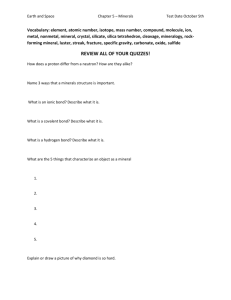

OCR Document

advertisement

Industrial Minerals – Global Geology Harben & Kuzvart (1996) 462 p. INTRODUCTION Industrial minerals are the workhorses of our world. Without them life as we know it today would quite simply stop. Broadly defined, they include all those materials that man takes out of the earth's crust except for fuels, metallic ores, water, and gemstones. More than 50 rocks and minerals are discussed in this book that ranges from the pure to the applied - from the geological genesis to marketing realities. It has grown out of several previous publications from the co-authors. Additional data is derived from lectures given by Professor Kuzvart at the Faculty of Science at the Charles University, Prague, Czech Republic. Both authors bring extensive expertise in the field of industrial minerals through participation in various international industrial mineral projects. In general, each chapter deals with a given mineral or rock and contains information on physical and chemical properties and their industrial significance as well as the most common geological habitats and genesis. Classic producing districts are discussed along with some individual deposits, and official production figures are provided for the last six years. Sections on "Exploration and Exploitation" cover the main exploration, extraction, and processing techniques used for a particular mineral or rock, and each chapter ends with references and a bibliography for further reading. The main unit of production used is metric tons, given simply as tons; distances are in kilometers and areal measurements in hectares and square kilometers. Temperature appears as degrees Celsius (ºC). THE FIELD OF INDUSTRIAL MINERALS The term "industrial minerals industry" is not only repetitious but inaccurate. There are many industries. The simple term field is convenient. The broad field of the industrial minerals covers a highly diverse group of materials. At the one extreme are gravel and crushed stone, which sell in large tonnages for a few dollars per too and must be obtained dose to their point of use. At the other is the industrial diamond, with such a high unit value that its occurrence in minute amounts thousands of kilometers from markets is no deterrent to its use. The great range of industrial minerals falls between these two extremes of unit value and place value. This range is indeed great and while the central realm of the industrial minerals and rocks is 1 clear enough, its margins are hard to define. Bauxite, for example, is the prime ore of aluminium; but it has several significant uses in industry - in chemicals, abrasives, and refractories - and thus is included in this book. More than 90% of manganese goes into steel, but manganese also has dozens of nonmetallic uses. The diamond is both a gem and an industrial mineral. Then there is the frontier between natural nonmetallics and artificial or synthetic competitors. Traffic across this frontier has been mostly one-way: manufactured abrasives, for example, have largely replaced corundum and its cohorts. A major movement in the opposite direction is the emergence of trona, a natural sodium carbonate, which has replaced manufactured soda ash in the United States and some other markets through exports. Waste materials may provide competition; fly ash can be used as a cement raw material, or slag as an aggregate. With most products the boundaries of the mineral industry are clear: the mining and milling of feldspar, for example, belong to this book but the manufacture of ceramics does not. But how does one draw the line between mining and manufacturing where brine from a salt well goes directly into a process for making chlorine and sodium chemicals ? Industrial minerals are a satisfyingly physical group on the whole. Granted, some are valued for their chemical and metallurgical properties, their physical characteristics being only incidental. For a large proportion, however, physical properties are of prime importance and remain essentially unchanged in the end use. Not only is this true for such bulk products as crushed stone but also for specialized materials like diatomite, asbestos, and graphite. Certain fabricators of crucibles have been known to insist that their graphite supply must come not merely from one district but from a single mine. Thus the physical properties of many rocks and minerals - the ways in which they occur in the ground - have to concern the geologist, since they are of importance to the ultimate consumer. RECENT DEVELOPMENTS While the metallics have always had the glitter, there is nothing dull about the nonmetallics especially in today's rapidly changing consumer marketplace. The following are some of the current trends that can be discerned in the broad field of the industrial minerals. Value without glamour. The market for nonmetallics continues to increase steadily, and with less volatility than metallic or energy products. For example, in 1995 the value of US mine production of industrial minerals exceeded $24 billion, more than for coal and almost double that for all the metals combined. The value of sand and gravel production alone was about 2 equal to gold and exceeded that of copper; the value of days exceeded iron ore. Development of new applications. The market for fillers used in paper, paint, plastics, rubber, and adhesives has developed through the use of various grades of kaolin, talc, calcium carbonate, mica, wollastonite, silica, diatomite, and even gypsum. Rather than merely acting as a replacement for a more expensive material, these minerals contribute electrical conductivity, flexural strength, heat resistance or some other desired property. This has expanded the use of products like plastics which has replaced everything from glass milk bottles to steel panels on automobiles. The market for pet litter is a 90's phenomenon with atapulgite, diatomite, sepiolite, bentonite, zeolites, gypsum and synthetic calcium sulfate serving the booming market. The trend toward scoopable cat litter, for example, has taken US annual consumption of swelling sodium bentonite in this market from zero to 500,000 tons in less than 5 years. Other recent developments include the use of thin panels of stone as nonload-bearing veneer on the outside of large buildings, and the use of sulfur in pavements and concrete blocks. Specifications become ever more stringent. Fast, automated methods of manufacture demand raw materials of a high degree of uniformity. In glassmaking, for example - where there is no "slagging stage" and what goes in, stays in - precise control of the charge to the furnaces is absolutely essential. In the manufacture of high-quality paper, only the finest grades of filler and coating material can be used. In the emerging fields of advanced ceramics and engineering plastics, raw-material specifications are still more rigid. Such requirements place heavy responsibilities on the suppliers of raw materials. Processing needs. There is a trend toward increasingly elaborate processing techniques and the production of value-added grades. Kaolin may be ground and airfloated to produce filler for rubber; waterwashed for use as filler in paper, or floated, delaminated, calcined, and magnetically separated to produce bright lightweight-coated grades of paper designed to counter escalating postal rates. Fine grinding and flotation are applied to minerals as diverse as silvite and feldspar. Mica and talc may be micronized, i.e. subjected to ultra-fine grinding. The mineral processor needs to brush up on colloidal physics. Electrostatic separation, optical sorting, and various chemical processes are applied to one or another of the industrial minerals. Surface treatment with silanes or titanates, for example, is used in the plastics industry to alter the characteristics of a mineral filler; this treatment prevents the filler from repelling the resin and maximizes dispersion. Supplier-customer relations. The supplier and the consumer of minerals need to liaise over 3 specifications and supply. Relationships have been fashioned whereby a consumer single sources a particular raw material using multi-year contracts. This requires a dose relationship and requires sophisticated electronic transmission of analysis data, allows quality control to reside with the supplier, and encourages joint R&D projects. Environment and health and safety. These issues, never far from the concerns of the mineral producer, range from land use and zoning problems faced by management of a gravel pit to alleged health hazards that affect the whole industry, as with asbestos. A "hot" topic in the 1990s has been the content of radionuclides (U + Th) in products such as ilmenite, rutile, monazite, zircon, and synthetic gypsum. New standards have caused tremendous shifts in purchasing patterns and have put some operations out of business. It is conjectured that a mining giant sold its US Silica subsidiary in 1995 out of concern over the liability aspects of silicosis. The elimination of CFC's and halons through the Montreal Protocol has depressed the market for certain grades of fluorspar. There is concern over the arsenic levels of colemanite, and attempts have been made to replace certain grades with synthetic colemanite or boric acid. With the demise of leaded gasoline, bromine lost its market as ethylene dibromide or EOB, a lead scavenger (purificador) in gasoline anti-knock compounds, but has recovered well through expanded use in various products including tire retardants and oilwell drilling muds. Major shifts in emphasis within industries. This is being driven by the need to maximize profit, reduce costs, comply with new regulation, or satisfy the customer. These include the decline in production of Frasch sulfur in favor of recovered sulfur; beryllium no longer comes primarily from beryl in pegmatites, but from the mineral bertrandite: the success of seawater as a source of magnesia over the mineral magnesite in some areas; the trona mine rather than the Solvay plant is now the main source of soda ash in the United States and increasingly in Latin America and Asia through US exports; ilmenite is upgraded to "synthetic rutile" as a feed for titanium-dioxide plants; natural sodium sulfate operations are facing stiff competition from involuntary synthetic production such as battery recycling and nylon manufacture; lithium extracted from hard-rock pegmatites in the United States has been eclipsed by production from the brines of South American salars; chemical or FGD gypsum is beginning to replace mined natural gypsum in some wallboard plants: and the increasing use of precipitated calcium carbonate is outpacing ground calcium carbonate in many applications. Increased recycling and conservation. Both have reduced the demand for virgin raw materials used to make everything from aluminum and glass containers, paper, and plastics to refractories, steel, and even road beds. For example, the content of post-consumer cullet in 4 container-glass batches ranges from 25% in the United States to over 70% in Switzerland and the Netherlands. This has been "stimulated" by the passage of legislation such as California's Assembly Bill 2622 mandating that by the year 2002 postfilled glass will constitute a minimum of 65% of the raw material for glass containers. The dirty and dull paper in the photocopier looks like it has been through the mill several times. The consumption of fluorspar and refractories per ton of aluminum or steel produced is a fraction of what it was a decade ago. In road construction, some Departments of Transportation contracts stipulate that any new construction contains a minimum content of recycled roadway. In a similar way, many authorities are reducing the quantities of de-icing salt used on the roads. Substitution. This has always been part of the industrial minerals scene. For example, in the paper industry calcium carbonate is a major challenger to kaolin as a filler and coater, although precipitated calcium carbonate competes with ground calcium carbonate in many applications. Regional bans on the use of phosphates in detergents provided the synthetic zeolites industry with a boost which in turn aided sodium silicate producers and therefore silica sand and chloralkali suppliers farther down the food chain. Coproduction and byproduction. Involuntary production influences the supply position of many minerals. This include monazite and zircon with titanium minerals, sulfur recover during the refining of crude Gil and sour natural gas controlled by the demand for energy, sodium sulfate in many chemical production units, chlorine with caustic soda, and silica sand from feldspar. Foreign ownership and corporate rationalization. Foreign language courses have blossomed in the industrial minerals field over the past ten years, and there are fewer companies producing more products. Major companies like RTZ, Harris Chemical, and Unimin have been active in the acquisition area forming larger and more sophisticated producing companies. In fact, Unimin now controls the only two commercial nepheline syenite operations outside of Russia. Production of cement in the Czech Republic is fully controlled by Heidelberger Zement, Italcementi SpA, Lafarge-Coppée SA, CBR Cimentieres SA, and Holderbank Financieres. Producers and consumers of soda ash in Japan and Korea have invested in the trona operations of Green River in order to secure supplies and possibly replace high-cost production units. Ownership in the potash and phosphate industries as well as silica sand has been difficult to track without a computer. Corporate rationalization in many of the industries that consume industrial minerals has resulted in increased central even global purchasing in order to negotiate lower raw material prices. 5 Industrial minerals are market driven. The demographics destiny equation. Many of the traditional markets for industrial minerals - North America, western Europe, and Japan - are saturated with flat growth prospects. In contrast, China economy is dynamic and continues to influence and disrupt the minerals industry through exports, imports, and the periodic switch from being a net exporter to a net importer (or vice versa) of a particular commodity. There are dynamic growth prospects elsewhere in Asia, including Korea and Taiwan, and more particularly emerging markets like Thailand, Malaysia, the Philippines. If population growth is a barometer of the market, then India with almost 1 billion people is critical. Not far behind is Latin America where the population is expected to grow to 654 million by the year 2025. The sociology of industrial minerals makes for interesting marketing strategies and perhaps even political forecasting for the armchair theorist. Changing trading partners. Old regimes like COMECON have fallen, and new partnerships are emerging to encourage international trade. Latin America, for example, offers immense potential for industrial minerals. This potential may be fortified still further with the proposed Free Trade Area of the Americas (FTAA) that would create the world's largest single market $13 trillion with a population of 850 million. Production from yet-to-be discovered industrial minerals deposits will be essential to feed these burgeoning markets. The industrial minerals as world travelers. "The single most important fact about mineral resources is that they are not distributed equally over the world" (Flawn, 1966). Therefore, deep-sea trade in industrial minerals continues to grow as talc is shipped from Montana to Belgium, salt from Mexico to Japan, feldspar from Finland to Malaysia, and gypsum from Mexico to California. More highly developed techniques of materials handling and transportation have been a notable factor, as has the demand by industry for materials with special or unique properties, no matter where these materials are found. Kaolin and calcium carbonate can be shipped considerable distances in slurry form, and unit trains can carry potash from Saskatchewan to the corn belt of the United States or the port of Vancouver. In the same way we find Wyoming bentonite being delivered to Gil rigs all over the world, and Australian rutile and ilmenite feeding manufacturers all TiO2 pigment on other continents. Soda ash from deep within the western United States is transported via dedicated unit trains to dedicated port facilities to be loaded on dedicated ships and delivered uncontaminated to glass plants all over the Pacific Rim and Latin America. 6 Security of supply. This important factor been eased somewhat with recent political changes. Users of chromite, for example, who must rely on supplies from the former USSR, South Africa, Albania, and the Philippines, feel a little more secure in 1996 compared with 1986; similarly for borates long dominated by supplies from the United States and Turkey. Today there is a variety of suppliers from South America, and Russia has emerged as a major exporter. Australia has come from nowhere to be the world's largest producer of diamonds. It has also decided to market the gems independently, breaking with the DeBeers tradition. These complex trends should put the field of industrial minerals into a proper perspective. Oddly enough, they are often ignored by policy makers who remain oblivious to their vital significance. INDUSTRIAL COMPLEXITIES Industrial minerals clearly make the world go round. Despite their dynamism, growth prospects, and strategic importance, however, the minerals industry in general and the industrial minerals sector in particular have been traditionally ignored by governments, institutions, and individuals. This is illustrated by the lamentable fact that in 1995 the US Government decided it was politically expedient to "unfund" the US Bureau of Mines after 85 years of service. To add insult to injury, just a handful of institutions of higher learning teach a course on industrial minerals; most prefer to leave it to chance and concentrate on fossils or adopt environment titles to attract grants. Industry has so far also failed to cure this irresponsible myopia and has largely opted either for a low profile or for a hasty exit to more hospitable climes like South America. The public has been prejudiced while completely dependent on industrial minerals from cradle to grave. Not only are industrial minerals indispensable to modern civilization, but the field is an endlessly challenging one with endless potential and fascinating questions. Can research mix a fiber cocktail that will come anywhere near the cost effectiveness of asbestos? When, if ever, will natural zeolites break into the industrial picture on a large scale? Can brucite develop sufficient markets to bring it into the mainstream of the mineral business? Will explorationists or even serendipity find another trona field like Green River? Will fluorine from Florida phosphate rock reduce fluorspar's pre-eminence as a fluorine source? Will gypsum from flue-gas desulfurization at coal-fired power plants, or from phosphate manufacture, erode natural 7 gypsum's market in wallboard production? Could synthetic colemanite ever replace the real thing? Will the market for wollastanite expand with increased production? Finding the answers as well as new questions, make the field of industrial minerals and rocks complex, unpredictable, and endlessly interesting. But who will do it? To rephrase a US advertising slogan, "a mine is a terrible thing to waste". SOURCES OF INFORMATION A basic reference work, Industrial Minerals and Rocks, is published by the Society for Mining, Metallurgy, and Exploration, Inc. (SME). The 6th edition appeared in 1994. By many authors and with Donald D. Carr as Senior Editor, it is an indispensable 1,196-page volume on geology, engineering, and uses of the nonmetallics. Proceedings of the Forum on Geology of Industrial Minerals, held annually in North America, provide much geological and related information. The Proceedings of the 31st Forum was published by the New Mexico Bureau of Mines & Mineral Resources in August 1996. The same organization published an index of the papers in the 26th through the 31st Forum (1990 - 1995) to supplement the index of the 1st to the 25th (1965 - 1989) published in 1990 by Oregan's Department of Geology and Mineral Industries. These proceedings are an invaluable information source for a range of subjects. Until its untimely demise in 1996, the US Bureau of Mines published statistical and technological data via the Minerals Yearbook, Mineral Facts and Problems (published every five years 1955-1985), Annual Commodity Summaries, and a number of surveys including material life cycles. Much of this work has been taken over by the US Geological Survey (USGS) as its Minerals Information Division. Data is available in the printed form as well as on CD ROM, via FaxBack, and over the Internet. The USGS publishes a wealth of information on mineral deposits in its Bulletins, Professional Papers, and Open-File Reports. Natural Resources Canada publishes the Canadian Minerals Yearbook each year plus a series of reports on minerals and mineral issues. Thee organization has a Factsback fax service and a Web page with the Geological Survey of Canada. The Canada Centre for Mineral and Energy Technology (CANMET) published some 20 summary reports on industrial minerals between 1988 and 1993 which include details of processing and Canadian deposits (see references in individual chapters). Similar publications in other countries include the Minerals Dossier Series by the British Geological Survey, and Mineral Deposits of Europe by the Mineralogical Society and Institution of Mining and Metallurgy, in the UK; Mineral Resources of the Republic of South Africa by the Department of Mines and the Geological Survey of South Africa; such profiles as Perfil Analítico da Barita by Ministério das Minas e Energia in Brazil. A major contributor to the literature is the monthly journal Industrial Minerals, which celebrated its 350th issue in 8 November 1996. The journal's staple diet is a world survey of a specific mineral, updated periodically. Variations on a theme include a review of the minerals used in specific industries, such as plastics or ceramics. Some of these reviews have been expanded into publications, in the series "Raw Materials for. . .", which include glass and ceramics, oilwell drilling materials, refractories, and pigments, fillers, and extenders. Another approach is a review of the industrial minerals of a country. Related publications include Mineral Price Watch and North American Mineral News. The organization also has a series of textbooks including the Industrial Minerals Directory, The Industrial Minerals Handbook, plus a series on the uses and markets for individual materials such as Chromite, Manganese, and Bauxite & Alumina. Industrial Minerals also sponsors international conferences and publishes the proceedings. The twelfth International Congress took place in Chicago, USA, in April 1996 and the thirteenth is in Kuala Lumpur, Malaysia, in 1998. REFERENCES AND FURTHER READING Bates. R.L., 1975, "Channels of communication in the industrial minerals field" in Proceedings, First Industrial Minerals International Congress, R.ES. Fleming. Ed. Metal Bulletin. Ltd., London, pp. 266-269. Bates, R.L., 1969, Geology of the Industrial Rocks and Minerals, Dover Publications Inc., New York, 459 pp. Bates, R.L., 1995, "Geology of the Forum" in Proceedings, 30th Forum on the Geology of Industrial Minerals, S.AA Merlini, ed., New Brunswick Dept. Nat. Res. and Energy, Minerals and Energy Div., Misc. Rpt. 16, pp. 6-8. Bender, E ed., 1986, Angewandt Geowissenschaften, Band IV, Enke Verlag,Stuttgart, 422 pp. Carr D. D., Herz N, Eds, 1989, Concise Encyclopedia of Mineral Resources, Pergamon Press, OxfordNew York, 426 pp. Carr, D.D., Ed., 1994, Industrial Minerals & Rocks, 6th. ed., D.D Carr, ed. SME. Littleton, CO, 1,196 pp. Evans AM., 1993, Ore geology and industrial minerals - an introduction, Thirdedition, Blackwell Scientific Publications, Oxford, UK, 390 pp. Flawn, PT., 1966, Mineral Resources, Rand McNally, Chicago, IL, 406 pp. Govett, GJS., and Govett, M-H. (editors), 1976, World Mineral Supplies: Assessment and Perspective, Elsevier Scientific Publishing Company, Amsterdam, 472 pp. Harben, PW, 1983, "Industrial minerals as world travelers" in Proceedings, Nineteenth Forum on the Geology of Industrial Minerals, S.E. Yundt, ed., Ontario Geol. Surv. Misc. Papel 114, pp. 148-155. Harben, PW, 1992, The Industrial Minerals HandyBook, Industrial Minerals Div. Metal Bulletin pie. London, 148 pp. Harben, PW, 1995, The Industrial Minerals HandyBook, 2nd ed., Industrial Minerals Information Ltd., London, 254 pp. Harben, PW, 1996. "Industrial minerals south of the Mexican border" in Proceedings, 31st Forum Geology of Industrial Minerals, G.5. Austin, G.K. (continua) 9