A Rough Guide to Tax Increment Financing

advertisement

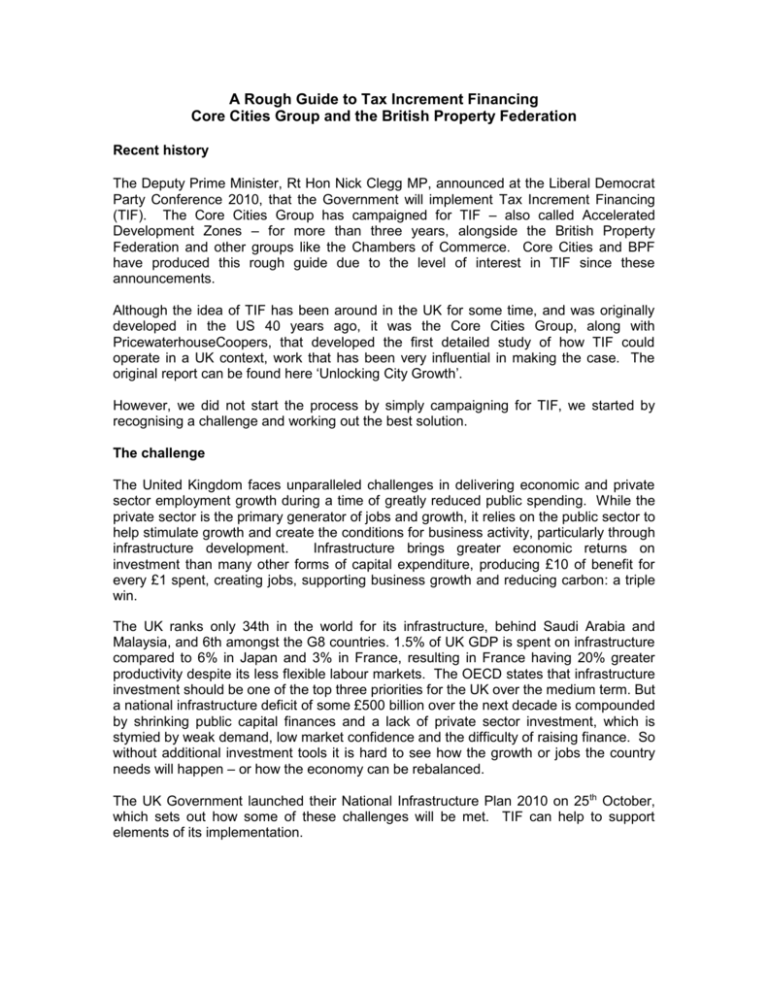

A Rough Guide to Tax Increment Financing Core Cities Group and the British Property Federation Recent history The Deputy Prime Minister, Rt Hon Nick Clegg MP, announced at the Liberal Democrat Party Conference 2010, that the Government will implement Tax Increment Financing (TIF). The Core Cities Group has campaigned for TIF – also called Accelerated Development Zones – for more than three years, alongside the British Property Federation and other groups like the Chambers of Commerce. Core Cities and BPF have produced this rough guide due to the level of interest in TIF since these announcements. Although the idea of TIF has been around in the UK for some time, and was originally developed in the US 40 years ago, it was the Core Cities Group, along with PricewaterhouseCoopers, that developed the first detailed study of how TIF could operate in a UK context, work that has been very influential in making the case. The original report can be found here ‘Unlocking City Growth’. However, we did not start the process by simply campaigning for TIF, we started by recognising a challenge and working out the best solution. The challenge The United Kingdom faces unparalleled challenges in delivering economic and private sector employment growth during a time of greatly reduced public spending. While the private sector is the primary generator of jobs and growth, it relies on the public sector to help stimulate growth and create the conditions for business activity, particularly through infrastructure development. Infrastructure brings greater economic returns on investment than many other forms of capital expenditure, producing £10 of benefit for every £1 spent, creating jobs, supporting business growth and reducing carbon: a triple win. The UK ranks only 34th in the world for its infrastructure, behind Saudi Arabia and Malaysia, and 6th amongst the G8 countries. 1.5% of UK GDP is spent on infrastructure compared to 6% in Japan and 3% in France, resulting in France having 20% greater productivity despite its less flexible labour markets. The OECD states that infrastructure investment should be one of the top three priorities for the UK over the medium term. But a national infrastructure deficit of some £500 billion over the next decade is compounded by shrinking public capital finances and a lack of private sector investment, which is stymied by weak demand, low market confidence and the difficulty of raising finance. So without additional investment tools it is hard to see how the growth or jobs the country needs will happen – or how the economy can be rebalanced. The UK Government launched their National Infrastructure Plan 2010 on 25th October, which sets out how some of these challenges will be met. TIF can help to support elements of its implementation. The opportunity Tax Increment Financing is an investment tool for financing infrastructure and other related development that has been successfully employed in North America for 40 years. The UK version of TIF has been developed by industry and local government to work in the UK context. It does not involve any additional taxation and results in a net gain for the local and national economies, delivering private sector jobs and physical and social regeneration which can save public money. UK TIF is a national framework through which responsibility and power for local economic growth and renewal is given to local communities. Case studies developed in Core Cities, London and other parts of the UK show how this model can work for schemes where other sources of funding are not appropriate or simply not available. All the case studies so far have demonstrated increased economic output and job numbers. It’s a win for business, for government and for people. How it works The UK TIF model is based on reinvesting a proportion of future business rates from an area back into infrastructure and related development. It applies where the sources of funding available for a scheme to deliver economic growth and renewal cannot cover the cost of infrastructure required by the scheme. Often this will be a regeneration project, and although UK TIF could be used more widely, it will not be suitable for all schemes. A lead agency – a local authority, private sector partner or some combination – raises money upfront to pay for infrastructure, on the basis that the increased business rate revenues generated by the scheme can be used to repay that initial investment. The upfront funding may be borrowed from public or private sources, or it may be provided by the developer from capital available to it. The Treasury may enjoy the wider fiscal benefits of the scheme – higher stamp duty revenues resulting from rising property values, higher income and corporate tax revenues due to more economic activity, and lower health, security and benefits costs as the community enjoys the social benefits of regeneration. The full increased revenue from business rates in the designated area will also be available to the Treasury after the funding cost for the infrastructure has been paid off. It’s a neat solution where the risks can be clearly allocated to the lead agency or the private sector partner and controlled. Progress on UK TIF The Deputy Prime Minister’s announcement on TIF, confirmed in the Comprehensive Spending Review, is warmly welcomed. Further detail has been set out in the Local Government White Paper, which consults on TIF, alongside proposals for incentives like the Business Increase Bonus and the potential for retention of locally raised business rates in the future (deadline for responses is 1st December 2010). Prior to this, a lot of work has already been done on the detail of UK TIF by Core Cities Group, British Property Federation, London, Chambers of Commerce, the Department for Communities and Local Government, the Treasury and others. This work has answered many of the challenges of implementing UK TIF and so we should get off to a flying start. Several local authorities and private sector partners have identified schemes they think are suitable for UK TIF. Some of these have carried out detailed work and could be up and running very quickly if they had a green light. Government has outlined proposals for the Business Increase Bonus, as above. BIB is an incentive, designed to encourage local authorities to promote growth where they might otherwise focus on different priorities, whereas TIF is designed to unlock major economic renewal opportunities for which the money would otherwise be unavailable. Although there are challenges for any scheme that attempts to link the behaviour of local authorities to economic consequences, and previously it has proven complex, BIB could be a welcome addition to the suite of locally available financial tools. BIB would not however be able to unlock economic renewal through major infrastructure investment. It will be more short term and therefore too uncertain for infrastructure development that typically has longer-term payback periods, and BIB doesn’t link income to what it’s been spent on, or apportion risk in the way that TIF does. Nevertheless, it may prove to be a complementary tool in driving local economies. In the meantime, the Scottish Government is forging ahead with a scheme in Edinburgh, concluding that they can use their devolved powers to enable TIF. Frequently Asked Questions Isn’t this just more borrowing? In most cases, UK TIF will involve borrowing. But debt is a vital source of capital, particularly for major capital-intensive investment projects. The Government recognises that too – that’s why it’s encouraging the banks to lend more to business. UK TIF is about identifying schemes which are low risk but would deliver important benefits in terms of jobs, economic growth and physical and social regeneration if they could be funded. It is not borrowing in the unsure hope that money will be found at a later date, but investment with clear returns to support it. Both private sector and local authorities would take a cautious approach, because they will take on the risk. For local authorities this means using the Prudential Code, so the borrowing would have to pass stringent tests, but some schemes might be developer led and therefore not on the public balance sheet. Even for those that are, there is the potential to take the borrowing off balance sheet further down the line, for example by issuing bonds. Won’t schemes just displace existing business from nearby areas? There may be some displacement in some schemes and this can be factored in to calculating the additional revenues, and what will be payable as a TIF. It’s something to be thought about carefully in each scheme, but business needs opportunities to grow and thrive, and it’s better it moves a short distance than leaves the area altogether because its needs can’t be met. But schemes will need to show some new business growth and will only be allowed to access incremental business rates which are truly additional. How can you be sure the rates are additional? There will need to be a pragmatic agreement on an overall formula that is negotiated for schemes. This will not be an entirely scientific exercise, as modelling financial outcomes in alternative scenarios inevitably involves assumptions and some guesswork. However, it is not impossible to do and there are precedents that can help. The lead agency will be asked to take the risk on this, which in most cases will be relatively small. Isn’t it a bad time economically to be doing this? Actually, this is probably the best time to do it. It is in the early stages of economic recovery that raising capital by ordinary means is most difficult, but that is also the time when major, carefully targeted investments can make the greatest contribution to driving recovery. In North America properly underwritten schemes have performed well during recession, and Federal and State Governments have worked to enable wider use of TIF and similar mechanisms during the downturn. In the UK, it is needed to stimulate growth, recovery and jobs. How would we decide which schemes happened? UK TIF isn’t the right tool for every scheme. For example, schemes which are socially very valuable but are not expected to raise additional business rate revenues couldn’t be funded using UK TIF. Government would need to decide on what criteria future schemes should meet, in consultation with local authorities and industry. But there are also other mechanisms already in existence that will influence which schemes went ahead, like the planning system and the priorities that Local Enterprise Partnerships might determine. Why can’t schemes be funded through another route? Some schemes can be entirely funded through other routes and so are not suited to this model. In reality, most schemes are funded through a cocktail of financial mechanisms from both public and private sources. But there are many cases where a scheme could deliver undoubted net benefits but the upfront funding available for it simply isn’t enough to allow it to proceed. Why won’t Business Increase Bonus do the job of UK TIF? There are things about BIB that will be welcomed – this is the proposal to allow authorities to retain uplifts in business rates. But the currently proposed timescale of six years is too short to finance the kind of infrastructure projects we think need to happen, and it’s not certain that a lead agency would be able to borrow against it in the same way. BIB is also proposed for a whole local authority area, which is beneficial in some ways, but may be more difficult to relate to a specific scheme. In short, BIB is valuable in that it reconnects the actions of local authorities to the financial consequences of those actions – but in the form currently proposed it simply cannot unlock the major infrastructure-led growth and renewal that many communities need. However, BIB and UK TIF operating together would provide a powerful set of tools to deliver private sector growth and jobs.