Pharmaceutical Price Policies and Practices in China

advertisement

Candidate Number: 30571

China’s Pharmaceutical Price Policies and Practices

Contents

Abbreviations ........................................................................................................................................3

Abstract .................................................................................................................................................4

1. Introduction ...................................................................................................................................5

2. Methodology .................................................................................................................................8

3. Background ...................................................................................................................................9

3.1. Health System ...................................................................................................................9

3.1.1.

Financing Hospitals and Doctors ..........................................................................9

3.1.2.

Medical Insurance ...............................................................................................10

3.1.3.

Generic Policy ..................................................................................................... 11

3.2. Pharmaceutical Industry and Commerce ........................................................................13

3.2.1.

Pharmaceutical Industry ......................................................................................13

3.2.2.

Pharmaceutical Commerce..................................................................................14

3.2.3.

Medicines Procurement through Central Bidding ...............................................14

3.3. Pharmaceutical Pricing Policies ......................................................................................16

3.4. High Level Forum on Developing NMP to Secure the Essential Medicine System .......18

4. Pricing Surveys ...........................................................................................................................19

4.1. Availability ......................................................................................................................19

4.2. Prices for Core Drugs......................................................................................................20

4.3. Affordability ...................................................................................................................21

4.4. Price Components ...........................................................................................................23

4.5. Comparison with India’s Surveys ...................................................................................24

5. Summary of China’s Medicines Price and Availability Problems ..............................................25

5.1. Complexity and Bureaucratic Structures.........................................................................25

5.2. Lack of Access ................................................................................................................25

5.3. Price and Affordability ....................................................................................................26

5.4. Generic Policy.................................................................................................................27

5.5. Price Components ...........................................................................................................27

5.6. Financing Hospitals ........................................................................................................27

5.7. Drug Use Patterns ...........................................................................................................28

5.8. Conflicts of Interests .......................................................................................................28

5.9. Corruption .......................................................................................................................29

6. Policy Options.............................................................................................................................30

6.1. Selection of Essential Drugs ...........................................................................................30

6.2. Drug Pricing ....................................................................................................................30

6.3. Generic Policy.................................................................................................................31

6.4. Supply and Distribution ..................................................................................................32

6.5. Affordability ...................................................................................................................33

6.6. Rational Reimbursement to Hospitals and to Doctors ....................................................33

6.7. Research ..........................................................................................................................33

August 31, 2007

1

Candidate Number: 30571

7. Conclusion ..................................................................................................................................34

Annex 1-8 ...........................................................................................................................................35

References...........................................................................................................................................45

August 31, 2007

2

Candidate Number: 30571

Abbreviations

BMI

CNHEI

Basic Medical Insurance

China National Health Economics Institute

EDL

Essential Drug List

GDP

Gross Domestic Product

GMP

Good Manufacture Practice

HAI

Health Action International

IB

Innovator Branded drugs

IDA

International Dispensary Association

INN

International Non-proprietary Names

IRP

International Reference Price

LPG

Lowest-Priced Generics Equivalent

MOH

Ministry of Health

MHS

Management Science of Health

MOSSL

Ministry of Labour and Social Security

MPR

Median Price Ratio

NDRC

National Development and Reform Commission

NMP

National Medicine Policy

OECD

Organization for Economic Co-operation and Development

R&D

Research and Development

SC

State Council

SFDA

State Food and Drug Administration

SPDC

State Planning and Development Commission (after 2003 became NDRC)

THE

Total Health Expenditure

WHO

World Health Organization

August 31, 2007

3

Candidate Number: 30571

Abstract

This paper describes China’s complex pharmaceutical sector, covering the overall health

system, the pharmaceutical industry and commerce, and the drug pricing system. I have

tried to collect all current relevant drug-related policies in China and the literature to

evaluate these policies. Also, I have interviewed some key informants in the Chinese

Government and academia. Problems in China’s pharmaceutical sector include lack of

access, irrational reimbursement to hospitals/doctors and consequent irrational drug use

patterns, disorganized supply and distribution systems and conflicts of interest among

different stakeholders. Possible policy options to address these problems include generic

promotion, rational reimbursement of hospitals and doctors, the promotion of regular

supply and distribution systems, reasonable pricing, and encouragement of more

research on all aspects of the pharmaceutical sector.

A comprehensive and balanced National Medicine Policy (NMP), reconciling the varied

interests of the many stakeholders, needs to be established to guide the whole process of

drug production, selection, distribution, consumption and pricing, to promote a

pharmaceutical industry that would ensure access by the Chinese population to essential

medicines that are used rationally.

August 31, 2007

4

Candidate Number: 30571

1.

Introduction

In 2005, China spent 4.73% of its Gross Domestic Product (GDP) on Total Health

Expenditure (THE) {Ministry of Health (Statistic Information Centre), 2007 #41}.

Drug expenses accounted for 50.5% of medical expenses for out patients and 42.7%

for in patients in 2006 {Ministry of Health (Statistic Information Centre), 2007 #41}.

China spends over 2.26% of GDP on pharmaceuticals which is more than most OECD

countries, as shown in Figure 1.

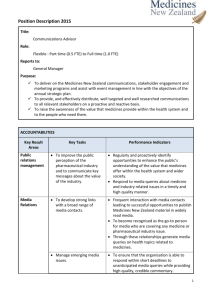

Figure 1. Pharmaceutical Expenditure/GDP in OECD Countries and China (2005)

August 31, 2007

5

Candidate Number: 30571

Source: OECD 2007 and MOH, China, 2007

Although medicine retail price indexes have continually decreased since 1995

{National Bureau of Statistics of China, 1995-2006 #31} (See Annex 1), patients still

regard drug prices as unaffordable and their out-of-pocket expenses accounted for

52.21% of THE {China National Health Economics Institute, 2006 #32}.

The pharmaceutical sector in China is very complicated, involving many stakeholders

with different and sometimes contradictory interests. In this paper, I describe the whole

pharmaceutical sector. Although the focus is on pharmaceutical pricing polices, all the

other policies described in the sector impact on prices, including: policies which impact

on access to drugs; reimbursement to hospitals/doctors; and drug use patterns; supply

and distribution systems; and the functions of different stakeholders, etc. No articles

were found which collected all drug policy related documents involving all the

stakeholders to analyse pharmaceutical price issues systematically. Therefore, I present

information on all related policies to show their influence on drug prices. An annotated

bibliography and the text of policy documents and related articles will be produced and

made available on request to WHO. Also, as there is a lack of in-depth surveys on drug

prices, this paper will synthesize existing drug price survey data between China’s

provinces.

August 31, 2007

6

Candidate Number: 30571

The first part of the paper describes current drug policies and their application. The

second part presents the methodology and the third provides background. The fourth

part compares two medicine pricing surveys in Shandong Province and Shanghai City

on the availability of drugs, drug prices, affordability and price components.

Comparison is also made with surveys done in six Indian states. The fifth part

summarizes China’s medicines price and consequent availability problems, while the

sixth part provides some policy options for Chinese decision-makers to consider. The

paper concludes that a comprehensive NMP should be established to address

pharmaceutical sector issues due to the complexity of the sector.

August 31, 2007

7

Candidate Number: 30571

2.

Methodology

Drug policy documents were collected from all relevant Government websites,

including SFDA, MOH, NDRC, MOSSL and from individual informants. They were

sorted into the following categories: financing hospitals/doctors, medical insurance,

generic policies, pharmaceutical industry/commerce and pharmaceutical pricing.

Practical evaluations were mainly from VIP-database (a Chinese academic database);

websites with the titles of specific policies as keywords, and other articles were

provided by interviewees and from Pubmed searches.

Interviews were undertaken in Beijing and Shanghai in July 2007. I interviewed key

informants, 12 of whom were from the Chinese Government, who either have been or

are involved in drug price-related policy-making, and 2 were from top academic

institutions, who are all key experts in China doing research on pharmaceutical sector

and also involved in the process of drug policy-making. For each informant, I prepared

a list of questions which depended on their specific roles. See Annex 2. All citations in

this paper are confirmed and authorized by interviewees.

August 31, 2007

8

Candidate Number: 30571

3.

Background

3.1. Health System

3.1.1. Financing Hospitals and Doctors

China’s health facilities have experienced a transformation from planned management

by Central Government to market-oriented management instigated since China’s

economic reform. The percentage of Government financial support to hospitals

decreased from about 60% at the beginning of the 1980s to 8.2% in 2003 {Ying XH,

2007 #18}. As a result, hospitals regard pharmaceutical sales revenues as their main

financial sources. They accounted for nearly 80% of total drug sales {China National

Health Economics Institute, 2006 #32}. Due to information asymmetry, patients have

no power to control the quality and amount of medical services, and have to rely on

physicians to make decisions on their behalf. So, hospitals and physicians can boost

drug sales. In 2005, hospitals’ margins were over 50 billion Yuan (US$ 6.75 billion),

which accounted for 42% of the procurement price (Zhu CH, 2007, Interview). To

resolve this issue, NDRC {National Development and Reform Commission, 2006 #57}

required retail prices to equal “the procurement price plus margin” with the profit rate

fixed at 15%, while this gives hospitals incentives to procure higher-priced drugs (Li

XF, 2007, Interview).

The irrational salary system for doctors (Lu J, 2007, Interview) and pharmaceutical

companies’ marketing (Wei JG, 2007, Interview) encourages them to prescribe

expensive drugs to obtain higher rebates to compensate for their low salaries. The

monthly salary and allowances of a county hospital doctor are between 1000 and 1500

Yuan ($US125 to $US187.5), while the monthly rebates from prescriptions are

between approximately 3000 and 5000 Yuan (US $375 to US $625) {Liang, 2005

#52}.

August 31, 2007

9

Candidate Number: 30571

MOH {Ministry of Health, 2000 #56} piloted instituting two-line management in

Anhui Province to separate drug revenues and expenses in medical facilities, and

expenses and revenues from medical services and drug sales. Net drug revenues are

pooled and used to support medical services. An evaluation showed that this policy

had failed to limit the growth in drug expenditure {Wang, 2006 #55}.

Community health services have been encouraged to promote proper distribution of

health resources with more government financial support since the beginning of 2006

{State Council, 2006 #60}.

3.1.2. Medical Insurance

China provides free medicine services to a limited number of individuals, such as

Government officials, most of whom could afford medical expenses (Wu YP, 2007,

Interview). Five years after Zhenjiang Province and Jiujiang City’s pilots in 1993,

the BMI system for urban employees (compulsory), which include employees of

state-owned enterprises, collective-owned enterprises, foreign enterprises and private

enterprises, government offices, institutions, and social groups, was officially

established by the Chinese Government with the premiums paid by both employers

and employees. Also, publication of a national BMI drug list followed {State Council,

1998 #58}. Drugs on the A-list could not be altered, while drugs on the B-list could be

adjusted by the provincial government. The most recent 2004 edition includes 1027

western medicines, far more than the 300 drugs on the WHO Model List of Essential

Medicines {World Health Organisation, 2007 #59}. At the end of 2006, 150.732

million urban employees were covered. Revenues from medical insurance funds were

174.7 billion Yuan (21.84 billion US$) and the expenditure was 127.7 billion Yuan

(15.96 billion US$) in 2006, 24.3% and 18.3% higher respectively than in 2005.

August 31, 2007

10

Candidate Number: 30571

In 2003, a new rural co-operative medical system was implemented mainly covering

severe diseases. The rural population is expected to participate voluntarily and funds

from individuals, collectives, central and local government. By the end of 2006, 508

million farmers were covered. The Government suggested establishing practical drug

supply, distribution and monitoring systems; promoting drug procurement through

centralized bidding or by county or township health centres on behalf of village clinics;

and encouraging chain enterprises to supply drugs though a centralized supply system

to grassroots-level medical facilities {Ministry of Health, 2003 #14; Ministry of Health,

2006 #13}.

For

drugs

consumed

in

both

urban

communities

and

rural

areas,

Government-designated manufacturers are encouraged to assure the quality of drugs,

print the retail price on even the smallest retail package, and reduce drug costs and

prices by simplifying packaging, and centralizing supply. These drugs’ prices are set

by the Government separately with more flexible mark-ups. Community and rural

medical facilities should give priority to procuring and consuming drugs produced by

designated manufacturers, not through a central bidding system and they should be

procured by medical facilities directly and supplied centrally {State Food and Drug

Administration, 1999 #63}. As a result, drug prices were reduced by 19% in

Dongcheng District (Beijing) compared to hospital prices and the cost per prescription

was reduced by 50%{Liu, 2006 #4}.

3.1.3. Generic Policy

No generic substitution policies exist in China. However, MOH {Ministry of Health

(Statistic Information Centre), 2007 #41} suggested that doctors should prescribe with

INN, patented drug names for new-active compounds, and names of combination

August 31, 2007

11

Candidate Number: 30571

preparations authorized and published by the SFDA.

August 31, 2007

12

Candidate Number: 30571

3.2. Pharmaceutical Industry and Commerce

3.2.1. Pharmaceutical Industry

The 2006 production and sales revenues, profits and export delivery values of the

pharmaceutical industry are shown in Table 1. See Annex 3 also.

Table 1. Chinese Pharmaceutical Industry’s Production and Sales Revenues, Profits and

Export Delivery Values and Pharmaceutical Commerce’s Net Sales and Profits in 2006

2006

Compared to 2005

(%)

Pharmaceutical

Total

Medical

and

520/65

+17.53

Industry

Pharmaceutical Product sales

total profits

41.51/8.13

+11.01

Export Delivery Values

67.059/8.38

+25.51

Pharmaceutical

Net Sales

280/35

+16.7

Commerce

Net Profits

68/21

+6.1

revenues

Source: NDRC, 2007

Note: in column 3, figures are first given in billion Yuan and then in billion US$ equivalent.

There are over 4000 pharmaceutical manufacturers in China {Wei JG, 2007 #65}, most

are small scale and produce the same drugs (Wu YP, 2007, Interview). For example,

Compound Sulfamethoxazole are produced by over 1000 manufacturers {Wei JG, 2007

#65}. R&D capacity is very weak and financing for R&D is also low, only accounting

for about 1% of the sales value {Wei JG, 2007 #65}. In 1994, GMP Certification began

in China, but drug production is still not regulated effectively, with no established

regulatory procedures for approving a drug. In 2006, 10386 “new” drugs were approved

for the market by SFDA (Wu YP, 2007, Interview).

August 31, 2007

13

Candidate Number: 30571

Competition among pharmaceutical manufacturers is based on price, not on quality.

NDRC has reduced drug prices 24 times since 2000. Therefore, manufacturers aim to

produce more “new” drugs, usually branded generics, to increase profits by only

changing the name, formula, or packaging, while effective, “old” drugs were removed

from the market because of their low profit margins. NDRC {National Development

and Reform Commission, 2005 #61} issued “Regulation on Drug Price Differences

Ratio” to verify drug prices for different dosages or weights of selected sample drugs,

and the trend to create “new” drug are expected to be controlled.

3.2.2. Pharmaceutical Commerce

The 2006 net sale values and profits of China’s medical and pharmaceutical industry are

shown in Table 1 {National Development and Reform Commission (Department of

Price), 2007 #29}.

With the intense competition, whether health facilities procure or prescribe a drug is

extremely important for manufacturers, making marketing essential. Therefore,

manufacturers try to decrease production costs and increase marketing costs to ensure

their viability, so adversely affecting drug quality (Wu YP, 2007, Interview). This makes

the drug supply chain another important factor influencing prices. There are usually 6 to

9 links from production to sale in the pharmaceutical sector. The final retail prices

reflect the margins deducted by each link, distributors’ competition, information

asymmetry, the relationship among consecutive links and related policies (Wei JG, 2007,

Interview), which are normally 5 to 10 times higher than actual factory prices {Liang,

2005 #52}. Assuming the retail price of a drug is 100 Yuan, 23 Yuan is given to the

manufacturer, 20 to the the hospital, 10-12 to doctors as rebates and the rest, 45 to 47

Yuan, to the wholesaler {Zuo, 2006 #54}.

3.2.3. Medicines Procurement through Central Bidding

August 31, 2007

14

Candidate Number: 30571

Drug procurement through centralized bidding has been implemented since 1998. The

savings made from the bidding system compared with Government set prices or market

prices were required to be redistributed rationally between patients and medical

facilities, with the majority transferred to patients {State Council, 2001 #62}.

Communities in Beijing are implementing central bidding procurement {Xin Hua Net,

2007 #25}, centralized supply and cancellation of the previous 15 % mark up rate for

312 common drugs. After implementing central bidding procurement, drug prices in the

first half of 2007 were 21.1% less than in 2006.

In practice, however, some local governments are responsible only for the procurement

of drugs and the contracts signed are usually ambiguous, so the companies which

submit bids have to renegotiate with hospitals after the bidding process to ensure that

hospitals procure their drugs. The bidding procurement system is not well coordinated

and the companies have to take part in several bids per year, wasting financial and

human resources (Zhuang N, 2007, Interview).

August 31, 2007

15

Candidate Number: 30571

3.3. Pharmaceutical Pricing Policies

Since 2000, new price-setting policies {State Planning and Development Commission,

2000 #21; State Planning and Development Commission, 2000 #22; State Planning and

Development Commission, 2001 #23} have come into effect. Central Government

(SPDC/NDRC) sets maximum retail prices for A-list medicines on the national BMI

drug lists, and for patented innovator and first-class new drugs (i.e. the active ingredient

and its preparation materials extracted from plants, animals or minerals, etc), which

have not previously been on sale in China and for second-class new drugs (i.e. newly

discovered drugs or preparations) {State Food and Drug Administration, 2007 #26}.

Central Government also sets the factory price/landed price of first-class drugs used in

mental health, anesthetics, immunization medicines, and family planning medicines,

leaving retail pharmacies and public hospitals to set their own retail price – which

cannot be higher than the maximum retail price. Provincial governments set prices for

B-list drugs, and the wholesale prices and retail prices of first-class drugs used in mental

health and anesthetics. Since 2000, NDRC has only set the prices of prescription drugs

and provincial price bureaus set OTC medicine prices {State Food and Drug

Administration, 1999 #63}. NDRC {National Development and Reform Commission,

2005 #27} began to set factory prices and maximum retail prices for selected samples of

drugs. Prices are based both on declared costs by manufacturers and calculated as

factory or import prices with duty/taxes and retail distributional profits incorporated

(Annex 4). Manufacturers can apply for special pricing permission for higher prices if

their drugs have greater efficacy and safety or if the treatment cycle and expenses are

much lower than those of other manufacturers producing the same drug. No

international drug price information is currently referred to (Xu WM, 2007, Interview).

August 31, 2007

16

Candidate Number: 30571

The price of off-patent innovators could be set up to be 35% higher for injections and

30% higher for other formula than generics produced by GMP certified manufacturers.

For patented drugs, manufacturers or distributors can set prices themselves in the year

after they received their import registration license, but after one year, SPDC/NDRC

makes an official assessment of the price. However, all prices not set by Central

Government have to be registered with the Government pricing authority. Drugs with

GMP Certification could be priced up to 40% higher for injections and 30% higher for

other dosage forms than non-GMP certified products.

In practice, the factory price set by manufacturers is usually much higher than the actual

production cost, because the Government pricing authority does not have enough

capacity to check these costs (Wu YP, 2007, Interview). Different prices for the same

drug exist in different areas because of local competition, procurement transparency and

local protection (Xu WM, 2007, Interview).

For medicines with market pricing, the retail price is set based on production costs,

market supply and demand. Wholesalers, retail pharmacies and hospitals can set the

actual selling price but cannot exceed the retail price set by the manufacturer.

August 31, 2007

17

Candidate Number: 30571

3.4. High Level Forum on Developing NMP to Secure the Essential

Medicine System in China

On 14 June, 2007, a High Level Forum on Developing NMP to Secure the Essential

Medicine System in China was held in Beijing. Some international experts were invited

to suggest policy options as part of China’s health system reform. WHO presented a

strategic framework to achieve reforms in the pharmaceutical sector, including

suggestions on improving affordability, supply, distribution, selection of essential

medicines, regulation and quality assurance, rational use, management, R&D, together

with the relevant implementation procedures {World Health Organisation, 2007 #17}.

Also, WHO background paper {Tang, 2007 #11} for this meeting examined and

described the main problems existing in pharmaceutical sector, critically analyzed the

main socio-economic and institutional factors associated with these key problems and

made recommendations. See Annex 5.

August 31, 2007

18

Candidate Number: 30571

4.

Pricing Surveys

In 2004 and 2006, WHO/HAI supported two surveys in Shandong Province and

Shanghai City, China {Ye, 2006 #3; Sun, 2005 #2}. The study design of both was based

on the standardized methodology developed by WHO/HAI using a standard list of

medicines, plus additional locally important medicines (supplementary medicines) to

compare the prices and availability of medicines in different sectors and regions in the

provinces {World Health Organisation, 2006 #24}. Sectors surveyed included public

hospital clinics (procurement prices, prices paid by patients and availability) and private

retail pharmacies (prices paid by patients and availability). In Shandong, 39 core and

supplementary medicines were surveyed in 4 areas; in Shanghai 41 core and

supplementary medicines were surveyed in 4 districts (See Annex 6). In the survey,

price data is expressed as MPR, which is the median unit price of the medicine across

the facilities surveyed, divided by the median IRP from MSH {Management Science of

Health, 2003/2005 #10; Management Science of Health, 2005 #67}.

Key findings from these two surveys showed availability of drugs, prices for core

medicines, affordability and price components.

4.1. Availability

In both surveys, availability of medicines surveyed was very poor in the public and

private sectors. This may have been due to the selection of medicines. But even for

life-saving medicines, such as Amoxicillin, Glibenclamide, Omeprazole and Salbutamol

inhaler, the availability ranged from 5% to 90%.

August 31, 2007

19

Candidate Number: 30571

Table 2. Median of Availability of Medicines in the Public and Private Sectors

Shandong

Shanghai

Public

Private

Public

Private

IB

0.0%

0.0%

13.3%

10.0%

LPG

7.5%

10.0%

33.3%

15.0%

Source: HAI, 2007

Note: “median %” of medicines found in at least 4 facilities; for examples of the top 5 drugs see Annex 7.

4.2. Prices for Core Drugs

MPRs ranged from 0.62 in Shandong for public sector procurement to 9.85 for private

sector innovator products in Shanghai. Comparing patient prices between the public and

private sectors, the MPR was the same or higher in the public sector --- an unusual

situation in which the public sector can charge a price premium.

Table 3. MPRs of Core Medicines

Shandong

Shanghai

Public

IB

LPG

Private

procurement

patient

6.30

4.09

(9)

(6)

0.62

0.93

(15)

(10)

August 31, 2007

Public

Private

procurement

patient

7.14 (9)

7.63 (8)

9.83 (9)

9.85 (8)

0.51 (11)

1.44 (10)

1.84

1.43 (9)

(12)

20

Candidate Number: 30571

Source: HAI, 2007

Note: MPRs were reported of medicines found in at least 4 facilities; the number in brackets represents

the number of drugs which were found in the survey; Annex 8 provides the MPRs for some selected

drugs.

Within provinces and sectors, there was considerable price variation for the same

product, e.g. Amoxicillin price varied in Shandong’s private sector from 0.96 to 4.28.

Table 4. Variations of MPR Among Different Areas for Selected Drugs

LPG

Shandong

Public Sector

Aciclovir

1.25-1.59

Beclometasone inhaler

1.89-1.93

Hydrochlorothiazide

Private Sector

Shanghai

0.52-0.77

Ranitidine

0.87

Aciclovir

0.88-1.58

Amoxicillin

0.96-4.28

Beclometasone inhaler

1.83-1.89

Captopril

0.12-0.18

Hydrochlorothiazide

0.33-0.83

Ranitidine

0.39-0.65

0.42-0.96

Source: HAI, 2007

4.3. Affordability

In terms of affordability measured in day’s wages of the lowest paid unskilled

government worker, major differences existed between innovator and generic

equivalents.

For example, in Shanghai, a month’s diabetes treatment with Metformin,

would cost 3.9 day’s wages for the innovator and 0.8 day’s wages for the generic.

August 31, 2007

21

Candidate Number: 30571

Table 5. Affordability of Treating Sample Conditions in the Public and Private Sectors

Shandong

Shanghai

Public

Private

Private

Median

Day’s

Median

Day’s

Median

Day’s

Median

Day’s

price

wages

price

wages

price

wages

price

wages

(Yuan)

Diabetes:

Public

(Yuan)

IB

144

(Yuan)

10.8

(Yuan)

98.40

3.9

90.90

3.6

LPG

19.16

0.8

IB

203.14

8.1

203.14

8.1

LPG

117.43

4.7

106.28

4.3

Metformin

500mg

per

tab,

3

times daily for 30 days

Hypertension:

Amlodipine

5mg per cap, once

daily for 30 days

Adult resp. infects

IB

Amoxicillin

250mg per

cap,

3

LPG

4.20

0.3

7.98

0.6

22.31

0.9

22.31

0.9

IB

59.4

4.5

54.4

4.1

59.40

2.4

59.40

2.4

0.72

0.1

IB

360.99

14.4

354.64

14.2

LPG

155.00

6.0

150.00

6.0

times daily for 7 Days

Arthritis:

Diclofenac

25mg per cap, twice

LPG

daily for 30 days

Depression

Fluoxetine

20mg per cap, once

daily for 30 days

Asthma:

IB

36.45

2.7

37.50

2.8

35.30

1.4

35.65

1.4

4.75

0.4

22.40

0.9

18.55

0.7

Salbutamol inhaler

0.1mg per dos for 200

LPG

doses

August 31, 2007

22

Candidate Number: 30571

Peptic ulcer:

IB

Ranitidine

150mg per cap, twice

LPG

8.6

0.6

5.9

0.4

9.00

0.4

8.80

0.4

daily for 30 days

Note: the dosage listed in the first column is based on the Shandong data; however, there are some

variation in Shanghai data, i.e. Metformin, twice a day; Amoxicillin, 500mg per tablet.

4.4. Price Components

In Shandong, cumulative mark-ups (from the manufacturer’s price to the patient price)

were 24-35% in the public sector, and 11-33% in the private sector. In the public sector,

hospital mark-ups were the greatest contributor (hospital mark-ups of up to 26% were

seen). Business tax is applied in the private sector.

Table 6. Medicine Price Composition in the Public and Private Sectors

Only

Generic

Innovator and Generic

Equivalent

Medicine Name

Only Innovator Brand

in China

Amoxicillin

Losec

Omeprazole

Losartan

(Generic)

(Innovator brand)

(Generic)

(Innovator Brand)

12

140.72

48

42.39

12

140.72

48

42.39

10.33%

13.70%

0.58%

6.16%

13.24

160

48.28

45

Hospitals’ Mark-up

14.05%

18.75%

26.14%

17.11%

Hospitals’ Retail Price

15.10

190

60.9

52.7

3%

2%

3%

3%

12.36

143.53

49.44

43.66

Manufacturer’s Selling

Price / Landed Price

(set by manufacturer)

Wholesalers’

Procurement Price

Public Sector

Wholesalers’ Mark-up

to Hospital

Hospitals’ Procurement

Price

Private Sector

Wholesalers’ Mark-up

to Pharmacies

Pharmacies

August 31, 2007

23

Candidate Number: 30571

Procurement Price

excluding Tax

Regional Tax Paid by

3%

3%

3%

3%

12.73

147.84

50.92

44.97

Pharmacies’ Mark-up

25.69%

22.30

17.83%

4.51%

Retail Price Charged by

16

180.81

60

47

16.1

217

64.7

56.4

Pharmacies

Pharmacies

Procurement Price

including Tax

the Pharmacies

The Maximum Retail

Price Set by

Government

Source: HAI, 2007

4.5. Comparison with India’s Surveys

These surveys reflect similar findings to those done in India {Kotwani, 2007 #28},

using the same methodology. Availability in the public and private sectors was generally

poor, with Shanghai an exception, which may reflect the choice of medicines surveyed.

In terms of price ratios, public sector procurement was generally efficient being less

than IRP, except in Shanghai where price ratios were 44% more than IRP. In India,

public sector procurement price ratios ranged from 0.27 to 0.48 in different states and

private patient prices were substantially higher than public sector patient prices.

Table 6. Comparisons between China and India in terms of Availability of Drugs and

Drug Prices in Both Public and Private Sectors

Shandong

Shanghai

Indian (6 states)

IB

0.0%

13.3%

0

LPG

7.5%

33.3%

0.0%-30.0%

IB

0.0%

10.0%

0.0%-22.9%

Medicine Availability

Public

Procurement

Private

August 31, 2007

24

Candidate Number: 30571

LPG

10.0%

15.0%

51.0%-95.0%

IB

6.30

7.63

-

LPG

0.62

1.44

0.27-0.48

IB

7.14

9.85

1.74-4.38

LPG

0.51

1.43

1.30-1.84

MPRs for core drugs

Public

Procurement

Private

Source: HAI, 2007; Kotwani, 2007

5.

Summary of China’s Medicines Price and Availability Problems

5.1. Complexity and Bureaucratic Structures

At Central Government level, SFDA, MOSSL, NDRC and MOH are responsible for

different aspects of medicine policies: registration, selection, pricing and procurement

of medicines, and at provincial level, similar devolutions of responsibilities occur. Also,

MOSSL and the Department of Rural Health of MOH are responsible for urban and

rural population separately. Different parties tend to act in their own interests without

mutual monitor, leaving the pharmaceutical market with the problems of a lack of

accurate information and ineffective price regulation (Lu J, 2007, Interview).

Manufacturers, wholesalers, hospitals and pharmacies all play a role in drug distribution,

and each will obtain a profit commensurate with their activity.

5.2. Lack of Access

August 31, 2007

25

Candidate Number: 30571

Most key informants said that there are enough medicines available to ensure access in

China. However, although there are thousands of pharmaceutical manufacturers, access

to essential medicines as measured in WHO/HAI surveys was not as good as

Government officials expected due to the production structure, procurement, pricing

policies and prescribing habits. According to the surveys, even the availability of

commonly used drugs is very poor.

5.3. Price and Affordability

In-depth research on medicine prices is scarce in China. It would be more appropriate to

compare China’s drug prices with other developing countries, e.g. India, Thailand and

Brazil, and inappropriate to compare with developed countries, such as the USA, UK,

Japan, Germany and Australia, as was done by IMS {National Development and

Reform Commission (Department of Price), 2007 #34}. So, although the results showed

overall drug prices were lower than in these developed countries, and that generally

great price differences exist between branded innovators and generics, it may not reflect

the reality.

The WHO/HAI surveys showed that innovator drugs prices were frequently higher than

MSH IRP. This might be due partly to the over protection of innovator products, for

example by the Drug Pricing Measures, which allow for off-patent innovator prices

higher than domestically produced equivalent generic drugs {State Planning and

Development Commission, 2000 #21}. Also, most drugs with frequent and wide

ranging reductions on the NDRC reduced-price lists were generics, while the reduction

level for innovators was only 5% (Zhu CH, 2007, Interview).

August 31, 2007

26

Candidate Number: 30571

Although the lowest paid government workers’ incomes have improved rapidly,

out-of-pocket expenses for buying medicines are still high for patients. Medicines are

unaffordable to many of them.

5.4. Generic Policy

In China, generic medicines are usually sold as branded generics {IMS Health, 2007

#66}, which are pharmaceutically identical to the innovator and INN generic (generic

generic), and may be sold at close to the innovator medicine price and actively

marketed.

There are no requirements for generic substitution, or favorable terms for registering

generics and there is no policy to promote the prescription of INN generics in China.

However, in the prescription management strategies issued by MOH {Ministry of

Health (Statistic Information Centre), 2007 #41}, the Government suggested that

doctors should prescribe using the INNs, but this is not a requirement.

5.5. Price Components

Drug prices are calculated based on the costs declared by manufacturers themselves,

and there are insufficient human resources to check their figures, which might cause

some discrepancies. Import duty and tax contribute to the final high prices of imported

drugs as does the regional tax on drug prices in pharmacies. There are too many links in

the drug distribution process. The WHO/HAI surveys, only revealed end user prices but

from other literature, there is evidence that private rebates exist in the whole process,

which benefit wholesalers, retailers and hospitals {Liang Y, 2005 #52}.

5.6. Financing Hospitals

August 31, 2007

27

Candidate Number: 30571

The Government does not provide adequate funds to support hospitals. The percentage

Government financial input to hospitals at the beginning of the 1980s was about 60%,

while in 2003, it was only 8.2% {Ying XH, 2007 #18}. Increasingly hospitals have to

rely on revenues generated from drug sales, which are considerable as drug expenditure

accounted for nearly a half of total health expenditure in 2006 {Ministry of Health

(Statistic Information Centre), 2007 #41}. Overprescribing of medicines by doctors and

overpaying for medicines by hospitals is common.

5.7. Drug Use Patterns

Total pharmaceutical expenditures are determined not only by drug prices but by

another important element --- the amounts consumed, which is decided by the behaviors

of doctors (Chen V, 2007, Interview). Drug prescription patterns are influenced by the

rebates doctors and hospitals receive from distributors, rather than by patients’ needs.

Branded generics are marketed irrationally. The higher the drug price, the more the

incentives to procure and prescribe it. This is linked to the irrational salary structure for

doctors and the irrational financial reimbursement structure for hospitals {Liang, 2005

#52; Lian, 2004 #51}.

5.8. Conflicts of Interests

Conflicts exist between hospitals’ public service role and their ways of funding in order

to survive, between the ways doctors treat patients and their ways of gaining revenues,

and between wholesalers’ distribution systems and their ways of promoting their

products. All parties are acting in their own interests and frequently what makes sense

personally or institutionally may be contrary to the interests of patients and public

health.

August 31, 2007

28

Candidate Number: 30571

5.9. Corruption

Rebates exist at every stage of the distribution chain including wholesalers, hospital

directors, hospital pharmaceutical department directors and doctors. Different drug lists

exist at the same time: the EDL, BMI Drug List, New Rural Medical Cooperation Drug

List and Procurement Drug List. Local governments can change the drugs included in

the lists. Inclusion of a drug on the lists can be critical for a manufacturer’s survival and

these factors increase the likelihood of corruption (Lu J, 2007, Interview). Although

China has a Drug Management Law {State Food and Drug Administration, 2001 #47},

stating that manufacturers, wholesalers or medical facilities would be punished if they

receive rebates, enforcement of the law is not rigorous enough in practice (Wu YP, 2007,

Interview).

August 31, 2007

29

Candidate Number: 30571

6.

Policy Options

Above all, the pharmaceutical sector is very complex, with many players and different

often conflicting interests involved. Therefore, a comprehensive and balanced NMP

should first be developed, followed by adaptions at provincial level, in order to integrate

policies across whole sector, and to guide drug production, distribution and

consumption. This would promote the development of the pharmaceutical industry and

ensure access to essential medicines for most of the population. This NMP should

include the following components.

6.1. Selection of Essential Drugs

Smaller essential drug lists should be established for medicines to treat common

diseases according to evidence-based medicine and cost-effective analysis, which

should favour generic drugs. The drug list should be updated regularly using a

transparent consultative process involving all relevant parties and it should be used as a

basis to develop all reimbursement drug lists, including the medical insurance

reimbursement list. Both the essential drug list and medical insurance reimbursement

drug list should be established jointly by MOSSL, MOH, SFDA and regional health

authorities.

6.2. Drug Pricing

Since there are usually a sufficient number of competing products in China, NDRC

should consider removing price controls on generic drugs to increase competition

among manufacturers (Zhu CH & Zhou Y, 2007, Interview). Free pricing could be

implemented with enough public information provided to ensure price transparency at

all stages of the public sector medicine supply chain, i.e. manufacturers’ selling prices,

August 31, 2007

30

Candidate Number: 30571

wholesale mark-ups, distribution charges; hospitals’ mark-ups, pharmacies’ mark-ups,

taxes and duties, and other related charges. In the private sector, end user prices need to

be reported in such a way that consumers can make informed choices. Such as in Jordan,

a mobile service allowing citizens to obtain information on medicines (prices,

formulation and dosage) via mobile telephones was implemented {Jordan Food and

Drug Administration, 2006 #64}.

The maximum retail price of drugs on the BMI Reimbursement List should be set by

MOSSL not NDRC (Chen W, 2007, Interview) and the opinions by representatives from

patient groups, other government departments, medical facilities and the pharmaceutical

industry and commerce should be heard (Wei JG, 2007, Interview). Where drug prices

are regulated, the relevant authorities should invest in more human and technical

resources to improve verification of manufacturer-declared production costs and

international reference pricing index should be considered. There seems to be a lack of

sufficient national price information for Government pricing of drugs. This reference

procurement price information could be found in MSH Drug Price Indicator Guide

{Management Science of Health, 2003/2005 #10}, IDA Price Indicator {IDA

Foundation, 2007 #42}, AFRO Essential Medicines Price Indicator {World Health

Organization Regional Office for Africa, 2003 #43}, Generic Pharmaceuticals

Electronic Market Information Tool (eMIT) {National Health Service of United

Kingdom, 2007 #40}, Pharmaceutical Schedule of New Zealand {Pharmaceutical

Management Agency of New Zealand, 2007 #36}, or from the WHO website {World

Health Organisation, 2007 #35}.

6.3. Generic Policy

The SFDA should concentrate on ensuring the quality of medicines in China. Policies to

promote the production of INN generic drugs should be established. Permission given in

August 31, 2007

31

Candidate Number: 30571

the Drug Registration Management Regulation for generic registration two years prior

to patent expiry is a positive development {State Food and Drug Administration, 1999

#63}. MOSSL should give priority to generic equivalent prescribing and require generic

substitution for reimbursement. A fixed dispensing fee with regressive mark up rates

should be used to create incentives to use lower-price generics, as in the USA

{Department of Health and Mental Hygiene of United States, 2006 #49}. The use of

generics could be promoted by requiring the use of INN for all procurement,

reimbursement, prescribing and dispensing in public facilities. Generic substitution

should be allowed or required even in the private sector. Regulations rather than

suggestions are needed to promote a generic policy.

6.4. Supply and Distribution

The number of small- and medium-sized manufacturers, wholesalers and pharmacies

should be rationalized by tightening the criteria for license applications and renewal.

Taxes and duty for the production and distribution of medicines should be removed

(Zhou Y, 2007, Interview), especially for essential medicines. A policy should be

developed to encourage pharmaceutical manufacturers to export finished generic

medicines, not just pharmaceutical raw materials. A central bidding procurement system

should be further encouraged and the Government should monitor the whole

procurement process including contract, payments and drug delivery details, where

possible, using internet procurement (Li XF, 2007, Interview). Supply chains should be

shortened by reducing the number of irrational distribution levels between

manufacturers and patients. (Wei JG, 2007, Interview). The Government should ensure

the use of WTO/TRIPS flexibilities, such as Sweden’s use of parallel import {Ganslandt,

2004 #39} and compulsory licenses for government use as Thailand has done

{Washington College of Law, 2007 #46}.

August 31, 2007

32

Candidate Number: 30571

6.5. Affordability

The drugs to treat and prevent chronic diseases should be procured and supplied directly

by the Government to registered patients and the reimbursement rates should be

increased. Health insurance or financial assistance schemes should cover more of the

poor and vulnerable groups, and reimbursement rates should also be increased for these

people to create incentives for them to seek treatments.

6.6. Rational Reimbursement to Hospitals and to Doctors

It is crucial to increase Government input to hospitals. Appropriate mechanisms for

direct government financing hospitals must be developed (Zhu CH & Lu J, 2007,

Interview). Doctors’ salaries should be increased and unethical rebates banned. Standard

treatment protocols should be developed by the Government, not pharmaceutical

companies, using an evidence-based medicines approach (Lu J, 2007, Interview).

Legislation should be strengthened to monitor doctors’ and hospitals’ behavior. For

example, the US Federal Government recovered US$3.89 billion for fraud by drug

manufacturers against Medicaid between 2001 and 30 September, 2006, e.g. TAP

Pharmaceuticals was fined US$875 million for marketing frauds {Schneider A., 2007

#44}.

6.7. Research

Research on implementation of all aspects of pharmaceutical pricing policies should be

actively encouraged. The Government should co-ordinate and direct surveys, including,

as a minimum, those on the availability of drugs, drug prices and price components.

August 31, 2007

33

Candidate Number: 30571

7.

Conclusion

The problems existing in China’s pharmaceutical sector are complicated, involving the

national health system, the pharmaceutical industry and commerce, and drug pricing. In

China, 2.26% of GDP was spent on pharmaceutical expenses and patient’s out-of-pocket

expenses were almost 50% of total pharmaceutical expenditure. Although there are

thousands of manufacturers in China, many people still lack access even to essential

drugs. This is due to irrational supply and distribution systems, ineffective pricing

regulation, irrational reimbursement to hospitals and doctors (corruption issues involved)

and a lack of promotion of generics. The solution is to establish a comprehensive and

balanced NMP which reconciles the interests of different players in the pharmaceutical

sector and guides the whole process: drug production, distribution, consumption and

pricing. It is critical to for government to regulate industry with patient’s-need- oriented

production, not profit-oriented, and increase financial support to hospitals to break the

present incentive system and increase salaries for doctors to prevent rebates. Also,

improving transparency and providing adequate price and quality information to

empower patients are crucial. These actions are not easy to implement simultaneously,

but as China develops rapidly as a world power and a potential member of OECD, the

national health system must reflect this reality. To do this, China must inevitably

increase Total Health Expenditure while decreasing pharmaceutical expenditure as a

percentage of GDP from the present 2.26% to less than 2%. This can only be done

through major policy changes and the starting point is development of a NMP.

August 31, 2007

34

Candidate Number: 30571

Annex 1 Medicine Retail Price Index

Price indices compilation is implemented by the department of urban social and

economic survey, national bureau of statistics of China every year. The survey selected

business sites with large scale and wide assortment of drugs in sample small, middle

and large cities or counties which divided by economic regions and rational regional

distribution. There are 226 cities or counties taken the surveys at present. In additional,

the price information were investigated and recorded directly in every site by the

investigators and assistant investigators. Price Index of western medicines was 93.1 for

Shanghai and 96.9 for Shandong in 2004.

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

Traditional Chinese and

NI

111.5

108.8

104.4

102.8

101.0

100.2

98.5

96.5

98.4

96.7

97.6

Western Medicines and

UI

111.2

108.4

104.2

102.8

101.3

100.1

97.8

96.2

98.2

96.7

97.7

Health Apparatus and Articles

RI

112.1

109.3

104.6

102.7

100.6

100.4

99.7

97.0

98.8

96.7

97.4

NI

111.6

112.8

108.4

108.1

105.6

104.6

102.3

97.5

104.4

98.4

96.5

UI

111.2

113.1

108.4

108.7

106.3

104.7

101.7

97.1

104.0

98.7

96.6

RI

112.2

112.5

108.4

107.1

104.4

104.5

103.3

98.3

105.2

97.9

96.3

NI

111.0

106.2

101.6

99.1

97.9

97.3

95.8

95.4

94.3

94.5

97.8

UI

110.6

105.3

101.2

98.7

97.9

97.0

95.0

95.1

94.2

94.3

97.8

RI

111.6

107.3

102.1

99.8

97.9

97.7

97.0

96.0

94.4

95.0

97.8

NI

114.9

106.8

103.5

101.0

100.1

99.6

98.8

99.0

100.6

101.9

98.4

UI

114.8

106.7

103.5

100.8

100.0

99.7

98.0

99.2

100.5

102.0

98.6

RI

115.0

107.1

103.6

101.6

100.4

99.5

100.5

98.7

100.7

101.7

98.0

Traditional Chinese Medicinal

Materials and Medicines

Western Medicines

Medical Apparatus and Articles

Notes: the values are on the basis of previous year’s value, which is assumed as 100. RI = Rural Indices;

UI = Urban Indices; NI = National Indices

August 31, 2007

35

Candidate Number: 30571

Annex 2 Interviews conducted in Beijing and Shanghai between 16 and 25 July

2007

1. Chen Vivian

Director of Healthcare Economics, China Association of Enterprises with Foreign

Investment, R&D-based Pharmaceutical Association Committee

Main topics discussed: the factors impacting pharmaceutical expenditure; protection

of Intellectual Property Rights

2. Chen Wei

Deputy Director of Division of Health Insurance, Department of Health Insurance,

Ministry of Labour and Social Security of China

Main topics discussed: how do they set reimbursement prices and make agreements

with health care providers or hospitals; alternative policies for financing especially

for hospitals; how do they select drugs in positive or negative drug lists;

3. Hu Shanlian

Prof. of Epidemiology and Health Economics, School of Public Health, Fudan

University, Shanghai, China

Main topics discussed: the ways of manufacturers to cope with the reduced drug

prices; comments on the methodology of WHO/HAI surveys

4. Hu Yin

Secretary General of Development Center of Science and Technology of Chinese

Pharmaceutical Association / China Pharmaceutical Database Services

Main topics discussed: the existing national medical economic information network

5. Li Xianfa

Expert in Drug Procurement through Central Bidding

Main topics discussed: evolvement of China’s drug procurement through centralized

bidding, its pros and cons and development trends

6. Lu Jun

Deputy Secretary General of Chinese Medical Doctor Association

Main topics discussed: reasons for high pharmaceutical expenditure in China;

development of Standard Treatment Guidelines; doctors’ salary

7. Wei Jigang

Senior Research Fellow of Industrial Economics Research Department, Development

Research Center, The State Council of P.R.China

Main topics discussed: possibility for general policies to remove tax and duties on

medicine at both national and local levels considering the regressive nature of

medicine taxes; drug supply chain

8. Wu Yongpei

Director of Department of Pharmacy Regulation/National Institue of Hospital

Administration

Main topics discussed: reasons for high pharmaceutical expenditure in China

August 31, 2007

36

Candidate Number: 30571

9. Xu Weimin

Director of Division 1, Evaluation Center of Drug Pricing, NDRC

Main topics discussed: Criteria, data sources and methods used to price single source

patent protected innovator medicines, multi source existing generic medicines, new

innovator medicines and new generic medicines including those which have just

changed patent status; what the process is; if international reference pricing used

when pricing drugs

10. Ye Lu

Associate Prof. Department of Health Economics, School of Public Health, Fudan

University, Shanghai, China

11. Zhou Yan

Secretary-General of China Pharmaceutical Industry Association

Main topics discussed: reasons for high pharmaceutical expenditure in China; reasons

for increasing production costs; quality of drugs

12. Zhu Changhao

Routine Vice-President of China Association of Pharmaceutical Commerce

Main topics discussed: the process of producing prices including single-source

product, multi-source drugs; if they think price controls have effects on price

reduction of generics with quality assurance as precondition;

13. Zhuang Ning

Department of Planning and Finance, Division of Planning and Price, MOH

Main topics discussed: Are suppliers pre-qualified and how do the procurement

officers monitor the procurement process and the performance of suppliers;

whether international reference prices are considered when awarding tenders; how

they monitor the bidding system

August 31, 2007

37

Candidate Number: 30571

Annex 3 China’s Medical and Pharmaceutical Industry Sales Revenues, Profits

and Export Delivery Values in 2006

Products

revenues

2006

Pharmaceutical

Raw Materials

Pharmaceutical

Finished

Products

Bio-tech

Products

Chinese

medicine

finished

products

Chinese

Medicine raw

materials

Compared 2006

to 2005

(%)

13.41

41.51/

5.19

14.78

11.51/

1.44

Export

Values

Compared 2006

to 2005

(%)

11.01

29.781/

3.72

2.34

5.889/

0.74

39.06/

4.88

114.01/

14.25

25.50

4.13/

0.52

10.42/

1.30

14.06

19.02/

2.38

29.44

10.37/

1.30

24.58

125.85/

15.73

138.25/

17.28

sales Products sales profits

13.80

2.89

6.778/

0.85

2.964/

0.37

Delivery

Compared

to 2005

(%)

17.16

16.34

30.61

22.6

Note: in columns 2, 4 and 6, figures are first given in billion Yuan and then in US$ equivalent.

August 31, 2007

38

Candidate Number: 30571

Annex 4 Formula to Calculate Drug Retail Price

The formula to calculate drug retail price of domestic drugs is “retail price=factory

price (inc. tax) *(1+distribution price differences)”;

The formula to calculate drug retail price of imported drugs is “retail price= border

price*(1+distribution price differences)”;

The formula for the factory price of domestic and imported subpackage drug is

“factory price = (manufacture costs + period expenses) / (1-sales profit rate) *

(1+VAT)”;

The formula for the border price of imported drugs is “border price = C.I.F. *

(1+duty rate) * (1+VAT) + border expenses”.

Note: C.I.F.= Cost, Insurance and Freight; VAT=Value-Added Tax

August 31, 2007

39

Candidate Number: 30571

Annex 5 WHO Background Paper

A background paper {Tang, 2007 #11} for this meeting described and examined the

main problems existing in pharmaceutical registration, production, distribution, use and

administration, and critically analyzed the main socio-economic and institutional factors

associated with these key problems. It was pointed out that the Chinese medicine

registration and pricing systems have not functioned well in pharmaceutical sector

development; the medicine distribution system lacks effective government regulation

and management; the number of pharmacies has increased significantly in recent years

but there is serious concern about their adherence to regulatory standards , particularly

in rural areas; irrational use of medicines, particularly in low level health facilities, has

been increasing, chiefly because of perverse financial incentives. There is also a lack of

co-ordination and communication between various government agencies. It was

suggested that an indicator-based assessment should be followed by more detailed

studies on individual drugs or specific diseases, and the availability/affordability of

essential medicines, especially using time-series analysis. A comprehensive NMP

should be developed. A balanced policy for promoting the development of the

pharmaceutical industry should be drawn up which would also ensure access to

essential medicines for most people. Perverse incentives (hospitals and doctors making

money from selling medicines to maintain the running of their establishments) must be

removed and incentives have to be changed in the alternative provider payment system

to promote rational use of effective treatments.

August 31, 2007

40

Candidate Number: 30571

Annex 6 The Lists of Core and Supplementary Medicines Surveyed

Core medicines

Shandong

Aciclovir 200mg cap/tab

Amitriptyline 25mg cap/tab

Amoxicillin 250mg cap/tab

Atenolol 50mg cap/tab

Beclometasone 0.05mg/dose inhaler

Captopril 25mg cap/tab

Carbamazepine 200mg cap/tab

Ceftriaxone 1g injection

Ciprofloxacin 500mg cap/tab

Co-trimoxazole 8+40mg/ml suspension

Diazepam 5mg cap/tab

Diclofenac 25mg cap/tab

Fluconazole 200mg cap/tab

Fluoxetine 20mg cap/tab

Glibenclamide 5mg cap/tab

Hydrochlorothiazide 25mg cap/tab

Losartan 50mg cap/tab

Lovastatin 20mg cap/tab

Metformin 500mg cap/tab

Nifedipine Retard 20mg tab

Omeprazole 20mg cap/tab

Phenytoin 100mg cap/tab

Ranitidine 150mg cap/tab

Salbutamol 0.1mg/dose inhaler

Shanghai

Aciclovir 200mg cap/tab

Amitriptyline 25mg cap/tab

Atenolol 50mg cap/tab

Beclometasone 0.05mg/dose inhaler

Captopril 25mg cap/tab

Carbamazepine 200mg cap/tab

Ceftriaxone 1g injection

Diazepam 5mg cap/tab

Diclofenac 25mg cap/tab

Fluoxetine 20mg cap/tab

Glibenclamide 5mg cap/tab

Hydrochlorothiazide 25mg cap/tab

Losartan 50mg cap/tab

Lovastatin 20mg cap/tab

Metformin 500mg cap/tab

Omeprazole 20mg cap/tab

Phenytoin 100mg cap/tab

Ranitidine 150mg cap/tab

Salbutamol 0.1mg/dose inhaler

Supplementary medicines

Shandong

Amlodipine 5mg cap/tab

Shanghai

Albendazole 200mg cap/tab

Alendronate 10mg cap/tab

Amlodipine 5mg cap/tab

Amoxicillin 500mg cap/tab

Anastrozole1mg cap/tab

Atorvastatin 10mg cap/tab

Azathioprine 50mg cap/tab

Azithromycin 500mg cap/tab

Candesartan 4mg cap/tab

August 31, 2007

41

Candidate Number: 30571

Cefiroxime 250mg cap/tab

Cefradine 0.5g/vial

Ceftazidime 1g/vial

Celecoxib 200mg cap/tab

Cimetidine 0.4g cap/tab

Ciprofloxacin 250mg cap/tab

Clarithromycin 250mg cap/tab

Digoxin 0.25mg cap/tab

Efavirenz 600mg cap/tab

Erythromycin 250mg cap/tab

Esomeprazole 20mg cap/tab

Fluconazole 150mg cap/tab

Ganciclovir 500mg injection

Lisinopril 20mg cap/tab

Gliclazide 80mg cap/tab

Lisinopril 10mg cap/tab

Loratadine 10mg cap/tab

Ketoconazole 200mg cap/tab

Nifedipine 30mg cap/tab

Ofloxacin 200mg cap/tab

Olanzapine 5mg cap/tab

Rifampicin 150mg cap/tab

Rosiglitazone 4mg cap/tab

Simvastatin 20mg cap/tab

Simvastatin 20mg cap/tab

Sodium Chloride 0.9% 500ml

Stavudine 40mg cap/tab

August 31, 2007

42

Candidate Number: 30571

Annex 7 Top Five Drugs with High Availability in Both Public and Private

Facilities in the Two Provinces Surveyed

Public

facilities

Private

facilities

August 31, 2007

Shandong

1. Diclofenac (45%)

2. amlodipine, diclofenac, omeprazole,

rosiglitazone, simvastatin beclometasone

inhaler (21-50%)

Shanghai

IB

1. Losartan (76.7%)

2. Fluoxetine (63.3%)

3. Beclometasone inhaler

(56.7%)

4. Ceftriaxone injection

(56.7%)

5. Metformin (56.7%)

LPG 1. hydrochlorothiazide (≥ 80%)

1. Omeprazole (90.0%)

2. ceftriaxone inj (≥ 80%)

2. Hydrochlorothiazide

3. captopril (≥ 80%)

(86.7%)

4. amoxicillin (≥ 80%)

3. Phenytoin (80.0%)

5. ranitidine (51-79%)

4. Aciclovir (70.0%)

5. Ranitidine (60.0%)

IB

1. Diclofenac (85%)

1. Omeprazole (85.0%)

2. amlodipine, beclometasone inhaler, 2. Beclometasone inhaler

carbamazepine, celecoxib,

(65.0%)

losartan, omeprazole, rosiglitazone, 3.

Carbamazepine

simvastatin (21-50%)

(60.0%)

4. Metformin (60.0%)

5. Losartan (55.0%)

LPG 1. captopril (≥ 80%)

1. Ranitidine 150mg

2. ranitidine (≥ 80%)

(95.0%)

3. hydrochlorothiazide (≥ 80%)

2. Aciclovir 200mg

4. amoxicillin (≥ 80%)

(75.0%)

5. omeprazole, (≥ 80%)

3. Hydrochlorothiazide

25mg (70.0%)

4. Omeprazole 20mg

(70.0%)

5. Phenytoin 100mg

(60.0%)

43

Candidate Number: 30571

Annex 8 MPRs for some drugs in Shanghai and Shandong

Shandong

Public

facilities

(20)

IB

LPG

Amoxicillin

Beclometasone

Ceftriaxone inj

Clarithromycin

Diclofenac

Fluoxetine

Metformin

Nifedipine

Omeprazole

Salbutamol inh

August 31, 2007

1.52 5.89 0.33

Shanghai

Public

Private

facilities (30) facilities (20)

Private

facilities

(20)

IB

LPG IB

2.69

5.95

0.19

9.83

LPG

IB

LPG

9.87

4.29

0.88

21.64 0.29

-

21.28

4.51

7.74 1.09

69.45 28.94 68.42 28.94

11.85 2.31

7.98

44

4.13

0.51

26.46 6.28

2.72 1.73

26.46 5.83

2.75 1.43

Candidate Number: 30571

References

August 31, 2007

45