Public Contracts Regulations 2015: What`s new for SMES?

advertisement

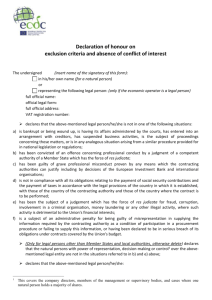

10 February 2016 Public Contracts Regulations 2015: What's new for SMES? One of the Government’s stated aims for the Public Contracts Regulations 2015 (PCR 2015) is to create ‘a simple and more consistent approach to procurement across all public sector agencies. This would support small and medium-sized enterprises (SMEs) and voluntary organisations in gaining better and more direct access to contract opportunities. This note looks at some key provisions in PCR 2015 that may be helpful to ACE’s SME members. We would invite any feedback from members on PCR 2015 or this note. Please note that ACE’s legal affiliate, BLM, have produced more detailed guidance on PCR 2015. Division of public contracts into lots Regulation 46 allows contracting authority to award a contract in the form of separate lots and even to limit the number of lots that may be awarded to a single tenderer. Notably, contracting authorities must provide in the procurement documents an indication of their main reasons not to subdivide a contract into lots. If awarding the lots in accordance with stated award criteria would result in award of more lots than the maximum specified to the same tenderer, then the contracting authority must publish the objective non-discriminatory criteria they will apply for determining which lots will be awarded. We anticipate that setting this criteria may be challenging in practice. Financial standing and PQQs Regulation 58 limits the maximum turnover requirements that contracting authorities may impose at PQQ stage. The maximum turnover requirement is now twice the contract value, unless a higher maximum can be justified due to special risks associated with the contract works, services or supplies. Other financial criteria may be imposed which are similar to the 2006 Regulations and associated guidance, including the requirement that financial assessment requirements are “proportionate, flexible and not overly risk averse” [1]. Notably, under Regulation 11 in procurements that are below the EU value thresholds a contracting authority may not include a pre-qualification stage.[2] In practice, this means no PQQ may be used. Contracting authorities may, however, The Association is registered as a company in England with the number 132142, it is limited by guarantee and has its registered office at the above address ask "suitability assessment" questions relating to a potential supplier provided that the questions are proportionate and relevant to the subject matter of the procurement. The changes to PQQ criteria are supported by the requirement in Regulation 59 for contracting authorities to accept an ESPD, which is a standard EU form of selfcertification for use by a supplier to demonstrate it is not within the exclusion criteria and that it meets the technical capability and financial standing criteria. It is hoped that ESPD will make the process less burdensome. Other supporting documents or evidence may be requested by the contracting authority, but the authority must itself make use of central databases to obtain information where it is possible to do so. ESPD’s may be re-used where they remain accurate. Advertising of under-threshold Contracts Implementing one of Lord Young’s proposed reforms, Regulations 110 to 112 require that in cases where contracting authorities, with some exemptions, choose to advertise contracts that are under the relevant EU value thresholds the contracts must be advertised on the Government’s “Contracts Finder” portal. This requirement applies to contracts as low as £10,000 (£25,000 for sub-central contracting authorities). Payment of Invoices Regulation 113 requires that contracts (with some exceptions) entered into by contracting authorities contain provisions requiring the authority to pay all validated and undisputed invoices within 30 days of the date of validation. Validation must be carried out in a timely manner. These new requirements are supported by a requirement on public authorities to report their payment practices, similar to requirements which have been imposed on large undertakings under the Small Business, Enterprise and Employment Act 2015. Additionally, any contract granted by a contracting authority with a lead contractor must contain provisions requiring any sub contracts entered into by the lead contractor to contain equivalent payment provisions to those required in the lead contract. Where there is a failure to include such payment provisions in the lead contract, then those provisions (including the stipulations as to provisions to be included in subcontracts) will be implied terms. We look forward to seeing the extent to which this requirement is adhered to and enforced and how the courts approach the requirements for provisions in sub contracts. It is not immediately clear how a subcontractor will enforce its entitlement to be paid in 30 days, if the contract does not state it expressly; the sub-contractor may not have a contractual relationship with the contracting authority pursuant to which it may seek a remedy. For more information on the PCR 2015 please see BLM LLP’s. Please be aware that ACE presents this guidance note to assist ACE members with managing their commercial risk. We also have a Business Helpline. Please note that the guidance and Helpline are not intended as a substitute for specific independent legal advice. ACE recommends that independent legal advice is taken in any individual case and before pursuing a course of action. Members may also gain a referral to one of ACE's Legal Affiliates who can provide approximately 15 minutes of free advice. ACE Legal and Compliance Team, April 2015 [1] S.6 CCS 2015 Guidance on PQQs [2] Currently £112,000 in central government and £173,000 outside central government and in NHS Trusts.