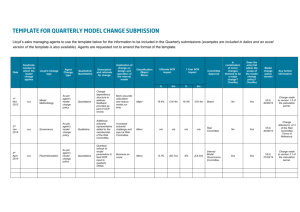

Comments Template QRT SCR final

advertisement