1. This note sets out the method used for estimating the revenue

advertisement

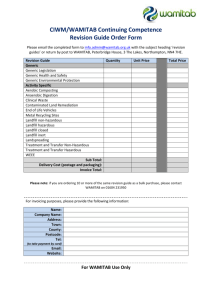

Government Expenditure and Revenue in Scotland (GERS) Revenue Estimates: Landfill Tax Methodology Used in GERS 2004/05 Introduction 1. This note sets out the method used for estimating the revenue raised in Scotland from Landfill Tax, as used for the estimates in the latest (2004/05) GERS publication. Description of Duty 2. Landfill Tax is a tax on the disposal of waste, paid on top of normal landfill fees. It aims to encourage waste producers to produce less waste and to recover more value from waste, for example through recycling or composting, and to use more environmentally friendly methods of waste disposal. Landfill Tax applies to all waste: disposed of by way of landfill at a licensed landfill site on or after 1 October 1996 unless the waste is specifically exempt. 3. Landfill Tax was introduced in 1996; £7 per tonne was levied on active waste going to landfill. The standard rate was increased to £10 per tonne from 1 April 1999, with a lower rate for inactive waste frozen at £2 per tonne. Inert waste used in the restoration of landfill sites and quarries was exempt from 1 October 1999. In the 1999 budget the landfill tax was placed on an "landfill escalator" of £1 per year until 2004. In 2003 this escalator was raised to £3 per year from 2005. 4. Currently the tax is charged by weight and there are two rates. Inert or inactive waste (such as rocks and soil) is subject to the lower rate (of £2 per tonne - increasing to £2.50 per tonne from April 2008). All other waste is subject to the standard rate- £24 per tonne in the 2007/08 tax year and increasing by £8 per tonne each year from April 2008 until at least 2010/11. 5. Tax. VAT applies to the full amount charged on a waste disposal, including the Landfill 6. Waste arising from the following activities is exempt subject to meeting certain conditions: - some dredging activities - quarrying and mining - pet cemeteries - reclamation of contaminated land Inactive waste used for landfill restoration and filling quarries is exempt subject to meeting certain conditions: - landfill restoration - filling quarries 7. Landfill operators can apply to have tax-free status for any part of a site that is not used for landfill, but for: - recycling waste - incinerating waste - sorting waste pending its disposal or transfer - storing inactive waste for use in landfill restoration - sorting material to obtain the above 8. Tax credits are available for waste that landfill operators send: - for recycling, incineration or reuse - to another landfill site Current Estimates 9. The latest published estimate for revenue raised in Scotland from Landfill Tax, in 2004/05, is £57 million, 8.5% of UK revenue. Table 1 £millions LandfillTax 1999-00 2000-01 2001-02 2002-03 2003-04 2004-05 UK 430 461 502 541 607 672 Scotland 37 40 43 46 52 57 Scotland/UK 8.7% 8.6% 8.6% 8.5% 8.5% 8.5% Figures are likely to be revised prior to the next GERS publication. Data Sources and Methodology 10. The UK revenue figure is obtained from National Accounts (DOLC). 11. Scotland’s proportion of the UK population (using mid-year population estimates) is applied to the UK revenue figure, to arrive at an estimate for the Scottish revenue from Landfill Tax. Summary 12. The above sets out the method used to estimate Scottish revenue from landfill tax in the latest GERS publication. The method will be subject to review prior to the next GERS publication. A consultation note is (or will be soon) available on the consultation section of the SG GERS website.