Relevant Costing Problems

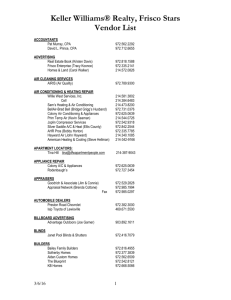

advertisement

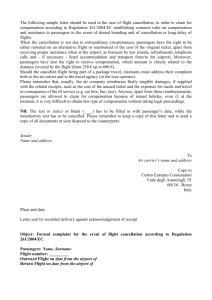

Relevant Costing Problems I. Contribution approach, relevant costs. Air Frisco owns a single jet aircraft and operates between San Francisco and the Fiji Islands. Flights leave San Francisco on Mondays and Thursdays and depart from Fiji on Wednesdays and Saturdays. Air Frisco cannot offer any more flights between San Francisco and Fiji. Only tourist-class seats are available on its planes. An analyst has collected the following information: Seating capacity per plane Average number of passengers per flight Flights per week Flights per year Average one-way fare Variable fuel costs Food and beverage service costs (no charge to passenger) Commission to travel agents paid by Air Frisco (all tickets are booked by travel agents) Fixed annual lease costs allocated to each flight Fixed ground services (maintenance, check in, baggage handling) costs allocated to each flight Fixed flight crew salaries allocated to each flight 360 passengers 200 passengers 4 flights 208 flights $500 $14,000 per flight $20 per passenger 8% of fare $53,000 per flight $7,000 per flight $4,000 per flight For simplicity, assume that fuel costs are unaffected by the actual number of passengers on a flight. Required 1. Calculate the operating income that Air Frisco earns on each one-way flight between San Francisco and Fiji. 2. The Market Research Department of Air Frisco indicates that lowering the average one-way fare to $480 will increase the average number of passengers per flight to 212. Should Air Frisco lower its fare? Show your calculations. 3. Travel International, a tour operator, approaches Air Frisco on the possibility of chartering (renting out) its jet aircraft twice each month, first to take Travel International’s tourists from San Francisco to Fiji and then to bring the tourists back from Fiji to San Francisco. If Air Frisco accepts Travel International’s offer, Air Frisco will be able to offer only 184 (208 – 24) of its own flights each year. The terms of the charter are as follows: (a) For each one-way flight, Travel International will pay Air Frisco $75,000 to charter the plane and to use its flight crew and ground service staff; (b) Travel International will pay for fuel costs; and (c) Travel International will pay for all food costs. On purely financial considerations, should Air Frisco accept Travel International’s offer? Show your calculations. What other factors should Air Frisco consider in deciding whether or not to charter its plane to Travel International? II. Discontinuing a product line, selling more units. The Northern Division of Grossman Corporation makes and sells tables and beds. The following estimated revenue and cost information from the division’s activity-based costing system is available for 1999. 4,000 Tables 5,000 Beds Revenues ($125 x 4,000; $200 x 5,000) $500,000 $1,000,000 $1,500,000 Variable direct materials and direct manufacturing labor costs ($75 x 4,000; $105 x 5,000) 300,000 525,000 825,000 Depreciation on equipment used exclusively by each product line 42,000 58,000 100,000 Marketing and distribution costs $40,000 (fixed) + $750 per shipment x 40 shipments 70,000 Total 205,000 $60,000 (fixed) + $750 per shipment x 100 shipments 135,000 Fixed general administration costs of the division allocated to product lines on the basis of revenues 110,000 220,000 330,000 Allocated corporate office costs allocated to product lines on the basis of revenues 50,000 100,000 150,000 Total costs 572,000 1,038,000 Operating income (loss) $ (72,000) $ (38,000) $(110,000) 1,610,000 Additional information includes: a. On January 1, 1999, the equipment has a book value of $100,000 and zero disposal price. Any equipment not used will remain idle. b. Fixed marketing and distribution costs of a product line can be avoided if the line is discontinued. c. Fixed general administration costs of the division and corporate office costs will not change if sales of individual product lines are increased or decreased, or if product lines are added or dropped. Required 1. Should the Northern Division discontinue the tables product line assuming the released facilities remain idle? Show your calculations. 2. What will be the effect on Northern Division’s operating income if it were to sell 4,000 more tables? Assume that to do so, the division would have to acquire additional equipment costing $42,000 with a 1-year useful life. Assume further that the fixed marketing and distribution costs will not change but that the number of shipments will double. Show your calculations. III. Multiple choice, comprehensive problem on relevant costs. The following are the Class Company’s unit costs of manufacturing and marketing a high-style pen at an output level of 20,000 units per month: Manufacturing costs Direct materials Direct manufacturing labor Variable manufacturing indirect costs Fixed manufacturing indirect costs Marketing costs Variable Fixed $1.00 1.20 0.80 0.50 1.50 0.90 Required The following situations refer only to the preceding data: there is no connection between the situations. Unless stated otherwise, assume a regular selling price of $6 per unit. Choose the best answer to each question. Show your calculations. 1. In an inventory of 10,000 units of the high-style pen presented in the balance sheet, the unit cost used should be (a) $3.00, (b) $3.50, (c) $5.00, (d) $2.20, (e) $5.90. 2. The pen is usually produced and sold at the rate of 240,000 units per year (an average of 20,000 per month). The selling price is $6 per unit, which yields total annual revenues of $1,440,000. Total costs are $1,416,000, and operating income is $24,000, or $0.10 per unit. Market research estimates that unit sales could be increased by 10% if prices were cut to $5.80. Assuming the implied cost-behavior patterns continue, this action, if taken, would a) Decrease operating income by $7,200. b) Decrease operating income by $0.20 per unit ($48,000) but increase operating income by 10% of revenues ($144,000) for a net increase of $96,000. c) Decrease unit fixed costs by 10%, or $0.14, per unit, and thus decrease operating income by $0.06 ($0.20 - $0.14) per unit. d) Increase unit sales to 264,000 units, which at the $5.80 price would give total revenues of $1,531,200, and lead to costs of $5.90 per unit for 264,000 units, which would equal $1,557,600, and result in an operating loss of $26,400. e) None of these. 3. A contract with the government for 5,000 units of the pens calls for the reimbursement of all manufacturing costs plus a fixed fee of $1,000. No variable marketing costs are incurred on the government contract. You are asked to compare the following two alternatives: Sales Each Month to Regular customers Government Alternative A 15,000 units 0 units Alternative B 15,000 units 5,000 units Operating income under alternative B is greater than that under alternative A by (a) $1,000, (b) $2,500, (c) $3,500, (d) $300, (e) none of these. 4. Assume the same data with respect to the government contract as in requirement 3 except that the two alternatives to be compared are: Sales Each Month to Regular customers Government Alternative A 20,000 units 0 units Alternative B 15,000 units 5,000 units Operating income under alternative B relative to that under alternative A is (a) $4,000 less, (b) $3,000 greater, (c) $6,500 less, (d) $500 greater, (c) none of these. 5. The company wants to enter a foreign market in which price competition is keen. The company seeks a one-time-only special order for 10,000 units on a minimumunit-price basis. It expects that shipping costs for this order will amount to only $0.75 per unit, but the fixed costs of obtaining the contract will be $4,000. The company incurs no variable marketing costs other than shipping costs. Domestic business will be unaffected. The selling price to break even is (a) $3.50, (b) $4.15, (c) $4.25, (d) $3.00, (e) $5.00. 6. The company has an inventory of 1,000 units of pens that must be sold immediately at reduced prices. Otherwise, the inventory will be worthless. The unit cost that is relevant for establishing the minimum selling price is (a) $4.50, (b) $4.00 (c) $3.00, (d) $5.90, (e) $1.50. 7. A proposal is received from an outside supplier who will make and ship these highstyle pens directly to the Class Company’s customers as sales orders are forwarded from Class’s sales staff. Class’s fixed marketing costs will be unaffected, but its variable marketing costs will be slashed by 20 percent. Class’s plant will be idle, but its fixed manufacturing overhead will continue at 50% of present levels. How much per unit would the company be able to pay the supplier without decreasing operating income? (a) $4.75, (b) $3.95, (c) $2.95, (d) $5.35, (e) none of these.