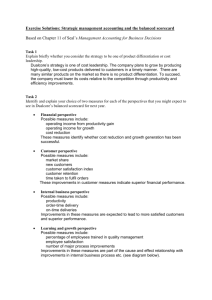

Behavioral & Organizational Issues in Management Accounting

advertisement