DOC - Europa

advertisement

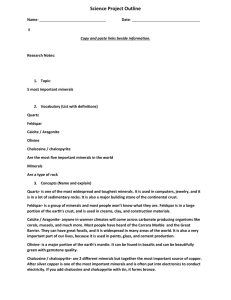

IP/07/767 Brussels, 5th June 2007 VP Verheugen: Securing raw material supply for EU industries The European industry is facing increasing challenges in ensuring access to raw materials, which are essential for manufacturing. As a result of rising global demand, prices for many metals have reached record levels and Europe’s capacity to provide raw materials is limited. Many metallic minerals are either geologically not available within the EU or only in relatively small volumes compared with global production, e.g. copper (5%), iron ore (2%), nickel (1.7%), and zinc (8.5%). A working paper from the services of the European Commission, published today, gives a comprehensive picture of the current situation of EU industry's access to raw materials which is affected by the unprecedented demand for minerals mainly as a result of the rapid industrialization of emerging countries, such as Brazil, China and India. The global dimension of this problem is being increasingly recognized. Access to raw materials is on the agenda of the forthcoming G8 Summit on 6-8 June. On that occasion a Declaration on "Responsibility for raw materials: transparency and sustainable growth" is expected to be adopted, which will address the key priorities for a sustainable and transparent approach to this question. In addition the Competitiveness Council meeting on 21 May has invited the Commission to develop a coherent political approach to the issues arising. Commission Vice President Günter Verheugen, responsible for enterprise and industry policy, said: "European industries need predictability in the flow of raw materials and stable prices to remain competitive. We are committed to improve the conditions of access to raw materials, be it within Europe or by creating a level playing field in accessing such materials from abroad.” The non-energy extractive industry is providing a wide range of different minerals, including metallic ores, clays and aggregates which are mined or quarried to produce roads, homes, schools and hospitals and many products such as computers, cars and household appliances which are often taken for granted in a modern economy. The present situation calls for an integrated approach through which relevant EU policies and instruments work in concert with the aim of ensuring availability of essential raw materials, and sustainability in their extraction and use. Among the findings of the above document are: - For geological reasons the world distribution of non-energy resources is very uneven. Europe, together with Japan, United States and China, lacks specific materials, especially ores, and has to compete for them on world markets. - In the case of metallic minerals, Europe’s capacity to provide in its own supply through domestic extraction is very limited. As an illustration 177 million tonnes of metallic minerals were imported into the EU in 2004 with a total value of € 10,4 billion, compared to the EU’s production of some 30 million tonnes. - For construction minerals (in particular aggregates) Europe is self sufficient, and for certain industrial minerals such as feldspar, kaolin, magnesite, gypsum and potash, the EU continues to be either the largest or second largest producer in the world. The document identifies and assesses the factors which have the biggest potential impact on the competitiveness of the industries which extract minerals within EU and recognizes that the rules on access to materials are primarily a matter for Member States. Among the key aspects identified are: access to sites, access to land, investment and operating costs, the regulatory framework, the availability of a skilled workforce, research and innovation, and health & safety requirements. The staff working document was prepared based on an extensive consultation of the Raw Materials Supply Group (this a stakeholder group comprising extractive and user industries, Member States, environmental NGOs, trade unions and the Commission). The question of availability and use of raw materials is currently being analyzed by the High Level Group (HLG) on Competitiveness, Energy and the Environment which is expected to deliver policy recommendations on June 11 on a coherent approach to the issues identified. Facts about the extractive industry in Europe The non-energy extractive industry (NEEI) within the EU25 has an annual turnover of some €40 billion and directly provided some 250,000 jobs in 2004. The NEEI sector, with over 16.500 enterprises, is dominated by Small and Medium-Sized Enterprises (SME’s) with less than 10 employees. Apart from this direct contribution to employment and production, these companies play an essential role as suppliers to major downstream industrial sectors, such as the construction-, metal- and chemical sectors. 2 - Statistical Annex1 Annual import of minerals into the EU 1999-2004 – by weight (‘000 tonnes) 200000 180000 160000 '000 tonnes 140000 120000 100000 80000 60000 40000 20000 0 1999 Construction minerals 2000 2001 Industrial minerals 2002 Metallic minerals 2003 2004 Other industrial minerals Ranking of the three main producing regions for selected metallic minerals (2004) First Second Third Bauxite Australia 40% Guinea 12% Jamaica 10% Cadmium Japan 22% China 20% Mexico 12% South Chromium Africa 53% Kazakhstan 18% India 8% Copper Chile 37% USA 8% Peru 7% Iron ore Brazil 23% Australia 20% China 14% Lead China 30% Australia 21% USA 14% Manganese China 24% Gabon Mercury EU 43% Nickel Russia Silver 17% South Africa 13% Kyrgyzstan 26% China 23% 24% Australia 14% Canada 14% Mexico 16% Peru 15% Australia 12% Tungsten China 87% Russia 6% EU 4% Zinc China 26% Peru 14% Australia 14% Data source: World mining data (2006) 3