rates ........................................................ 12 22 4. Combining MPS and HPS rates ............................................................ 12 C. EG Rates ......................................................................................................... 12 23 VII. OTHER RATES ....................................................................................................... 13 24 A. Firm Access Rights (FAR) ............................................................................. 13 25 B. Public Purpose Program Rates ...................................................................... 13' 20 26 27 A. B. VIII. LRMC RATES ......................................................................................................... 14 APPENDICES A, B, AND C 28 -i- 1 PREPARED DIRECT TESTIMONY OF JASON BONNETT 2 3 I. QUALIFICATIONS 4 My name is Jason Bonnett. My business address is 8330 Century Park Court, San Diego, 5 California, 92123-1530. 6 I am employed by San Diego Gas & Electric Company (SDG&E) as a Principal 7 Regulatory Economic Advisor in the Regulatory Policy & Analysis Department of SDG&E and 8 Southern California Gas Company (SoCalGas). My primary responsibilities include analytical 9 support for rate design proposals prepared in regulatory rate filings and exhibits related to natural 10 gas proceedings before the California Public Utilities Commission (Commission). 11 I received a Bachelor of Science degree in Business Administration from Mankato State 12 University in 1992, a Juris Doctorate from Hamline University School of Law in 1995, and a 13 Master of Arts degree in Public Administration from Hamline University in 1997. 14 From May 1998 to July 2007, I was employed as a Public Utilities Rates Analyst by the 15 Minnesota Office of Energy Security with various responsibilities including: reviewing and 16 providing comments on natural gas utility filings on behalf of the Office of Energy Security 17 before the Minnesota Public Utilities Commission. In July 2007, I assumed my current position. 18 Since that time, I have performed analyses for the purpose of preparing advice letters before this 19 Commission. 20 II. PURPOSE 21 The purpose of my testimony is to present SDG&E’s proposed natural gas transportation 22 rates. The proposed rates rely upon embedded cost (EC) principles for allocating SDG&E’s 23 authorized base margin costs among customer classes as shown in the prepared direct testimony 24 of Mr. Emmrich and Ms. Hom. 25 III. SUMMARY 26 The proposed changes in SDG&E’s transportation rates are shown below in Table 1. 27 These are the class average transportation rates excluding the proposed charges for Firm Access 28 1 Rights (FAR). The FAR charge will be collected from core customers in the gas procurement 2 rate and from noncore customers through a separate bill. 3 4 Electric Generation Present $0.581 $0.290 $0.088 $0.037 System Total $0.188 5 Residential Core C&I 6 Noncore C&I Table 1 Class Average Rates $/therm Proposed $ Change $0.560 ($0.021) $0.276 ($0.014) $0.114 $0.026 $0.039 $0.002 % Change (4%) (5%) 30% 6% 7 8 9 $0.208 $0.020 11% In order to obtain a comparable rate with present rates, Table 2 has the FAR charge 10 included in the proposed transportation rates. 11 12 13 Residential Core C&I 14 Noncore C&I Electric Generation 15 System Total 16 Table 2 Class Average Rates Including FAR charge $/therm Present Proposed $ Change $0.581 $0.565 ($0.015) $0.290 $0.281 ($0.009) $0.088 $0.119 $0.031 $0.037 $0.044 $.0007 $0.188 $0.213 $0.025 % Change (3%) (3%) 36% 20% 13% The proposed rates reflect a decrease in the natural gas transportation revenue 17 requirement of $18,363,000 (approximately 6.8 percent). The primary drivers behind the lower 18 revenue requirement for SDG&E are distribution costs and regulatory accounts offset by an 19 increase in Company Use Fuel and unaccounted for gas (UAF). 20 Appendix A contains a complete set of rate tables using the embedded cost (EC) 21 allocation method which represents this proposal. This is the preferred case. Appendix B 22 contains a complete set of rate tables also using the EC allocation method; however, the present 23 revenue is derived using the present rate for each rate tier applied to the proposed volumes for 24 that tier. Appendix C contains a complete set of rate tables using the Long Run Marginal Cost 25 (LRMC) allocation method. This is the compliance case. 26 The rate results addressed herein are based on several inputs, including but not limited to 27 the proposed allocation of base margin costs to specific customer classes, the allocation of other 28 operating costs such as company-use fuel, the amortization of regulatory accounts to specific -2- 1 customer classes, and the class-specific demand forecasts sponsored by Mr. Emmrich. My 2 testimony completes the cost allocation process by adding the non-margin cost allocation results. 3 The cost allocation process utilizes various cost and demand forecasts to compute system 4 revenue requirements and allocates the revenue requirements among customer classes. The rate 5 design section of my testimony explains the development of specific unit charges to recover the 6 class-specific revenue requirements from customers based on proposed class throughput for the 7 cost allocation period. 8 The following lists the non-margin cost allocation and rate design proposals incorporated 9 in my testimony that are different from current practices. My testimony: 10 11 12 13 1) Reflects an EC allocation sponsored by Mr. Emmrich and Ms. Hom of authorized base margin costs in effect on January 1, 2008. 2) Reflects a proposed throughput forecast for a three-year period, January 2009 through December 2011. 14 3) Reflects rates consistent with the Commission’s FAR decision (D.06-12-031). 15 4) Modifies the rate design for GN-3 customers by: 16 one; and 17 18 19 20 21 reducing the applicable number of monthly customer charges from three to discontinuing the practice of charging seasonal rates. 5) Reflects a single set of “Sempra-wide” natural gas vehicle (NGV) rates applicable to both SDG&E and SoCalGas as discussed by Mr. Schwecke. 6) Modifies the rate design for noncore (GTNC) customers by: 22 replacing transmission level service; 23 reducing the applicable number of monthly customer charges from six to one; 24 25 discontinuing the practice of charging seasonal rates; and 26 replacing the current medium and high pressure system distribution level 27 service rates with a single set of rates for distribution level services. 28 -3- 1 7) Proposes to have 100% fully de-averaged Core rates by the end of the 3 year cost allocation period. 2 3 8) Reflects the recovery of transmission costs through a proposed transmission 4 level service (TLS) rate, which is applicable to all noncore customers of 5 SDG&E and SoCalGas served from the transmission system, regardless of 6 end-use, as sponsored by Mr. Schwecke. This rate provides noncore 7 customers served from the transmission system the option to choose either a 8 reservation or a volumetric rate. This rate is in addition to any FAR charges 9 incurred by a noncore customer. 10 9) Due to the proposed TLS rate, the “Sempra-wide” electric generation (EG) 11 rate applies to EG customers served from the distribution system. EG 12 customers served from the transmission system pay the proposed TLS rate 13 which is applicable to all customers of SDG&E and SoCalGas that are served 14 from the transmission system. 15 IV. COST ALLOCATION 16 A. 17 Cost allocation is a two-step process where an overall revenue requirement is developed Overview 18 and then allocated to specific customer classes. The revenue requirement broadly consists of two 19 primary cost categories, base margin and non-base margin (non-margin) costs. Base margin 20 costs include what is generally considered the utility’s authorized gas margin. The derivation 21 and allocation of SDG&E’s base margin cost among customer classes is sponsored by Mr. 22 Emmrich and Ms. Hom. 23 Non-margin costs (for ratemaking purposes) reflect other costs incurred by the utility to 24 provide basic transportation services to its customers during the forecasted cost allocation period. 25 These costs reflect, but are not limited to, regulatory account balance amortizations, core de26 averaging adjustments, and SoCalGas transportation and storage costs. 27 Except as noted in this testimony, the methods employed to develop and allocate non- 28 margin costs are consistent with the methods employed to develop the SDG&E transportation -4- 1 rates adopted in D.00-04-060, SDG&E’s most recent Biennial Cost Allocation Proceeding 2 (BCAP) decision. 3 B. Non-Margin Costs 4 Non-margin costs are aggregated into the following four categories: 5 Regulatory account amortizations; 6 SoCalGas costs; 7 Other operating costs; and 8 Core de-averaging. 9 10 1. Regulatory Account Amortizations Mr. Roy explains in his testimony the forecasted balances of regulatory accounts 11 amortized into rates. 12 13 2. SoCalGas Costs The SoCalGas costs allocated to SDG&E reflected in the present application are 14 consistent with the figures shown in the prepared direct testimony of Mr. Lenart. 15 16 3. Other Operating Costs Other non-margin costs include, but are not limited to, UAF costs, and company-use gas 17 (CU) costs. Both UAF and CU costs are currently allocated to customer classes on an equal 18 cents-per-therm (ECPT) basis, using Average Year Deliveries as adopted in SDG&E’s most 19 recent BCAP decision (D.00-04-060). SDG&E proposes to change the ECPT UAF methodology 20 based on a UAF study sponsored by Mr. Emmrich. The total level of UAF costs is forecasted to 21 be substantially higher than UAF costs currently recovered in rates. This increase is due to a 22 substantial increase in the forecasted level of gas commodity prices proposed in this filing 23 relative to those adopted in the last BCAP decision. UAF costs are developed using a simple 24 calculation of UAF volumes multiplied by the utility’s forecasted gas commodity price for the 25 cost allocation period. Gas quantities and commodity prices estimated for UAF are discussed in 26 the Demand Forecast testimony of Mr. Emmrich. 27 SDG&E will continue to recover CU costs in the transportation rate. Gas volumes for 28 CU are discussed in the testimony of Mr. Emmrich. -5- 4. 1 2 Core De-Averaging SDG&E’s residential and core C&I rates are currently 85.2% de-averaged. SDG&E 3 proposes to be 100% de-averaged by the end of the 3 year cost allocation period. The de4 averaging adjustment will be as follows each year of the cost allocation period: 5 Current = 85% de-averaged 6 Year 1 = 90.1% de-averaged 7 Year 2 = 95.1% de-averaged 8 Year 3 = 100% de-averaged 9 The proposal to be full de-averaged is being made in order to return to cost based rates. 10 The adjustment is being phased over the cost allocation period rather than in a single year in 11 order to maintain rate stability and less volatility in the residential and core C&I rates. 12 C. Completed Revenue Requirements 13 The non-margin cost allocation results are added to the results of the base margin cost 14 allocation to complete the transportation rate revenue requirements. The completed 15 transportation revenue requirements becomes the starting point for rate design calculations. 16 V. CORE RATE DESIGN 17 In this section, SDG&E updates its individual core tariff rates. This section describes 18 SDG&E’s proposed changes to current rate design methods. 19 A. Residential Rates 20 Current residential rates consist of a two-tiered usage structure: baseline (BL) and non- 21 baseline (NBL) volumetric rates. In an effort to promote energy conservation, California Public 22 Utilities Code section 739.7 mandates that the NBL rate must be higher than the BL rate. The 23 current tier differential between SDG&E’s BL and NBL bundled rates is a factor of 1.19 (i.e., the 24 NBL rate is 19 percent higher than the BL rate). SDG&E proposes no change to the current tier 25 differential between SDG&E’s BL and NBL bundled transportation rates. 26 B. Residential Baseline Allowances 27 SDG&E proposes no changes to baseline allowances in this proceeding. 28 -6- 1 C. Submeter Credits 2 Submeter credits apply to customers with a master meter that provides service to 3 residential sub-units (i.e., multi-family dwelling units and mobile home parks). SDG&E 4 proposes no changes to submeter credits in this proceeding. 5 D. Liquefied Natural Gas Service Rates 6 SDG&E continues to provide liquefied natural gas (LNG) service to approximately 310 7 customers who are residents of the Roadrunner Mobile Home Park located in the desert 8 community of Borrego Springs. The current rate design consists of two monthly customer 9 facility charges, one for domestic use and the other for non-domestic use, and a single volumetric 10 rate. The current LNG rates, which are based on the methodology adopted in SDG&E’s 1996 11 BCAP (D.97-04-082), reflect a design where the average combined LNG and electric bill to 12 these customers would not exceed the average Borrego Springs area all-electric bill. 13 SDG&E proposes to retain the Commission-approved rates from the 1999 BCAP. 14 However, doing so will cause the average combined LNG and electric bill to exceed the average 15 Borrego Springs area all-electric bill. Therefore, SDG&E proposes that the Commission modify 16 its requirement that the average combined LNG and electric bill not exceed the average Borrego 17 Springs area all-electric bill. The rationale for SDG&E’s proposal is twofold: 18 the commodity price of natural gas has substantially increased over recent 19 years, which properly reflects the cost of providing utility natural gas 20 services to residential customers; while, 21 the electric residential rates for usage up to 130% of baseline were capped 22 pursuant to Assembly Bill (AB) 1X effective February 1, 2001, which 23 artificially understates the cost of providing utility electric services to 24 residential customers. 25 Since the 1999 BCAP decision, the wholesale price of natural gas has increased from 26 $2.60 per decatherm in the 1999 BCAP to a forecasted $7.66 per decatherm, almost a threefold 27 increase since the last BCAP. The wholesale price of natural gas has been fully deregulated (i.e., 28 -7- 1 not subject to price caps) since 1993. Finally, both the gas baseline and non-baseline rates reflect 2 the full cost of the wholesale price of natural gas. 3 Conversely, electric residential “bundled” rates for usage up to 130% of baseline were 4 capped pursuant to California Assembly Bill (AB) 1X effective February 1, 2001. In subsequent 5 rate proceedings, the Commission has authorized rate increases to residential electric rates except 6 for residential usage up to 130% of baseline. 7 SDG&E contends that the electric price caps for LNG services provided to Borrego 8 Springs customers distort the results from bill capping under the current LNG rate formula by 9 increasing the subsidy paid by all other residential natural gas customers who do not use LNG 10 services. SDG&E concludes that its natural gas customers, who, again, do not use LNG services 11 in Borrego Springs should not be penalized by paying a larger share of costs associated with 12 delivery of LNG to Borrego Springs. It would be illogical to further distort utility rates by 13 increasing this cost subsidy by artificially reducing the current charges under Schedule GL-1 in 14 order to bring the average combined LNG and electric bill below the average all-electric bill. 15 The methodology established by the Commission in the 1996 BCAP decision has been 16 rendered unmanageable by recent events. Therefore, SDG&E proposes: 17 to retain the Commission-approved rates from the 1999 BCAP; and 18 that the Commission eliminate the requirement for the average combined 19 LNG and electric bill to not exceed the average Borrego Springs area all- 20 electric bill. 21 The effect of this proposal is to allow SDG&E to maintain the current Commission 22 approved rate structure. 23 E. Residential NGV Rates 24 SDG&E currently permits home refueling of natural gas vehicles through tariff page G- 25 NGVR. SDG&E does not propose to change the current rate design. 26 F. Core C/I Rates 27 SDG&E has a single tariff serving its core commercial customers: Schedule GN-3. 28 Presently, the GN-3 rate design consists of three tiers of customer charges and seasonal three- -8- 1 tiered declining block volumetric rates. The Tier 1 rate applies to customers that use 1,000 2 therms or less per month. Tier 2 rates apply to customers using 1,001 to 21,000 therms per 3 month and Tier 3 rates apply to customers using in excess of 21,000 therms per month. The 4 winter season is defined as December 1st through March 31st and the summer season is from th 5 April 1st through November 30 . 1. 6 7 Consolidation of customer charges SDG&E proposes to consolidate its current series of three customer charges into a single 8 customer charge of $10 per month. Currently, GN-3 Tier 1 customers pay a $5.58 monthly 9 customer charge, Tier 2 customers pay an $11.16 monthly customer charge and Tier 3 customers 10 pay a $111.61 monthly customer charge. 11 There are two main reasons for the change in the GN-3 customer charge. The first reason 12 is simplicity. One customer charge is easier for a customer to understand than multiple charges. 13 Furthermore, since all customers in this class will have the same charge, this proposal will end 14 any debate (and possible gaming) over whether or not a customer qualifies for a particular 15 charge. The second reason is that the current tiered volumetric rate structure, in tandem with a 16 single customer charge, continues to provide a similar “cost-based” price signal as does the 17 current rate structure with multiple customer charges. This is particularly true for larger-use 18 customers. Since the same cost-based price signals are provided under either customer charge 19 structure, SDG&E proposes a rate structure that has the fewest, and least confusing, customer 20 charges. 21 In theory, customer charges reflect the recovery of utility customer-related costs such as 22 meter reading, bill processing, and related services. These costs are, in general, unaffected by 23 changes in customer usage. Accordingly, if the goal is to match cost causation with rate 24 recovery (i.e., cost-based rates), then all non-variable costs should be recovered through fixed 25 charges. Moreover, a larger-use customer typically has a bigger meter and regulator set than 26 does a smaller-use customer. A larger meter and regulator set may require more sophisticated 27 meter reading and maintenance relative to a smaller-use customer. This would result in a higher 28 fixed charge to a larger-use customer than a smaller-use customer. -9- 1 One way to achieve cost-based fixed fees is to have multiple customer charges, with 2 higher charges for higher-use customers. Another way to achieve the same thing is to have a 3 single customer charge with declining block rates. For larger-use customers, the initial tiered 4 rate effectively becomes another fixed fee because these customers will always consume 5 volumes in excess of the initial tiered usage block. This is not the case for smaller-use 6 customers. At a minimum, while a smaller-use customer will always pay the monthly customer 7 charge, the larger-use customer will always pay the monthly customer charge plus the first tiered 8 rate charge. Therefore, the larger-use customer will pay “fixed fees” that are generally larger 9 than the “fixed fees” paid by a lower-use customer under a rate structure that consists of a single 10 customer charge and declining block rates. Thus, the concept of cost-based recovery of customer 11 costs (i.e., larger per unit costs for larger use customers) is preserved under the proposed rate 12 structure. 2. 13 Elimination of seasonality in rates 14 SDG&E proposes to simplify core C/I rates by eliminating the seasonal difference in rates. A 15 single set of declining block rates is easier for the customer to understand. 16 G. NGV Rates 17 SDG&E currently provides three types of “fully bundled” and “transport-only” NGV 18 services through tariff pages G-NGV and GT-NGV, respectively. The three types of services 19 are: 20 uncompressed gas; 21 compressed gas; and 22 co-funded stations. 23 Since there are no longer any co-funded NGV stations, SDG&E proposes to discontinue 24 the co-funded rate. SDG&E also proposes to create a set of “Sempra-wide” NGV rates (i.e., the 25 same tariff rates) applicable to both SDG&E and SoCalGas customers. Mr. Schwecke sponsors 26 the rationale for this proposal. 27 28 - 10 - 1 VI. NONCORE RATE DESIGN 2 In this section, SDG&E updates its individual noncore tariff rates. This section describes 3 specific changes to current rate design methods. 4 A. Separate Rates for Transmission and Distribution Services 5 As discussed in the testimonies of Mr. Lenart and Mr. Schwecke, SDG&E and SoCalGas 6 propose a TLS rate for all noncore customers served from the transmission system, regardless of 7 end-use. 8 B. Noncore C/I Distribution Rates 9 The current rate design consists of a series of six customer charges and seasonal 10 volumetric rates. Currently, there are three service level distinctions, medium-pressure 11 distribution service (MPS), high-pressure distribution services (HPS), and Transmission. 12 1. Replacement of Noncore Transmission service 13 As discussed above, SDG&E proposes to replace noncore transmission service. 14 15 2. Consolidation of customer charges SDG&E proposes to consolidate its current six customer charges into a single customer 16 charge of $350 per month. There are two main reasons for this change. The first reason is 17 simplicity. A single customer charge is easier for customers to understand than six. Further, 18 because all customers in this class would have the same charge, this proposal will end any debate 19 (and possible gaming) over whether or not a customer qualifies for a particular charge. The 20 second reason is that the proposed rate structure, in tandem with the customer charge, provides a 21 similar “cost-based” price signal as does the current rate structure with six customer charges. 22 Since the same cost-based price signals are provided under either customer charge structure, 23 SDG&E proposes a rate structure that has fewer customer charges. 24 The 2006 usage profile of SDG&E’s GTNC customers revealed that most customers paid rd th th 25 customer charges associated with the 3 , 4 , and 5 customer charge tiers, with roughly 68 th 26 percent of the customers falling in the $338 per month 4 tier customer charge tier. As such, the 27 current six-tier customer charge structure contains some customer charges that in reality are not 28 appropriate for any existing or expected GTNC customer. The proposed customer charge of - 11 - 1 $350 per month reflects a modest cost based relationship, because it is in the range of current 2 customer charges for GTNC customers and because it is similar to the customer charge that is 3 currently authorized by the Commission for use by SoCalGas. 3. 4 5 Elimination of seasonality in rates The seasonal differentiation of rates is a carryover of the state-wide rate design 6 established in 1988 to recognize different seasonal usage patterns and the different costs that 7 reflected storage service provided. However, since the utility no longer provides bundled storage 8 services to noncore customers, this seasonal rate differentiation is no longer required or 9 constructive. 4. 10 11 Combining MPS and HPS rates Combining MPS and HPS customers into a single rate simplifies the tariff rates and 12 addresses an anomaly of the current rate design that results in significant bill differences for 13 similarly situated customers due entirely to a service-level designation. There is a significant 14 discontinuity between the bills an MPS customer would pay and what a comparable (similar size, 15 operating equipment, load profile, etc.) HPS customer would pay for the same usage. This 16 difference is the result of whether or not the customer happens to be located near an MPS or HPS 17 hookup. Customers of similar usage located close to each other could pay very different rates 18 simply because one customer may be located next to an HPS instead of an MPS pipeline. 19 C. EG Rates 20 Due to the proposed TLS rate, the proposed “Sempra-wide” EG rate would only apply to 21 EG customers served from SDG&E’s distribution system. No other changes are proposed to the 22 EG rate design other than it will apply to and will only be derived from EG customers served 23 from the distribution system. 24 EG customers served directly from the transmission system will pay the proposed TLS 25 rate which is applicable to all customers of SDG&E and SoCalGas that are served directly from 26 the transmission system. 27 28 - 12 - 1 VII. OTHER RATES 2 A. 3 As discussed by Mr. Lenart, the FAR rate applies to all customers of SDG&E and Firm Access Rights (FAR) 4 SoCalGas. The rate is consistent with the Commission’s FAR decision (D.06-12-031). 5 B. Public Purpose Program Rates 6 While the Public Purpose Program (PPP) rate (i.e., G-PPPS) is no longer part of this 7 proceeding, the allocation of PPP costs among customer classes is. In this proceeding, SDG&E 8 proposes to remove the allocation of any costs comprising the G-PPPS rate from customer 9 classes that do not pay the G-PPPS rate. In the last BCAP, the Commission allocated certain 10 costs, such as Public Benefit Research Development & Demonstration program costs, to the EG 11 class. At that time, the PPP surcharge did not exist. PPP costs were recovered as part of gas 12 transportation rates. Pursuant to D.04-08-010, the Commission determined that PPP costs should 13 be recovered as a separate surcharge. Additionally, the Commission decided that EG rates would 14 be exempt from PPP surcharge rates. However, the Commission did not authorize a change in 15 the allocation of PPP costs among customer classes as set forth in SDG&E’s last BCAP decision. 16 Therefore, SDG&E currently has a situation where some PPP costs are being allocated to the EG 17 class but SDG&E is prohibited from recovering such costs from EG customers. 18 SDG&E’s proposal to remove the allocation of any costs comprising the G-PPPS rate 19 from customer classes that do not pay the G-PPPS rate will have minimal impact on the G-PPPS 20 rate for two reasons: 21 the $670,000 of costs currently being allocated to classes not paying G- 22 PPPS is minimal when compared to the $27,600,000 of total costs that are 23 currently allocated to the G-PPPS rate; and 24 this amount allocated to customers not paying G-PPPS rate is a “built-in” 25 under-collection in balancing accounts that is recovered from customers 26 that do pay the G-PPPS . 27 SDG&E’s proposal will allow SDG&E to correct a mismatch between the allocation of 28 PPP costs and the recovery of PPP costs from the various rate classes. - 13 - 1 VIII. LRMC RATES 2 The compliance case is attached in Appendix C. These are the transportation rates 3 resulting from an allocation of base margin items using the LRMC allocation method. The 4 LRMC allocation of base margin is discussed by Ms. Hernandez and Ms. Smith. 5 This concludes my prepared testimony. 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 - 14 - APPENDIX A Transportation Rate Tables Preferred Case APPENDIX B Transportation Rate Tables Present Revenue Shown as Present Rate * Proposed Volumes APPENDIX C Long Run Marginal Cost-Based Transportation Rate Tables Compliance Case