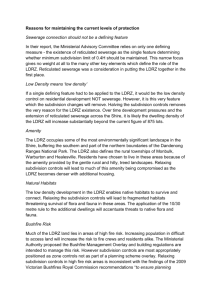

96th Day] Tuesday, May 4, 2010 Journal of the House [96th Day

advertisement

![96th Day] Tuesday, May 4, 2010 Journal of the House [96th Day](http://s3.studylib.net/store/data/007237487_1-d99273fdd5904d6da139a0d8fae1a555-768x994.png)