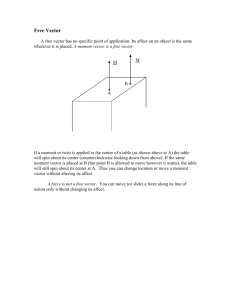

fig. 1

advertisement

Duality and Optimality in the Analysis of the Policy for Sustainable Development1 Ivan Ivanov* and Julia Dobreva * Assoc. Prof. Ivan Ivanov, PhD, Department of Statistics and Econometrics, Faculty of Economics and Business Administration, Sofia University , St. Kliment Ohridski”, 125 Tzarigradsko chaussee blvd., bl.3, Sofia 1113, Bulgaria, e-mail: i_ivanov@feb.uni-sofia.bg Julia Dobreva, PhD student, Department of Economics, Faculty of Economics and Business Administration, Sofia University , St. Kliment Ohridski”, 125 Tzarigradsko chaussee blvd., bl.3, Sofia 1113, Bulgaria, e-mail: dobreva_julia@abv.bg Duality and optimality in the analysis of the policy for sustainable development: In this paper we show that the solution to the maximization problem and its dual is one and the same and they can be applied as a research method for the study of different economic processes. The derived equation, which is known form the consumption theory as the Slutsky equation, and the classification of variables from our model are applied in the example we provide with an analysis of the policy for sustainable development. In this paper we propose an application of the model in the process of production and consumption of private goods and the balance of such processes with the policies for environmental protection. We further claim that such analysis can benefit from a classification of the variables, object of the study which can be attributed to the study of sustainable development. Key words: duality, optimization model, the Slutsky equation, sustainable development 1. Introduction The optimization models have a wide application in the analyses of economic processes [4], [8], [11], [13], [16] mainly with their classical examples in the consumption and the production theory. The analysis in [8] consists of defining an objective function and finding a solution of the maximization problem under a given constraint. In this paper, we claim that the solution to the proposed optimization problem leads to the definition of its “dual” in which we swap the places of the constraint and the objective function and find a solution for a minimum. A similar approach can be found in the papers of [12] and [15]. However, these models do not provide an in-depth analysis of the unique solution to the maximization and the minimization problem and its application in economics. By analogy to the classical application of the model in the consumption and the production theory, in this paper we propose two dual optimization problems, for which we have proven [7] that the maximization and the minimization problem have one and the same solution, which indicates the relation between the maximum and the minimum of the two problems. The model, as suggested by us, leads to the definition of the dual problem and the Slutsky equation as well as to the definition of a classification of variables, which are arguments of the objective function in our model. The objective of this paper is to apply the model in the analysis of the sustainable development process, Section 2, by using the results from the model, i.e. that the maximization problem and its dual have one and the same solution and they result in the derivation of a universal equation, analogous to the Slutsky equation. In Section 3 and Section 4 we apply the model in the analysis of the sustainable consumption and the sustainable production processes. 1 This paper was financially supported under the Sofia University “St. Kl. Ohridski” research project 24/2007. 1 Then, in Section 5 we use the model for defining a positive governmental policy for sustainable development. Section 6 summarizes and concludes. The notion “sustainable development” was introduced by the International Union for the Conservation of Nature (IUCN)2 and by the World Commission3, with the proposed definition in the latter publication: „development that meets the needs of the present without compromising the ability of the future generations to meet their own needs”. The modern EU policy for sustainable development has been laid down in the Sustainable Development Strategy4, which argues that: „economic growth, social cohesion and the protection of the environment should go hand in hand”. The economic processes of sustainable development with regard to the change of the economic operations and their transformation into more sustainable structures have been analyzed by [3], [6], [9], and [10]. The object of study in these papers is the connection between the optimization processes and the notion of “sustainable development”. In our analysis we show that the dual problem and the derived unique (Slutsky) equation, as well as the classification of variables based on it, can be used in the analysis of the policy for sustainable development. By applying the classification of the different types of variables in the analysis of the optimizing behavior of the economic agents in the consumption and production processes, our suggested applications of the model show that in the log-run we can study the optimal choice in the provision and consumption of private goods, on the one hand, and the goods/activities for environmental protection, on the other hand, through the introduction of a classification of these commodities/activities. The analysis of the policy for sustainable development incorporates the behavior of the consumers as well as the choices of the producers. In this paper we will apply our model in the analysis of sustainable consumption and sustainable production. We will firstly study the optimal choices of the respective economic agents and then analyze the influence that the governmental policy for sustainable development has on these choices. 2. The Model In our analysis we shall introduce the function (x)=(x1, х2, ..., xn), defined in a convex and compact set x X R n , which is continuous, monotonic, twice differentiable, quasiconcave and homogenious of degree 1 and this set is also characterized by local non-satiation5. The function (x) 2 IUCN (1980) The World Conservation Strategy: Leaving Resource Conservation fir Sustainable Development (Geneva: International Union for the Conservation of Nature and Natural Resources) 3 World Commission (1987) Our Common Future (New York: Oxford University Press) 4 Communication from the Commission: A Sustainable Europe for a Better World: A European Union Strategy for Sustainable Development; Brussels, 15.5.2001 COM(2001)264 final (Commission’s proposal to the Gothenburg European Council) 5 A given set is characterized by local non-satiation under the condition that there exists a vector x X and >0, and also a vector x X such that x x and x x . 2 is an objective function, which we wish to maximize under a given linear constraint. In the ndimensional case the model takes the following form: max ( x) x0 such that a, x b where x = (x1, x2, …, xn) is a vector of the arguments of the objective function, a = (a1, a2,…, an) is a vector of parameters, which are positive numbers and influence the constraint. The scalar is b, which determines the value of the constraint and b≥0. The solution to this problem is the vector x*, which is known as the optimal vector and in which the arguments of the defined objective function (x) take values in which the function (x) reaches its maximum. In order to illustrate geometrically the model, we shall study the two-dimensional example (fig. 1): х2 A (x1, x2)=y3 x2* (x1, x2)=y2 (x1, x2)=y1 x1 * х1 l Fig. 1 Optimization model The graphical representation of the function (x1, x2) = y, where y is some number, gives the coordinates of the points (x1, x2), in which the objective function has one and the same value of y. On fig. 1 this function is represented by a family of curves, or level curves, which are defined upon changes in the value of y. The second element of the model is a linear constraint, which is the line l : а1x1 + а2x2 = b, where b is some constant. The aim with this model is to find the vector x* ( x1* , x2* ) , for which the function (x1, x2) has a common point with the constraint and in this point it reaches its maximum value. We will prove that point А (x1*, x2*) in fig. 1, represented by the vector x* ( x1* , x2* ) , in which the curve is tangent to the constraint l, is a solution to the maximization problem. We introduce the value function v (a, b) which takes the following form: v(a, b) max ( x) x0 (1) such that a, x b In our problem the value function v (a, b) is decreasing in a and increasing in b, homogeneous of degree zero in (a, b), quasi-convex in a, and continuous for all a>0, b>0. 3 This problem is usually solved using the Lagrangean, which for our problem (1) takes the form L( x, ) ( x) (b a, x ) . The solution to this problem is the vector x*(a,b) with coordinates x*k = х*k (a, b), for k = 1, 2, …, n. In the two-dimensional case which we have discussed above, the vector x ( a, b) depends x* ( x1* (a, b), x2* (a, b)) defines the point of maximum and the function x (a, b)= 1 x ( a , b ) 2 on the vector а and the right side of the constraint a, x b and determines the quantity of the fist and the second variable, which are x1 (a, b) and x2 (a, b) , for obtaining a maximum value of φ (х). As the value function v (a, b) is monotonic with regard to b, then for each level curve ( x) y we can get the minimum value of a, x , necessary for obtaining a certain level of y with a given vector a. We now introduce a second value function g(a, y), which represents this dependence and we can formulate the problem for obtaining a minimum value of a, x : g (a, y) min a, x x 0 (2) such that ( x) y The function g (a, y) is increasing, homogenious of degree 1, concave and continuous in a. To solve this problem we again use the Lagrangean, which for our problem (2) takes the form: L( x, ) a, x ( y ( x)) . The solution to this problem is h*(a,y), which has coordinates h*k = h*k(a, y), for k = 1, 2, …, n. In the two-dimensional case, the vector h* (h1* (a, b), h2* (a, b)) defines the point of minimum h ( a, y ) we shall define as a function which depends on the vector а and the function h (a, y) 1 h2 (a, y ) and the value y of the function φ (х) and determines the necessary quantity of the first and second variables, which are h1* (a, y ) and h2* (a, y ) , for reaching a minimum value of g(a, y), i.e. h* is a solution to the problem. Thus we have found a solution to the so called “dual” problem, as it defines one and the same objective swapping the places of the objective function and the constraint. The point of minimum coincides with the point of maximum, i.e. the solution to the two problems is one and the same vector. We shall now formulate the following Theorem, which was proved in [7]: 4 Theorem 1 If the function φ(x) is continuous and defined in a convex and compact set х X, characterized by local non-satiation, then the optimal vector x*, which is a solution to the problem for maximizing φ(x) determines the optimal vector x*, which is a solution to the problem for minimizing a, x . And vice versa, the optimal vector x*, which is a solution to the problem for minimizing a, x determines the optimal vector x*, which is a solution to the problem for maximizing φ(x). This dependence takes the following form: v (a, b*) = max φ(x) = φ(x*) = φ* a, x b* and g (a, φ*) = min a, x = a, x * = b* φ(x) φ* Hence, from Theorem 1 it follows that we can formulate the following identities: g (a, v (a, b)) = b and v (a, g(a, y)) = y (3) and x(a, b) ≡h (a, v(a, b)) and h(a, y ) ≡ x (a, g(a, y)) (4) From identities (3) and (4) and applying the chain rule we can derive the following equation: xi (a * , b* ) hi (a * , y * ) x (a * , b* ) x j ( a * , b* ) i for i, j = 1, …, n a j a j b (5) In this equation we will call hi / a j substitution effect, x j xi / b we shall define as constraint effect, and xi / a j we claim to be the total effect. The substitution effect determines a line tangent to the curve of the function φ(x) and measures the impact on the hi coordinate upon the increase in the parameter aj in the problem for minimizing the value of b, and the effect of the constraint measures the impact on the xi coordinate upon the increase in the value of the constraint in the problem for maximizing the value of the function φ(x), multiplied by the xj coordinate. The total effect xi / a j determines the change of some variable, respectively ∂hi or ∂xi, as a result of the change in a given parameter from the vector а and this is shown through the difference hi / a j x j xi / b . Using the equation (5) we get: xi (a, b) h (a, v(a, b)) x (a, b) x j (a, b) a j i a j i a j a j a j a j b 5 By substituting with а and b in the equation from the two-dimensional case, the total effect is the following vector: h1 x1 a1 x2 h2 a 1 h1 a2 a1 x2 x2 a1 x1s x1b x1 x2 h2 a2 b b a2 x2s x2b a2 x1s The vector s represents the substitution effect by showing the change of the function x 2 xa, b . As the function xa, b determines the optimum vector for a constant value of the function φ(x)=y, then the substitution effect determines the tangent to the respective level curve. The vector x1b x b represents the constraint effect. The substitution effect determines the value of the function 2 xa, b at different values of the constraint and constant value of φ(x). By changing the parameter that influences the constraint, a change occurs also in the value of xa, b , i.e. the position of the optimal vector is moved to another level curve, which gives a higher value of φ(x) and in this case we have the constraint effect. By solving equation (5) and depending on the changes that occur in the values of the vector a and the parameter b, we can propose a classification of the variables x1, х2,..., xn, contained in the optimal vector х*. Variables for which, upon a fixed value of the vector а, there is an increase in the value of the function xa, b as a result of an increase in the value of b, we shall define as normal, i.e. x j b 0 . When upon a fixed value of the constraint, the value of the function xa, b , which consists of normal variables, decreases with the increase of the vector а, and vice versa, such variables we shall also define as ordinary, or in this case we have x j a j 0 ,. When upon an increase in the value of b and upon a fixed value of the vector a, the value of one variable increases proportionately more, whereas the value of the other variable increases proportionately less, then the first variable we shall define as luxury and the second variable as necessary. However, if x j b 0 , then the sign of effect and the positive effect of the constraint, i.e. x j a j x j a j is determined by the negative substitution 0 or x j a j 0 . If the value of the function xa, b for the j-th variable has increased with the increase in the value of the coordinates of the 6 vector a, or x j a j 0 , and also vice versa, the value of xa, b for the j-th variable has decreased upon the decrease in the values of the vector a, then we shall define this variable as a Giffen variable. When we have decreases and also x j a j x j b 0 , i.e. with the increase in the constraint, the value of xa, b 0 , then we shall define the j-th variable as inferior variable. If there are variables for which we have hi h j 0 , then we shall define the i and j variables as substitutes, a j ai and if there are variables for which hi h j 0 , then the variables i and j we shall define as a j ai complements. 3. Optimality and sustainable consumption We can find examples for the application of our optimization model in [11] and [16], in the theory of consumption and production. In the consumption theory our problem (1) from Section 2 has the following form: v( p, m) max u ( x) x 0 (6) such that p, x m where the objective function u(x) is the utility function, and it is continuous, defined in a convex and compact set of consumers’ preferences x X R n ; x ( x1 , x2 ,..., xn ) is the consumption bundle, chosen by the consumer based on his/her preferences; p ( p1 , p2 ,..., pn ) is a vector of the prices of these goods which are positive numbers, i.е. p>0, and it influences the value of the budget constraint m. In the consumption theory the function v(p, m) is defined as indirect utility function and it has the properties of the value function v(a, b) from Section 2. The solution to this problem by using the Lagrangean is the function x*(p, m), which is defined as the Marshallean demand function [16] or the Walrasian demand function [11]. On the other hand, problem (2) from Section 2 in the consumption theory has the form: e( p, u ) min p, x x 0 (7) such that u ( x ) u where the function e( p, u ) is known as the expenditure function and is characterized by the properties of the value function g(a, y). Using the Lagrangean, the solution to this problem is the function h*(p, u), which is defined as the Hicksian demand function ([11] and [16]). By applying 7 Theorem 1 from Section 2 and identities (3) and (4) in the consumption theory, we derive the Slutsky equation by substituting a p, b m : xi ( p, m) hi ( p, v( p, m)) xi ( p, m) x j ( p, m) , i, j = 1, 2, …, n p j p j m (8) The derivative hi / p j is the substitution effect upon the choice of goods, x j xi / m is the income effect, and the derivative xi / p j is the total effect from the change in the chosen commodity bundle. From the Slutsky equation (8) and by applying the definitions from the classification in Section 2, the private goods in the consumption theory can be defined as: normal, ordinary, luxurious, inferior, Giffen goods, substitutes and complements. In the analysis as proposed by [2], the change in the consumption demand patters is studied through the Engel curves over time and across countries and the commodities consumed are classified as luxury, normal and inferior goods on the basis of the budget elasticity of the consumers. According to [10], the consumers’ behavior and their lifestyle are deemed to be decisive factors for sustainable development as they have impact on the intensity of the production processes and the use of production factors. In our analysis of sustainable consumption we will apply the model from Section 2, consisting of two optimization problems, and we will study the choice of the consumers between environmentally unfriendly commodities and services on the one hand and environmental goods (environmental activities) on the other hand. The analysis for sustainable development according to the classical definition of the term suggests the use of an intertemporal model. Hence, in order to study the sustainability patterns in the consumers’ behavior we will use the dynamical model of the Slutsky equation [15], by also adding to it the utility function. We shall analyze the consumption for period t, where t 1, . If N is the aggregate quantity of environmental goods (activities) and C is the quantity of other consumed goods/services (which are not environmentally friendly), then the value function (6) in our model of sustainable consumption will take the following form: v t ( p t , I t ) max u (C t , N t ) t t C , N 0 (9) such that pct C t pNt N t I t where p Nt is the price for environmental goods (activities), p Ct is a vector of the price for other consumed private goods, which are environmentally unfriendly; C t (C1t ,..., C st ) is a vector of the quantities of private goods for the period t, N t ( N1t ,..., Nqt ) is a vector of the quantities of environmental goods (activities) for the period t, and I t is the budget of a given consumer in terms of labor and non-labor income. 8 The analysis of the Slutsky dynamical equation [15] shows that the vector x* xt ( pt , I t ) and p t ( pCt , p Nt ) , which is a solution to our problem (9) is “locally asymptotically stable”, and each change in the income and prices is followed by a change in the value of the optimal vector x*. According to [1], optimality and sustainability are two different notions. Hence, to analyze the consumers’ behavior with regard to the two types of goods and to evaluate the level of sustainability, it is necessary for our model to be analyzed in dynamics, i.e. to find the following solutions to the problem for finding an extremum after the period t. If t 1,2, then the solutions to the problem for t1 1 and t2 2 will be accordingly x1* ( pC1 , p1N , I 1 ) and x2* ( pC2 , pN2 , I 2 ) . We will claim that namely the difference x2* x1* for period t 2 compared to the one for period t1 indicates sustainable development in the transition from period t1 to period t 2 , or for the vector v2 we will have v2 x2* x1* 0 . By substituting with the arguments of the value function (9) in the expenditure function (7) we get: e t ( p t , u ) min ( pCt , pNt ), (C t , N t ) t C , N t 0 (10) such that u t (C t , N t ) u The solution to the minimization problem for period t1 1 is the vector h * ( p1 , u1 ) , and for period t2 2 is the vector h * ( p 2 , u 2 ) , and we also have e2 h2* h1* 0 . By applying Theorem 1 and the Slutsky equation (8) in our model of sustainable consumption, which leads to the analysis of the substitution effect, the income effect and the total effect, characterizing the change in the consumers’ choice, we can classify the chosen environmental goods (activities) and also the other consumed (environmentally unfriendly) private goods. We will introduce the following two definitions: Definition 1: Sustainable consumption is consumption in which the solution for a maximum of the utility function and minimum of the expenditure for period t is higher in value than the solution to the optimization model for period t 1, where t 1, or: xt* ( p t , I t ) ht* ( p t , u t ) xt*1 ( p t 1 , I t 1 ) ht*1 ( p t 1 , u t 1 ) Hence, by applying the Slutsky equation and the classification from the optimization model in Section 2 we will claim that: Definition 2: Sustainable consumption is consumption in which the quantity of environmental goods (activities) increases over time, accompanied by an increase in the quantity of other consumed (non-environmental) private goods, i.e. we have a process of sustainable consumption from moment t 0 when in each moment t that follows ( t t0 ) the goods remain of the 9 type they were in moment t 0 . This means that there are indications of sustainable development if the goods are normal in moment t 0 and they remain normal in the next periods and also if the good N is luxury in moment t 0 , then it remains such in each subsequent moment. The proposed two definitions represent two different approaches to the explanation of the concept of sustainable development. If for period t one of the aggregate goods C or N is an inferior good or a Giffen good, i.e. x j I 0 or x j p j 0 and xt* ( p t , I t ) xt*1 ( p t 1 , I t 1 ) , and respectively ht* ( p t , u t ) ht*1 ( p t 1 , u t 1 ) , then we will claim that the principle of sustainable consumption has been violated. 4. Optimality and sustainable production In their analysis [5] argue that the development and use of environmentally friendly technologies are key elements towards attaining sustainable development and also contribute to economic growth. They analyze the potential benefits for the business from the integration of the policy for sustainable development with the process of industrial development. In this application of our model we will describe the process of sustainable production in period t, where t 1, and we will formulate the maximization problem, which will take the following form: vt ( p t , Rt ) max f (K t , N t ) t t K , N 0 such that p , ( K t , N t ) R t t where the objective function f ( K t , N t ) is the production function, which is continuous and defined in a convex and compact technological set of the producer. ( K t , N t ) X R n is the bundle of investment decisions, which the producer chooses in period t , depending on his technological possibilities, and uses for the production of a certain type of good y. K t is the aggregate quantity of all capital investments and N t is the aggregate quantity of investments, aiming at the conservation of nature. We will define with p ( p1 , p2 ,..., pn ) the vector of prices for these investments, which are positive numbers, p > 0 , and they influence the value of the budget constraint R t , i.e. on the financial resource which the company spares for capital expenditure and environmental activities. The value function vt ( pt , Rt ) , introduced here by us, is characterized by the properties of the value function v(a, b) in Section 2. This function has not been defined in the production theory so far and for the purposes of our analysis we will refer to it as the indirect production function by analogy with the already discussed indirect utility function. By applying the Lagrangean, the function xt* ( p t , R t ) is the solution to the problem and we can define it as the Marshallean demand function in the choice of investment decisions. Here, following the example provided in Section 3, 10 to analyze the behavior of the producers with respect to the two types of goods and to assess the level of sustainability in the production process, it is necessary that our model be studied in dynamics, i.е. to find more than one solution to the problem for finding an extremum. An application of problem (2) form Section 2 in the production theory, [11] and [16], is the cost minimization problem, which for our model will take the following form: ct ( pt , y t ) min t t K , N 0 pt , ( K t , N t ) such that f ( K t , N t ) y t where the function ct ( pt , y t ) is the cost function and is characterized by the properties of the value function g(a, y) in Section 2. By applying the Lagrangean, the function ht* ( p t , y t ) is a solution to the problem for period t and we can define it as the Hicksian function in the choice of investment decisions. The solution to the minimization problem for period t1 1 is the vector h1* ( p1, y1 ) and for period t2 2 is the vector h2* ( p 2 , y 2 ) , where we have c2 h2* h1* 0 . By applying Theorem 1 and the Slutsky equation, which has the same form as equation (8), we can study the change in the choice of investment decisions. The derivative hi / p j we will define as the substitution effect in the choice of investment decisions, x j xi / R is the budget effect, and the derivative xi / p j we will call the total effect from the choice of investment decisions. The investments in the production can be classified as: normal, ordinary, luxury, inferior, Giffen investments, substituting and complementing investments. By analogy to the process of sustainable consumption, we will introduce the following definitions for sustainable production: Definition 3: Sustainable production is production in which the solution for a maximum of the production function and minimum of the costs for investments for period t is higher in value than the solution to the optimization model for period t 1, or: xt* ( p t , R t ) ht* ( p t , y t ) xt*1 ( p t 1 , R t 1 ) ht*1 ( p t 1 , y t 1 ) By applying the Slutsky equation (8) and the classification from the optimization model in Section 2, we will claim that: Definition 4: Sustainable production is a production in which the quantity of investments for environmental protection increases in time along with the increase in the quantity of other investments, i.e. we have a process of sustainable production from moment t 0 , when in each moment t that follows ( t t0 ) the investments remain of the type they were in moment t 0 . This means that there are indications of sustainable development if the investments are normal in 11 moment t 0 and they remain normal in the next periods and also if N is a luxury investment in moment t 0 , then it remains such in each subsequent moment. If in period t one of the aggregated quantities of investments К or N is inferior or a Giffen investment, i.e. x j R 0 or x j p j 0 and xt* ( p t , R t ) xt*1 ( p t 1 , R t 1 ) , and respectively ht* ( p t , y t ) ht*1 ( p t 1 , y t 1 ) , then we will claim that the principle of sustainable production has been violated. We will now study the model in which the state (the government) introduces a regulation mechanism in the cases when the principle of sustainable consumption and sustainable production has been violated in order to recover the balance between economic growth and environmental protection. 5. Optimality and the governmental policy for sustainable development One of the sustainable development mechanisms of the government is the provision of state grants for the production of environmental goods and environmentally friendly activities. The state grants are used for financing public goods as well as for co-financing private investments and thus supporting the competitiveness in the business sector. In our model, following the ideas suggested by [14], we will assume that part of the budget of the government is spared for the provision of grants for the production of private goods which are environmentally unfriendly (or also known [14] as environmentally harmful subsidies) as well as for subsidizing the production of environmentally friendly goods and activities for environmental protection. We can apply problem (1) from Section 2 and by analogy to the example, provided in [7] for the optimal choice between public and private goods, we can formulate a problem for maximizing the utility from the governmental subsidies for private environmentally friendly and environmentally unfriendly goods for a given period t: vt ( t , Bt ) max W (u1 (G t , N t ),...un (G t , N t )) t t G ,C 0 (11) such that 1t G t 2t N t Bt where the objective function W (u1 (G t , N t ),..., un (G t , N t )) is the social welfare function in the choice of a bundle of subsidized private environmental products and other subsidized private goods (environmentally unfriendly), G t is the total (aggregate) quantity of subsidized environmentally unfriendly commodities for period t, N t is the total (aggregate) quantity of subsidized environmental goods/activities, 2t is the cost for the financing of investments which aim at the production of environmental products, 1t is the amount of state grants for the financing of other, environmentally unfriendly private goods, and B t is the total amount of the budget constraint of the government for these two activities for period t. We will define the function v( t , B t ) for the 12 purposes of our analysis as the indirect social welfare function, expressing the utility from the financed environmental and non-environmental private goods. The solution to problem (11) is the G t t , B t function x * ( t , B t ) t t t , which in our model we will define as the Marshallean function N , B in the choice of the government between subsidized environmental goods (activities) and other nonenvironmental private goods. Also, by applying problem (2) from Section 2, we can formulate the dual (inverse) problem of (11) for minimizing the costs of the government (upon allocating the budget) when subsidizing environmental production/activities and also when providing environmentally harmful subsidies by supporting other private goods. This problem will take the following form: et ( t ,W t ) t mint 1t G t 2t N t G 0, N 0 such that W (u1 (G , N t ),..., un (G t , N t )) W t t where we will define the function e( t , u t ) as the function of governmental expenditure for subsidizing environmental goods/activities and other, environmentally unfriendly production. By applying the Lagrangean, the solution to this problem is the function h * ( t , u t ) , which we will refer to as the Hicksian function for the government’s choice between subsidized environmental production/activities and other, non-environmental goods. By applying Theorem 1 we can claim that the following identities are fulfilled: x( t , Bt ) h( t , v( t , Bt )) and h( t ,W t ) x( t , e( t ,W t )) In this application of the model, similarly to the above analysis of sustainable consumption and sustainable production, it is necessary to solve a number of problems for finding an extremum (a minimum and a maximum) in different time periods in order to assess the government’s policy for sustainable development. By deriving and solving the dynamic Slutsky equation in this application of our model and thus analyzing the substitution effect, the budget effect and the total effect, we can classify the environmental goods and also the other environmentally unfriendly private goods, subsidized by the state budget. Hence, we introduce the following definition: Definition 5: A positive governmental policy for sustainable development is the policy in which the solution for a maximum of the social welfare function and minimum of the expenditure for subsidized environmental production (including activities for environmental protection), on the one hand, and the costs for other subsidized, non-environmental private goods, on the other hand, for period t is greater in value than the solution to the optimization model for period t 1, where t 1, or: xt* ( t , B t ) ht* ( t ,W t ) xt*1 ( t 1 , B t 1 ) ht*1 ( t 1 ,W t 1 ) (12) Definition 6: A positive governmental policy for sustainable development from moment t 0 is the policy in which we observe sustainability when in each moment t that follows ( t t0 ) the 13 subsidized commodities/activities remain of the type they were in moment t 0 . This means that a government’s policy for sustainable development is positive if the subsidized environmental and non-environmental goods are normal in moment t 0 and they remain normal in the next periods and also if the environmentally friendly goods/activities N are luxury goods in moment t 0 and they remain such in each subsequent moment. In the cases when inequality (12) is fulfilled, we will claim that the provided additional grants for environmental production (environmental activities) not only provide a greater social benefit but they also reduce the costs of the firms for environmentally friendly production, which respectively results in the decrease in the value of this production and brings about an increase in the quantity of produced and consumed environmental products while also diminishing the chance for their transformation into inferior or Giffen goods. Precisely with these stimuli for environmental consumption and production, the government regulates the balance between competitiveness and economic growth, on the one hand, and the protection of the environment on the other, and thus implements a positive policy for sustainable development. 6. Conclusion The objective of this paper was to present the optimization model through the solution of the dual problem and to provide an example for the application of the model and the derived equation (based on the Slutsky equation) in the analysis of the sustainable consumption and sustainable production processes. Also, we additionally expanded the model by proposing a classification of the goods on the basis of the solution to the problem and the derived equation and we suggested a governmental mechanism for regulating the balance between economic growth and environmental consumption/production, contributing to the conservation of nature. We proved that the arguments of the objective function, introduced by us, can be classified according to our proposed general classification from the model. This classification is based on the analysis of the change in their quantities and the change in the parameters, which influence the optimal choice. The definitions, introduced by us, can be used in the assessment of the governmental policy for sustainable development. References 1. Arrow, K. , Dasgupta, P, and Karl-Goran Maeler (2003): “Evaluating Projects and Assessing Sustainable Development in Imperfect Economies” Fondazione Eni Enrico Mattei Nota di Lavoro 109.2003:1-36. http://www.econ.cam.ac.uk/faculty/dasgupta/imperf.pdf (downloaded: March, 2007) 2. Blow, L., Kalwij, A., and Ruiz-Castillo, J. (2004):”Mehtodological issues on the analysis of consumer demand patterns over time and across countries”. DEMPATEM research project (20012004), Working paper No 9, February 2004. http://www.uva-aias.net/lower.asp?id=186. (downloaded: February, 2007) 3. Demange, G. and Heunet, D. (1991): “Sustainable Oligopolies”. Journal of Economic Theory Vol. 54.2: 417-428. 14 4. Friedman, D. (1990): Price Theory. South-Western Publishing Co. Cincinnati, Ohio. 5. Gibbs, D and Longhurst, J. (1995): “Sustainable development and environmental technology: a comparison of policy in Japan and the European Union”. The Environmentalist, Vol. 15, No 3.: 196201 6. Hensler, D. and Edgeman, R.L (2002): “Modeling BEST business excellence”. Measuring Business Excellence 6.2 pp. 49-54 7. Ivanov, I., and Dobreva, J. (2007): “Duality and the Slutsky Equation: Theory and Some Applications”, (submitted for publication). 8. Ivanov, I., and Ivanova, V. (2005): “Basic maximization model and its application in economic education”. Proceedings of International Conference on Mathematics Education, Svishtov , Bulgaria: 203-208. 9. Kamihigashi, T. and Roy, S. (2007): “A non-smooth, non-convex model of optimal growth”. Journal of Economic Theory Vol. 132.1: 435-460. 10. Kratena, K. Wueger, M. (2004): “A consumers demand model for sustainable development”. Input and General Equilibrium Modeling. Data, Modeling and Policy Analysis. Brussels, September 2-4, 2004: http://www.iioa.org/pdf/Intermediate-2004/546.pdf (downloaded:September, 2007) 11. Mas-Collel, A. et al. (1995): Microeconomic Theory. Oxford University Press. 12. Menezes, C. F., and Wang X. H. (2005): “Duality and the Slutsky income and substitution effects of increases in wage rate uncertainty”. Oxford Economic Papers 57: 545-557. 13. Moschandreas, M. (1994): Business Economics. Routledge. 14. Parry, I. W. H. (1997): “A Second-Best Analysis for Environmental Subsidies”. Resources for the Future. 1-21. www.rff.org (downloaded: September, 2007) 15. Sedaghat, H. (1996): “A variant of the Slutsky equation in a dynamical account based model”. Economics Letters 50: 367-371. 16. Varian, Hal R. (1992): Microeconomic Analysis. W. W. Norton & Company, New York, NY. 15