THEME 1: Current operation of purchase/sale

advertisement

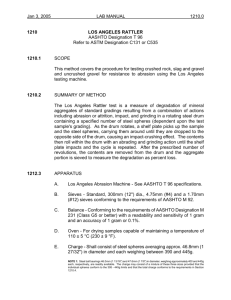

1 THEME 1: Current operation of purchase/sale. Statement of economic operation. The firm A sells to the firm B a goods for 1,000 Belgian Francs (out value added tax). The operation takes place 1st February 1997. The payment takes place by check the15th March 1997. 1st case: for the two firms the goods is a merchandise. 2nd case: for the firm A the goods is a finished product and for the firm B a raw material. 3rd case: for the firm A it concerns a service and for the firm B too. Work to make: Pass, in each case, in the book of current operations of the firm A and B. Belgian solution. 1st case. Book of the firm A 4000 7040 4511 Sales of goods 5500 4000 Collection of the check 1 / 2/ 97 Customers 1210 Sales of goods for resale VAT due 18 / 3 / 97 Current account-bank Customers 1000 210 1210 1210 Book of firm B 6040 4111 4400 Purchase of goods 4400 5510 5510 5500 Payment of the purchase of 1 / 2/ 97 1 / 2 / 97 Purchase of goods for resale VAT deductable Suppliers 15 / 3 / 97 Suppliers Issued cheques 18/3/97 Issued cheques Current account-bank 1000 210 1210 1210 1210 1210 1210 2 2nd case Book of firm A . 4000 7040 4511 Sales of finished products . 5500 4000 Collection of the check 1 / 2/ 97 Customers Sales of goods for resale VAT due 18 / 3 / 97 Currrent account-bank Customers 1210 1000 210 1210 1210 Book of the firm B . 6000 4111 4400 Purchase of raw materials . 4400 5510 5510 5500 Payment of the purchase of 1 / 2 / 97 1 / 2 / 97 Purchase of raw materials VAT deductable Suppliers 15 / 3 / 97 Suppliers Issued cheque 18/3/97 Issued cheque Current account-bank 1000 210 1210 1210 1210 1210 1210 3 3rd case Book of the firm A . 4000 7050 4511 Sales of services . 5500 4000 Collection of the check 1 / 2 / 97 Customers Services rendered VAT due 18 / 3 / 97 Current account-bank Costumers 1210 1000 210 1210 1210 Book of the firm B . 6100 4111 4400 Purchase of services . 440 5510 5510 5500 Payment of the purchase of 1 / 1 / 97 1 / 2 / 97 Services and other goods VAT deductable Suppliers 15 / 3 / 97 Suppliers Issued cheque 18 /3 / 97 Issued cheque Current account-bank 1000 210 1210 1210 1210 1210 1210 Commentary : In Belgian accountancy, it is a necessary to distinguish operations: purchase/sale of goods, case n 1, purchase of raw materials and sale of finished products, case n 2, purchase/sale of services, case n 3. Remarks: 1) to a sale of merchandise can correspond a purchase of raw material; and to a sale of finished product a purchase of merchandise. The normal VAT rate in Belgium is since 1/1/1996 21 %. 2) When a service is a part of a purchase (f.e. transport of purchased goods) we use the 6020 ‘Services and other goods’ in stead of the more general account 6100 ‘Services and other goods’. 4 TECHNICAL FORM OF THEME N 1: CURRENT OPERATION OF PURCHASE/SALE. Definition of loads. Loads include sums or poured values or to pour : in counterpart of goods, supplies, works or services consumed by the firm, as well as of advantages that it have been consented by legal obligation that the firm has to fill ; exceptionally, without conterpart. They include also, for the determination of the exercice result : endowments to depreciations, the accounting value of assets yielded, destroyed or disappeared. Current purchases. Evaluation. Purchases are registered to the debit of accounts 601 to 607 at the price of the purchase. The purchase price means the invoiced price, net of recoverable taxes, to which add notably customs duties to goods acquired. Purchases are put in account, suitable rebate deduced of the amount of invoices (from the initial invoice). Definition of products. Products understand sums or values receive or to receive : in counterpart of the supply by the firm of goods, works, services as well as of advantages it has given ; by legal obligation existing to the cost of a third firm ; exceptionally without counterpart. They understand equally, for the determination of the exercice result : the stocked production during the exercice ; the production immobilized ; resumption on depreciations ; the price of transfer of assets yielded ; transfers of load. Current products. Turn over. The accounting plan defines the turnover as the amount of sells realized by the firm with thirds during the exercice of its normal professional and usual activity either, according to the profit and loss statement, the amount out taxes of sales and the production less ‘discounts, allowances and rebeates allowed’ granted by the firm (account 708). 5 Extract from the ‘MINIMUM STANDARD CHART OF ACCOUNTS’ compulsory for every company Class 4: Amounts receivable and payable within 1 year: 4000 Customers 4111 VAT recoverable 4400 Suppliers 4511 VAT payable Additional explanation These are VAT-balance-accounts. For the regular VAT-transactions most companies use other sub-accounts. For instance: 4111 VAT deductible and 4511 VAT due. Class 5: Current investment and cash at bank and in hand 5500 Current account-bank 5510 Cheques issued Class 6: Charges 6000 Purchase of raw materials 6010 Purchase of consumables 6020 Purchases of services, works and studies 6030 General sub-contracting 6040 Purchase of goods for resale 6I00 Services and other goods Class 7: Income 70 Turnover 700-707 Sales and services rendered 708 Discounts, allowances and rebates allowed (-) Remark All digit codes may be extended according to specific wishes . Most companies choose for a fixed number of digit codes for all their accounts.