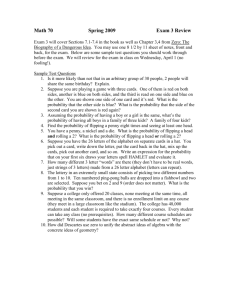

Lecture 20 Problems

Review of Lecture 20 Quiz and Test Problems

1.

SV4d The Company's total assets at year-end 2525 equal $4,000 and are financed by debt of $2,500 and stockholder's equity of $1,500 (170 shares outstanding). Their sales for year 2525, $10,800 , yielded a net profit margin (= net income / sales) of 2.40%; the payout ratio (= dividends / net income) always is 20%. The price-to-earnings ratio at year-end 2525 is 2.7. For the foreseeable future, the company intends to operate at their sustainable growth rate. You assess the share's intrinsic value by using a 22.6% discount rate. Suppose you buy the share today at its market price of 12/31/2525. You hold the stock until 12/31/2526, at which time you receive next year's dividend. Also, suppose the market shareprice has converged to its intrinsic value of 12/31/2526. What is the oneyear rate-of-return from investing in the share? a. 60.6% b. 55.1% c. 73.3% d. 80.6% e. 66.6%

2.

TR10 You observe the following for companies A and B: price per share: $17.60 for company A, and $27.30 for company B earnings per share: $0.73 for company A, and $0.92 for company B

In an equilibrium setting where prices are consistent with the dividend growth model, which statement is supported best by the above data? a. company A probably has riskier dividends than company B b. company A probably is overvalued relative to company B c. company A probably is undervalued relative to company B d. company A probably has less risky dividends than company B e. company A probably has more growth opportunities than company B

3.

ST10 Suppose the company stock price is $26 , earnings per share is $0.84 , operating cash flow per share is $1.27 , and book value per share is $6.77 . For a carefully constructed peer group you find the following average multiples: the price-to-earnings ratio is 25, the price-to-cash flow ratio is 18; the price-to-book is 3.4. Compare the company and peer group multiples and, assuming the peers are virtual clones of the company, make inferences about the company share price. a. comparison of price-to-earnings ratios makes the company seem relatively overvalued b. comparison of price-to-cash flow ratios makes the company seem relatively overvalued c. comparison of price-to-book ratios makes the company seem relatively overvalued d. Two choices, A and B, are correct e. The three A-B-C choices are all correct

4.

ER11 Suppose that you are able to perfectly measure risk and expected return, and the bigger the number the bigger the risk or return. Measurements of (risk, return) for three possible asset investments, call them X, Y, and Z, are as follows: X: (15,20); Y: (30,28);

Z: (30,13). Compare the three with regards to dominance or tradeoff. a. X and Y coexist as tradeoffs b. Y dominates Z c. X dominates Z d. Two choices, A and B, are correct e. The three A-B-C choices are all correct

5.

ER10 Suppose that you are able to perfectly measure expected return. Also, suppose that there exist two different kinds of risk that you can measure, call them Risk

1

and Risk

2

.

The amount of Risk

1

an investment possesses is totally unrelated to the amount of Risk

2 that it possesses. Three possible asset investments, call them X, Y, and Z, have measurements for (Risk

1

, Risk

2

, return) as follows: X: (25,20,30); Y: (20,20,28); Z:

(15,30,27). Compare the three with regards to dominance or tradeoff. a. Y dominates X b. Z dominates Y c. X and Z coexist as tradeoffs d. Two choices, A and B, are correct e. The three A-B-C choices are all correct

6.

SV3a The Company just announced earnings per share of $4.70 , which means that their price to earnings ratio is 7.44. The Company has an asset turnover ratio (= Sales t

/ Total assets t

) of 2.14, a net profit margin (= net income / sales) of 4.2%, a debt ratio (= total debt / total assets) of 40%, and a payout ratio (= dividends / net income) of 40%. The

Company always operates at their sustainable growth rate and successfully holds constant all relevant financial ratios. You would like to invest in the stock such that you'll get a 14.8% total rate of return. What is your assessment of the stock's intrinsic value? a. $28.65 b. $38.14 c. $31.52 d. $34.67 e. $41.95