Increasing the level of cultural philanthropy in Aotearoa New Zealand

advertisement

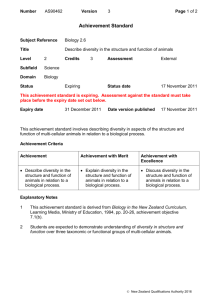

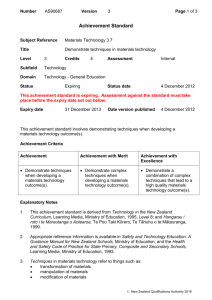

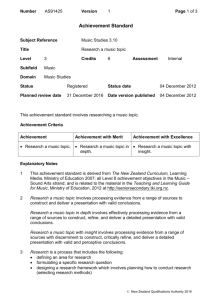

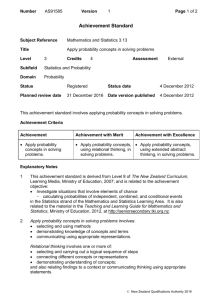

Growing the pie Increasing the level of cultural philanthropy in Aotearoa New Zealand Report of the Cultural Philanthropy Taskforce to the Minister for Arts, Culture and Heritage Hon Christopher Finlayson Presented December 2010 Website: http://www.mch.govt.nz/research-publications/publications/ministry-reports/cultural-philanthrophy Email: philanthropy@mch.govt.nz 2 Foreword Kia ora tatou For centuries, culture and private philanthropy have been inextricably linked. Early in the first century AD, the Roman poet Horace dedicated his first poem in Odes:I to his patron, Maecenas. The great painters of the European Renaissance were supported by wealthy individuals and rulers of states – both secular and religious. In pre-European Māori history, those with creative gifts were nurtured by their iwi or hapū. In modern Aotearoa New Zealand, the generosity of philanthropists over the decades has played a critical role in the growth of this nation’s cultural ecology. However, for culture to flourish truly and sustainably, it’s vital we boost the level of private philanthropy in Aotearoa New Zealand. This was the intention behind the Minister for Arts, Culture and Heritage Hon Christopher Finlayson’s establishment in 2009 of the Cultural Philanthropy Taskforce. His brief to the Taskforce was succinct: I am keen for the Taskforce to explore whether there are new opportunities to encourage private investment in the arts in New Zealand over the next five to ten years. The Minister also made it very clear that his intention is not to replace government funding but to grow the cultural philanthropy pie. The Taskforce has met regularly over the last fifteen months to respond to the Minister’s brief – and I’m pleased to present this final report. Together we have investigated best practice in philanthropy around the world, consulted within Aotearoa New Zealand with organisations and individuals, and drawn on the extensive experience and expertise of Taskforce members. The government has done its bit, directly through grants and indirectly through establishing a favourable tax environment for charitable giving that requires very little refinement. Government support can only ever be one part of an overall strategy for the cultural sector. It’s now time to ensure the cultural sector plays its part. Our recommendations are to: develop a fundraising capability building initiative to mentor and advise cultural organisations on a one-to-one basis promote knowledge and awareness of the recently introduced tax incentives introduce Gift Aid to boost private giving explore the workability of a cultural gifting scheme recognise and value the generosity of philanthropists reward with matched government funding cultural organisations that succeed in increasing their levels of income derived from private giving. 3 We should note that private philanthropy is more than just giving money. The donation of time, energy and skills to cultural organisations by generous and committed people is also of great value. As Kevin Spacey, the Artistic Director at The Old Vic in London recently commented: “I happen to believe that if you have been fortunate enough to be successful in your chosen field, you should spend a good portion of your time ‘sending the elevator back down’. That’s a phrase Jack Lemmon used to use. The truth is that it doesn’t matter what floor you’re on. There is always someone just dying to come to the top.” I’d like to thank my fellow members of the Taskforce - Margaret Belich, Alastair Carruthers, Dr Robin Congreve, Dame Jenny Gibbs, Carolyn Henwood, Jim Hill and Dayle Mace – for their indefatigable and enthusiastic commitment to getting the very best job done. I’d also like to pay tribute to Mark Da Vanzo of the Office of the Minister for Culture and Heritage, Lewis Holden, Chief Executive of the Ministry for Culture and Heritage, and Stephen Wainwright, Chief Executive of Creative New Zealand, and their officials, for their considerable assistance and wise counsel. I’d also like to express the gratitude of the Taskforce to the organisations and individuals in the cultural sector who made the time to engage in conversation with us over the past year. It’s fitting the Taskforce prepared its report in the season of new growth. It is our earnest desire that our work will result in a greater flowering of support for culture in our country. As Hone Tuwhare wrote in his lovely poem Snowfall: “Oh, come in, Spring”. Naku noa, na Peter Biggs Chair, Cultural Philanthropy Taskforce 4 We need to increase cultural philanthropy in NZ New Zealanders participate in the cultural sector as artists and performers, as viewers and audiences, as heritage advocates and as communities and supporters – both voluntary and professional. Government and private support for the cultural sector grew significantly through the second half of the 20th century – improving infrastructure and enabling an increasingly professional sector to become a valued part of our environment. But a new century brings new challenges. As a Taskforce we welcome the opportunity to take up the Minister’s challenge to find opportunities to realise the untapped potential for private giving to boost cultural activity in New Zealand. In a recently released report1 the Ministry for Culture and Heritage surveyed 480 cultural organisations and found that, at the time of the study, there were proportionately low levels of income derived from private giving (which includes individuals, companies, trusts and foundations) and from sponsorship.2 This information was collected prior to the introduction of the new tax regime and will need to be tested over time. The research also indicated: of those organisations that did not receive any form of corporate support (56 percent) or support from individuals (38 percent), most had not attempted to seek that support very few of the respondent organisations employed staff dedicated to fundraising while most respondent organisations had ‘registered charity status’ with the Charities Commission, only half knew if they had ‘donee status’3. Many cultural organisations struggle with how to source private support, how to “make the ask”. Perhaps they believe businesses aren’t interested in their particular organisation or art form. Perhaps they don’t know which individuals to ask for support, or they only know about and chase the same few high-profile individual cultural philanthropists. Some of the difficulties may be due to every-day organisational and resource pressures. The Taskforce encourages cultural groups to do more to raise their organisation’s profile and to connect actively with their supporters. No matter what their size, art form or location, we want to see cultural organisations being smarter about how they go about seeking private support. In the same vein, potential and willing philanthropists may be unsure of who to support, how to find a cultural organisation that is a good ‘fit’, and how to be certain the organisation they choose to support is worthy of that support and is sustainable. 1 Cultural Organisations: Giving and Sponsorship (for the April 2007-March 2008 tax year), Ministry for Culture and Heritage, April 2010. Refer to Appendix 3 for further information. 2 ibid 3 An organisation must have donee status to offer tax relief on donations from its supporters and to participate in the payroll giving scheme administered through the Department of Inland Revenue. 5 Can we learn from overseas experience of cultural philanthropy? The Taskforce was keen to know how levels of cultural philanthropy in New Zealand compared with those of other countries. The United States is often heralded for its generous culture of philanthropy, with culture relatively high up in the range of sectors receiving the most private support. There are also studies that provide information on levels of private support for the cultural sector in Australia (indicating increased levels over the past decade) and in the United Kingdom (indicating a private support level for cultural organisations comprising around 15 percent of total income)4. However, direct international comparisons can be problematic, given each country’s historical development, differing tax regimes and the impact of these factors on levels and expectations of private and/or public support. Comparisons can also be difficult due to the different research methodologies used. What we can say is that New Zealand’s private support for culture does appear to lag behind that of similar countries such as Australia and the United Kingdom. We talked to a number of organisations and philanthropists about ways to increase the level of cultural philanthropy in New Zealand, including ways to encourage cultural organisations to take a more proactive and diversified fundraising approach. Our discussions ranged from investigating the best of what works overseas, to thinking about how we can better promote existing incentives in New Zealand. We found that overseas engagement models designed to increase private sector support of cultural organisations tended to include all or most of the following elements: 4 raising awareness of tax incentives professional development of fundraisers working in cultural organisations (including mentoring, scholarships, awards, conferences, seminars and master classes) recognition of significant individual and corporate donors (including high-profile award ceremonies and other publicity and networking opportunities, and recognition online and in publications and other material) research and resources (with data on benchmarking, trends and evaluation of particular initiatives, and easily-accessible resources that include publications, FAQs, fundraising advice, case studies and online audio and/or visual downloads of professional development seminars or speeches) diversification and development of new philanthropic income streams, including targeting the next generation of potential philanthropists through philanthropy education programmes delivered in schools, and attracting new donors through new media methods such as online or text donations matched government and philanthropic funding and other financial incentives nomination services and skill development programmes for cultural organisation board members Refer Appendix 4 for further information on these two studies. 6 services that elicit volunteers’ particular skills and interests and match them to cultural organisations with those requirements, including volunteers from the corporate sector endowment funds – funds based on individual large donations and/or on pooling together multiple donations (small or large), where the capital is usually retained permanently and only the income from interest is distributed increased legacy and bequest levels – discretionary gifts to a cultural organisation of an individual’s personal property (cash or non-cash) under the terms of their will. We see some evidence of these initiatives in New Zealand, but recognise we need to fill some gaps and do more. Is there a philanthropy engagement model New Zealand could adopt? While the Taskforce did not find a single model of cultural philanthropy that could simply be transferred and adopted in New Zealand, we did find several international initiatives worth considering. Artsupport Australia, launched in 2003, has supported approximately 200 artists and 600 cultural organisations to develop their philanthropic potential. For an investment of A$4.6 million over seven years, Artsupport Australia has directly facilitated over A$45 million (and much more indirectly) in new philanthropic income, a return on investment of nearly 1000 percent.5 Artsupport Australia began as a three-year pilot following the introduction of several new tax incentives, and in an environment in which intergenerational shifts in responsibility for philanthropy were occurring. It was initially jointly sponsored by the Australia Council and the Australia Business Arts Foundation (AbaF) but is now solely attached to the Australia Council. From an initial core of three staff, the service now has eight highly skilled and independent people located in Darwin, Brisbane, Perth, Melbourne and Sydney. The focus of Artsupport’s work is on facilitating philanthropy or giving, in the form of gifts or donations from individuals (such as bequests and payroll giving), grants from private and corporate foundations and corporate donations. It does not spend time on corporate partnerships or sponsorships. In September 2010 Taskforce members attended a workshop where the Artsupport Australia Director, Louise Walsh, outlined the factors she considers have contributed to the success of her organisation: being a free advisory service providing customised mentoring to both cultural organisations and philanthropic individuals and entities having direct and quick access to specialist knowledge having national reach 5 Growing cultural philanthropy in Australia: the Artsupport Australia model, Artsupport Australia, July 2010 http://www.australiacouncil.gov.au/data/assets/pdf_file/0003/66189/Artsupport_model.pdf Refer to Appendix 5 for more information on a workshop convened by the Ministry for Culture and Heritage to explore the key features of the Artsupport model. 7 having a small and flexible team of experienced staff able to quickly respond to opportunities having staff salaries and expenses covered by government having access to the wider resources of a parent organisation (including venue for events, communications staff, IT support and HR services) holding strategic events to build brand, networks and business having high-profile champions with industry expertise who publicly campaign for the cause, and who facilitate strategic introductions having important relationships with key bodies in government, business and finance. The Australia Business Arts Foundation (AbaF) is a capacity-building initiative with a focus on individual philanthropy, and building and promoting effective giving and sponsorship partnerships between business and cultural organisations. It does this through: annual awards to recognise the best relationships between the private and cultural sectors with categories for young and emerging artists, business arts leadership etc matched funding through AbaF’s Premier’s Arts Partnership Funds in South Australia, Tasmania and Western Australia (see further discussion later in this report) AdviceBank and BoardBank providing significant levels of pro bono support for cultural organisations by connecting them to corporate employees with specific business skills for short-term voluntary projects or for longer-term governance roles providing scholarships that enable cultural managers to participate in tertiary level executive development courses regular workshops that enable cultural employees to network with, and learn alongside, colleagues across art forms and across each state in Australia research on levels of giving and sponsorship administering a fund that assists cultural organisations to take best advantage of Australia’s tax regime. Arts & Business UK was established in 1976 to focus on business sponsorship of the cultural sector. It has offices in England, Scotland, Wales and Northern Ireland. The range of support offered by Arts & Business UK is similar to that of AbaF: awards and other mechanisms for recognising and valuing philanthropic contributors to arts organisations, particularly ‘unsung heroes’ and cultural champions capability development programmes in the form of seminars and master classes an online Advice Line to provide quick-fire answers to well-prepared questions free legal advice on constitutional and governance matters, employment issues and contracts Fast Track Consultancy at a standard price and tailored consultancy to meet the needs of particular organisations, also at a fee a range of programmes to facilitate engagement in cultural organisations including a Board Bank programme to nurture business executives taking up roles on boards. The Taskforce considered the programmes offered by each of these organisations in developing a set of proposals that would best suit our needs here in New Zealand. 8 Cultural philanthropy – stepping up Increasing cultural philanthropy in New Zealand will depend on a range of initiatives – with all participants stepping up to take more responsibility. There is no single response. Some may see central government as the main ‘player’, arguing that barriers could be overcome if government were to increase its level of support - or introduce further new tax incentives. Our view is that government has played its part, directly through grants, and indirectly through establishing a favourable tax environment for charitable giving. It’s now up to the private sector to contribute. Recently commissioned Creative New Zealand research6 concluded that engaging with the corporate sector might be the most viable future source of funding growth for arts organisations. That report noted ‘corporate social responsibility’ as an area other not-forprofit organisations are particularly pursuing – and cultural organisations risk being left behind. We need to ensure that cultural organisations engage with business at the appropriate level. Corporate partnerships may be effective for larger organisations but smaller organisations which employ three or fewer people (which is the case with most cultural organisations in New Zealand) are unlikely to have the capacity to chase, secure and, importantly, sustain an ongoing partnership relationship. For these groups, less onerous relationships linking with local neighbourhood businesses may be more effective. Some commentators have suggested cultural philanthropy could be increased if individual wealthy philanthropists were targeted more often. But there is evidence from the United Kingdom that most support from individuals comes not from the wealthiest but from the ‘restaurant-rich’: those who earn a reasonable but not necessarily large amount and have some discretionary income to eat out and to support worthwhile causes. Many potential donors consider there are more deserving causes to support than culture and, in times of economic downturn, that’s not surprising. We suggest it’s time for cultural organisations to overcome this perception, make the connections and tell their own story vividly and with serious intent. It’s also time for many cultural organisations to look first to their existing supporters. These supporters already participate in cultural activities and should be more fully on board than potential new supporters. They attend performances or exhibitions or read literature or go to the movies. They may already be a ‘friend’ or member of one or more cultural organisation. Our focus is on initiatives to support cultural organisations to build their capability to harness the opportunities provided whatever their source – government, business or individuals - and then evaluate progress, learn from experience and set new goals. 6 The Art of the Possible: Strengthening Private Support for the Arts in New Zealand, October 2010, Allen Consulting Group, October 2010 [for Creative New Zealand]. Refer Appendix 6 for an outline of findings. 9 Recommendations We recommend several initiatives that complement one another and can be implemented together. Capability building There is a need for an initiative to build fundraising capability in New Zealand. Its primary function would be to mentor the boards and staff of cultural organisations on a one-toone basis unique to each organisation’s particular needs at any one time. Our recommendation is that this initiative should draw on facets of the Artsupport Australia model, along with aspects of the business philanthropy and sponsorship focus of AbaF and Arts & Business UK. The initiative must have a sector-wide mandate and be flexible and quick to respond to the needs of its clients. This must also be a dedicated resource, focusing on building cultural organisations’ fundraising capability, rather than stretching to other areas such as governance and management capability. The initiative should not attempt to engage directly by brokering funding partnerships on behalf of client organisations. We consider this initiative must have its own identity. This does not mean it needs to be a stand-alone body. Another organisation could host such an initiative, sharing resources such as accommodation, administration, communications and information technology. In considering an appropriate ‘home’ for the initiative, the Taskforce agreed it must be hosted in a way that provides a clear reporting line to a chair or chief executive. Drawing on other similar models, we consider key factors to ensuring the success of this initiative include: a small core of permanent staff (perhaps initially only two or three) who are highly qualified in fundraising and have the ability to gain respect in one-to-one mentoring with cultural organisations a focus on assisting cultural organisations to tell their ‘story’ vividly and with purpose assisting cultural organisations, where appropriate, to reach supporters who may initially be less interested in ‘art for art's sake’ and possibly more interested in associated social/educational/economic objectives effective advice on building and maintaining donor relationships and cultivating longterm donor loyalty enabling the cultural organisation itself to remain in control of its own fundraising strategy starting small and establishing clear milestones that demonstrate a clear return on investment in the initiative. This initiative should be funded by government, with expansion dependent on demonstrable success in attracting increased levels of private support to the cultural sector. Government funding, at a relatively low level (possibly $350,000 pa), would enable 10 the initiative to dedicate full attention to the capability building role, without ‘competing’ with clients for private sector funds. One option might be to support this initiative as a two or three year pilot with a clear point for evaluation of its effectiveness and acceptance by the cultural sector. Tax environment The Taskforce cannot emphasise enough the importance and consequences of the level tax playing field in New Zealand. We congratulate government for providing an incentive regime through which people can manage their own levels of giving. In particular, we commend recent initiatives such as the introduction of a payroll giving scheme, and the lifting of limits on tax credits for charitable donations made by individuals, companies and Māori authorities. We now have a tax regime that requires very little refinement. The proposal to remove gift duty announced in November 2010 removes the last fiscal restraint on giving. Although the limit on gifts possibly operates as a constraint more at a psychological than practical level (for example, it does not apply to gifts made to charities and donee organisations), gift duty is the only remaining intervention between the State and the ability of a citizen to dispose of all his or her wealth as he or she chooses. In many countries, most notably the United States, philanthropy is encouraged by granting relief from a range of taxes and duties. These measures vary in degree, in the outcomes they’re designed to encourage, and in the complexity of the mechanisms involved. We note, however, that almost invariably they give relief from a tax or levy that does not apply in New Zealand. For example, New Zealand does not have a capital gains tax, or death, inheritance or wealth taxes and (GST aside) no transaction tax. What New Zealand now has is the ability for individuals to claim a tax credit of one-third of all donations they make up to the level of their annual taxable income. For companies and Māori authorities, the tax deduction on donations is only limited by the amount of their net income. This provides a very favourable environment within which to encourage charitable giving. There is very little from overseas jurisdictions, therefore, we could consider as a useful addition to this country’s tax infrastructure. Similarly, there’s also very little from overseas examples of foundation or tax vehicle structures (such as Australia’s Private Ancillary Funds) that would add value because the structures that exist in New Zealand allow for equally favourable tax consideration. The Taskforce wrote to the Minister of Revenue suggesting work to find mechanisms to enable people not resident in New Zealand to make charitable contributions to New Zealand cultural activities, perhaps through inclusion in double tax agreements. We note, however, that one emerging concern is the recent rulings by the Charities Commission on interpretation of ‘advocacy’ and subsequent deregistration of established charities the Commission considers have advocacy as a primary rather than an ancillary purpose. This change has been adopted for organisations that have, in some cases, enjoyed charitable status for quite some time. 11 This is a troubling development if it were to impact on cultural organisations, such as heritage organisations for which advocating for greater levels of environmental protection is integral to their purpose. We urge government to consider with care the potential implications of this ruling. Greater awareness and uptake of existing tax incentives The Taskforce is convinced individuals and organisations need to be made more aware of the favourable tax regime that currently exists in New Zealand in regard to charitable giving. We also suggest there needs to be more evaluation of whether greater awareness makes a difference to giving behaviour. As noted earlier, for instance, only half the cultural organisations surveyed by the Ministry for Culture and Heritage definitely knew they had donee status – and the remainder either knew they didn’t or didn’t know one way or the other. Without donee status, individuals or companies cannot claim tax relief on donations. Having donee status, and promoting this to potential donors, is critical to organisations attracting private support and, overall, to improving levels of cultural philanthropy in New Zealand. This needs to be addressed. Payroll giving Awareness of payroll giving, still in the early stages of introduction, may also need further attention. Payroll giving is a voluntary scheme for both employers and employees, enabling donations to go directly from an individual’s pay to a community organisation of their choice. The scheme is administered through PAYE. This means people whose employers introduce a payroll giving scheme immediately receive the tax benefits of their donations each payday, without having to present donation receipts or wait to claim at the end of a tax year. Again, to participate, community organisations selected by donors must have approved ‘donee status’ with the Department of Inland Revenue.7 While payroll giving may not significantly improve levels of giving to the cultural sector, it does play one part in promoting an overall culture of philanthropy. There is also some indication it appeals particularly to young income-earners, encouraging them to develop a habit of giving early. These donors, whilst not necessarily earning or giving a high amount initially, may increase their giving as their income increases and continue support over the course of their lifetime - and beyond, through legacies and bequests. Gift aid Gift aid is the most significant remaining tax initiative New Zealand can consider. Gift aid is not a new tax incentive but rather a redirection of existing tax relief. It enables the tax benefit of charitable donations to go to the donee (the organisation) rather than the donor. This means the donee receives a greater cash donation without any change in giving levels. 7 Voluntary payroll giving schemes could operate before the new legislated scheme that came into force in January 2010, and payroll giving can operate independently of the new scheme, but in those cases deductions come out of employees’ net after-tax pay. 12 Gift aid is a tax-effective giving mechanism accessible to all taxpayers, irrespective of their income level or tax rate. In the United Kingdom, gift aid tax relief adds at least 20 percent to the value of donations to charities. This means a donation of £10 would actually be worth £12 to the recipient charity, because the recipient organisation also gains the additional tax relief otherwise owing to the donor. In 2009/10 charities in the United Kingdom claimed more than £1 billion in gift aid tax relief on donations from individuals alone – nearly 10 times more than the £106 million those community organisations received in total payroll giving donations. In 2010 Minister of Revenue Hon Peter Dunne asked the Taskforce, and a limited number of other agencies, for feedback on implementing gift aid in New Zealand. His officials proposed two options: Option One draws on the United Kingdom’s scheme enabling charities to claim the tax benefit of charitable donations on behalf of the donor. Option Two uses the current end-of-year donations tax credit system whereby donors direct the tax benefit of their charitable donations to a donee organisation by providing that organisation’s bank account number on a tax credit claim form. This option builds on current provisions. However, of those Inland Revenue clients who file a tax credit claim form, only 0.5 percent currently choose to redirect their tax credit to a charitable organisation. We support Option One Our response to the Minister in August this year firmly supports Option One because it reduces administration both for the donor and the donee organisation. Each donee organisation (rather than each donor) files a gift aid claim with Inland Revenue. Placing the responsibility on donee organisations enables them to proactively seek tax relief on a greater range of qualifying donations. And the donee organisation is, naturally, more motivated than the donor to make a gift aid tax relief claim. We cannot overlook the success of a provision that has operated effectively in the United Kingdom for the past 20 years, accounting for around 90 percent of all tax-effective giving in that country, despite the complexity of some of the scheme’s rules. Despite some administrative drawbacks, the UK government has remained strongly committed to gift aid and has been working with charities to simplify some aspects of the scheme to increase take-up. These discussions could usefully inform the design of a simplified Option One gift aid scheme in New Zealand. In summary, gift aid maximises the value of current donations, encourages increased and new giving, and helps create a wider culture of philanthropy. The Taskforce considers gift aid could be New Zealand’s most widely used mechanism for tax-effective giving. We strongly recommend, therefore, that government prioritise further work on gift aid and commit to a timeline for its design and implementation. 13 Cultural gifting We commend the government for its preliminary consideration of tax relief for nonmonetary gifts of cultural significance (cultural gifting). We understand the Ministry for Culture and Heritage and the Department of Inland Revenue are currently working on this. Cultural gifting is a form of non-cash philanthropy, available to both individuals and businesses, with the market value of a gift being deemed fully or partially tax deductible, and tax relief spread over a number of years. Gifts may range from paintings, jewellery, sculptures, books, manuscripts and personal papers through to technological, scientific or social history collections. In general, any such gift is expected to form part of the recipient organisation’s permanent collection. De-accessioning may be possible within each institution’s authorised policies. However, institutions are prevented from returning the gift to the donor because he or she has already received tax relief for the gift. Countries with cultural gifting programmes include Australia, Canada, Ireland, the United Kingdom and the USA. Since its establishment in Australia in 1978, over A$575 million worth of items have been donated through Australia’s “Cultural Gifts Program”. Donors are eligible for the following tax incentives under this programme: The market value of the gift is fully tax deductible, with some exceptions. Donors can elect to spread the deduction over up to five years. Gifts are exempt from capital gains tax (not applicable in New Zealand). Gifts must have the following characteristics: The transfer of ownership is made voluntarily. The transfer arises by way of benefaction. No material benefit or advantage is received by the donor. Cultural gifting would encourage increased donation of items of cultural significance from private collections to public institutions and help preserve cultural heritage. While this may not impact significantly on the level of cultural philanthropy, we consider cultural gifting does contribute to the overall culture of giving. Reaching philanthropists There’s also a need to help philanthropists who want to take a more informed and strategic approach to their giving, and who want to see clearly the impact of their support. Artsupport Australia, for instance, works with potential philanthropists to research and present options that may meet their interests. The following comment indicates the kind of advice a new philanthropist might need: I wanted to know if there was something like a “heart foundation tick” for charities that had passed rigorous tests such as whether the charity had a business plan, a budget, annual reports and government and tax regulations covered; and the right 14 ‘culture’. I wanted to know whether the key people were being paid excessively, and whether the organisation had a good balance of volunteer support. We think working with potential philanthropists could be part of the proposed sector capability building initiative but may also fit well with another sector-based organisation. Recognising and appreciating philanthropists New Zealand needs to recognise the contribution of significant individual and corporate supporters of the cultural sector. While some may prefer to maintain a low profile, greater recognition of their efforts could encourage new philanthropists to step forward. Though there are existing initiatives that recognise philanthropy in New Zealand, notably the Arts Foundation’s Patronage awards and the NBR Sponsorship of the Arts awards, recognition of philanthropy is important and could be strengthened. We recommend the Ministry for Culture and Heritage should work with Creative New Zealand, Philanthropy New Zealand, the Arts Foundation and other bodies to establish a more coherent overall approach to recognising cultural philanthropy. Clearly, recognition of philanthropy will also be part of the development of each cultural organisation’s own approach to attracting and retaining support. Diversification The Taskforce is interested in ‘new philanthropy’ characterised by younger, tech-savvy, entrepreneurial and globally-minded benefactors, who may no longer identify with the arms-length approach favoured by previous generations, and who see themselves more as active investors and partners. The cultural sector needs to broaden its base of support, to make more New Zealanders aware of the role they can play in supporting culture, beyond simply purchasing a ticket to a concert – to think supporting culture is a social good, like any other philanthropic act. There is evidence that some of the emerging philanthropists are strongly interested in the interconnections between cultural activity and economic, social and environmental outcomes, rather than culture as an end in itself. For some cultural organisations, identifying and building new sources of charitable income is intrinsically linked to growing new audiences – as from these new audiences will come the new philanthropists. To this end, we all need to better articulate the case for the value and contribution of culture to wider societal goals. Cultural organisations can diversify and increase support through: better use of social media to encourage giving, to keep donors informed, to promote cultural activities, and to grow new audiences working with professionals such as lawyers and accountants on improving the quality and angle of advice to clients around giving, tax relief and wills 15 working with organisations such as Philanthropy New Zealand to encourage more people to draw up a will, and to increase the levels of cultural bequests and legacies that are made to cultural organisations encouraging non-cash giving, such as employee volunteering and matching up the skills of other volunteers and board members to cultural organisations that require those specific skills exploring the potential of endowment or pooled funds as part of an investment portfolio. Matched funding One initiative that might resonate with the private sector is the idea of matched funding to support cultural activities. This involves government proposing a contribution that would depend on the ability of the recipient organisation to identify a matching amount from a business, or possibly from an individual or a trust or foundation. This could also happen in reverse with a private contribution dependent on matching support from government. For example, the Australia Business Arts Foundation operates the Premier’s Arts Partnership Fund in South Australia, West Australia and Tasmania which doubles the value of new cash partnerships between small-to-medium businesses and cultural organisations. The funding that matches that of the new business partner is provided by AbaF, corporate sponsorship and the state government. A matched funding initiative could perhaps be introduced as a three year pilot, subject to evaluation and adaptation as required. Research and evaluation We recommend that milestones should be set for each of the initiatives we have recommended and their effectiveness evaluated. We also strongly recommend setting a target for increased private support for the arts in New Zealand. This would need to be carefully calibrated. For example, we might aim to double the level of support from individuals by 2020 without impinging on other areas such as corporate, trust/foundation or government support. This could be monitored through several cross-referenced approaches: refining and continuing the research on overall levels of giving and sponsorship to cultural organisations establishing a smaller core sample of representative organisations to provide a benchmark from which to monitor the success of specific initiatives continuing to monitor barriers to giving and sponsorship creating case studies to enable cultural organisations to tell their stories. We would also like to see further research on the nature of the cultural sector, the challenges ahead and potential new ideas to support its development. 16 Collaboration For any of these initiatives to work we will need co-operation between the key players in the cultural and philanthropic sectors, in particular the Ministry for Culture and Heritage, Creative New Zealand, the Arts Foundation, and Philanthropy New Zealand. There is a great deal of work to be done in advocating for a favourable climate for cultural giving. We see a major role for all of these agencies in that effort. We considered where best to place the capability building initiative. It is particularly important the host organisation will enable the initiative to be nimble, independent and not find itself competing for support with its client cultural organisations. We don’t consider it appropriate to place the initiative with the Arts Foundation because the Foundation has made a niche for itself as an award and grant making body and may find it difficult to take on an expanded role. Philanthropy New Zealand’s reach may be too broad for a cultural sector focused initiative. Placement at the Ministry may be perceived by some as too close to government and hence possibly inhibiting independence. CNZ would seem a sensible choice given it already delivers capability building initiatives to the arts sector. We do have some reservations over the degree of reach and independence the initiative would achieve under that umbrella, given CNZ’s focus on a portfolio of funded clients. However, on balance, CNZ would provide the infrastructure to support the initiative provided funds were available and some thought could be given to ways of ensuring appropriate independence of operation. We recommend further work to find the best delivery mechanism for this initiative. Conclusion As we have noted, increasing cultural philanthropy in New Zealand will depend on a range of initiatives and involve all parties – government, business, individual New Zealanders, and the cultural sector itself. Each of these needs to step up and take responsibility for growing the resources the sector needs and deserves. We commend the government for the positive changes it has made to the taxation regime to encourage private giving. There is great scope for improving the level of private support for culture. We encourage you, as Minister, to accept the following Taskforce recommendations and implement them with urgency and speed: develop a one-to-one fundraising capability building initiative to mentor and advise cultural organisations promote knowledge and awareness of the recently introduced tax incentives introduce Gift Aid to boost private giving explore the workability of a cultural gifting scheme recognise and value the generosity of philanthropists reward with matched government funding cultural organisations that succeed in increasing their levels of income derived from private giving. 17 Appendices Appendix 1: Members of the Cultural Philanthropy Taskforce Peter Biggs (Chair) Peter Biggs is a former Chair of Creative New Zealand (1999-2006) and is Chief Executive of leading advertising agency Clemenger BBDO in Melbourne. Before taking up that appointment in 2006, he was Managing Director of Clemenger BBDO in Wellington. In New Zealand, Peter is Chair of the New Zealand Book Council, and in Melbourne he chairs Chunky Move Dance Company and is on the boards of the Melbourne Symphony Orchestra and the Wheeler Centre for Books, Writing and Ideas. He has a farm in the South Wairarapa and is a committed supporter and funder of the arts in New Zealand, particularly theatre and literature. Margaret Belich Margaret Belich is a project manager and fundraiser, with a background of building new initiatives across the arts and cultural and education sectors. Margaret has raised funds for Indian Ink Theatre Company, Q Theatre and the University of Auckland. Alastair Carruthers Alastair Carruthers is the current Chair of Creative New Zealand, and he has held governance roles since 2001. Alastair has been Chief Executive of the national law firm Chapman Tripp since 1998, and divides his working time between Auckland and Wellington. His studies include business, the arts, and classical music. He is a former trustee of the New Zealand String Quartet. Dr Robin Congreve Dr Robin Congreve was for 10 years a partner in Russell McVeagh McKenzie Bartleet and since then has been a director of a number of public and private companies including Lion Nathan Ltd, BNZ, Comalco NZ Ltd and Tru-Test Ltd. He is a principal of Oceania & Eastern (a New Zealand private equity group) and Chair of Neuren Pharmaceuticals. Robin was the Founding Chair of the Auckland Medical School Foundation. He is on the Art Gallery Foundation Board, Founder and Principal Donor of The Walters Prize, Governor of The Arts Foundation, former Chair of the New Zealand Opera and a Member of the Museum of Modern Art and Tate International Councils. 18 Dame Jenny Gibbs Dame Jenny Gibbs' work has included helping to buy and redevelop the derelict telephone exchange now leased as the New Gallery, an adjunct to the Auckland Art Gallery; establishing the biennial $50,000 Walters Prize for contemporary art; supporting an internship at Artspace Gallery; and substantial patronage of the Auckland Writers and Readers Festival, the Opera NZ Foundation and the Auckland Philharmonia Orchestra. Dame Jenny is Deputy Chair of the new Regional Facilities Auckland Council Controlled Organisation. She was made a Dame Companion of the New Zealand Order of Merit in 2009, for her services to the arts. Carolyn Henwood CNZM Carolyn Henwood has been a lawyer and a District Court judge for 25 years. She has a long association with the arts, being a founder member of Circa Theatre since 1975 and a Trustee of the Theatre Artists Charitable Trust since 1987. She was Deputy Chair of the Toi Whakaari NZ Drama School Board. Carolyn has been involved in fundraising and sponsorship for professional theatre for over 30 years. She currently chairs the Confidential Listening and Assistance Service an independent body in Internal Affairs. Carolyn is an expert in youth justice and is the Chair of the Henwood Trust. Carolyn works as a Convenor for the New Zealand Parole Board. Jim Hill Jim Hill is the Director (Advancement) of External Relations at The University of Auckland. He has 27 years wide-ranging experience of fundraising through private philanthropy, 24 of those in the United States working in private and public institutions in the tertiary sector, including Donald A Campbell & Company (one of the top five consulting firms in the States). He has worked on comprehensive campaigns with goals that range from US$40 million to US$1 billion. Other non-profit experience includes serving as National Field Manager for 53 offices of the Cystic Fibrosis Foundation and as Director of Volunteer Activities for St Jude Research Hospital. Dayle Mace MNZM Dayle Mace has a long history involvement in arts in Auckland and is currently Chair of the Patrons of the Auckland Art Gallery. She is a noted philanthropist and is a major donor for the Walter's Prize for contemporary art. Dayle is the Head of Patrons for New Zealand at the Venice Biennale, and is on the Auckland Art Gallery Foundation Board. In 2009 she was made a Member of the New Zealand Order of Merit for services to the arts and the community. 19 Ex-officio advisers Lewis Holden Ministry for Culture and Heritage Stephen Wainwright Creative New Zealand 20 Appendix 2: Overview of the work of the Taskforce In September 2009 the Minister for Arts, Culture and Heritage Hon Chris Finlayson announced the appointment of a Taskforce comprised of some of this country’s most well-known and dedicated cultural supporters. The Minister asked the Taskforce to investigate ways to improve levels of philanthropic support for New Zealand’s cultural sector.8 The Minister noted the prevailing view that a culture of private giving, which adds to the resources of many cultural institutions in other countries, was not so well entrenched in New Zealand. He stated his government’s strong support for the cultural sector and asked the Taskforce to explore how to increase charitable giving over and above – not instead of – government funding. The wide-ranging brief included looking at ways government could help cultural institutions, and at ways those institutions could help themselves, drawing on a scan of models and initiatives in New Zealand and overseas. Alongside the work of the Taskforce, the Ministry for Culture and Heritage and Creative New Zealand undertook research into current levels of charitable support for cultural organisations and into ways of strengthening those levels of support. This research helped inform the work of the Taskforce. The Taskforce met for the first time in Auckland in September 2009 and continued throughout 2010, alternating between Auckland and Wellington. The Taskforce met with various cultural organisations and philanthropists to discuss barriers to charitable giving facing the cultural sector and opportunities for increasing private support of culture. These individuals and organisations included: Robyn Scott and Kate Frykberg (Philanthropy New Zealand) Simon Bowden, Ros Burdon, Sir Ron Scott and Brian Stevenson (the Arts Foundation) David Inns (Auckland Festival) Emma Bugden (Artspace) Charles Ngaki (Inland Revenue) Louise Walsh (Artsupport Australia) Wayne Burns and Pam Muth (Allen Consulting Group) Fiona Campbell (Real Art Roadshow) Jennifer Gill (ASB Community Trust) In the course of its work, the Taskforce also spoke with and wrote to the Minister of Revenue Hon Peter Dunne a number of times on charitable giving, on tax incentives such as payroll giving, cultural gifting, gift aid and facilitating philanthropic support and on tax relief for overseas-based donors to New Zealand cultural organisations. The Taskforce chaired an online discussion forum on cultural fundraising and on attracting philanthropy hosted on The Big Idea/Te Aria Nui website (in April 2010), and presented at Creative New Zealand’s Conference (in June 2010).9 Taskforce members also participated in the Ministry for Culture and Heritage’s workshop on “Growing cultural philanthropy in New Zealand” in September 2010. This report was presented to the Minister for Arts, Culture and Heritage Hon Chris Finlayson at the Taskforce’s final meeting in Wellington in December 2010. 8 A press release on the establishment of the Cultural Philanthropy Taskforce can be found at http://www.beehive.govt.nz/release/review+improve+arts+philanthropy 9 The online discussion can be found on The Big Idea / Te Aria Nui website http://www.thebigidea.co.nz/smarttalk/smart-talk-03-philanthropy-getting-enough 21 Appendix 3: Cultural Organisations: Giving and Sponsorship (for the April 2007-March 2008 tax year), April 2010 This report presents the findings of a survey conducted by the Ministry for Culture and Heritage (MCH). Over March-April 2009, MCH surveyed cultural organisations on the income they had obtained from gifts, grants and other charitable and sponsorship sources in the tax year of 1 April 2007 to 31 March 2008 (prior to the introduction of the new tax incentive provisions). MCH worked with Creative New Zealand and the Charities Commission to invite around 2,000 cultural organisations to participate in the survey. The 480 10 organisations that responded included a wide range of small through to major organisations that might have received funding from central or local government, the Lottery Grants Board or community/ gaming/energy trusts. Respondents were asked about sources of funding or support received, and the form of support grants, donations, cash or in-kind sponsorship, membership or friends' schemes, and bequests. The research established an annual level of cash and non-cash support. It provides comparisons between organisations on the basis of size, location and type of cultural activity, and also the source and type of support. This information will enable trends to be identified, including the impact of any tax or other incentives for charitable giving. The total amount of gifts, grants and sponsorship, both cash and non-cash, received in 2007/08 by the 480 responding organisations was $383.2 million. Central and local government contributed the lion’s share at 80 percent while Lottery Grants contributed 6.5 percent. The corporate sector contributed 6 percent (or $22.6 million) towards total giving and sponsorship levels (that is, excluding all other types of income such as earned income from ticket sales). Trusts and foundations contributed 4.5 percent ($16.7 million) and individuals just 3 percent ($9.9 million). The study indicates that for the total giving and sponsorship levels (ie excluding all other types of income) of the cultural organisations surveyed (prior to the introduction of tax incentives): 13.5 percent was private support (from individuals, companies and trusts and foundations) 86.5 percent was public (central and local government) support. These figures came from all organisations surveyed and cover both cash and non-cash support. Some organisations had greater proportions of private to government support, some less. The research also indicated: of those organisations that did not receive any form of corporate support (56 per cent) or support from individuals (38 percent) most had not attempted to seek that support very few of the respondent organisations employed staff dedicated to fundraising while most respondent organisations had ‘registered charity status’ with the Charities Commission, only half knew their ‘donee status’ 11. The research is not a census; as with any survey, respondents made up only a sample of the sector. However, most of the cultural organisations directly and recurrently funded by government were included. The survey provides an initial benchmark that will enable trends in charitable giving to be identified, including the impact of the new tax incentives. Future surveys will differentiate between different types of trust and foundation giving (gaming, community and energy trusts and philanthropic foundations). Effort will also be made to tease out whether individuals providing funds through a family trust or foundation consider their support to be ‘personal’ giving. 10 This is a 25 percent response rate, a viable response rate for a survey of this nature. An organisation must have donee status to offer tax relief on donations from its supporters and to participate in the payroll giving scheme administered through the Department of Inland Revenue. 11 22 Appendix 4: Synopsis of two UK and Australian studies In a study released in June 2010, the Australia Business Arts Foundation found private support for culture almost doubled in the last decade, averaging an annual growth rate of 13 percent.12 Private support as a proportion of total income (from all sources including earned revenue such as ticket sales, and from cash giving and sponsorship) increased from 6.7 percent in 2001-02, to 9 percent in 2008-09. Despite difficult economic conditions, sponsorship increased almost 2 percent in 2008-09, compared with 2007-08 sponsorship levels. Giving went up by 6 percent. Overall, this represents a 4 percent increase in the past year in private support for culture in Australia. A study released in the United Kingdom in October 2010 estimated that private support as a proportion of total income (from all sources including earned revenue such as ticket sales, and from cash giving and sponsorship) accounted for 15 percent of the total income of cultural organisations. 13 Yet the United Kingdom is aiming to better that level of support. Arts & Business UK, for instance, considers levels of private support for the arts have yet to reach a ‘plateau’. 12 13 AbaF Survey of Private Sector Support 2008-09, Australia Business Arts Foundation, June 2010. Arts Philanthropy: The facts, trends and potential, Arts & Business UK, October 2010 Appendix 5: MCH convened Artsupport Australia workshop, 16 September 2010: Participants Over 16 and 17 September 2010 the Ministry for Culture and Heritage hosted a visit to New Zealand by Artsupport Australia Director, Louise Walsh. As part of that visit, Louise was the keynote speaker at a workshop convened to enable a representative group of New Zealand arts sector people to consider the key elements of the Artsupport model. The workshop was opened by Hon Chris Finlayson, Minister for Arts, Culture and Heritage and several Taskforce members also attended. Participants at the workshop were: Auckland Philharmonia Orchestra Samantha Walker ASB Community Trust Jennifer Gill Asia Foundation NZ Liyang Ma Auckland Festival David Inns Auckland Theatre Company Anna Connell Chamber Music NZ Euan Murdoch, Jenni Hall Creative New Zealand Elizabeth Beale, Kim Acland Dance Aotearoa NZ Linda Lim Emerging Artist Trust Sally Thorburn Ministry of Pacific Island Affairs Heker Robertson Museum of Wellington City and Sea Kim Young Museums Aotearoa Phillipa Tocker NBR NZ Opera Alexandra Granville NZ International Festival of the Arts Sahra Grinham NZ String Quartet Elizabeth Kerr NZ Symphony Orchestra Chris Doig Office of the Community and Voluntary Sector James King Philanthropy New Zealand Robyn Scott Royal NZ Ballet Amanda Skoog Taki Rua Keryn Jones Te Matatini Titia Graham Te Papa Annette Meates, Tracy Puklowski The Arts Foundation Sir Ron Scott, Simon Bowden Toi Māori Aotearoa Ananda Gotty Arts, Culture and Heritage Minister’s Office Mark Da Vanzo Margaret Belich, Robin Congreve, Jim Hill, Dayle Mace Lewis Holden, Katherine Baxter, Ingrid Kamstra, Mary Donn, Jeremy Winter Cultural Philanthropy Taskforce Ministry for Culture and Heritage 24 Appendix 6: The Art of the Possible: Strengthening Private Support for the Arts in New Zealand, October 2010 In May 2010, Creative New Zealand commissioned the Allen Consulting Group to conduct research into private sector support for the arts, and to develop an action plan for increasing this support. The research had two main objectives: to examine and analyse the environment, trends and barriers/opportunities for increasing private sector support for the benefit of the arts to develop an action plan and recommendations that identify actions or initiatives that could be taken or developed by Creative New Zealand, arts organisations and the New Zealand Government to increase private sector support for the arts. The report was delivered to CNZ in October 2010. The Executive Summary to the report noted the challenge facing developed economies and nations internationally: sustaining operations in a climate of continued economic uncertainty flowing from the crisis in the global financial system that started in 2008. The report observed it is unlikely government funding for arts organisations will increase in the short to medium term, given efforts to reduce the budget deficit. The report offered 33 recommendations that carried the following themes: the private sector is the most viable source of additional external support (financial, in kind goods and services, skills-based volunteering) for arts organisations seeking to broaden their revenue base, reduce costs, and fund value adding activities it is unrealistic to expect that the wealthy philanthropists will be the primary source of funds from the private sector increasing the number of New Zealanders who give to the arts, in a highly competitive and sophisticated philanthropic market, is a worthy but long-term endeavour arts/ business partnerships offer the greatest opportunity closer relationships need to be established with community trusts and foundations a new entity should be established within CNZ to build capability and capacity, and sustain a focused effort private individuals remain an important source to increase funding of the arts. 25