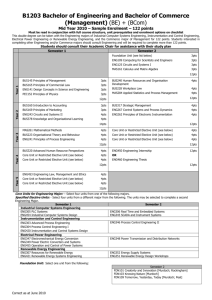

Iowa State University

Iowa State University

Economics 353 Money & Banking

Fall 2001 Prof. Kilkenny

First Exam

October 1, 2001

General Instructions:

1. There are 30 questions on 5 pages. Write on these pages. It is OK to use both sides.

2. Read each question carefully before answering.

3. Mark all answers which apply to the multiple choice questions, unless directed otherwise.

You earn points for correctly leaving blank what doesn't apply , as well as points for correctly choosing what does apply. But there are NO POINTS if nothing is marked. Some examples:

(4pts) Mark all that apply:

) it is a weekday b) it is 1998

)this is Story County d) tomorrow is Friday

(4pts) Mark all that apply:

) it is a weekday

) it is 1998 c) this is Story County d) tomorrow is Friday

(4pts) Mark all that apply: a) it is a weekday b) it is 1998 c) this is Story County d) tomorrow is Friday this person scores 100% (4/4) this person scores 50%(2/4) this person earns NO points

On other multiple-choice exams, a person would earn NO points unless they correctly chose the one that offers "both (a) and (c)." That is why other exam average scores are so low, and why scores on these exams are reasonably higher.

4. On the multiple choice questions for substantial partial credit

SHOW FORMULAS, use GRAPHS, and provide DEFINITIONS .

5. For full credit on the essay questions:

1) LABEL all graphs completely, including "demand for _____ by _____ " and "supply of ____ by _____ ."

2) Explain, using complete sentences, what causes which changes in behavior.

DO write "demand(or supply) for(of) _____ increases(or decreases);"

DO write “this causes market prices to rise” or “this causes interest rates to fall.”

DO NOT write "shifts right(left, up, or down)."

DO NOT write "i rises," or, "P falls."

Follow basic rules of academic integrity: do your own work. Do not look at anyone else or their test.

Even if it just seems like you are looking at someone else's answers (not doing your own work), you can be graded an "F" on this exam.

You have until 7:45pm.

When you are finished (or the time is up), be sure your name and ID# is on the front (and any loose pages); and, your name is on the OUTSIDE of the back page .

CQ indicates this is from the list of “ c lass q uestions”

H1,H2,H3,H4 indicates this was h omework #1, 2, 3, or 4 material

GE refers to an in-class g roup e xercise

MARK ALL THAT APPLY:

1. (4pts/H1) A weaker U.S. dollar will make

A) U.S. consumers happy because imported goods will be cheaper

B) U.S. consumers unhappy because imported goods will cost more

C) U.S. businesses that make products for export happy because foreigners can afford more US products

D) U.S. businesses that make products for export unhappy because US goods will cost more

2. (2pts/H1)An increase in the rate of money growth can lead to

A) an increase in inflation

B) a decline in inflation

3. (9pts/H1) Indicate which securities pay interest ( not face value, capital gains, nor dividends), is equity ( not debt), or are capital market ( not money market) financial instruments: check all that apply a) corporate stock

: pays i equity Capital Mkt

_____ _____ _____ b) discount bond (2yr) c) farm mortgages

4. (3pts/H1) Adverse selection:

_____ _____ _____

_____ _____ _____

A) is when one party to a contract does things in their own interest at the other party’s expense

B) occurs because those who could benefit most offer the most attractive terms

C) is a consequence of symmetric information

5. (4pts/H1) Which assets proportions in U.S. capital markets fell between 1980-2000?

A) U.S. government debt

B) commercial and farm mortgages

C) business loans from banks

D) corporate equities

MARK ALL THAT APPLY:

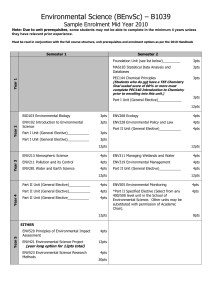

MONEY STOCK AND DEBT MEASURES

Billions of dollars (Sept. 6, 2001)

6. (3pts/GE) The current measure of M1 is:

573

A) $573 billion currency + travelers checks

574

B) $3,282 billion demand + checkable deposits

2135

C) $1 .

147 trillion savings deposits

1011 small time deposits

998

7. (3pts/GE) The current measure of M2 is: retail Money Mkt funds

1008

A) $3,146 billion institutional Money Mkt funds

798

B) $4,144 billion large savings deposits

580

C) $5,291 billion

REPOs + Euro$s

8. (4pts/GE) Nominal U.S. GDP ( Y P ) is $10.2 trillion . What is M 1 velocity ( v )?

A) v = Y P M 1

B) v = Y P / M 1

C) v = 11.699 trillion

D) v = 8.89

9. (2pts/H2-H3) Mark ONLY ONE : When interest rates fall, the market prices of discount bonds

A) fall

B) rise

10. (2pts/H2) Mark ONLY ONE : A bond-holding saver can earn capital gains when

A) interest rates fall

B) interest rates rise

11. (3pts/H2) Which two year, $1000 face value bond offers the highest yield to maturity?

( Note: no calculator is needed to answer this problem.)

A) a 5% coupon bond selling for $960

B) a 5% coupon bond selling for $980

C) a 5% coupon bond selling for $1000

12. (3pts/H2) Consider a $1,000 face value bond that makes a $20 coupon payment annually, which matures in one more year. Its yield to maturity is now 2%. What is the current price of this bond?

( No calculator is needed to answer this problem.)

A) $980

B) $1,000

C) $1,020

13. (3pts/H2) If the yield on 1-year T-bills is 6% and the yield on Inflation Indexed 1-year T-bills is 2%

A) the real interest rate is 4% and the expected rate of inflation is 2%

B) the real interest rate is 2% and the expected rate of inflation is 4%

C) the real interest rate is 8% and the expected rate of inflation is 2%

14. (3pts/H2) When is the best time to buy a house?

A) when the mortgage interest rate is 7% and housing prices are expected to rise at 2%

B) when the mortgage interest rate is 9% and housing prices are expected to rise at 4%

C) when the mortgage interest rate is 6% and housing prices are not expected to rise at all

15. (4pts/H3) If interest rates are expected to be higher in the future, borrowers prefer to:

MARK ALL THAT APPLY:

A) supply more bonds now

B) supply less loanable funds now

C) demand fewer bonds now

D) demand more loanable funds now

16. (4pts/H3-H4) Indicate how interest rates on long term bonds are affected if:

RISE

A) lower returns are expected on corporate equities

B) future short-term interest rates are expected to rise

C) stocks become more risky

_____

_____

_____

FALL

_____

_____

_____

D) the Federal government incurs a deficit _____ _____

****THIS PAGE COMES FROM ANOTHER EXAM *****

(when Prof K was giving 4 exams per term rather than 3)

**. (4pts/H4) Fill in the blanks: The cartoon above illustrates two consequences of ______________.

Dogbert (the character in the first panel) is employed as a stock market expert. Dogbert’s recommendation to buy only stock that he owns reflects _________. The character in the third panel will probably experience __________.

CHOOSE ONLY ONE:

A) incentive incompatibility, adverse selection, moral hazard

B) asymmetric information, moral hazard, adverse selection

C) moral hazard, incentive incompatibility, collateral damage

D) asymmetric information, free riders, moral hazard

**. (4pts/H4) People who buy the stock because it is recommended by Dogbert or because its price rose last week are called ___________. The cartoon illustrates one reason why stocks provide about _______ of the external finance for firms, called the __________ problem.

CHOOSE ONLY ONE:

A) venture capitalists, 31%, principal-agent

B) savers, 15%, incentive compatibility

C) free riders, 2%, lemons

D) free riders, 31%, principal-agent

The New York Times

September 25, 2001

Even Yielding 3%, Money Market Funds

Appeal to Many

By DANNY HAKIM

Money market funds have long been the first stop for investors in troubled times. But a number of conservative investments, from savings accounts to high- quality bonds, have served as havens during the recent retreat from the stock market.

The Sept. 11 attacks on the World Trade Center and the

Pentagon redoubled a pullback from stocks and stock mutual funds that began when the market first faltered early last year. In times of political risk, both professional and amateur investors tend to cleanse their portfolios of financial risk.

During the three trading days before and the three days after the terror attacks, taxable bond funds - mostly high quality and government-backed bonds - took in $639 million in net inflows, according to AMG Data Services.

Investors have been shying away from Q18 ___ yield, or junk, bonds because they represent loans to companies and municipalities that have the least likelihood of repaying them.

But bonds have not been nearly as popular as money market funds, which savers can quickly buy into and sell out of without penalty or much risk, making them one of the safest investments. Last week, the category had its second-largest inflow, according to iMoneyNet, which tracks money market funds.

ARTICLE TRUNCATED

Copyright 2001 The New York Times Company

17. (4pts/H1) Which of the following are money market instruments?

A) federal funds

B) commercial paper

C) government agency bonds

D) CDs

18 . (3pts/H1,H4) Recall the problem of adverse selection . Now fill in Q18_____ blank (above)

A) zero

B) below average

C) high

19. (3pts) When did stock market prices first begin to decline?

A) early last year

B) three days before the terror attacks

C) three days after the terror attacks

20. (2pts/CQ,H3-H4) According to the article, why are money market funds more popular than bonds right now?

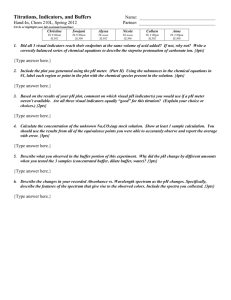

21. (4pts/H3) LABEL all lines in the graph below in WORDS to set up the Bond or

Loanable Funds Market framework, and label the initial equilibrium .

22. (2pts/H3) Use dashed lines and arrows to illustrate the effect of that behavior (Q20) on money market security (bond) prices or interest rates. Summarize: interest rates on money market securities (circle one:) fall / rise.

23. (4pts/CQ,H3-H4) Label the graph below to analyze the junk bond market. Use dashed lines and arrows to illustrate the behavior (Q20).

24. (4pts/H3) Summarize: (check one for each) junk bond prices rise fall

___ ___

and interest rates on junk bonds ___ ___

The New York Times September 23, 2001

Dazed Companies Sit on Their Wallets

By LOUIS UCHITELLE

American business, already pulling back as the economy weakened, is now cutting back even more, freezing the investment in new buildings and equipment that had contributed so much to the prosperity of the late 1990's.

Analysts are just beginning to notice the cutbacks. In the days after the terrorist attacks, they had focused on consumers, who curtailed spending immediately.

Consumers appear to be gradually returning to more normal shopping habits, although they continue to be cautious about big purchases like cars and homes and extra spending on family outings.

Business’s retreat, however, seems to be gaining momentum. The slowdown that hit the nation more than a year ago came mostly from a sharp cutback in business investment, not consumer spending. Now, thousands of companies, simply by waiting or avoiding additional investment, appear to be pushing the economy into a recession.

Uncertainty is overwhelming the economy in ways rarely experienced in the United States. David Collander, an economic historian at Middlebury College, says that companies are used to dealing with risks, but that the response to terrorist attacks goes beyond the normal range of economic theory. "The only thing economists and forecasters can do," he said, "is follow along and see what happens."

When the uncertainty lifts, or corporate executives learn how to live with it, then the economy may come back stronger than ever, rebounding from the sharp decline in part because Washington is moving aggressively to cut interest rates and to expand federal deficit spending.

Alan Greenspan, the Federal Reserve chairman, was optimistic on Thursday. "For the longer term," he told the Senate Banking Committee, "prospects for continued rapid technological advance and associated faster productivity growth are scarcely diminished."

ARTICLE TRUNCATED

Copyright 2001 The New York Times Company

25. (2pts) According to the article, who started the economic slowdown a year ago?

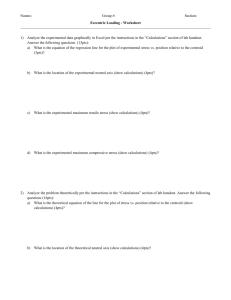

26. (4pts/H4) LABEL this Liquidity

Preference graph:

27. ( 2pts) According to the article, whose money demand has changed, and how ?

28. (2pts) What does the article say Washington is doing to encourage an economic rebound?

29. (4pts/ H4) On your labeled liquidity preference graph above , add dashed lines and arrows to illustrate your answers to Q27-28 .

30. (4pts/ CQ,H4) Analyze and predict the combined effect of these actions on interest rates.

Is there an unambiguous prediction about interest rates?