CHAPTER:4

advertisement

CHAPTER:4

RECONSTITUTION OF APARTNERSHIP FIRM

RETIREMENT /DEATH OF A PARTNER

Q.1 Distinguish between Sacrificing Ratio and Gaining Ratio.

Ans. 1

Basis

Sacrificing Ratio

(i) Meaning

Proportion in which old partners sacrifice their

share in favour of new partner.

(ii) Occasion

(iii) Formula

Sacrificing ratio is calculated at the time of

admission of new partner.

Sacrificing ratio = Old ratio – New ratio

Gaining Ratio

Proportion in which continuing partner

gain the share of outgoing partner on his

retirement.

Gaining ratio is calculated at the time of

retirement or death of a partner.

Gaining ratio – Old ratio

Q.2

Kamal, Kishore and Kunal are partners in a firm sharing profits equally. Kishore retires

from the firm. Kamal and Kunal decide to share the profits in future in the ratio 4:3.

Calculate the Gaining Ratio.

Ans. 2 Gaining Ratio = New ratio – Old ratio

Kamal’s Gain = 4/7 – 1/3 = 5/21

Kunal’s Gain = 3/7 – 1/3 = 2/21

Gaining Ratio = 5:2

Q.3

P, Q and R are partners sharing profits in the ratio of 7:2:1. P retires and the new profit

sharing ratio between Q and R is 2:1. State the Gaining Ratio.

Ans. 3 Old ratio

= P Q R

7: 2: 1

New ratio

=Q R

2:1

Gaining Ratio = New ratio – Old ratio

Q’s gain

= 2/3 – 2/10 = 14/30

R’s gain

= 1/3 – 1/10 = 7/30

Gaining Ratio = 14:7 or 2:1

Q.4

A, B and C are partners in a firm sharing profits in the ration of 2:2:1. B retires and his

share is acquired by A and C equally. Calculate new profit sharing ratio of A and C.

Ans. 4 A’s gaining share = 2/5 X ½ = 1/5

A’s new share = 2/5 + 1/5 = 3/5

C’s gaining share = 2/5 X ½ = 1/5

C’s New share = 1/5 + 1/5 = 2/5

New ratio of A and C = 3:2

Q.5

X, Y and Z are partners sharing profits in the ratio of 4/9, 1/3 and 2/9. X retires and

surrenders 2/3rd of his share in favour of Y and remaining in favour of Z. Calculate new

profit sharing ratio and gaining ratio.

Ans. 5

Y’s gaining share

Z’s gaining share

Y’s new share

Z’s new share

= 4/9 X 2/3 = 8/27

= 4/9 – 8/27 = 4/27

= Old share + gain

= 1/3 + 8/27 = 17/27

= 2/9 + 4/27 = 10/27

New Ratio

Gaining ratio

= 17:10

= 8/27 : 4/27 or 2:1

Q.6

X, Y and Z have been sharing profits and losses in the ratio of 3:2:1. Z retires. His share is

taken over by X and Y in the ratio of 2:1. Calculate the new profit sharing ratio.

Ans. 6

Old Ratio

=

3:2:1

Z Retire

X’s Gaining

= 1/6 X 2/3 = 2/18

X’s New share

= 3/6 + 2/18 = 11/18

Y’s Gaining

= 1/6 X 1/3 = 1/18

Y’s new share

= 2/6 + 1/18 = 7/18

New Ratio

= 11/18, 7/18 Or 11:7

Q.7

P, Q and R were partners in a firm sharing profits in 4:5:6 ratio. On 28-02-2008 Q retired

and his share of profits was taken over by P and R in 1:2 ratio. Calculate the new profit

sharing ratio of P and R.

Ans. 7 Old ratio

=PQR

= 4:5:6

Q retired

P’s gaining

= 1/3 X 5/15 = 1/9

P’s new share

= 4/15 + 1/9 = 17/45

R’s Gaining share

= 2/3 X 5/15 = 2/9

R’s new share

= 6/15 + 2/9 = 28/45

New Ratio

= 17:28

Q.8

Mayank, Harshit and Rohit were partners in a firm sharing profits in the ratio of 5:3:2.

Harshit retired and goodwill is valued at Rs 60000. Mayank and Rohit decided to share

future profits in the ratio 2:3. Pass necessary journal entry for treatment of goodwill.

Ans. 8 Rohit’s capital A/C

Dr. 24000

To Mayank’s capital A/C

6000

To harshit’s Capital A/C

18000

(Adjustment Entry for treatment of goodwill in gaining ratio.)

Q.9

Ramesh, Naresh and Suresh were partners in a firm sharing profits in the ratio of 5:3:2.

Naresh retired and the new profit sharing ratio between Ramesh and Suresh was 2:3. On

Naresh retirement the goodwill of the firm was valued at Rs. 120000. Pass necessary

journal entry for the treat.

Ans. 9 Suresh capital A/C

Dr. 48000

To Ramesh’s capital A/C

12000

To Naresh capital A/C

36000

(Goodwill adjusted among the gaining partner in gaining ratio.)

Q.10 L, M and O were partners in a firm sharing profits in the ratio of 1:3:2. L retired and the

new profit sharing ratio between M and O was 1:2. On L’s retirement the goodwill of the

firm was valued Rs. 120000. Pass necessary journal entry for the treatment of goodwill.

Ans. 10 O’s capital A/C

Dr. 40000

To C’s capital A/C

20000

To M’s capital A/C

20000

(Adjustment of goodwill in gaining partners in their gaining ratio.)

Q.11 State the journal entry for treatment of deceased partners share of profit for his life period

in the year of death.

Ans. 11 Profit and loss suspense A/C

To deceased partner’s capital A/C

Dr

Q.12 X, Y and Z were partners in a firm sharing profits and losses in the ratio of 3:2:1. The

profit of the firm for the year ended 31st March, 2007 was Rs. 3,00000. Y dies on 1st July

2007. Calculate Y’s share of profit up to date of death assuming that profits in the year

2007- 2008 have been accured on the same scale as in the year 2006-07 and pass

necessary journal entry.

Ans. 12 Total profit for the year ended 31st March 2007

=

Rs 300000

Y’s share of profit up to date of death

=

300000 X 2/6 X 3/12

=

25000

Profit and Loss suspense A/C

Dr. 25000

To Y’s capital A/C

25000

( Y’s share of profit transferred to Y’s capital A/C)

Q.13 A, B and C were partners in a firm sharing profits in 3:2:1 ratio. The firm closes its books

on 31st March every year. B died on 12-06-2007. On B’s death the goodwill of the firm

was valued at Rs. 60000. On B’s death his share in the profit of the firm till the time of

his death was to be calculated on the basis of previous years which was Rs.150000.

Calculate B’s share in the profit of the firm. Pass necessary journal entries for the

treatment of goodwill and B’s share of profit at the time of his death.

Ans. 13 Profit and Loss suspense A/C

Dr. 10000

To B’s capital A/C

10000

(B’s share of profit transferred to B’s capital A/C)

A’s capital A/C

Dr. 15000

C’s capital A/C

Dr. 5000

To B’s capital A/C

20000

(B’s share of goodwill transferred to B’s capital A/C and debited to remaining

partners capital A/C in their gaining ratio.)

B’s share of profit

B’s share of profit

=

=

=

=

Number of days from 1 April to 12th June 2007

73 Days

150000 X 1/3 X 73/365

Rs. 10000

Q.14 A, B and C were partners in a firm sharing profits in the ratio of 2:2:1. C dies on 31 st July,

2007. Sales during the previous year upto 31st march, 2007 were Rs. 6,00,000 and profits

were Rs. 150000. Sales for the current year upto 31st July were Rs. 250000. Calculate C’s

share of profits upto the date of his death and pass necessary journal entry.

Ans. 15 Profit & Loss suspense A/C

Dr. Rs. 12,500

To C’s capital A/C

Rs. 12,500

RETIREMENT OF PARTNER

6 to 8 marks

Q.1 The balance sheet of X, V, Z who was sharing profits in proportion of capital as follows :Particulars

Sunday creditors

Capitals

Amount Particulars

Amount

1,000 Cash at bank

25,000 Debtors

X

20,000 Less provision

Y

15,000

Z

67,000 Stock

P/M

11,500

Furniture

25,000

67,000

15,600

5,000

4,900

100

10,000

67,000

Y retires arid the following adjustment of the assets and liabilities has been made before the

ascertainment of the amount payable by the firm to Y

1.

That the stock be depreciated by 5%

2.

That the provision for doubtful debts be increased to 5% on debtors.

3.

That a provision of RS.750 be made in respect of outstanding legal charges.

4.

That the land and building be appreciated by 20%.

5.

That the goodwill of the entire firm be fixed at Rs. 16,200 and V share of the same be

adjusted into the account of X and Z (No good will account is to be raised)

6.

That X and Z decide to share future profits of the firm in equal proportions

7.

That the entire capital of the new firm at Rs. 48000 between X and Z in· equal proportion.

For

the purpose, actual cash is to be brought in or paid off.

You are required to prepare the revolution account; partner’s capital account and bank account and

revised balance sheet after V’s retirement also indicate the gaining rates.

Solution 1

Dr.

Revaluation A/c

Particulars

To stock A/c

To provision for doubtful debts a/c150

To outstanding

Legal charges

To profit transferred to

Capital A/c

X

1500

Y

1200

Z

900

Dr.

Rs. Assets

500 By land and building

Cr.

Rs.

5,000

750

3,600

5,000

Partner’s Capital Accounts

5,000

Cr.

Particulars

ARs.

B Rs.

C Rs. Particulars

To Y’s Cap A/c

1350

—

1050 By bal b/d

To Y’s loan A/c

-

2600

251150

-

To bal C/d

A Rs.

B Rs.

C Rs.

25,000 25,000 15,000

- By Rev. A/c

11850 By X’s Cap A/c

1500

1250

900

-

1350

-

-

4050

-

(G/W)

By X’s cap A/c

(G/W)

26500

26600

15900

26500 26600 15900

To bank A/c

1150

-

To Bal C/d

24000

-

24000 By Bank

25150

-

24000

- By bal b/d

Dr.

25150

- 11850

-

- 12150

25150 24000 25150

Bank A/c

Cr.

To Bal B/d

15,600 By X’s cap A/c

To Z’s Capital A/c

12,150 By bal c/d

26,600

27,750

27,750

Liabilities

BALANCE SHEET OF THE NEW FIRM

Rs. Assets

Sundry Creditors

7,000 Cash at bank

Outstanding legal charges

750 Sundry debtors (5000-250)

Y’s Loan

26,600 Stock

Capital

X

24000

Z

24000

48,000

1,150

Rs.

26,600

4,750

9,500

Plan & Machinery

11,500

Land & Building

30,000

83,250

83,250

Q.2 The Balance Sheet of A, B and C on 31st December 2007 was as under :

BALANCE SHEET

as at 31.12.2007

Liabilities

Amount Assets

Amount

A’s Capital

400,00 Buildings

20,000

B’s Capital

30,000 Motor Car

18,000

C’s Capital

20,000 Stock

20,000

General Reserve

17,000 Investments

Sundry Creditors

1,20,000

1,23,000 Debtors

40,000

Patents

12,000

2,30,000

2,30,000

The partners share profits in the ratio of 8 : 4 : 5. C retires from the firm on the same date subject to

the following term S and conditions:

i) 20% of the General Reserve is to remain’ as a reserve for bad and doubtful debts. ;

ii)

Motor)r Car is to be decreased by 5%.

iii)

Stock is to be revalued at Rs.17, 500.

iv)

Goodwill is valued at’ 2 ½ years purchase of the average profits of last 3 years.

Profits were; 2001: Rs.11,000; 200l: Rs. 16,000 and 2003: Rs.24,000.

C. was paid in July A and B borrowed the necessary amount from the Bank on the security of

Motor Car and stock to payoff C.

Prepare Revaluation Account, Capital Accounts and Balance Sheet of A and B.

Ans.2 SOLUTION

REVALUATION ACCOUNT

Particulars

Rs. Particulars

To Motor Cars A/C

900 By Loss transferred to

To Stock A/C

Rs.

2,500 A’s Capital A/c Rs.

1,600

B’s Capital A/c Rs.

800

C’s Capital A/c Rs.

1,000

3,400

3,400

3,400

PARTNERS CAPITAL ACCOUNT

Particulars

ARs.

B Rs.

To C’s Capital A/c

8,334

4,166

To Revaluation A/c (Loss) 1,600

800

To Bank A/c

Balance c/d

-

C Rs. Particulars

- By Balance b/d

A Rs.

B Rs.

C Rs.

40,000 30,000 20,000

1,000 By General Reserve A/c 6,400

3,200

4,000

-

35,500 By A’s Capital A/c

-

-

8,334

36,466 28,234

- By B’s Capital A/c

-

-

4,166

46,400 33,200

36,500

46,400 33,200 36,500

By Balance b/d

36,466 28,234

-

BALANCE SHEET OF A AND B

Liabilities

Rs. Assets

Sundry creditors

1,23,000 Building

Bank Loan

Capital A

B

35,500 Motor Card

36,466

28,234

Stock

64,700 Investment

Debtors

Patents

2,23,200

Rs.

20,000

17,100

17,500

1,20,000

36,600

12,000

2,23,200

Q.3 A, Band C were partners in a firm sharing profits equally: Their Balance Sheet on.31.12.2007 stood

as:

BALANCE SHEET AS AT 31.12.07

Liabilities

Rs. Assets

Rs.

A

Rs. 30,000

Goodwill

18,000

B

Rs. 30,000

Cash

38,000

C

Rs. 25,000

85,000 Debtors

Bills payable

20,000 Less: Bad Debt provision

Creditors

18,000 Bills Receivable

. 43,000

3,000

40,000

25,000

Workers Compensation Fund

8,000 Land and Building

60,000

Employees provide4nt Fund

60,000 Plant and Machinery

40,000

General Reserve

30,000

2,21,000

2,21,000

It was mutually agreed that C will retire from partnership and for this purpose following terms were

agreed upon.

i)

Goodwill to be valued on 3 years’ purchase of average profit of last 4 years which were

2004 : Rs.50,000 (loss); 2005 : Rs. 21,000; 2006: Rs.52,000; 2007 : Rs.22,000.

ii)

The Provision for Doubtful Debt was raised to Rs. 4,000.

iii)

To appreciate Land by 15%.

iv)

To decrease Plant and Machinery by 10%.

v)

Create provision of Rs;600 on Creditors.

vi)

A sum of Rs.5,000 of Bills Payable was not likely to be claimed.

vii)

The continuing partners decided to show the firm’s capital at 1,00,000 which would be in

their new profit sharing ratio which is 2:3. Adjustments to be made in cash

Make necessary accounts and prepare the Balance Sheet of the new partners.

Ans.3

REVALUATION ACCOUNT

Particulars

Rs. Particulars

Rs.

To Provision for Debts A/c

1,000 By Land A/c

To Plant & Machinery A/c

4,000 By Provision on Creditors A/c

To Profit transferred to

9,000

600

By Bills Payable A/c

A’s Capital A/c

Rs. 3,200

B’s Capital A/c

Rs. 3,200

C’s Capital A/c

Rs. 3,200

5,000

9,600

14,600

14,600

PARTNER’S CAPITAL ACCOUNTS

Particulars

ARs.

B Rs.

C Rs. Particulars

To Goodwill A/c

6,000

6,000

6,000 By Balance b/d

To C’s Capital A/c

2,250

9,000

-

-

To C’s Loan A/c

- By General Reserve

46,116 By Worksmen A/c

A Rs.

B Rs.

C Rs.

30,000 30,000 25,000

10,000 10,000 10,000

2,667

2,667

2,666

3,200

3,200

3,200

By A’s Capital A/c

-

-

2,250

By B’s Capital A/c

-

-

9,000

By Cash A/c (Deficiency) 2,383 29,133

-

Compensation Fund

To Balance c/d

40,000 60,000

48,250 75,000

- By Revalu A/c (profit)

52,116

48,250 75,000 52,116

By Balance b/d

40,000 60,000

-

BALANCE SHEET

Liabilities

Bills Payable

Creditors

Employees Provident Fund

C’s Loan

A’s Capital

40000

B’S Capital

60000

as at 31.12.07

Rs. Assets

15,000 Debtors

17,400 Less: Provision

60,000 Bills Receivables

46,116 Land & Buildings

Plant & Machinery

1,00,000 Cash

2,38,516

Rs.

Rs. 43,000

Rs. 4,000

39,000

25,000

69,000

36,000

69,516

2,38,516

Q.4 A, Band C were partners in a firm .sharing profits in the ratio of 5: 3: 2. On 31st March, 2005 their

Balance Sheet was as under:

Liabilities

Rs. Assets

Creditors

7,000 Buildings

20,000

Reserve

10,000 Machinery

30,000

Accounts:

Rs.

Stock

A

30,000

B

25,000

C

15,000

Patents

10,000

6,000

Debtors

8,000

70,000 Cash

13,000

87,000

87,000

A died on 1st October, 2005. It was agreed between his executors and the remaining partners that

a.

Goodwill be valued at 2 years’ purchase of the average profits of the previous five years,

which were 2001: Rs. 15,000; 2002: Rs. 13,000; 2003: Rs. 12,000; 2004: Rs. 15,000 and

2005: Rs. 20,000.

b.

Patents be valued at Rs. 8,000; Machinery at Rs. 28,000; Buildings at Rs. 30,000.

c.

Profit for the year 2005-06 is taken as having accrued at the same rate as the previous

year.

Ans.4

d.

Interest on capital be provided at 10% p.a.

e.

A sum of Rs. 11,500 was to be paid to his executors immediately.

Prepare A’s Capital Account and his executors’ account at the time of his death.

A’s Capital A/c

Particulars

Executor’s A/c

Rs.

61,500

Particulars

Rs.

By Balance b/d

30,000

By Reserves [10,000× ]

5,000

By B’s Capital A/c [15,000 × ]

9,000

By C’s Capital A/c [15/000 × ]

6,000

By Revaluation A/c [10,00 × ]

5,000

By Profit & Loss Suspense A/c

5,000

By Interest on Capital A/c [30/000 × × ]

1,500

60,500

61,500

A’s EXECUTORS ACCOUNT

Particulars

Balance c/d

Rs. Particulars

Rs.

61,500 By A’s Capital A/c

61,500

61,500

61,500

By Balance b/d

61,500

Q.5 A, B and C were partners in ka firm sharing profits in the ratio of 5:3:2 On 31st March 2005 their

Balance Sheet was as under :

Liabilities

Rs. Assets

Reserves

10,000 Buildings

Creditors

7,000 Machinery

A’s Capital

30000

Stock

B’s Capital

25000

Patents

C’s Capital

15000

Rs.

20,000

30,000

10,000

6,000

70,000 Cash

21,000

87,000

87,000

C died on 1st Oct. 2005. It was agreed between his executors and the remain partners that:

a.

Goodwill be valued at 2 years’ purchase of the average profits of the pre five years, which

were 2001 :Rs. 15,000; 2002 : Rs. 13,000; 2003 : Rs. 12,000; Rs. 15,000 : 2004 and 2005

: Rs. 20,000.

b.

Patents be valued at Rs. 8,000; Machinery at Rs. 28,000; Buildings at Rs. 30,

c.

Profit for the year 2005-06 be taken as having accrued at the same rate previous year.

d.

Interest on capital be provided at 10% p.a.

e.

A sum of Rs. 7,750 was paid to his executors immediately.

Prepare C’s Capital Account and his executors account at the time of his death.

Ans.5

C’S CAPITAL ACCOUNT

Particulars

To C’s Executor’s A/c

Rs. Particulars

27,750 By Balance b/d

Rs.

15,000

By Reserves

2,000

By Revaluation A/c

2,000

By p& L Suspense A/c

2,000

By Interest on Capital

750

By A’s Capital A/c

3,750

By B’s Capital A/c

2,250

27,750

27,750

C’S EXECUTOR’S ACCOUNT

Particulars

To Cash A/c

Rs. Particulars

Rs.

7,750 By C’s Capital A/c

27,750

To Executor’s Loan A/c

or Bal c/d

20,000

27,750

Q.6 Anil, Jatin and Ramesh were sharing profit in the ratio of 2:1:1. Their Balance Sheet as at

31.12.2001 stood as follows:BALANCE SHEET

as at 31.12. 2001

Liabilities

Rs. Assets

Creditors

24,400 Cash

Bank Loan

10,000 Debtors

Profit and Loss A/c

18,000 Less : Provision

Bills Payable

2,000 Stock

Rs.

1,00,000

20000

1600

18,400

10,000

Anil’s Capital

50,000 Land & Building

20,000

Jatin’s Capital

40,000 Investment

14,000

Ramesh’s Capital

40,000 Goodwill

22,000

1,84,400

1,84,400

Ramesh died on 31st March 2002. The following adjustments were agreed upon(a)

Building be appreciated by Rs. 2,000

(b)

Investments be valued at 10% less than the book value.

(c)

All debtors (except 20% which are considered as doubtful) were good.

(d)

Stock be increased by 10 %

(e)

Goodwill be valued at 2 years’ purchase of the average profit of the past five years.

(f)

Ramesh’s share of profit to the death be calculated on the basis of the profit of the

preceding year. profit for the years 1997, 1998, 1999 and 2000 were Rs. 26,000, Rs.

22,000, Rs. 20,000 and Rs. 24,000 respectively.

Ans.6 Prepare revaluation account, partner’s capital Account, Ramesh ‘s Executors’ Account and

Balance sheet immediately after Ramesh’s death assuming that Rs. 18, 425 be paid immediately

to

his executors and balance to b left to the Ramesh’s Executor’s Account

REVALUATION ACCOUNT

Particulars

Rs. Particulars

Rs.

To Investment A/c

1,400 By Building A/c

2,000

To Provision for doubtful debt A/c

2,400 By Stock A/c

1,000

By Loss transferred to

Anil’s Capital A/c

Rs.400

Jatin’s Capital A/c

Rs. 200

Ramesh’s Capital A/c

Rs. 200

800

3,800

3,800

PARTNERS’ CAPITAL ACCOUNTS

Particulars

Anil

Jatin

Ramesh

Rs.

Rs.

Rs.

Particulars

Anil

Rs.

Jatin Ramesh

Rs.

Rs.

To Goodwill A/c

11,000

5,500

5,500

7,333

3,667

-

400

200

200

-

-

50,925

40,267

35,133

-

To Ramesh Capital A/c

To Revaluation A/c (Loss)

To Ramesh’s Executor’s A/c

To Balance c/d

59,000

41,500

By Balance b/d

By Profit and Loss A/c

9,000

4,500

4,500

By Profit &Loss Susp A/c

-

-

1,125

By Anil’s Capital A/c

-

-

7,333

By Jatin’s Capital A/c

-

-

3,667

56,625

59,000 41,500 56,625

By Balance b/d

Date

Particulars

Rs.

2002

50,000 40,000 40,000

Date

40,267 35,133

Particulars

-

Rs.

2002

Mar. 31

To Cash A/c

18,425

Dec. 31

To Balance A/c

32,500

Mar. 31 By Raeesh’s Capital A/c

50,925

50,925

50,925

2003

Jan.1

By Balance b/d

32,500

BATANCE SHEET

Liabilities

Rs. Assets

Bank Loan

10, 000 Cash

Creditors

20,400 Debtors

Bills Payable

Rs.

81,575

Rs. 20,000

2,000 Less: Provision

Rs. 4,000

16,000

Ramesh’s Executor’s Loan

32,500 Stock

11,000

Anil’s Capital

40,267 Land and Building

22,000

Jatin’s Capital

35,133 Investments

12,600

Profit and Loss Suspense A/c

1,44,300

1,44,300

1,125

Retirement and Death of a Partner

Q.1

What is meant by retirement of a partner?

Ans.

Retirement of a partner is one of the modes of reconstituting the firm in which

old partnership comes to an end and a new partner among the continuing

(remaining) partners (i.e., partners other than the outgoing partner) comes into

existence.

Q.2

‘How can a partner retire from the firm?

Ans.

A partner may retire from the firm;

i)

in accordance with the terms of agreement; or

ii) with the consent of all other partners; or

iii) where the partnership is at will, by giving a notice in writing to all the

partners of his intention to retire.

Q.3

What do you understand by ‘Gaining Ratio*?

Ans.

Gaining Ratio means the ratio by which the share in profit stands increased. It

is computed by deducting old ratio from the new ratio.

Q.4

What do you understand by ‘Gaining Partner’?

Ans

Gaining Partner is a partner whose share in profit stands increased as a result

of change in partnership.

Q.5

Ans.

Q.6

Distinguish between Sacrificing Ratio and Gaining Ratio.

Distinction between Sacrificing Ratio and Gaining Ratio

Give two circumstances in which gaining ratio is computed. Ans.

Gaining

Ratio is computed in the following circumstances: (i) When a partner retires or

dies. (ti) When there is a change in profit-sharing ratio.

Q.7

Why is it necessary to revalue assets and reassess liabilities at the time of

retirement of a partner ?

Ans.

At the time of retirement or death of a partner, assets are revalued and

liabilities are reassessed so that the profit or loss arising on account of such

revaluation upto

the

date of retirement or death of a partner may be

ascertained and adjusted in all partners’ capital accounts in their old profitsharing ratio.

Q.8

Why is it necessary to distribute Reserves Accumulated, Profits and Losses at

the time of retirement or death of a partner?

Ans.

Reserves, accumulated profits and losses existing in the books of account as

on the date of retirement or death are transferred to the Capital Accounts (or

Current Accounts) of all the partners (including outgoing or deceased partner)

in their old profit-sharing ratio so that the due share of an outgoing partner in

reserves, accumulated profits/losses gets adjusted in his Capital or Current

Account.

Q.9

What are the adjustments required on the retirement or death of a partner?

Ans.

At the time of the retirement or death of a partner, adjustments are made for

the following:

(i) Adjustment in regard to goodwill.

(ii) Adjustment in regard to revaluation of assets and reassessment of

liabilities.

(iii) Adjustment in regard to undistributed profits.

(iv) Adjustment in regard to the Joint Life Policy and individual policies.

Q.10

X wants to retire from the firm. The profit on revaluation of assets on the date of

retirement is Rs. 10,000. X is of the view that it be distributed among all the

partners in their profit-sharing ratio whereas Y and Z are of the view that this

profit be divided between Y and Z in new profit-sharing ratio. Who is correct in

this case?

Ans.

X is correct because according to the Partnership Act a retiring partner is

entitled to share the profit upto the date of his retirement. Since the profit on

revaluation arises before a partner retires, he is entitled to the profit.

Q.11

How is goodwill adjusted in the books of a firm -when a partner retires from

partnership?

Ans.

When a partner retires (or dies), his share of profit is taken over by the

remaining partners. The remaining partners then compensate the retiring or

deceased partner in the form of goodwill in their gaining ratio. The following

entry is recorded for this purpose:

Remaining Partners’ Capital A/cs

...Dr.

[Gaining Ratio]

To Retiring/Deceased Partner’s Capital A/c

[With his share of goodwill]

If goodwill (or Premium) account already appears in the old Balance Sheet, it

should be written off by recording the following entry :

All Partners’ Capital/Current A/cs ...Dr.

[Old Ratio]

To Goodwill (or Premium) A/c

Q.12

X, V and Z are partners sharing profits and losses in the ratio of 3 : 2 :1. Z

retires and the following Journal entry is passed in respect of Goodwill:

Y’s Capital A/c

...Dr.

20,000

To X’s Capital A/c

10,000

To Z’s Capital A/c

10,000

The value of goodwill is Rs. 60,000. What is the new profit-sharing ratio

between X and Y?

Ans.

Without calculating the gaining ratio, the amount to be adjusted in respect of

goodwill can be calculated directly with the help of following statement:

STATEMENT SHOWING THE REQUIRED ADJUSTMENT FOR GOODWILL

Particulars

X(Rs.)

V(Rs.)

Z(Rs.)

Right of goodwill before retirement (3:2:1)

30,000

20,000

10,000

(Old Ratio) Right of goodwill after retirement

20,000

40,000

—

(-) 10,000

(+) 20,000

(-) 10,000

(Balancing Figure) (New Ratio)

Net Adjustment

The new ratio between X and Y is 1 : 2.

Q.13

State the ratio in which profit or loss on revaluation will be shared by the

partners when a partner retires. ;

Ans.

Profit or loss on revaluation of assets/liabilities will be shared by the partners

(including the retiring partner) hi their old profit-sharing ratio.

Q.14

How is the account of retiring partner settled?

Ans.

The retiring partner account is settled either by making payment in cash or by

promising the retiring partner to pay in installments along with interest or by

making payment partly in call and partly transferring to his loan account. The following Journal entry is passed:

Retiring Partner’s Capital A/c

...Dr.

To Cash*

[If paid in cash]

Or

To Retiring Partner’s Loan

[If transferred to loan]

Q.15

What is Joint Life Policy?

Ans.

Joint Life Policy is an insurance policy taken on the lives of the partners jointly.

Premium of the policy is paid by the firm.

Q.16

What is the objective of taking a Joint Life Policy by a partnership firm?

Ans.

A partnership firm takes a Joint Life Policy with the objective of receiving

sufficient amount in cash and thereby enabling itself to pay the amount payable

to the retiring partner or to the representatives of the deceased partner, without

adversely affecting the financial position and working of the business.

Q.17

When does the Joint Life Policy become due?

Ans.

Joint Life Policy becomes due for payment by the Insurance Company either on

the death of any partner or on its maturity, whichever is earlier. The policy may

also be surrendered before its maturity.

Q.18

What is Surrender Value?

Ans.

Surrender Value is the value of the insurance policy that the insurance

company pays on the surrender of a policy before the date of its maturity.

Q.19

How is the share of profit of a deceased partner calculated from the date of last

balance sheet to the date of death?

Ans.

If a partner dies on any date after the date of balance sheet; then his share of

profit is calculated from the beginning of the year to the date of death on the

basis of average profits or last year’s profit. It is calculated on either of the

following two bases:

(i) On the Basis of Time: In this method, it is assumed that the profits had

accrued uniformly in the previous year. On the basis of time, deceased

partner’s share in the profits till the date of death is calculated as follows:

Share of Deceased Partner

= Average Profits x x Proportion of Deceased Partner

(ii) On the Basis of Sales: Deceased partner’s share in profit till the date of

death

shall be:

= Sales for the period* x x Proportion of Deceased Partner

*Period = from the beginning of the year to the date of death.

Q.20

How is amount payable to the representative of a deceased partner calculated?

Ans.

In the case of death of a partner, the legal representatives of a deceased

partner are entitled to the following:

(i) The amount standing to the credit of the deceased partner’s capital

account.

(ii) His share in the goodwill of the firm.

(iii) His share of profit on the revaluation^ assets and reassessment of

liabilities. (iv) His share of reserves and accumulated profits.

(v) His share of profits earned from the date of last balance sheet of the date

of death.

(vi) Interest on capital provided in the partnership agreement.

(vii) His share of the proceeds of Joint Life Policy.

The following amounts will be debited to his account:

(i) His share in the reduction in the value of goodwill, if any.

(ii) His share of loss on revaluation of assets and reassessment of liabilities.

(iii) His drawings.

(iv) Interest on drawings, if provided in the partnership deed.

(v) His share of loss from the date of last balance sheet to the date of death.

The balance in the capital account is transferred to his Executor’s Account.

Q.21

Can an outgoing partner or Legal Representative of Deceased Partner share in

the subsequent profits?

Or

What will happen if deceased or retired partner’s dues are not settled

immediately?

Ans.

As per the provisions of Section 37 of the Partnership Act, 1932 if full or part

amount of outgoing partner still remains to be paid then

(i) He will be entitled to interest or share in profit or nothing as has been

mutually agreed among partners.

(ii) If nothing is agreed among the partners, then outgoing partner or his

representatives have the choice to get either of the following till final settlement:

(a)

Interest @ 6% per annum on the balance amount.

(b)

Share in the profit earned proportionate to their amount outstanding

to

total capital.

Share in Profit =

Normally he will opt for the better of (a) or (b).

CHAPTER:5

DISSOLUTION OF PARTNERSHIP FIRM

Q.1 Distinguish between dissolution of partnership and dissolution of partnership firm on the

basis of continuation of business.

Ans. 1 In case of dissolution of partnership, the firm may continue its business operation but in

case of dissolution of partnership firm, the business operations are discontinued.

Q.2 Why is Realisation Account prepared on dissolution of partnership firm?

Ans. 2 Realisation account is prepared to ascertain profit or loss on sale of assets and payment of

liabilities.

Q.3 State any one point of difference between Realisation Account and Revaluation Account.

Ans. 3 Realisation Account is prepared on dissolution of partnership firm and Revaluation

account is prepared on reconstitution of partnership firm.

Q.4 All partners wish to dissolve the firm. Yastin, a partner wants that her loan of Rs. 2,00000

must be paid off before the payment of capitals to the partners. But, Amart, another

partner wants that the capital must be paid before the payment of Yastin’s loan. You are

required to settle the conflict giving reasons.

Ans. 4 Yustin’s claim is valid as according to section 48 (b) of partnership Act, partners loan are

to be paid before any amount is paid to partners on account of their capitals.

Q.5 On a firms dissolution debtors as shown in the Balance sheet were Rs. 17000 out of these

Rs. 2000 became bad. One debtor of Rs. 6000 became insolvent and 40% could be

recovered from him. Full recovery was made from the balance debtors. Calculate the

amount received from debtors and pass necessary journal entry.

Ans. 5 Cash A/C

Dr. 11400

To Realisation A/C

11400

(For debtors realized on dissolution of firm)

Q.6 On dissolution of a firm, Kamal’s capital account shows a debit balance of Rs. 16000. His

share of profit on realization is Rs. 11000. He has taken over firms creditors at Rs. 9000.

Calculate the final payment due to /from him and pass journal entry.

Ans. 6 Kamal’s capital A/C

Dr. 4000

To cash A/C

4000

(for final payment to Kamal)

Q.7 A and B were partners in a firm sharing profits and losses equally. Their firm was dissolved

on 15th March, 2004, which resulted in a loss of Rs. 30,000. On that date the capital A/C

of A showed a credit balance of Rs. 20,000 and that of B a credit balance of Rs. 30000.

The cash account has a balance of Rs. 20000. You are required to pass the necessary

journal entries for the (i) Transfer of loss to the capital accounts and (ii) making final

payment to the partners.

Ans. 7 (i) A’s capital A/C

Dr. 15000

B’s capital A/C

Dr. 15000

To realization A/C

30000

(For transfer of loss on dissolution)

(ii) A’s capital A/C

Dr. 5000

B’s capital A/C

Dr. 15000

To cash A/C

20000

(For final payment to partners)

Q.8 What journal entries would be passed in the books of A and B who are partners in a firm,

sharing profits in the ratio of 5:2, for the following transactions on the dissolution of the

firm after various assets (other than cash) and third party liabilities have been transferred

to Realisation Account?

(a)

(b)

(c)

(d)

(e)

(f)

Bank loan Rs. 12,000 is paid.

Stock worth Rs. 6000 is taken over by B.

Loss on Realisation Rs. 14,000.

Realisation expenses amounted to Rs. 2,000, B has to bear these expenses.

Deferred Revenue Advertising Expenditure appeared at Rs. 28,000.

A typewriter completely written off in the books of the firm was sold for Rs. 200.

Ans. 8

JOURNAL

(a)

(b)

(c)

(d)

(e)

(f)

Realisation A/C

To Bank A/C

B’s capital A/C

To realisation A/C

A’s capital A/C

B’s capital A/C

To Realisation A/C

B’s capital A/C

To bank A/C

A’s capital A/C

B’s capital A/C

To deferred revenue advertising expenditure A/C

Bank A/C

To realisation A/C

Dr.

Dr. (Rs)

12000

Dr.

6,000

Dr.

Dr.

10,000

4,000

Cr. (Rs.)

12000

6,000

14000

Dr.

2,000

2,000

Dr.

Dr.

20,000

8,000

28,000

Dr.

200

200

CBSE SAMPLE PAPER

ACCOUNTANCY

CLASS - XII

Time Allowed : 3 Hours

Maximum Marks : 80

General Instructions:

1.

This question paper contains three parts A, B and C.

2.

Part A is compulsory for all.

3.

Attempt onfy one part of the remaining parts B and C.

4.

All parts of questions should be attempted at one place.

PART-A

PARTNERSHIP AND COMPANY ACCOUNTS

1.

Not-for-profit organisations have some distinguishing features from that of profit

organisations. State any one of them,

[1]

2.

Alka, Barkha and Charu are partners in a firm having no partnership agreement.

Alka Barkha and Charu contributed Rs. 2,00,000, Rs. 3,00,000 and Rs. 1,00,000

respectively. Alka and Barkha desire that the profits should be divided in the ratio

of capital contribution. Charu does not agree to mis. How will you settle the

dispute?

[1]

3.

Give the formula for 'calculating gaining share' of apartner in a partnership firm.

[1]

4.

Pawan and Jayshree are partners. Bindu is admitted for l/4th share. What is the ratio

in which Pawan and Jayshree will sacrifice their share in favour of Bindu?

[1]

5.

What is meant by Convertible debentures?

6.

Show the following information in the Balance Sheet of the Cosmos Club as on 31st

March, 2007:

[1]

Particulars

Tournament Fund

Tournament Fund Investment

Income from Tournament Fund Investment

Tournament Expenses

Debit Rs.

Credit Rs.

-

1,50,000

1,50,000

-

-

18,000

12,000

-

Additional Information :

Interest Accrued on Tournament Fund Investment Rs. 6,000.

7.

[3]

Shubh Limited has the following balances appearing in its Balance Sheet:

Rs.

Securities Premium

22,00,000

9% Debentures

120,00,000

Underwriting Commission

10,00,000

The company decided to redeem its 9% Debentures at a premium of 10%. You are

required to suggest the ways in which the company can utilise the securities

premium amount.

[3]

8.

20,000 Shares of Rs. 10 each were issued for public subscription at a premium of

10% Full amount was'pavaD'e °n application. Applications were received for

30,000 shares and the Board decided to allot the shares on a pro-rata basis. Pass

Journal entries. [3]

9.

A, B and C are partners in a firm. They have omitted interest on capital @ 10%

pa.a. for three years ended 31st March, 2007. Their fixed capitals on which interest

was to be calculated throughout were :

A

Rs. 1,00,000

B

Rs. 80,000

C

Rs. 70,000

Give the necessary adjusting journal entry with working notes.

10.

[4]

'X, Y'and Z were sharing profits and losses in the ratio of 5:3:2. They decided to

share future profits and losses in the ratio of 2:3:5 with effect from 1.4.2007. They

decided to record the effect of the following, without effecting their book values:i)

Profit and Loss Account

Rs. 24,000

ii)

Advertisement Suspense Account

Rs. 12,000

Pass the necessary adjusting entry.

[4]

11. Sajal Limited had issued shares of Rs. 100 each at a discount of 5%, payable as

follows:

On application

Rs. 25 per share

On allotment

Rs. 25 per share

On first and final call

Balance

One shareholder, Pran holding 50 shares did not pay his first and final call. As a res!

his shares were forfeited.

Of these, 40 shares were reissued to Ram as fully paid up @ Rs. 110 per share, Pass

necessary journal entries to record the forfeiture and reissue of shares in: books of

Sajal Limited.

[4]

12 (a) Raghav Limited purchased a running business from Krishna Traders for a sum

of Rs. 15,00,000, payable Rs. 3,00,000 by cheque and for the balance issued 9%

Debentures of Rs. 100 each at par.

The assets and liabilities consisted of the following :

Rs.

Plant and Machinery

4,00,000

Buildings

6,00,000

Stock

5,00,000

Sundry Debtors

3,00,000

Sundry Creditors

2,00,000

Record necessary journal entries in the books of Raghav Limited,

(b) On January 1,2004, Rhythm Limited issued 1,000 10% debentures of Rs. 500

each at par. Debentures are redeemable after 7 years. However, the company gave

an option to debenture holders to get their debentures converted into equity shares

of Rs. 100 each at a premium of Rs. 25 per shareany time after the expiry of one

year.

to

Shivansh, holder of 200 debentures, informed on Jan. 1, 2006 that he wanted

exercise the option of conversion of debentures into equity shares.

The company accepted his request and converted debentures into equity

shares.

Pass necessary journal entries to record the issue of debentures on Jan. 1,2004

and conversion of debentures on Jan. 1,2006.

(3+3 = 6)

13. From the following Receipts and Payments Account of Sonic Club and from the

given additional information; prepare Income and Expenditure Account for the year

ending 31st December, 2006 and the Balance Sheet as on that date :

RECEIPTS AND PAYMENTS ACCOUNT

for the year ending 31st December, 2006

Cr.

Dr.

Receipts

Rs. Payments

To Balance b/d

1,90,000 By Salaries

To Subscriptions

6,60,000 By Sports Equipment

To Interest on Investments

@ 8% p.a. for full year

By Balance c/d

Rs.

3,30,000

30,000

1,60,400

40,000

8,90,000

8,90,000

Additional Information :

(a)

The club had received Rs. 20,000 for subscription in 2005 for 2006.

(b)

Salaries had been paid only for 11 months

(c)

Stock of Sports Equipment on 31st December, 2005 was Rs. 3,00,000 and on

31

st December, 2006 Rs. 6,50,000.

(6)

14. Ram, Mohan and Sohan were partners sharing profits and losses in the ratio of

5:3:2. On 31 st March, 2006 their Balance Sheet was as under:

Liabilities

Rs. Assets

Capitals :

Rs

Leasehold

Ram

1,50,000

Patents

Mohan

1,25,000

Machinery

Sohan

75,000 3,50,000 Stock

Creditors

Workmen's Compensation

1,50,000 Cash at Bank

Rs.

1,25,000

30,000

1,50,000

1,90,000

40,000

30,000

Reserve

5,35,000

5,35,000

Sohan died on 1st August, 2006. It was agreed that:

i)

Goodwill of the firm is to be valued at Rs. 1,75,000.

ii)

Machinery be valued at Rs. 1,40,000; Patents at Rs. 40,000; Leasehold at Rs.

1,50,000 on this date,

iii) For the purpose of calculating Sohan?s share in the profits of 2006-07, the

profits should be taken to have accrued on the same scale as in 2005-06, which

were Rs. 75,000.

Prepare Sohan's Capital Account and Revaluation Account.

(6)

15. Srijan Limited issued Rs. 10,00,000 new capital divided into Rs. 100 shares at a

premium of Rs. 20 per share, payable as under:

On Application

Rs. 10 per share

On Allotment

Rs 0 per share (including

premium of Rs, 10 per share)

On First and Final Call

Balance

Over-payments on application, were to be applied towards sums due on allotment

and first and final call. Where no allotment was made, money was to be refunded in

full. The issue was oversubscribed to the extent of 13,000 shares. Applicants for

12,000 shares were allotted only 2,000 shares and applicants for 3,000 shares were

sent letters of regret and application money was returned to them. All the money

due was duly received.

Give Journal Entries to record the above transactions (including cash transactions)^

the books of the company.

[8]

OR

Sangita Limited invited application for issuing 60,000 shares of Rs. 10 each at par.

amount was payable as follows:

On Application

Rs. 2 per share

On Allotment

Rs. 3 per share

On First and Final Call

Rs. 5 per share

Applications were received for 92,000 shares. Allotment was made on the following

basis :

i)

To applicants for 40,000 shares - Full

ii) To applicants for 50,000 shares - 40% (iii) To applicants for 2,000 Shares Nil Rs. 1,08,000 was realised on account of allotment (excluding the amount

carried first application money) and Rs. 2,50,000 on account of call.

The directors decided to forfeit shares of those applicants to whom full allotment^

made and on which allotment money was overdue.

Pass journal entries in the books of Sangita Limited to record the above

transactions.

[5]

16. L and M share profits of a business in the ratio of 5:3. They admit N into the firm

for a fourth share in the profits to be contributed equally by L&M. On the date of

admission the Balance Sheet of L&M is as follows :

BALANCE SHEET

as at......

Liabilities

Rs. Assets

L's Capital

30,000 Machinery

26,000

M's Capital

20,000 Furniture

18,000

Reserve Fund

Bank Loan

Creditors

Rs.

4,000 Stock

10,000

12,000 Debtors

8,000

2,000 Cash

6,000

68,000

68,000

Terms of N's admission were as follows :

i)

N will bring Rs. 25,000 as his capital.

ii) Goodwill of the firm is to be valued at 4 years? purchase of the average super

profits of the last three years. Average profits of the last three years are Rs. 20,000;

while the normal profits that can be earned on the capital employed are Rs. 12,000.

iii) Furniture is to be appreciated to Rs. 24,000 and the value of stock into by

20%.

Prepare Revaluation-Account, Partners Capital Accounts and the Balance

Sheet

of the firm after admission of N .

(8)

OR

On 31st December, 2006 the Balance Sheet of A. B and C, who were sharing profits

and losses in proportion to their capitals, stood as follows :

Liabilities

Amount Assets

Creditors

Capitals :

Amount

10,800 Cash at Bank

Rs.

Debtors

A

45,000

Less : Provision

B

30,000

Stock

C

15,000

90,000 Machinery

8,000

Rs 10,000

200

9,800

9,000

24,000

Land and Buildings

1,00,800

50,000

1,00,800

B retires and the following readjustments of assets and liabilities have been agreed

upon before the ascertainment of the amount payable to B :

i)

That Land and Buildings be appreciated by 12%.

ii)

That provision for Doubtful Debts be brought upto 5% of debtors.

iii) That a provision of Rs. 3,900 be made in respect of an 'outstanding bill for

repairs,

iv) That Goodwill of the entire firm be fixed at Rs.. 18,000 and B?s share of the

same be adjusted into the accounts of A&C, who are going to share future profits in

the proportion of 3/4th and l/4th respectively,

v) That B be paid Rs. 5,000 immediately and the balance to be transferred to his

Loan Account.

Prepare Revaluation Account, Capital Accounts of Partners and the Balance

Sheet

of the firm of A and C.

(8)

PART-B

ANALYSIS OF FINANCIAL STATEMENTS

17. Assuming that the Current Ratio is 2:1, state giving reason whether the ratio will

improve, decline or will have no change in case a Bill Receivable is dishonoured.(1)

18. State whether cash deposited in bank will result in inflow, outflow or no flow of

cash.(1)

19. Interest received by a finance company is classified under which kind of activity

while preparing a cash flow statement ?

(1)

20. Show the major headings into which the liabilities side of a Company's Balance

Sheet is organised and presented as per Schedule VI Part 1 of the Companies Act,

1956.(3)

21. Prepare a Comparative Income Statement with the help of the following information

:

(4)

Particulars

2006

2007

Sales

Rs. 20,00,000

Rs. 30,00,000

Gross Profit

Indirect Expenses

Income Tax

22.

40%

30%

50% of G P.

40% of G.P.

50%

50%

Following is the Balance Sheet of X Ltd. as on 31st March, 2006 :

Liabilities

Share Capital

Reserves

10% Loans

Amount Assets

Amount

20,00,000 Fixed Assets (Net)

5,00,000 Current Assets

29,00,000

25,00,000

10,00,000 Underwriting

Commission

Current Liabilities

8,00,000

Profit for the year

12,00,000

55,00,000

1,00,000

55,00,000

Find out 'Return on Capital Employed;

23.

From the following balance sheets of ABC Ltd., Find out cash from operating

activities only.

Liabilities

31.3.2006 31.3.2007

Rs.

Rs.

Assets

31.3.2006 31.3.2007

Rs.

Rs.

Equity Share Capital

General Reserve

Profit & Loss Account

10% Debentures

Sundry Creditors

Provision for Depreciation

on Machinery

30,000

10,000

21,000

8,500

35,000

15,000

7,000

25,000

12,500

9,000

13,000

78,500

Goodwill

Machinery

10% Inv.

Stock

Cash and Bank

Discount on

Debentures

Profit & Loss

Account

1,07,500

10,000

41,000

3.000

6,000

12,000

8,000

54,000

8.000

24,500

13,000

500

-

6,000

-

78,500

1,07,500

Additional Information :

*Debentures were issued on 31.3.2007.

* Investments were made on 31.3.2007.

ANNUAL PAPER

ACCOUNTANCY

CLASS - XII

Time Allowed : 3 Hours

Maximum Marks : 80

General Instructions :

1.

This question paper contains three parts A, B and C.

2.

Part A is Compulsory for all candidates.

3.

Candidates can attempt only one part of the remaining parts B and C.

4.

All parts of the questions should be attempted at one place.

PART-A

(Not for Profit Organisations, Partnership Firms and Company Accounts)

1.

Distinguish between Income and Expenditure Account and Receipt and Payment

Account on the basis-of nature of items recorded therein.

[1]

2.

Ram and Mohan are partners in a firm without any partnership deed. Their capitals

are

Ram Rs.8,00,000 and Mohan Rs.6,00,000. Ram is an active partner and looks after

the business. Ram wants that profit should be shared in proportion of capitals. State

with reason whether his claim is valid or not.

[1]

3.

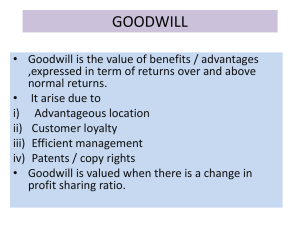

Defined goodwill.

[1]

4.

State any two reasons for the preparation of 'Revaluation Account' on the admission

of a partner.

[1]

5.

Give the meaning of 'minimum subscription'.

6.

Calculate the amount of sports material to be debited to the Income and Expenditure

Account of Capital Sports Club for the year ended 31.3.2007 on the basis of the

following information

[1]

1.4.2006

31.3.2007

Rs.

Rs.

Stock of sports material

7,500

6,400

Creditors for sports material

2,000

2,600

Amount paid for sports material during the year was Rs. 19,000.

7.

Samta Ltd. forfeited 800 equity shares of Rs. 100 each for the non-payment of first

call of Rs. 30 per share. The final call of Rs.20 per share was not yet made. Out of

the share 400 were re-issued at the rate of Rs.105 per share fully paid up.

Pass necessary journal entries in the books of Samta Ltd. for the above transaction.

[3]

8.

Deepak Ltd. purchased furniture Rs.2,20,000 from M/s Furniture Mart. 50% of the

amount was paid to Furniture Mart by accepting a bill of exchange and for the

balance the company issue 9% debentures of Rs.100 each at a premium of 10% in

favour of Furniture Mart. Pass necessary journal entries in the books of Deepak Ltd.

for the above transactions.

[3]

9.

Kumar and Raja were partners in a firm sharing profits in the ratio of 7 :3. Their

fixed capital were: Kumar Rs.9,00,000 and Raja Rs.4,00,000. The partnership deed

provided for the following but the profit for the year was distributed without

providing for:

i)

Interest on capital @ 9% p.a.

ii)

Kumar's salary Rs.50,000 per year and Raja's salary Rs.3,000 per month.

The profit for the year ended 31.3.2007 was Rs.2,78,000.

Pass the adjustment entry.

[4]

10. P, Q and R were partners in a firm sharing profits in 2 : 2 :1 ratio. The firm closes its

book on 31 March every year. P died three months after the last accounts were

prepared. On that date the goodwill of the firm was valued at Rs.90,000. On the

death of a partner his share of profit in the year of death was to be calculated on the

basis of the average profits of the last four years The profits of last four years were :

Year ended 31.3.2007

Rs.2,00,000

Year ended 31.3.2006

Rs. 1,80,000

Year ended 31,3.2005

Rs. 2,10,000

Year ended 31.3.2004

Rs. 1,70,000 (Loss)

Pass necessary journal entries for the treatment of goodwill and P's share of profit

on his death.

Show clearly the calculation of P's share of profit.

(4)

11. Sagar Ltd. was registered with an authorised capital of Rs. 1,00,000 divided into

1,00,000 equity shares of Rs.100 each. The company offered for public subscription

60,000 equity shares.

Applications for 56,000 shares were received and allotment was made to all the

applicants. All the calls were made and were duly received except the second and

final call of Rs.20 per share on 700 shares. Prepare the Balance Sheet of the

company showing the different types of share capital.

(4)

12. Following is the Receipt and Payment Account of Indian Sports Club for the year

ended 31.12.2006.

Receipts

Amount Payments

Amount

To Balance b/d

10,000 By Salary

15,000

To Subscriptions

52,000 By Billiards Table

20,000

To Entrance Fee

To Tournament Fund

To Sale of old newspapers

To Legacy

5,000 By Office Expenses

26,000 By Tournament Expenses

1,000 By Sports Equipment

37,000 By Balance c/d

1,31,00

6,000

31,000

40,000

19,000

1,3 1,000

Other Information:

On 31.12.2006 subscription outstanding was Rs.2,000 and on 31.12.2005

subscription outstanding was Rs.3,000. Salary outstanding on 31.12,2006 was

Rs.1,500.

On 1.1.2006 the club had building Rs.75,000, furniture Rs. 18,000,12% investment

Rs.30,000 and sports equipment Rs.30,000, Depreciation charged on these items

including purchases was 10%.

Prepare Income and Expenditure Account of the Club for the year ended 31.12.2006

and ascertain the Capital Fund on 31.12.2005.

(6)

13. K and Y were partners in a firm sharing profits in 3 :2 ratio. They admitted Z as a

new partner for l/3rd share in the profits of the firm. Z acquired his share from K

and Y in 2 : 3 ratio. Z brought Rs.80,000 for his capital and Rs.30,000 for his 1/3"1

share as premium. Calculate the new profit sharing ratio of K, Y and Z and pass

necessary journal entries for the above transactions in the books of the firm.

(6)

14. Pass necessary journal entries in the books of Varun Ltd. for the following

transactions: i) Issued 58,000, 9% debentures of Rs.l,000each at a premium of

10%.

ii) Converted 350,9% debentures of Rs. 100 each into equity shares of Rs. 10

each issued at premium of 25%.

iii)

Redeemed 450, 9% debentures of Rs.100 each by draw of lots.

(6)

15. R, S and T were partners in a firm sharing profits in 2 :2 : 1 ratio. On 1.4.2004 their

Balance Sheet was as follows :

Liabilities

Amount Assets

Amount

Bank Loan

12,800 Cash

51,300

Sundry Creditors

25,000 Bills Receivable

10,800

Debtors

35,600

44,600

Capitals :

R

80,000

Stock

S

50,000

Furniture

7,000

T

40.000

1,70,000 Plant and Machinery

19,500

Profit: and Loss A/c

9,000 Building

2,16,800

48,000

2,16,800

S retired from the firm on 1.4.2004 and his share was ascertained on the revaluation

of assets as follows:

Stock Rs.40,000; Furniture Rs.6,000; Plant and Machinery Rs. 18,000; Building

40,000, Rs.1,700 were to be provided for doubtful debts. The goodwill of the firm

was valued at Rs. 12,000.

S was to be paid Rs. 18,080 in cash on retirement and the balance in three equal

yearly instalments. Prepare Revaluation Account, Partner's Capital Accounts, S's

Loan Account and Balance Sheet on 1.4.2004.

OR

D and E were partners in a sharing profits in 3 :1 ratio. On 1.4.2007 they admitted F

as a new partner for 1/4th share in the firm which he acquired from D. Their

Balance Sheet on the date was as follows:

Liabilities

Amount Assets

Amount

Creditors

Capitals :

D

1,00,000

S

70.000

General Reserve

54,000 Land and Building

Machinery

Stock

1,70,000 Debtors

40,000

32,000 Less provision

for bad debts

3,000

37,000

Investments

50,000

Cash

44,000

2,56,000

2,56,000

F will bring R. 40,000 as his capital and the other terms agreed upon were :

i)

Goodwill of the firm was valued at Rs. 24,000

ii)

Land and Building were valued at Rs. 70,000

iii)

Provision for bad debts was found to be in excess by Rs.800

iv)

A liability for Rs.2,000 included in sundry creditors was not likely to arise.

v)

Excess or shortfall, if any, to be transferred to current accounts.

'

Prepare Revaluation Account, Partner's Capital Accounts and the Balance Sheet of

the New firm.

16. Janata Ltd. invited application for issuing 70,000 equity shares of Rs.10 each at a

premium of Rs. 2 per share. The amount was payable as follows:

On application

Rs.4 per share (including premium)

On allotment

Rs.3 per share

On first and final

Balance

Applications for 1,00,000 shares were received. Applications for 10,000 shares

were rejected. Shares were allotted to the remaining applicants on pro-rata basis.

Excess money received with applications were adjusted towards sums due on

allotment. All calls were made and were duly received except first and final call on

700 shares allotted to Kanwar. His shares were forfeited.

The forfeited shares were re-issued for Rs.77,000 fully paid up.

Pass necessary journal entries for the books of the company for the above

transactions.

(8)

OR

Shubham Ltd. invited applications for the allotment of 80,000 equity shares of

Rs.10 each at a discount of 10%. The amount was payable as follows :

On application

Rs.2 per share

On allotment

Rs.3 per share

On first and final call-

Balance

Applications for 1,10,000 shares were received. Applications for 10,000 shares

were rejected. Shares were allotted on pro-rata basis to the remaining applicants.

Excess application money received on application was adjusted towards sums due

on allotment. All calls were made and were duly received. Manoj who had applied

for 2,000 shares failed to pay the allotment and first and final call. His shares were

forfeited. The forfeited shares were re-issued for Rs.24,000 fully paid up. Pass

necessary journal entries in the books of the company for the above transaction.

PART-B

(Analysis of Financial Statements)

17. The stock turnover ratio of a company is 3 times. State, giving reason, whether the

ratio improves, declines or does not change because of increase in the value of

closing stock by Rs.5,000.

(1)

18. State whether the payment of cash to creditors will result in inflow, outflow or no

flow of cash.

(1)

19.

Dividend paid by a manufacturing company is classified under which kind of

activity while preparing cash flow statement?

(1)

20. Show the major headings on the liabilities side of the Balance Sheet of a company as

per Schedule VI Part I of the Companies Act, 1956.

(3)

21. From the following information prepare a comparative Income Statement of Victor

Ltd:

(4)

2006

2007

Rs.

Rs.

Sales

15,00,000

18,00,000

Cost of goods sold

11,00,000

14,00,000

20% of Gross Profit

125% of Gross Profit

50%

50%

Indirect Expenses

Income Tax

22. From the following information calculate any two of the following ratios

(4)

i)

Net Profit Ratio

ii)

Debt-Equity Ratio

iii)

Quick Ratio

Paid up Capital

Capital Reserve

9% Debentures

Net Sales

Gross Profit

Indirect Expenses

Current Assets

Current Liabilities

Opening Stock

Closing Stock : 2% more than opening stock.

Rs.

20,00,000

2,00,000

8,00,000

14,00,000

8,00,000

2,00,000

4,00,000

3,00,000

50,000

23. From the following Balance Sheets of Som Ltd. as on 31.3.2006 and 31.3.2007

prepare a Cash Flow Statement :

Liabilities

Amount

Equity Share Capital

2,00,000

5,00,000

Profit and Loss

1,25,000

10% Debentures

Assets

Amount

Fixed Assets

3,00,000

4,50,000

25,000

Stock

1,00,000

1,50,000

1,00,000

75,000

Debtors

75,000

1,25,000

8% Preference Shares Capital

50,000

75,000

Bank

45,000

65,000

General Reserve

45,000

1,15,000

5,20,000

7,90,000.

5,20,000

7,90,000

During the year machine costing Rs.70,000 was sold for Rs. 15,000. Dividend paid

Rs.24,000

(6)

ANSWERS

SET-1

(Not for Profit Organisations, Partnership Firms and Company Accounts)

1.

Income and Expenditure Account records items of revenue nature whereas Receipt

and Payments Account records items of both capital and revenue nature.

2.

His claim is not valid because in the absence of a partnership deed, profits and

losses should be shared equally.

3.

Goodwill is the value of the reputation of a firm is respect of the profits expected in

future over and above the normal profits earned by other similar firms belonging to

the same industry.

4.

The two reasons are :

(i)

To show the assets and liabilities at their current / correct values.

ii) To ensure that no partner is at an advantage or disadvantage due to change in

the value of assets and liabilities.

5.

Minimum subscription is the minimum amount which in the opinion of the Board of

Directors must be raised through the issue of shares so that the company has

necessary funds to carry out its objectives as stated in its memorandum of

Association.

Minimum subscription, according to SEB1 guidelines is 90% of the issued capital.

6.

Dr.

Cr.

STOCK OFSPORTS MATERIAL ACCOUNT

Particulars

Amt. (Rs.) Particulars

To Balance b/d

Amt (Rs.)

7,500 By Income & Expenditure A/c -

20,700

(stationery consumed)

To Creditors -

19,600 By Balance c/d

(purchases)

27,100

6,400

27,100

Dr.

27,100

CREDITORS FOR SPORTS MATERIAL ACCOUNT

Particulars

To Cash (paid)

To Balance c/d

Amt. (Rs.) Particulars

Cr.

Amt (Rs.)

19,000 By Balance b/d

2,000

2,600 By Purchases A/c

19,600

(credit -bal.fig.)

21,600

21,600

OR

Calculation of Sports Material consumed during the year

Cash paid during the year

19,000

Add Opening Stock of sports Material

7,500

Less Closing stock of sports Material

6,400

Less Creditors in the beginning

2,000

Add Creditors at the end

2.600

Amount to be debited to Income & Expenditure A/c

20,700

JOURNAL OF SAMTALTD.

7.

Date

Particulars

L.F.

Dr. (Rs.)

Share Capital A/c

Dr.

Cr.(Rs)

64,000

To Share Forfeited A/c

40,000

To Share First Call A/c / Calls in Arrears A/c

24,000

(Being 800 shares forfeited for noh payment of

first call)

Bank A/c

Dr.

42,000

To Share Capital A/c

40,000

To Securities Premium A/c

2,000

(Being 400 Shares reissued)

Share Forfeited A/c

Dr.

20,000

To Capital Reserve A/c

20,000

(Being amount transferred to Capital Reserve)

8.

JOURNAL OF DEEPAK LTD.

Date

Particulars

Furniture A/c

L.F.

Dr.

Dr. (Rs.)

2,20,000

Cr.(Rs)

To M/s Furniture Mart A/c

2,20,0001

(Being furniture purchased)

Ms Furniture Mart A/c

Dr.

1,10,000

To Bills Payable A/c

1,10,000:,

(Being Bill payable Accepted)

M/s Furniture Mart A/c

Dr.

1,10,000

To 9% Debentures A/c

1,00,000

To Securities Premium

10,000

(Being Debentures issued at 10% premium)

9.

JOURNAL

Date

Particulars

L.F.

Kumar's Current A/c

Dr.

To Raja's Current A/c

Dr. (Rs.)

Cr.(Rs)

11,100

11,100

(Being adjustment made which was omitted

earlier)

Working Notes:

STATEMENT SHOWING ADJUSTMENTS

Particulars

Kumar (Rs.)

Raja (Rs.)

Interest on Capitals

81,000 (Cr.)

36,000 (Cr.)

Salaries

50,000 (Cr.)

36,000 (Cr.)

Wrong Profits

1,94,600 (Dr.)

83,400 (Dr.)

Actual Profits

52,500 (Cr.)

22,500 (Cr.)

Adjustments

11,100 (Dr.)

11,100 (Cr.)

10.

JOURNAL

Date

Particulars

L.F.

P & L Suspense A/c

Dr.

Dr. (Rs.)

Cr.(Rs)

10,500

To P's Capital A/c

10,500

(Being share of profit credited to his A/c)

Q's Capital A/c

Dr.

24,000

R's Capital A/c

Dr.

12,000

To P's Capital A/c

36,000

(Being adjustment made in respect of P's share

of goodwill)

Working Note :

(a)

P's Share of profit

Average Profit

P's share of profit

=

Average profit x 3/12 x 2/5

=

2,00,000 + 1,80.000 + 2,10,000 -1,70,000

= Rs.1,05,000

=

1,05,000 x 3/12 x 2/5 = Rs.l0,500

P's share in goodwill = Rs.90,000 x 2/5 = Rs. 36,000

11.

BALANCE SHEET OF SAGAR LTD.

.

as at ..........

Liabilities

Amount (Rs.)

SHARE CAPITAL

Authorised Capital

1,00,00,000

Assets

Amount (Rs.)

1,00,000 equity shares of Rs. 100 each

Issued Capital

60,000 equity shares of Rs. 1 00 each

60,00,000

Subscribed Capital

56,000 equity shares of Rs.100 each

56,00,000

Less calls in arrears

14.000

55,86,000

OR

Liabilities

Amount (Rs.)

Assets

Amount (Rs.)

A uthorised Capital

1,00,000 Equity Shares of Rs.100 each

1,00,00,000

Issued Share Capital

60,000 Equity Shares of Rs.100 each

60,00,000

Subscribed Share Capital

56,000 Equity Shares of Rs. 100 each

56,00,000

Called up and Paid up Share Capital

56,000 Equity Shares of Rs. 100 each

Less, calls in arrears

56,00,000

14.000

55,86,000

Note : If the Issued Capital is taken as Rs.56,00,000, full credit was given.

12.

INCOME & EXPENDITURE ACCOUNT

for the year ended 31st December 2006

Expenditure

To Salary

Amt. (Rs.) Income

15,000

By Subscription

Amt (Rs.)

52,000

Add: Outstanding Salary

1,500

To Office Expenses

16,500 Add: Subscription Outstanding

6,000 at the end

2,000

To Excess of Expenses

Over Tournament Fund

5,000 Less: Subscription

(31,000-26,000)

Outstanding in the

beginning

3.000

To Depreciation on Building

7,500 By Entrance Fees

5,000

To Depreciation on Furniture

1,800 By Sale of old Newspaper

1,000

To Depreciation on Sports Equipment

7,000

To Surplus

16,800 By Accrued Interest

60,600

3,600

60,600

BALANCE SHEET

as at 31" December 2005

Liabilities

Capital

Amount (Rs.)

1,66,000

Assets

Cash

Amount (Rs)

10,000

Subscription

Outstanding

3,000

Building

75,000

Furniture

18,000

Sports

1,66,000

Notes :

Equipment

30,000

1 2% Investments

30,000

1,66,000

1. If Billiards Table is included in furniture, then depreciation On furniture would be

Rs.3,800

and the surplus would be Rs.l 4,800.

2. No marks were deducted if depreciation has been charged on Investments. The

surplus

would change accordingly.

13.

Old Ratio

=

3:2

Z's share

=

1/3

Z acquires from K = 1/3 x 2/5 = 2/15

Z acquires from Y = 1/3 x 3/5 = 3/15

K's new share = Old share-share to Z = 3/5-2/15 = 7/15

Y's new share = Old share - share to Z = 2/5 -3/15 = 3/15

New profit sharing ratio = 7:3:5

JOURNAL

Date

Particulars

Cash A/c

L.F.

Dr.

Dr. (Rs.)

Cr.(Rs)

1,10;000

To Z's Capital A/c

80,000

To Premium A/c

30,000

(Being Capital and share of goodwill brought in by

the new partner)

Premium A/c

Dr.

30,000

To K's Capital A/c

12,000

To Y's Capital A/c

18,000

(Being the amount of premium distributed in

Sacrificing ratio)

14.

i)

Date

JOURNAL OF VARUN LTD.

Particulars

L.F.

Bank A/c

Dr.

Dr. (Rs.)

Cr.(Rs)

6,38,00,000

To Debenture Application and Allotment A/c

6,38,00,000

(Being Debenture Application money received)

Debenture Application and Allotment A/c

Dr.

6,38,00,000

To 9% Debentures A/c

5,80,00,000

To Securities Premium A/c

58,00,000

(Being issue of Debentures at Premium of 10%)

II)

Date

JOURNAL

Particulars

L.F.

9% Debentures A/c

Dr.

Dr. (Rs.)

Cr.(Rs)

35,000

To Debenture Holders

35,000

(Being amount due to Debenture Holders)

Debenture holders A/c

Dr.

To Equity Share Capital A/c

28,000

To Securities Premium A/c

7,000

(Being 2,800 Equity Shares issued at a premium of 25%)

III)

35,000

JOURNAL

Date

Particulars

L.F.

9% Debentures A/c

Dr.

Dr. (Rs.)

Cr.(Rs)

45,000

To Debenture Holders

45,000

(Being amount due to Debenture Holders)

Debenture Holders A/c

Dr.

45,000

To Bank A/c

45,000

(Being amount paid to Debenture Holders)

REVALUATION ACCOUNT

15.

Expenditure

Amt. (Rs.) Income

Amt (Rs.)

To Stock

4,600 By Loss transferred to

To Furniture

1,000 Partners capital A/cs :

To Plant &. Mach.

1,500

R 6,720

To Building

8,000

S 6,720

To Provision for

T 3,360

Doubtful Debts

16,800

1,700

16.800

16.800

CAPITAL ACCOUNTS

Particulars

R Rs.

S Rs.

T Rs. Particulars

6,720

6,720

3,360 By Balance b/d

R Rs.

S Rs.

T Rs

To

Revaluation A/c

By P&L A/c

To S's Capital A/c

To Cash A/c

3,200

18,080

80,000 50,000 40,000

3,600

3,600

1,800

_

3,200

-

1,600 By R's

Capital A/c

To S's Loan

A/c

By T's

- 33,600

- Capital A/c

To Bal. c/d

83,600 58,400

41,800

-

1,600

-

73,680 36,840

83,600 58,400 41,800

BALANCE SHEET

as at 1.4.2004

Liabilities

Amt (Rs.) Assets

Bank Loan

12,800 Cash

33,220

Sundry Creditors

25,000 Bill Receivables

10,800

S'sLoan

33,600 Debtors

Capital

Less Provision

Amt (Rs.)

35,600

1,700

33,900

R

73,680

Stock

T

36,840

Furniture

40,000

6,000

1,10,520 Plant & Machinery

18,000

Building

40,000

1,81,920

1,81,920

S's LOAN ACCOUNT

Cr.

Date

Dr.

Particular

Amount (Rs,)

Date

33,600

2004

To Balance c/d

Apr. 1

Particular