Document Retention Policy Template

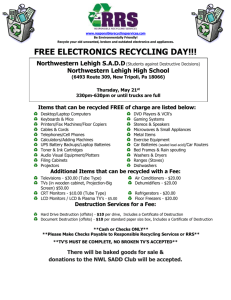

advertisement

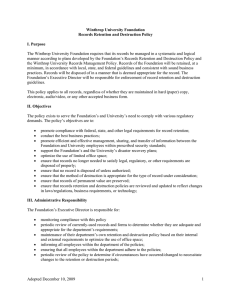

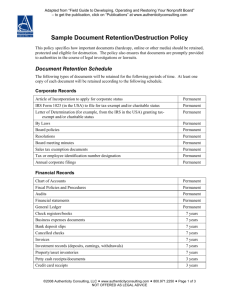

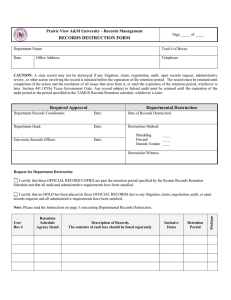

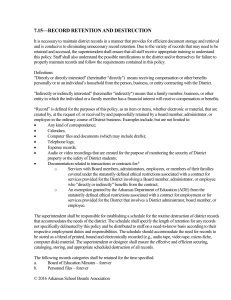

Document Retention Policy Template Section 1: Intent and Purpose Some policies introduce document retention and destruction procedures with a statement of intent and purpose of the policy. Example purposes include The organization takes seriously its obligations to preserve information related to litigation, audits, and investigations. The purposes of this document retention policy are for organization to enhance compliance with Sarbanes-Oxley Act and to promote the proper treatment of corporate records of the Organization. Section 2: Legal Holds This section generally gives notice that Board chairs or presidents may issue legal holds. A legal hold requires suspension from any document destruction due to the reasonable likelihood of litigation, audits, government investigations, or similar proceedings. Generally, a legal hold specifies the type of documents that should not be destroyed even if scheduled for destruction. Section 3: Document List and Retention Time Period This section outlines in list format: the category of records and documents to be retained; specific documents items; and retention periods. Some policies also require listing of where document is located or stored. Categories of records or files and documents commonly retained often include: Corporate records such as o foundational documents such as articles of incorporation and bylaws; and o governance and board policies including corporate resolutions, board agendas and minutes, and conflict-of-interest disclosure forms. Finance and administration files including o financial statements, payroll records, bank deposits and statements, invoices, sales records; and o equipment files and maintenance records, contracts, general administrative and legal correspondence, donor records, and grant applications Insurance records including o policies and claims made on policies, accident reports, OSHA safety reports and group disability records Real property records including o Real property deeds, leases (current and expired), mortgages and security agreements Tax documents including o 501(c)(3) application – Form 1023, IRS Form 990s, charitable organization registration statements, exemption application Human resources documents including o employee personnel files, retirement benefit plans, employee handbooks and training materials, employment applications o IRS Form I-9, tax withholding statements, payroll tax returns Technology o software licenses and support agreements Other o press releases and publicly filed documents The retention period varies by type of document. Some documents, such as foundational documents should be retained permanently, other documents such as general correspondence may be retained for a certain number of years. In determining retention periods, some considerations to keep in mind include federal or state legal requirement to retain certain documents, statutes of limitation for certain claims that may be brought against an organization by employees, third parties or the attorney general, and IRS audit cycles. Section 4: Electronic Documents and Records This section outlines procedures to retain electronic documents or correspondence. An organization may require that electronic documents be printed and stored with other physical files, or allow for electronic documents to be archived electronically with backup and recovery methods in place to prevent loss. Section 5: Emergency Planning This section generally requires that records are stored in a safe, secure, and accessible manner. Section 6: Document Destruction This section generally outlines who is responsible for overseeing document destruction process and mechanism for destruction. Some policies also include an affirmative statement that requires suspension of any document destruction upon notice of an official investigation. Section 9: Compliance This section lays out possible consequences for non-compliance with the policy, including disciplinary actions, as well as, civil and criminal sanctions. It also may call for periodic review of the policy with legal counsel and/or a certified public accountant.