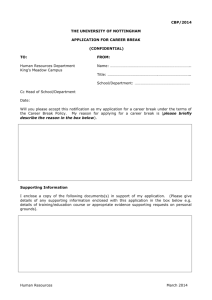

Armed Forces Pension Scheme (Reserved Reasons)

advertisement