Gift Acceptance Policy - Queen Margaret University

advertisement

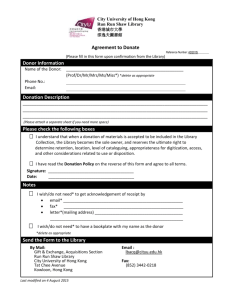

Queen Margaret University Gift Acceptance Policy 1. Introduction 1.1 This policy sets out the principles that the University will follow when seeking and accepting gifts from individuals, charitable trusts and corporate bodies. It also sets out the commitments that it makes to donors and prospective donors. 2. Context 2.1 It is important both for donors and for the University that their reputations be protected from any real or perceived impropriety in the relationship that is established through the offer and a receipt of a gift. 2.2 In particular, it is imperative that the integrity of the University’s teaching and research activities be free from compromise or undue influence, including the perception thereof. 3. Ethical Fundraising 3.1 The University recognises the guidance for fundraising published by CASE Europe (Council for Advancement and Support of Education) and is a registered charity. 4. General Principles and Procedures for Gift Acceptance 4.1 Donations are accepted on the understanding that they will not undermine the impartial, independent research, scholarship and teaching undertaken by the University, nor student outcomes. 4.2 The Development Office will receive gifts on behalf of the University, record them and arrange for their appropriate allocations. 4.3 Donations should not be directly received by other departments or academic schools, unless previously agreed by the Development Office. As well as ensuring good financial administration, this requirement is designed to avoid the possibility of any influence (or perceived influence) of a donation on academic standards, processes or student outcomes. The Development Office will offer professional support to staff in Schools and Departments that seek or are offered donations. 4.4 Members of the University staff or Court must disclose immediately to the Development and Alumni Manager any actual or apparent conflict of interest that a gift may pose to them. A conflict of interest, could, for example, be a pecuniary, family or other personal interest in a donor. 4.5 The Development Office will maintain appropriate records to enable tax to be reclaimed under the UK Gift Aid scheme. 4.6 A donor’s right to remain anonymous in terms of external donor recognition will be respected, but full donor details will be recorded in the University’s Raiser’s Edge donor database. 4.7 If a donation is offered anonymously, the Development Office will be charged with seeking such information from the donor’s representatives so as to ensure that it would be appropriate for the University to accept the funds. (A truly anonymous donation, in which the University only deals with an intermediary, who is not prepared to identify the donor, would not be acceptable without evidence of the source of funds). 4.8 Where conditions are attached to the offer of a gift, other than designating use for a specific University project for which fundraising is taking place, the Development Office will discuss with the donor any issue of concern in relation to those conditions so that an agreement can be reached by all parties prior to acceptance of the gift. The University will not normally accept a gift prior to ensuring that any imposed conditions are appropriate and can be satisfactorily met by the University. 4.9 The Development Office will ensure appropriate acknowledgment of gifts, stewardship to ensure that gifts are used for the purposes for which they are given and appropriate levels of communication with donors. 4.10 The University will not raise funds on behalf of another charity or allow use of its alumni and donor databases for such purposes. This is necessary to meet Office of the Scottish Charity Regulator (OSCR) requirements. 4.11 The Development Office will ensure that all benefits afforded to donors under the Gift Aid scheme comply with HM Revenue and Customs Rules and Regulations. 4.12 Care will be taken in terms of differentiating corporate sponsorship, which attracts VAT, and philanthropic donations. 4.13 Gifts of up to £5000 These will normally be accepted by the Development Office without further investigation if (1) they are given without conditions in support of an existing fundraising project or programme and (ii) are received from donors already known or on the donor database. In other cases, the Development and Alumni Manager will use his/her judgment as to whether to accept the gift, conduct a more extensive process of due diligence (based on information in the public domain), or liaise with the donor regarding any concerns. He/she will base his/her decision on the University’s policy as regards sources of donations (see section 6). 4.14 Gifts over £5000 i. The Deputy Principal should be notified of such gifts on their offer or receipt, initiating an appropriate process of donor screening. ii. Screening will be carried out by the Development Office. It will be based on information that is available in the public domain and therefore cannot be exhaustive. iii. After the screening process is complete, the Deputy Principal will normally make the decision as to whether the gift can be acceptance, basing his/her decision on the University’s policy as regards sources of donations (see section 6). iv. In cases of concern, and for all donations in excess of £50,000, the Deputy Principal will seek the guidance of the Senior Management Team as to whether to accept the donation. v. If the donor is a corporate or a charity body that is legally permitted to operate in the UK, then the source of funding will not normally be contested. Greater care should be taken with donations from overseas. vi. Donors offering gifts of above £5000 will be asked to sign a gift agreement which outlines the details of the donation, the project to be supported (if designated), a pledge payment schedule and naming rights (if applicable). 4.15 The University may review and reconsider previous decisions taken in good faith relating to the acceptance of particular gifts and any naming rights attached, if subsequent events or the subsequent availability of additional information require it. The response to such circumstances should be transparent and proportionate, and should take account of the legal and reputational rights of the donor/s concerned. 5. Our promise to our donors Donors can expect: i. To be informed about the University’s priorities, strategies and objectives. ii. That a gift given for a specific purpose will be used for that purpose, noting that to protect the reputation of both the University and the donor, it is imperative that the integrity of the University’s teaching and research activities be free from compromise or undue influence, including the perception thereof. iii. To be informed when the intended purpose of a gift can no longer be fulfilled. In such cases the Development Office will discuss with the donor how best their wishes can continue to be met. iv. To be informed of the impact of their donation. v. To have their donation acknowledged in a timely manner, and, as appropriate to be publicly acknowledged, or to remain anonymous. vi. To have their questions relating to their donation answered in a timely and honest manner. vii. To have their right to privacy respected and their personal information to be treated in compliance with the Data Protection Act 1998. viii. To receive the University’s published accounts on request. 6. Sources of donations Donations will be sought based on the University’s mission, vision, values and objectives. Donations will not be accepted from sources which: i. Are deemed to be illegal. ii. Limit or compromise freedom of enquiry or academic integrity, or create the perception thereof. iii. Are from companies that produce products that have consistently harmful effects on the world, including the tobacco and armaments industries, or generate earnings from undesirable areas. For further guidance, see the University’s ethical investment policy. iv. Compromise the charitable status of the University. v. Create an unacceptable conflict of interest or compromise the mission, vision and values of the University. vi. Damage the reputation of the University. vii. Cause other harm to the University. 7. Return of Gifts 7.1 Gifts made the University will not normally be returned to the donor. 7.2 In cases where a donation with agreed restrictions has been received by the University in good faith, but where circumstances have changed so that the original purpose of the donation cannot be fulfilled, the University will normally seek to use the funds in a way that corresponds to the original objectives of the donor, consulting the donor or the donor’s representatives wherever possible. 7.3 If no agreement can be reached with the donor or his/her representatives about alternative uses for a restricted or designated donation, the University will return the unexpended portion of that donation. 7.4 Gifts made in error and bank overpayments will be refunded to the donor on request. 8. Further information For further information and guidance, please contact the Development and Alumni Manager at development@qmu.ac.uk .