Trade Dispute Resolution

advertisement

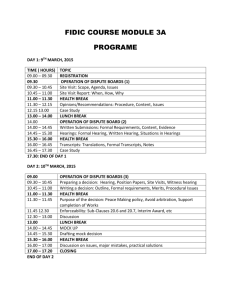

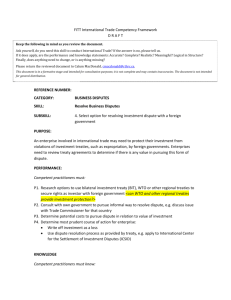

MASTER OF LAWS Course Code: LAW 619 Course Title: International Trade Dispute Resolution Instructor : Locknie Hsu Title : Associate Professor Email : lockniehsu@smu.edu.sg Date Submitted: 31 January 2012 PRE-REQUISITE/CO-REQUISITE/MUTUALLY EXCLUSIVE COURSE(S) COURSE SPECIALISATION Dispute Resolution GRADING BASIS Graded COURSE UNIT 1 CU FIRST OFFERING TERM Academic Year: AY2012/2013 Academic Term: Term 1 (May 2012) 1 COURSE DESCRIPTION International trade and investment activities are the life-blood of economic growth and development. This has been evident in Singapore - a centre of trade and investment - and much of Asia. In order to deal with disputes that may arise from such activities, institutions have been established to handle them. In particular, the birth of the World Trade Organization and its dispute settlement system more than a decade ago saw the introduction of a new, formal dispute settlement process in the area of trade. This development and the numerous dispute settlement mechanisms that have been created through a large network of free trade agreements and bilateral investment treaties have changed the face of trade dispute resolution immensely. It is essential to have an understanding of the landscape of trade and investment law, the barriers that may form the substance of disputes, and relevant institutions, to work more effectively for clients with cross-border trade and investment interests and multinational corporations and to formulate trade policies in government or government-related agencies. This course will equip students with an understanding of the sources of international trade law, interpretative instruments, the relevant institutions and their rules and practices, and the ability to identify common trade and investment issues facing international businesses and possible solutions and to work out appropriate legal advice and generate solutions. LEARNING OBJECTIVES By the end of this course, participants will be able to: Have a good understanding of major trade issues that often lead to trade disputes; Navigate major treaties and documents relating to international trade disputes; Understand relevant WTO issues and processes in its dispute settlement system and assess its effectiveness; and Be able to identify major trade dispute issues, conduct research with relevant materials and resources, and analyze these to work out possible solutions. 2 RECOMMENDED TEXTS AND READINGS General Apart from this Course Outline, each seminar outline will have an individual, detailed reading list setting out recommended textbook chapters, articles and other materials for the seminar topic. Treaties and case materials This course will involve the use of a number of treaty and case resources related to the WTO system. All WTO agreements and case reports are available online, free of charge, and relevant web-links and soft copies of some basic documents will be provided. Other non-WTO online material will also be provided. Journal articles Where relevant, web-links for recommended journal articles will be provided in the seminar outlines. Textbooks Selected chapters of textbooks available in the Li Ka Shing Library will be recommended for each seminar. The books mentioned below will be made available for course participants’ use (via short-term loans) in the Course Reserve section of the library during this course. It is not necessary to purchase these books unless a participant prefers to have his/her own personal copy. Introductory reading for an overview of the general trading system Michael J. Trebilcock, Understanding Trade Law, Edward Elgar, 2011 ISBN 9780 8579 31498 WTO Trade Disputes Selected chapters or parts thereof from the following books will be prescribed in the individual seminar outlines: Peter Van den Bossche, The Law and Policy of the World Trade Organization: Text, Cases and Materials, Cambridge University Press, 2nd Ed. (2008); 3 Mitsuo Matsushita, Thomas J. Schoenbaum, and Petros C. Mavroidis, The World Trade Organization: Law, Practice and Policy, Oxford University Press (2006); A Handbook on the WTO Dispute Settlement System, WTO (2004). Investment Disputes Selected chapters or parts thereof from the following books will be prescribed in the individual seminar outlines: Rudolf Dolzer and Christoph Schreuer, Principles of International Investment Law, Oxford University Press (2008); Campbell McLachlan, Laurence Shore and Matthew Weiniger, International Investment Arbitration: Substantive Principles, Oxford University Press (2008); Peter Muchlinski, Federico Ortino and Christoph Schreuer, The Oxford Handbook of International Investment Law, Oxford University Press (2008); Edited by Katia Yannaca-Small, Arbitration under International Investment Agreements: A Guide to the Key Issues, Oxford University Press, 2010. Supplementary materials Information on any supplementary materials other than the above will be provided in the seminar outlines. ASSESSMENT METHOD The following information is based on the expectation that the class size will be at least 6. Should the number be lower, the assessment components may be adjusted to reflect this, to better tailor assessment to a smaller group. 1. Progress Assessments (a short, written in-class test): 10% 2. Class participation: 10% 3. Projects / Assignments: 30% (made up of two components – an individual oral presentation of 15%, and an individual written assignment 15%) 4. Take-home Exam: 50% 4 INSTRUCTIONAL METHODS AND EXPECTATIONS Structure This course will be conducted through 3-hour seminars with a 15-minute break per seminar, during the course period. Role-play and other class exercises may be used to allow participants to simulate dispute resolution processes and issues. For each seminar, a detailed seminar outline and Powerpoint slides will be made available before the class. Class Participation Each participant will be assessed on his or her participation in class. Participants should therefore complete the assigned reading and any exercises prior to attending the seminar. Participants are reminded that their active participation is expected and will create a vibrant and interactive environment conducive for learning at an elevated level. The substance of participation is important and will be noted by the instructor. (Please note therefore that credit is given for the quality of meaningful contributions during class discussions and not merely for the frequency of participation.) Assignments/Presentations Participants may be assigned assignments/oral presentation work either individually or in a small assigned group (the arrangements will depend on the total class size). Assignments may take the form of hypothetical situations or specified legal issues. If the assignment takes the form of a group assignment, a common grade will be awarded to group members. For the oral presentations, each participant will receive an individual assessment grade for his/her presentation in class. Creative thinking and peer learning is expected through open sharing from real work situations. In-class Test The written in-class test will be held sometime after session 5, to test participants’ understanding of major topics discussed. Final Examination The final examination will be in a “take-home” format for which the participant is given 6 hours to send in the answer (of up to 5,000 words) on the following Sunday after the last class (giving a week to revise). The examination will begin at 6 pm and end at 5 midnight that same day. Participants will use the SMU eLearn Dropbox to submit their answers. Important: Academic Integrity All acts of academic dishonesty (including, but not limited to, plagiarism, cheating, fabrication, facilitation of acts of academic dishonesty by others, unauthorized possession of examination questions, or tampering with the academic work of others) are serious offences. All work (whether oral or written) submitted for purposes of assessment must be the participant’s own work. Penalties for violation of the policy range from zero marks for the component assessment to expulsion, depending on the nature of the offence. When in doubt, participants should consult the instructor of the course. Details on the SMU Code of Academic Integrity may be accessed at http://www.smuscd.org/resources.html. 6 COURSE SCHEDULE Session Topic Readings 4 May (AM) Background to Trade Dispute Resolution: Introduction to the World Trading System: International landscape of trade and investment law, and globalization Functions and processes of the World Trade Organization (WTO) Sources of international trade law and interpretative tools: Major treaties and organizations Trade and investment regulation and barriers Key interpretative and procedural issues 1 4 May (PM) 2 Background to Trade Dispute Resolution: Processes of the World Trade Organization Structure and decision-making Overview of WTO agreements Introduction to the WTO dispute settlement system 11 May (AM) 3 Key concepts in Trade Dispute Resolution: Key concepts and principles in WTO law that are the basis of trade disputes Examples in trade in goods, services, 7 investments, intellectual property rights Relating these key concepts to trade disputes and their resolution 11 May (PM) Trade Dispute Resolution: 4 Major features of the WTO’s dispute settlement system ► The Dispute Settlement Understanding (DSU) and Dispute Settlement Body (DSB) ► Panels ► The Appellate Body Major processes and issues (1) 12 May (AM) 5 Major processes and issues (2) Developing countries in the WTO dispute settlement system 12 May (PM) 6 Trade Dispute Resolution: The DSU System – issues in implementation, compliance issues and remedies 18 May (AM) 7 [The tentative plan is to hold the short written test (10%) for all participants during this session.] International Investment Dispute Resolution: Bilateral Investment Treaties Free Trade Agreements 8 The ICSID System UNCITRAL Arbitration Rules ASEAN Investment Treaty Provisions on Dispute Settlement 18 May (PM) International Investment Disputes: 8 Investment Dispute Tribunals and the effect of their decisions Jurisdictional Issues and Challenges 19 May (AM) 9 International Investment Disputes: Common Provisions in Investment Disputes 19 May (PM) 10 11 International Investment Disputes: Remedies and Enforcement Issues 27 May 2012 (Sunday) Take-home examination 9