Market Analysis for Chemicals Products

advertisement

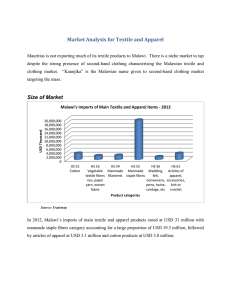

Market Analysis for Chemicals Products Market Overview – Soaps, Detergents and Laundry Bars There are few manufacturers of soaps and detergents in Malawi. The Malawian market is dominated by the following local and foreign based companies: Local Manufacturers & Retailers Foreign based companies Candlex (Manufacturer) Unilever (Also imports from sister companies in kenya and Zimbabwe) People's, Chipiku, Sana, Seven Eleven, Foodworths, Iponga and Tutla (Retailers) Golgate Palmolive (South African Subsidiary) Shoprite (retailer) According to Trademap, the imports of soaps and detergents amounted to USD 51.4 million in 2012, representing an increase in value of 17% p.a. over the 2008 to 2012 period. The total imports for washing & cleaning preparations (HS 3402) reached approximately USD 12.2 million in 2012. Accounting for 52% in Malawi’s share of imports, Zambia is the largest market, followed by Kenya (25.9%) and South Africa (13.1%). Another noticeable aspect is that the imports of soaps (HS Code 3401) stood at USD 36.4 million, registering 16% growth in value p.a. over the same period. Fastest growing markets for this product category are Germany, growing by 60% between 2007 and 2008, Kenya (36%) and UAE (128%). On the other hand, Malawi’s imports from South Africa experienced a decrease of 2% p.a. Our research has revealed that the Malawian market is dominated by several well established brands such as Sunlight, OMO and U-Fresh. The soaps and detergents market is a highly competitive sub-sector. Therefore, the potential for Mauritian suppliers to penetrate the market is quite limited. Mauritian suppliers will need to adopt a low price penetration strategy and create brand awareness to make Malawians switch brands in order to gain market share. . The below table summarizes the retail price of soaps and detergents in Malawi: COMPANY PRODUCT RETAIL PRICE (Malawi Kwacha) RETAIL PRICE USD Unilever Maluwa Blue 1kg 620.00 1.44 Maluwa Green 100g 80.00 0.18 Sunlight 150g 135.00 0.31 Omo Multi Active 100g 205.00 0.47 Candlex U-Fresh Washing Powder 400g 610.00 1.41 Colgate Palmolive Ajax Dish Liquid Lemon Lime 750ml 1420.00 3.30 Dyna Chem Gedent Dish Washing Liquid 750ml 935.00 2.17 Econo Gedent Dish Washing Liquid 750ml 685.00 1.59 Dyna Chem Toilet Cleaner/ Sanittiset 1litre Scoutex General Purpose Cleaner scouting Powder 500g 1040.00 2.41 145.00 0.33 Unilever Vim Scouter With Lemon 500g 135.00 0.31 Colgate Palmolive Axion The Greese Stripper Lemon Lime 200g 585.00 1.36 Source: People’s Supermarket Chipiku Stores Mr. Peter Kemp, the General Manager of Chipiku Stores claimed that he is currently sourcing most of his products from South Africa, Kenya and India. He was presented the soaps and detergents from Mauritius and asked to give his evaluation. According to him price and quality are the main factors influencing purchasing decision of laundry bars in Malawi. In regards to the beauty soaps and fabric softener the packaging were found to be of low quality. He stated it is important to have expiry date on the beauty soaps as Malawian consumers pay attention to this particular aspect. He further mentioned that washing powders is not very popular in Malawi. On the other hand, the floor polish has received positive feedback. Mr. Kemp mentioned that there is a huge demand for red floor polish. While the price and the quality of the packaging were found to be suitable for the Malawian market, Mr Kemp said that the imports for such type of products will also depend on the melting point degree. Deodorants Mr. Kemp informed us that competing in the deodorants market is hard as it is already flooded with well-established brands from South Africa. Commenting on the samples, Mr. Kemp found the price too expensive. He mentioned that he is currently importing Axe deodorant (50 ml) from South Africa for $1.00. Peoples Trading Centre Ltd Mr Dings Mpota, Deputy Merchandise Manager of People’ was also approached to explore the trade opportunities for household detergents and soaps. According to him, the Mauritian washing powder is very interesting and with the appropriate marketing strategies has a chance to be accepted by the Malawian consumers and can even compete with “OMO”. Market Overview –Fertilizers Malawi, being an agrarian economy, fertilizer plays an important role. Fertilizer is mainly used for maize and tobacco production. The country is a net importer of fertilizer. There are few local players in the market, of which the largest traders are; Export Trading, Nyiombo Investments and Farmers World Ltd and Agricultural Trading Company Ltd. It is important to note that the Malawian market is also flooded with small scale farmers. In 2012, imports of fertilizers amounted to USD 280 million, predominantly from UAE, China, India, Saudi Arabia and South Africa. Source: Trademap China is the leading market for fertilizers with a share of 20.4% in Malawi’s fertilizers imports. Malawi’s import of fertilizers from China has increased over the 2008-2012 period by 74%. On the other hand, we can see that South Africa’s export of fertilizers to Malawi has declined over the 2008-2012 period by 29% while its imports from the world have increased by 5% p.a. Agricultural Trading Company Ltd (A.T.C) With a view to explore the potential for exporting Bio-Fertilizers to Malawi, a meeting was arranged with the Sales Manager, Mr. Tony Sekani. Incorporated in 1962 as Agricultural Trading Company Nyasaland Limited, A.T.C has grown to become one of the leading suppliers of agricultural inputs and equipment in Malawi. They import fertilizers from South Africa and Saudi Arabia. Mr Sekani informed EM officers that there is a lengthy process of registration that may take up to two years as there are some tests that need to be carried out by the Ministry of Agriculture. The registration charges amount to USD 7000 and are to be borne exclusively by the manufacturer. It must be noted that the bio- fertilizers will have to undertake trials for over two seasons by the government authority before it is approved. He stated that although the Malawians farmers have just started getting acquainted with biofertilizers. ATC is not currently importing bio-fertilizers as they are five times more expensive than chemical ones and consumers are more prone used to utilising chemical rather than bio fertilizers.