18. Nuclear Power in Europe

advertisement

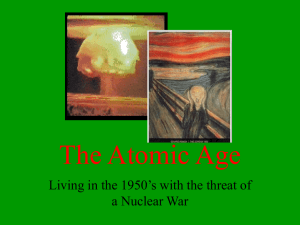

NUCLEAR POWER IN EUROPE June 25, 2014 By Justin Martino, Associate Editor Looking at nuclear energy programs in Europe serves as a microcosm to the uncertainty in nuclear power globally. While the overall capacity in the area is unlikely to change in the near future, many countries are moving in very different directions. While many countries in the region consider nuclear an important part of their fuel mix, others are moving in the opposite direction. France receives nearly 75% of its power from nuclear sources, Germany plans to retire all of its nuclear units by 2022, and Sweden prohibits the construction of any new facilities except to replace existing units. Work continues on operating plants in many European countries as plant operators look to extend the life of or increase the power of the nuclear units in operation. Of the 435 nuclear units in operation in April 2014, 185 are located in Europe, according to the International Atomic Energy Agency (IAEA). The 185 units have a total capacity of just more than 162,000-MW out of a global capacity of just less than 373,000-MW. European countries also tend to be the most reliant on nuclear energy. Globally, only four countries receive more than 50% of their power from nuclear sources, and they are all in Europe, according to the IAEA. France receives 73%, Belgium 52%, Slovakia 52% and Hungary 51%. Of the 13 total countries that receive more than 25% of their power from nuclear sources, 12 are located in Europe. South Korea is the only non-European country that receives more than a quarter of its power from nuclear. Of the 72 units currently under construction, 17 are in Europe with a total capacity of 15,500-MW. Russia is building more than half of those and currently has 10 units under construction with a total capacity of just less than 8,400-MW. GERMANY Germany will represent one of the largest drops in nuclear power in Europe in the future as the country plans to retire all of its nuclear capacity by 2022. Until 2011, Germany obtained onequarter of its electricity from 17 nuclear units. Years of political debate over a phase-out of nuclear energy concluded at that time, and the country's government passed a measure that immediately closed its eight oldest reactors and required the remaining nine reactors to close by the end of 2022. The total capacity of the 17 units that have or will retire is 20,339MW,. In 2013, the country obtained 16% of its total power from its nine remaining nuclear reactors. THE UNITED KINGDOM Currently, the U.K. has 16 reactors that provide 18% of its power and have a total capacity of 10,038-MW. The country will soon be facing retirements of most of that power, however – all but one of the U.K.'s nuclear generating units will be retired by 2023. The remaining unit has a capacity of 1,188-MW. Unlike Germany, however, U.K. is not permanently retiring its nuclear capacity and has implemented an assessment process for new reactor designs and siting. According to the WNA, the U.K is assuming a requirement of 60 GW of net new generating capacity by 2025. Although 35 GW of that will come from renewable power projects, the Draft National Policy Statement for Nuclear Power Generation states that the expectation is for a significant portion of the remaining 25 GW to come from nuclear. There have been 11 power reactors planned or proposed with a total capacity of 15,600-MW. The first of the new projects is expected to be online by 2023, and the government plans to have 16-GW of new nuclear capacity operating by 2030. RUSSIA Russia has been one of the most active European countries in nuclear developments. As of April 2014, the country had 33 units with a total capacity of 23,643-MW. In 2013, 17.5% of Russia's power supply came from nuclear sources. Russia also has 10 projects with a total capacity of around 8,500-MW currently under construction, according to the NEI. The earliest of these are expected to be completed this year, while a majority of the rest is expected to be online by 2018. In addition, Russia is planning an additional 31 nuclear units with a gross capacity of 32,780-MW, and proposing 18 units with an approximate capacity of 16,000-MW, according to the WNA. Russia's latest Federal Target Program is planning for a 25% nuclear share in electricity supply by 2030, increasing to 50% in 2050, and 75% by the end of the century. While some of the new reactors will replace existing units, present nuclear capacity is expected to increase by 50% by 2020. The country has also been extending the lives of its existing nuclear units, and many of the reactors are being uprated. SWEDEN Sweden has 10 units operating at three plants, providing a total power capacity of 9,474-MW and supplying the country with 42.7 percent of its electricity, according to the IAEA. Sweden has no immediate plans for building new nuclear units, and the government only allows nuclear unit construction at existing sites or to replace existing units. Vattenfall, operator of 7 units at two sites, has applied to build two new reactors at one of its sites, but a decision on construction is up to 10 years away.Sweden has, however, uprated all of its plants. One plant was uprated by about 400-MW between 2006 and 2011, and plans are to boost it to 660-MW over the next 25 years. A 27% uprate at one of the units at the Oskarshamn plant is also currently underway. FRANCE France had 58 nuclear units with a total capacity of 63,130-MW as of April 2014, and nuclear power supplied 73% of the nation's electricity in 2013. Its large nuclear output allows the country to be the world's largest net exporter of electricity, providing the country with more than EUR 3 billion ($4.1 billion) a year. AREVA headquartered in Paris is the world’s largest nuclear company, As a technology leader it is also building its first Generation III reactor with a capacity of 1,750-MW. The unit is expected to begin commercial operation in 2016. It is expected to continue research and development in nuclear power, as it remains the cornerstone of France's energy independence policy. OTHER PLANTS UNDER CONSTRUCTION Armenia is planning a second 1,060-MW nuclear unit. The county's current unit has a capacity of 376-MW. Nuclear power provided the country with 29% of its electricity in 2013. Slovakia currently has four nuclear units providing 52% of its energy, and two units with a total capacity of 880-MW are under construction. One unit is expected to come online later this year, with the second coming online in late 2015. Ukraine, which has 15 units with a total capacity of 13,107-MW, has two units under construction. The country received 44% of its power from nuclear in 2013, and the new units would add an addition 1,900-MW of capacity. According to the WNA, the country also plans to add an additional two units and has plans for nine replacement units, which would bring the total capacity of nuclear projects in the country through 2045 to 14,000-MW. The World Nuclear Association (WNA) founded in 2001 in London is an international organization which facilitates interaction on technical, commercial and policy matters and promoting wider public understanding of nuclear technology. Finland has one unit under construction with a capacity of 1,600-MW. There are already four units with a total capacity of 2,752-MW that provided 33% of the country's energy in 2013,. EMERGING NATIONS Several European countries are also identified as emerging nuclear energy countries by the WNA. Out of more than 45 countries currently not using nuclear, but are seriously considering the option, 12 are in Europe. The WNA lists Belarus, Turkey and Poland as front-runners to develop a nuclear program. Belarus currently has a unit under construction and has plans to begin construction on a second unit in early 2015. The WNA notes that consideration is not necessarily at the government level in order to qualify as an emerging nuclear nation. According to the WNA, Lithuania and Turkey both have signed contracts and a well-developed legal and regulatory infrastructure in place, while Poland has committed plans and a developing legal and regulatory infrastructure. Kazakhstan and Italy both have well-developed plans, but commitment is pending in Kazakhstan and stalled in Italy. Albania, Serbia, Croatia, Estonia, Latvia and Azerbaijan have all discussed nuclear as a serious policy option, according to the WNA. FUTURE UNCERTAINTY While retirements in Germany and other countries make it unlikely the overall nuclear capacity in Europe will significantly increase over the short term, it is possible that future developments and emerging nations could lead to an overall increase in the use of nuclear. However, there is a degree of uncertainty. Depending on the number of countries considering nuclear that build new units, the overall capacity could dramatically differ in the future. http://www.power-eng.com/articles/npi/print/volume-7/issue-3/nucleus/market-overview-europe.html EXTRACT AND EDITS BY KKOGANOWSKI Nuclear Power Plants Do Not Have A Fixed Life Expectancy When the plants were built the initial design life was calculated to be 30 to 40 years. This figure was used for financial investment purposes. With the exception of the reactor vessel, all elements in a nuclear power plant can be replaced. So the crucial element in determining the true engineering life expectancy of the plant depends on the degree to which the reactor vessel is neutron leak proof. This is monitored by surveillance capsules. Nuclear power plants renew their licences every ten years upon evaluation by a safety commission. If the surveillance capsules proves that the reactor vessel can continue to operate in absolute safety and all replacement and maintenance investments necessary to guarantee a safe and reliable operation are economically justified, an additional decade of operation is granted. This question arises for political reasons in countries with nuclear plants built before 1980. -Editor, KKOganowski 7/24/14