burial benefits - Law Office of Kay Perry

advertisement

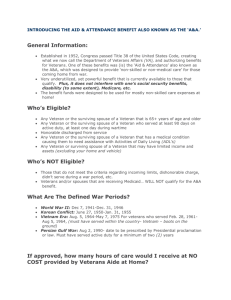

Overview of Department of Defense and

Department of Veterans’ Affairs Death and Burial Benefits

BURIAL BENEFITS

Military Funeral Honors: (http://www.militaryfuneralhonors.osd.mil/intro.html)

What is Military Funeral Honors?

Military Funeral Honors have always been provided whenever possible. However, the law

now mandates the rendering of Military Funeral Honors for an eligible veteran if requested

by the family. As provided by law, an honor guard detail for the burial of an eligible veteran

shall consist of not less than two members of the Armed Forces. One member of the detail

shall be a representative of the parent Service of the deceased veteran. The honor detail

will, at a minimum, perform a ceremony that includes the folding and presenting of the

American flag to the next of kin and the playing of Taps. Taps will be played by a bugler, if

available, or by electronic recording. Today, there are so few buglers available that the

Military Services often cannot provide one.

Who is eligible for Military Funeral Honors?

- Military members on active duty or in the Selected Reserve.

- Former military members who served on active duty and departed under conditions

other than dishonorable.

- Former military members who completed at least one term of enlistment or period of

initial obligated service in the Selected Reserve and departed under conditions other than

dishonorable.

- Former military members discharged from the Selected Reserve due to a disability

incurred or aggravated in the line of duty.

What can the family of an eligible veteran expect?

The core elements of the funeral honors ceremony, which will be conducted are:

- Flag folding

- Flag presentation

- Playing of Taps

The veteran’s parent Service representative will present the flag.

The Department of Defense has established a toll free line (1-877-MIL-HONR) for use by

Funeral Directors to request honors.

References: Title 10, United States Code, Section 1491 Title 10, United States Code,

Section 985 Title 38, United States Code, Section 2411

Presidential Memorial Certificate: (http://www.cem.va.gov/pmc.asp)

This is a parchment certificate with a calligraphic inscription expressing the nation's

grateful recognition of an honorably discharged, deceased veteran's service in the Armed

Forces. The veteran's name is inscribed and the certificate bears the signature of the

President.

To obtain this certificate: The family may request a Presidential Memorial Certificate

(PMC) either in person at any VA regional office or by U.S. mail. Requests cannot be sent via

email. There is no form to fill out when requesting the certificate.

Please send your PMC request in one of the following manners:

1. Fax your request and all supporting documents (copy of discharge and death

certificate) to: (202) 565-8054, or

2. Mail your request and all supporting documents using either the U.S. Postal Service

or a commercial mail service, such as one of the overnight or express mail delivery

services, to:

Presidential Memorial Certificates

(41A1C)

Department of Veterans Affairs

5109 Russell Road

Quantico, VA 22134-3903

Eligibility

An honorably discharged, deceased

veteran's service in the Armed Forces.

Eligible recipients include the deceased

veteran's next of kin and loved ones. More

than one certificate may be provided.

Application

If you have any questions about a

certificate you have received, a request

you have already sent in or about the

program in general, you may call (202)

565-4964. Or you may email Department

of Veterans Affairs at PMC@mail.va.gov

VA Form 40-0247 Application for Presidential Memorial Certificate

Transportation of Remains:

(https://www.hrc.army.mil/TAGD/Transportation%20of%20Remains)

Detailed information concerning the eligibility for transporting the remains may be found

in Table 2-1 chapter 2 of Army Regulation 638-2 - Care and Disposition of Remains and

Disposition of Personal Effects

Military Uniform:

Deceased servicemembers are eligible to be provided with a military uniform for burial.

Clothing authorized for burial of eligible civilian personnel (typically DoD employees)

consists of suitable clothing however the decedent's own clothing should be used when it is

available and suitable for burial. The cost of civilian clothing will not exceed the cost of an

Army green uniform.

Identification tags are Government property and will be attached to the remains in a

secure manner.

Headstone, Marker and Medallion:

(http://www.cem.va.gov/hm/hmorder.asp)

The United States Government provides headstones and markers for the graves of active

duty Soldiers, veterans, and eligible dependents anywhere in the world which are not

already marked. Flat bronze, flat granite, flat marble and upright marble types are available

to mark the grave of a veteran or dependent in the style consistent with existing

monuments at the place of burial. Bronze niche markers are also available to mark

columbaria in national cemeteries used for inurnment of cremated remains.

Who Can Apply for a Headstone, Marker or Medallion?

Under this new rule, only the following individuals may apply for a headstone, marker or

medallion:

1. the decedent's next-of-kin (NOK)

2. a person authorized in writing by the NOK

3. a personal representative authorized in writing by the decedent.

The following ordered list will be used by the National Cemetery Administration (NCA) to

define the NOK for the purpose of determining who may apply for a Government

headstone, marker or medallion as well as, who may request an emblem of belief not

available for inscription:

1. Surviving Spouse (including common law)

2. Children by age

3. Parents — biological, adoptive, step, foster

4. Brothers/sisters— half, step

5. Grandparents

6. Grandchildren

7. Uncles/Aunts

8. Cousins

9. Nieces/Nephews

10. Other lineal descendants

Any individual authorized in writing by the NOK, or a personal representative authorized

in writing by the decedent may also apply for a headstone, marker or medallion. If someone

other than the NOK is applying for the headstone, marker or medallion, the application

package must include a written statement signed by the NOK or decedent authorizing that

person (the applicant) to apply for this benefit. A notarized statement is not required for

these purposes.

NCA will also accept applications from funeral home directors, cemetery officials, and

Department of Defense appointed Casualty Assistance Officers, since they generally are

authorized to represent the decedent or the NOK. When a cemetery is historic and/or does

not have officials that are responsible for the administration of the cemetery, then the

landowner may be the applicant.

When burial is in a private cemetery, VA Form 40-1330, Application for Standard

Government Headstone or Marker must be submitted by the next of kin or a representative,

such as funeral director, cemetery official or Veterans counselor, along with Veterans

military discharge documents, to request a Government-provided headstone or marker. Do

not send original documents, as they will not be returned.

Ordering a Headstone or Marker in a National, Post, or State Veterans Cemetery

When burial or memorialization is in a national, post, or state Veterans' cemetery, a

headstone or marker will be ordered by the cemetery officials based on inscription

information provided by the next of kin.

Requesting a grave marker

When burial is in a private cemetery, VA Form 40-1330 - Application for Standard

Government Headstone or Marker for Installation in a Private Cemetery or a State

Veterans' Cemetery, must be submitted by the next of kin, funeral director or cemetery

representative, along with a copy of the veteran's military discharge documents. Your

funeral director will assist you or if you have questions about grave markers, family

members can send the completed request for a Government-provided headstone or marker

and the necessary supporting documents to:

Memorial Programs Service (41A1)

Department of Veterans Affairs

5109 Russell Road

Quantico, VA 22134-3903

OR fax to: 1-800-455-7143.

For the status of headstones and markers please call Veterans Affairs at 1-800-697-6947.

Setting Government Headstones and Markers

Cemetery staff in national, military post, and military base cemeteries are responsible for

setting the headstone or marker at no cost to the applicant. Some state Veterans'

cemeteries may charge the applicant a nominal fee for setting a Government-furnished

headstone or marker.

Arrangements for setting a Government-furnished headstone or marker in a private

cemetery are the applicant's responsibility and all placement costs are at private expense.

Memorial Headstones and Markers

Memorial headstones and markers, for individuals or groups, are furnished for eligible

deceased active duty service members and Veterans whose remains are not recovered or

identified, are buried at sea, donated to science or whose cremated remains have been

scattered.

Memorial headstones and markers may also be furnished in national, military post/base or

state Veterans cemeteries to eligible spouses whose remains are unavailable for interment,

whether or not they predecease the eligible Veteran.

These headstones and markers bear an "In Memory of" inscription, as their first line and

must be placed in a recognized cemetery.

Memorial headstones and markers for spouses and other dependents are not available for

placement in private cemeteries.

VA Form 40-1330, Application for Standard Government Headstone or Marker, must be

submitted to request a memorial marker.

* NOTE: Link will take you outside the Department of Veterans Affairs web site.

Burial Flags:

(http://www.cem.va.gov/bbene/bflags.asp)

A United States flag is provided, at no cost, to drape the casket or accompany the urn of a

deceased Veteran who served honorably in the U. S. Armed Forces. It is furnished to honor

the memory of a Veteran’s military service to his or her country. VA will furnish a burial

flag for memorialization for each other than dishonorable discharged:

Veteran who served during wartime

Veteran who died on active duty after May 27, 1941

Veteran who served after January 31, 1955

peacetime Veteran who was discharged or released before June 27, 1950

certain persons who served in the organized military forces of the Commonwealth

of the Philippines while in service of the U.S. Armed Forces and who died on or after

April 25, 1951

certain former members of the Selected Reserves

Who Is Eligible to Receive the Burial Flag?

Generally, the flag is given to the next-of-kin, as a keepsake, after its use during the funeral

service. When there is no next-of-kin, VA will furnish the flag to a friend making request for

it. For those VA national cemeteries with an Avenue of Flags, families of Veterans buried in

these national cemeteries may donate the burial flags of their loved ones to be flown on

patriotic holidays.

How Can You Apply?

You may apply for the flag by completing VA Form 21-2008, Application for United States

Flag for Burial Purposes. You may get a flag at any VA regional office or U.S. Post Office.

Generally, the funeral director will help you obtain the flag.

For More Information Call Toll-Free at 1-800-827-1000

Burial in a National Cemetery: (http://www.cem.va.gov/bbene_burial.asp)

Requests for burial in a Department of Veterans Affairs (VA) national cemetery cannot be

made via the Internet. The VA does not make funeral arrangements or perform cremations.

Families should make these arrangements with a funeral provider or cremation office. Any

item or service obtained from a funeral home or cremation office will be at the family’s

expense.

Burial benefits available include a gravesite in any of our 131 national cemeteries with

available space, opening and closing of the grave, perpetual care, at no cost to the family.

Some Veterans may also be eligible for Burial Allowances . Cremated remains are buried

or inurned in national cemeteries in the same manner and with the same honors as

casketed remains.

Burial benefits available for spouses and dependents buried in a national cemetery include

burial with the Veteran, perpetual care, and the spouse or dependents name and date of

birth and death will be inscribed on the Veteran's headstone, at no cost to the family.

Eligible spouses and dependents may be buried, even if they predecease the Veteran.

Preparing in Advance

Gravesites in Department of Veterans Affairs (VA) national cemeteries cannot be reserved

in advance.

You should advise your family of your wishes and where your discharge papers* are kept.

These papers are very important in establishing your eligibility. You may wish to make preneed arrangements with a funeral home.

At the time of need your family would contact a funeral home who will assist them with

making burial arrangements at the national cemetery.

To schedule a burial: Fax all discharge documentation to the National Cemetery Scheduling

Office at 1-866-900-6417 and follow-up with a phone call to 1-800-535-1117.

Persons Eligible for Burial in a National Cemetery

(http://www.cem.va.gov/cem/bbene/eligible.asp)

The National Cemetery Scheduling Office has the primary responsibility for verifying

eligibility for burial in VA national cemeteries. A determination of eligibility is usually

made in response to a request for burial in a VA national cemetery. To schedule a burial fax

all discharge documentation to 1-866-900-6417 and follow-up with a phone call to 1-800535-1117.

a. Veterans and Members of the Armed Forces (Army, Navy, Air Force, Marine Corps,

Coast Guard)

(1) Any member of the Armed Forces of the United States who dies on active duty.

(2) Any Veteran who was discharged under conditions other than dishonorable.

With certain exceptions, service beginning after September 7, 1980, as an enlisted person,

and service after October 16, 1981, as an officer, must be for a minimum of 24 continuous

months or the full period for which the person was called to active duty (as in the case of a

Reservist called to active duty for a limited duration). Undesirable, bad conduct, and any

other type of discharge other than honorable may or may not qualify the individual for

Veterans benefits, depending upon a determination made by a VA Regional Office. Cases

presenting multiple discharges of varying character are also referred for adjudication to a

VA Regional Office.

(3) Any citizen of the United States who, during any war in which the United States

has or may be engaged, served in the Armed Forces of any Government allied with the

United States during that war, whose last active service was terminated honorably by death

or otherwise, and who was a citizen of the United States at the time of entry into such

service and at the time of death.

b. Members of Reserve Components and Reserve Officers’ Training Corps

(1) Reservists and National Guard members who, at time of death, were entitled to

retired pay under Chapter 1223, title 10, United States Code, or would have been entitled,

but for being under the age of 60. Specific categories of individuals eligible for retired pay

are delineated in section 12731 of Chapter 1223, title 10, United States Code.

(2) Members of reserve components, and members of the Army National Guard or

the Air National Guard, who die while hospitalized or undergoing treatment at the expense

of the United States for injury or disease contracted or incurred under honorable

conditions while performing active duty for training or inactive duty training, or

undergoing such hospitalization or treatment.

(3) Members of the Reserve Officers’ Training Corps of the Army, Navy, or Air

Force who die under honorable conditions while attending an authorized training camp or

on an authorized cruise, while performing authorized travel to or from that camp or cruise,

or while hospitalized or undergoing treatment at the expense of the United States for injury

or disease contracted or incurred under honorable conditions while engaged in one of

those activities.

(4) Members of reserve components who, during a period of active duty for

training, were disabled or died from a disease or injury incurred or aggravated in line of

duty or, during a period of inactive duty training, were disabled or died from an injury or

certain cardiovascular disorders incurred or aggravated in line of duty.

c. Spouses and Dependents

(1) The spouse or surviving spouse of an eligible Veteran is eligible for interment in

a national cemetery even if that Veteran is not buried or memorialized in a national

cemetery. In addition, the spouse or surviving spouse of a member of the Armed Forces of

the United States whose remains are unavailable for burial is also eligible for burial.

(2) The surviving spouse of an eligible Veteran who had a subsequent remarriage

to a non-Veteran and whose death occurred on or after January 1, 2000, is eligible for

burial in a national cemetery, based on his or her marriage to the eligible Veteran.

(3) The minor children of an eligible Veteran. For purpose of burial in a national

cemetery, a minor child is a child who is unmarried and:

(a) Who is under 21 years of age; or,

(b) Who is under 23 years of age and pursuing a full-time course of

instruction at an approved educational institution.

(4) The unmarried adult child of an eligible Veteran. For purpose of burial in a

national cemetery, an unmarried adult child is:

Of any age but became permanently physically or mentally disabled and incapable

of self-support before reaching 21 years of age, or before reaching 23 years of age if

pursuing a full-time course of instruction at an approved educational institution.

Proper supporting documentation must be provided.

h. Parents

(1) Biological or adoptive parents, who died after October 13, 2010, and whose

biological or adoptive child was a servicemember:

(a) whose death occurred on or after October 7, 2001, and

(b) whose death was the result of a hostile casualty or a training-related

injury, and

(c) who is interred in a national cemetery, in a gravesite with available space

for subsequent interment, and

(d) at the time of the parent’s death, had no spouse, surviving spouse, or

child who is buried, or who, upon death, may be eligible for burial in a national cemetery.

(2) The term “hostile casualty” means a person who, as a member of the Armed

Forces, dies as the direct result of hostile action with the enemy, while in combat, while

going to or returning from a combat mission if the cause of death was directly related to

hostile action, or while hospitalized or undergoing treatment at the expense of the United

States for injury incurred during combat, and includes a person killed mistakenly or

accidentally by friendly fire directed at a hostile force or what is thought to be a hostile

force. The term “hostile casualty” does not include a person who dies due to the elements,

a self-inflicted wound, combat fatigue, or a friendly force while the person was absentwithout-leave, deserter, or dropped-from-rolls status or was voluntarily absent from a

place of duty.

(3) The term “training-related injury” means an injury incurred by a member of the

Armed Forces while performing authorized training activities in preparation for a combat

mission.

i. Others:

(1) Certain members of the National Oceanic and Atmospheric Administration,

Public Health Service, World War II Merchant Mariners, and the Philippine Armed Forces.

(2) Such other persons or classes of persons as designated by the Secretary of

Veterans Affairs (38 U.S.C. § 2402(6)) or the Secretary of Defense (Public Law 95-202, §

401, and 38 CFR § 3.7(x)).

Persons Not Eligible for Burial in a National Cemetery

a. Former Spouses

A former spouse of an eligible individual whose marriage to that individual has been

terminated by annulment or divorce, if not otherwise eligible.

b. Other Family Members

Family members of an eligible person except those defined as eligible in Section III,

paragraph g.

c. Disqualifying Characters of Discharge

A person whose only separation from the Armed Forces was under dishonorable

conditions or whose character of service results in a bar to Veterans benefits.

d. Discharge from Draft

A person who was ordered to report to an induction station, but was not actually inducted

into military service.

e. Persons Found Guilty of a Capital Crime

Under 38 U.S.C. § 2411, interment or memorialization in a VA national cemetery or in

Arlington National Cemetery is prohibited if a person is convicted of a Federal or State

capital crime, for which a sentence of imprisonment for life or the death penalty may be

imposed and the conviction is final. Federal officials may not inter in Veterans cemeteries

persons who are shown by clear and convincing evidence to have committed a Federal or

State capital crime but were unavailable for trial due to death or flight to avoid prosecution.

Federally funded State veterans cemeteries must also adhere to this law. This prohibition

is also extended to furnishing a Presidential Memorial Certificate, a burial flag, and a

headstone or marker.

f. Subversive Activities

Any person convicted of subversive activities after September 1, 1959, shall have no right

to burial in a national cemetery from and after the date of commission of such offense,

based on periods of active military service commencing before the date of the commission

of such offense, nor shall another person be entitled to burial on account of such an

individual. Eligibility will be reinstated if the President of the United States grants a

pardon.

g. Active or Inactive Duty for Training

A person whose only service is active duty for training or inactive duty training in the

National Guard or Reserve Component, unless the individual meets the eligibility criteria

listed in Section III.1.b. of this information sheet.

h. Other Groups

Members of groups whose service has been determined by the Secretary of the

Air Force under the provisions of Public Law 95-202 as not warranting entitlement to

benefits administered by the Secretary of Veterans Affairs.

View this document in its entirety.

VA-NCA-IS-1 Interments in VA National Cemeteries

Donating Burial Flags in National Cemeteries

Most of the Department of Veterans Affairs national cemeteries display an Avenue of Flags

on patriotic holidays and during special events. The Avenues consist of burial flags donated

by the families of deceased Veterans and provide a unique visible tribute to all of our

Nation's Veterans.

A Certificate of Appreciation is presented to the donor for providing their loved ones' burial

flag to a national cemetery.

Please contact the cemetery of your choice for information on how to donate a veteran's

burial flag.

Fort Sam Houston National Cemetery Military Honors:

The Fort Sam Houston National Cemetery Memorial Service Detachment (MSD) is available

Monday through Friday to provide military funeral honors for veterans. MSD teams are

volunteers. They compliment the services provided by the Department of Defense. They

ensure that all veterans are provided the rifle salute and taps. All military funeral honors

performed by the MSD are provided at no cost to the family. Contact the cemetery office for

scheduling information for the MSD.

Arlington National Cemetery: (http://www.arlingtoncemetery.mil/Default.aspx)

Eligibility for interment at Arlington National Cemetery is verified at the time of need (at

the time of death) and cannot be verified by the cemetery or accommodated before that

time. However, in accordance with the 1986 Title 32 Code of Federal Regulations Part 553,

section 15, the following individuals are eligible for interment (ground burial) at Arlington

National Cemetery:

a. Any active duty member of the Armed Forces (except those members serving on

active duty for training only).

b. Any retired member of the Armed Forces. A retired member of the Armed Forces, in

the context of this paragraph, is a retired member of the Army, Navy, Air Force,

Marine Corps, Coast Guard, or a Reserve component who has served on active duty

(other than for training), is carried on an official retired list, and is entitled to

receive retired pay stemming from service in the Armed Forces. If, at the time of

death, a retired member of the Armed Forces is not entitled to receive retired pay

stemming from his service in the Armed Forces until some future date, the retired

member will not be eligible for ground burial.

c. Any former member of the Armed Forces separated for physical disability prior to 1

October 1949 who has served on active duty (other than for training) and who

would have been eligible for retirement under the provisions of 10 United States

Code (U.S.C.) 1201 had that statute been in effect on the date of his separation.

d. Any former member of the Armed Forces whose last active duty (other than for

training) military service terminated honorably and who has been awarded one of

the following decorations:

1. Medal of Honor

2. Distinguished Service Cross (Air Force Cross or Navy Cross)

3. Distinguished Service Medal

4. Silver Star

5. Purple Heart

e. Persons who have held any of the following positions provided their last period of

active duty (other than for training) as a member of the Armed Forces terminated

honorably:

1. An elective office of the United States Government

2. Office of the Chief Justice of the United States or of an Associate Justice of the

Supreme Court of the United States

3. An office listed in 5 U.S.C. 5312 or 5 U.S.C. 5313

4. The Chief of a mission who was at any time during his/her tenure classified

in class I under the provisions of Section 411 of the Act of 13 August 1946, 60

Stat. 1002, as amended (22 U.S.C. 866, 1964 ed.)

f. Any former prisoner of war who, while a prisoner of war, served honorably in the

active military, naval, or air service, whose last period of active military, naval, or air

service terminated honorably and who died on or after November 30, 1993.

1. The term “former prisoner of war” means a person who, while serving in the

active military, naval, or air service, was forcibly detained or interned in line

of duty—

i. By an enemy government or its agents, or a hostile force, during a

period of war; or

ii. By a foreign government or its agents, or a hostile force, under

circumstances which the Secretary of Veterans Affairs finds to have

been comparable to the circumstances under which persons have

generally been forcibly detained or interned by enemy governments

during periods of war.

2. The term "active military, naval, or air service" includes active duty, any

period of active duty for training during which the individual concerned was

disabled or died from a disease or injury incurred or aggravated in line of

duty, and any period of inactive duty training during which the individual

concerned was disabled or died from an injury incurred or aggravated in line

of duty.

g. The spouse, widow or widower, minor child and, at the discretion of the Secretary of

the Army, unmarried adult child of any of the persons listed above.

1. The term “spouse” refers to a widow or widower of an eligible member,

including the widow or widower of a member of the Armed Forces who was

lost or buried at sea or officially determined to be permanently absent in a

status of missing or missing in action. A surviving spouse who has remarried

and whose remarriage is void, terminated by death, or dissolved by

annulment or divorce by a court with basic authority to render such decrees

regains eligibility for burial in Arlington National Cemetery unless it is

determined that the decree of annulment or divorce was secured through

fraud or collusion.

2. An unmarried adult child may be interred in the same gravesite in which the

parent has been or will be interred, provided that child was incapable of selfsupport up to the time of death because of physical or mental condition. At

the time of death of an adult child, a request for interment will be submitted

to the Executive Director, Army National Cemeteries Program, Arlington

National Cemetery. The request must be accompanied by a notarized

statement from an individual who has direct knowledge as to the marital

status, degree of dependency of the deceased child, the name of that child's

parent, and the military service upon which the burial is being requested. A

certificate of a physician who has attended the decedent as to the nature and

duration of the physical and/or mental disability must also accompany the

request for interment.

h. Widows or widowers of service members who are interred in Arlington National

Cemetery as part of a group burial may be interred/inurned in the cemetery, but not

in the same gravesite as the group burial.

i. The surviving spouse, minor child, and, at the discretion of the Secretary of the

Army, unmarried adult child of any person already buried in Arlington.

j. The parents of a minor child or unmarried adult child whose remains, based on the

eligibility of a parent, are already buried in Arlington National Cemetery.

Scheduling a Funeral Service

Upon the death of the veteran or veteran's spouse, the surviving spouse or personal

representative should contact a local funeral home to arrange for any desired services in

the hometown. The surviving spouse, personal representative, or the funeral director

should telephone the Arlington National Cemetery’s Customer Service Call Center at (877)

907-8585 to arrange for the interment/inurnment service.

An individual case number will be assigned and a cemetery representative will call the

point of contact to establish eligibility. Before scheduling the service, the cemetery staff will

need to determine the eligibility of the deceased in accordance with Arlington National

Cemetery interment eligibility criteria. Upon verification of eligibility, the cemetery staff

will reserve the necessary ceremonial resources and schedule the interment.

The cemetery staff needs documentation to show an unbroken chain of custody for the

remains of the deceased.

Any documents requested by the cemetery staff can be faxed to the cemetery at telephone

number (571) 256-3334 or emailed to anc.isb@conus.army.mil and must include the case

number provided by the Customer Service Call Center.

Burial Allowances:

VA burial allowances are partial reimbursements of an eligible Veteran's burial and funeral

costs. When the cause of death is not service related, the reimbursements are generally

described as two payments: (1) a burial and funeral expense allowance, and (2) a plot or

interment allowance.

Who Is Eligible?

You may be eligible for a VA burial allowance if:

you paid for a Veteran's burial or funeral, AND

you have not been reimbursed by another government agency or some other source,

such as the deceased veteran's employer, AND

the Veteran was discharged under conditions other than dishonorable.

In addition, at least one of the following conditions must be met:

the Veteran died because of a service-related disability, OR

the Veteran was receiving VA pension or compensation at the time of death, OR

the Veteran was entitled to receive VA pension or compensation, but decided not to

not to reduce his/her military retirement or disability pay, OR

the Veteran died while hospitalized by VA, or while receiving care under VA

contract at a non-VA facility, OR

the Veteran died while traveling under proper authorization and at VA expense to

or from a specified place for the purpose of examination, treatment, or care, OR

the Veteran had an original or reopened claim pending at the time of death and has

been found entitled to compensation or pension from a date prior to the date or

death, OR

the veteran died on or after October 9, 1996, while a patient at a VA-approved state

nursing home.

How Much Does VA Pay?

Service-Related Death. VA will pay up to $2,000 toward burial expenses for deaths on or

after September 11, 2001. VA will pay up to $1,500 for deaths prior to September 10, 2001.

If the Veteran is buried in a VA national cemetery, some or all of the cost of transporting the

deceased may be reimbursed.

Non-service-Related Death. For deaths on or after October 1, 2011, VA will pay up to $700

toward burial and funeral expenses (if hospitalized by VA at time of death), or $300 toward

burial and funeral expenses (if not hospitalized by VA at time of death), and a $700.00 plotinterment allowance (if not buried in a national cemetery). For deaths on or after

December 1, 2001, but before October 1, 2011, VA will pay up to $300 toward burial and

funeral expenses and a $300 plot-interment allowance. The plot interment allowance is

$150 for deaths prior to December 1, 2001. If the death happened while the Veteran was in

a VA hospital or under VA contracted nursing home care, some or all of the costs for

transporting the Veteran’s remains may be reimbursed. An annual increase in burial and

plot allowances, for deaths occurring after October 1, 2011, begins in fiscal year 2013

based on the Consumer Price Index for the preceding 12-month period.

How Can You Apply?

You can apply by filling out VA Form 21-530, Application for Burial Benefits. You should

attach a copy of the veteran’s military discharge document (DD 214 or equivalent), death

certificate, funeral and burial bills. They should show that you have paid them in full. You

may download the form at http://www.va.gov/vaforms/

Casket:

Some individuals are authorized a casket at Army expense. See Table 2-1 in chapter 2

of Army Regulation 638-2 - Care and Disposition of Remains and Disposition of

Personal Effects) for detailed information regarding who is eligible and under what

circumstances.

Burial Benefits for Women and Minority Veterans:

(http://www.cem.va.gov/Women_and_Minority_Veterans.asp)

For those who served in a branch of the military and were discharged under conditions

other than dishonorable you may be eligible for burial in a Department of Veterans Affairs

National Cemetery.

Female veterans married to a veteran are entitled to their own separate grave, headstone

or marker, burial flag and Presidential Memorial Certificate. However, they may choose to

be buried in the same gravesite as their spouse.

MONETARY BENEFITS THROUGH DOD OR VA

Chart Summarizing Benefits and Application Forms:

BENEFIT DESCRIPTION

APPLICATION FORMS

Dependency Indemnity

Compensation (DIC)

(Includes Spouse of National Guard

or Reserve Member)

VA Form 21-534

Death Pension

VA Form 21-534

Survivors' and Dependents'

Educational Assistance

(DEA)

VA Form 22-5490

Home Loan Guaranty

VA Form 26-1817

VA Form 10-10d

MEDICAL - CHAMPVA

VA Form 10-7959c

Request Copy of DD Form 214

Bereavement Counseling

Specialized Vocational Training

To Claim VA

Life Insurance

SGLI/VGLI Claims

VA Form 22-5490

Separate Claim Forms

are used for (SGLI/VGLI).

For all others, click here.

Financial Counseling Available

for SGLI/VGLI Beneficiaries

Burial Benefits a Spouse

Should Consider Upon

the Death of the Veteran

Separate Forms are

Available Through the

National Cemetery Administration

Web Site

Burial Flags

VA Form 21-2008

Related Benefits

TRICARE Dental Program

Social Security Administration

Civil Service Preference

Commissary and Exchange Privileges

Montgomery GI Bill Death Benefit

Death Gratuity

Military Records and Medals

Burial at Arlington National Cemetery

Internal Revenue Service information

Death Gratuity:

A lump sum gratuitous payment made by the military to designated beneficiaries of a

service member who dies on active duty including full-time active guard/reserve

personnel; USAR personnel traveling directly en route to or from or participating in

annual training (AT), active duty training (ADT), initial active duty training (IADT), active

duty for special work (ADSW), special active duty training (SADT) or inactive duty

training (IDT) and ARNG personnel traveling directly en route to or from or participating

in AT, ADT, full time national guard duty (FTNGD), temporary tour of active duty (TTAD),

IADT or IDT. The Soldier can designate up to ten individuals, without regard to

relationship, and allocate amounts in ten-percent increments to each designated

individual listed on the Soldier's DD Form 93.Its purpose is to help the survivors in their

readjustment and to aid them in meeting immediate expenses incurred. At the present

time, the amount of Death Gratuity is $100,000.00.

This amount is excludable from gross income for tax purposes. This change is retroactive

to October 7, 2001. If the Soldier did not designate any beneficiaries for the Death

Gratuity on the DD Form 93, then the death gratuity amount is made payable to survivors

of the deceased in this order:

The member's lawful surviving spouse.

If there is no spouse, to the child or children of the member, regardless of age or

marital status, in equal shares.

If none of the above, to the parents, or brothers and/or sisters, or any

combination as designated by the deceased member.

Father or mother through adoption, in equal shares.

Any person who stood "in loco parentis" for not less than one year at any time

before the deceased member's entry into active service.

Brothers and sisters of half blood and those through adoption.

Surviving parents, in equal shares.

Surviving brothers and sisters, in equal shares

If a designated beneficiary dies before receiving the amount to which entitled, such

amount is then paid to the living survivor(s) first listed above.

If a Soldier dies from a Service-connected injury/illness, a claim should be made to the VA

for their Death Gratuity determination.

Dependency and Indemnity Compensation (DIC) :

What Is DIC?

DIC is a monthly benefit paid to eligible survivors of a

military service member who died while on active duty, active duty for training,

or inactive duty training, OR

veteran whose death resulted from a service-related injury or disease, OR

veteran whose death resulted from a non service-related injury or disease, and

who was receiving, or was entitled to receive, VA Compensation for serviceconnected disability that was rated as totally disabling

for at least 10 years immediately before death, OR

since the veteran’s release from active duty and for at least five years

immediately preceding death, OR

for at least one year before death if the veteran was a former prisoner of

war who died after September 30, 1999.

retiree when:

o a disease or injury incurred or aggravated while on active duty or active

duty for training.

o An injury incurred or aggravated in the line of duty while on inactive

duty training.

o A disability otherwise compensable under laws administered by the VA.

o DIC payments may also be authorized for survivors of retirees who were

totally service-connected disabled at time of death but whose deaths

were not the result of their service-connected disability.

o The survivor qualifies if:

o The retiree was continuously rated totally disabled for a period of 10 or

more years immediately preceding death.

o The retiree was so rated for a period of not less than five years from the

date of discharge from military service.

o Payments under this provision are subject to offset by the amount

received from judicial proceedings brought on account of the retiree's

death.

Death cannot be the result of willful misconduct.

Who Is Eligible?

The surviving spouse if he or she:

validly married the veteran before January 1, 1957, OR

was married to a service member who died on active duty, active duty for

training, or inactive duty training, OR

married the veteran within 15 years of discharge from the period of military

service in which the disease or injury that caused the veteran’s death began or

was aggravated, OR

was married to the veteran for at least one year, OR

had a child with the veteran, AND

cohabited with the veteran continuously until the veteran’s death or, if separated,

was not at fault for the separation, AND

is not currently remarried.*

Note: A surviving spouse who remarries on or after December 16, 2003, and on or

after attaining age 57, is entitled to continue to receive DIC.

Reinstatement of DIC Eligibility Based Upon Terminated Marital Relationships.

Remarriage of a surviving spouse does not bar the payment of DIC to the surviving

spouse if:

The marriage was void, or annulled by a court having basic authority to render

annulment decrees.

On or after 1 January 1971, remarriage of a surviving spouse terminated prior

to 1 November 1990, or terminated by legal proceedings started prior to 1

November 1990, by the surviving spouse. The marriage had to be terminated

by death, or dissolved by a court with basic authority to render divorce decrees.

On or after 1 January 1971, the fact that a surviving spouse had lived with

another person and had held themselves out openly to the public as the spouse

of such other person, if the relationship terminated prior to 1 November 1990.

On or after 1 January 1971, the fact that DIC to a surviving spouse may

previously have been barred because his or her conduct or a relationship into

which he or she had entered had raised an inference or presumption that he or

she had remarried or had been determined to be open and notorious

adulterous cohabitation, or similar conduct, if the relationship terminated prior

to 1 November 1990.

The surviving child(ren), if he/she is:

not included on the surviving spouse’s DIC

unmarried AND

under age 18, or between the ages of 18 and 23 and attending school.

Note: Certain helpless adult children are entitled to DIC. Call the toll-free number

below for the eligibility requirements.

The surviving parent(s) may be eligible for an income-based benefit also.

How Much Does VA Pay?

The basic monthly rate of DIC is $1,154 for an eligible surviving spouse. The rate is

increased for each dependent child, and also if the surviving spouse is housebound or

in need of aid and attendance. VA also adds a transitional benefit of $286 to the

surviving spouse’s monthly DIC if there are children under age 18. The amount is

based on a family unit, not individual children. The amount of the DIC payment for

parents vary according to the number of parents, the amount of their individual or

combined total annual income, and whether they live together or if remarried, living

with a spouse.

The surviving spouse and parents who receive DIC may be granted a special

allowance for aid and attendance if a patient is in a nursing home, disabled, or blind

and needs or requires the regular aid and attendance of another person. If they are

not so disabled as to require the regular aid and attendance of another person but

who, due to disability, are permanently housebound, they may be granted additional

special allowances. DIC payments to a surviving spouse are payable for life, as long as

the spouse does not remarry. Should the surviving spouse remarry, payments are

terminated for life unless the marriage is later terminated by death or divorce.

Benefit rate tables, including those for children alone and parents, can be found on the

Internet at http://www.vba.va.gov/bln/21/Rates or call the toll-free number below.

How Should a Claimant Apply?

Claimants should complete VA Form 21-534 Application for Dependency and

Indemnity Compensation, Death Pension and Accrued Benefits by a Surviving Spouse or

Child.

For More Information, Call Toll-Free 1-800-827-1000.

Denial of Claim for DIC. If the VA denies your claim for DIC benefits, you may file an

appeal with the Board of Veterans' Appeals. The appeal must be filed within one year

from the date of the notification of a VA decision to file an appeal. The first step in the

appeal process is for you to file a written notice of disagreement with the VA regional

office that made the decision. This is a written statement that you disagree with the

VA's decision. Following receipt of the written notice, the VA will furnish you a

"Statement of the Case" describing what facts, laws and regulations were used in

deciding the case. To complete the request for appeal, you must file a "Substantive

Appeal" within 60 days of the mailing of the Statement of Case, or within one year

from the date the VA mailed the its decision, whichever period ends later.

Death Pension:

Death Pension is a needs based benefit paid to an unremarried surviving spouse, or an

unmarried child of a deceased wartime veteran.

Eligibility

One may be eligible if:

the deceased veteran was discharged from service under other than

dishonorable conditions, AND

the deceased veteran served at least 90 days of active military service 1 day of

which was during a war time period. If he or she entered active duty after

September 7, 1980, generally he or she must have served at least 24 months or the

full period for which called or ordered to active duty. (There are exceptions to this

rule.) AND

you are the surviving spouse or unmarried child of the deceased veteran,

AND

your countable income is below a yearly limit set by law (The yearly limit on income

is set by Congress).

If you do not initially qualify, you may reapply if you have un-reimbursed medical expenses

during the twelve month period after VA receives your claim that bring your countable

income below the yearly income limit. (These are expense you have paid for medical

services or products for which you will not be reimbursed by Medicare or private medical

insurance.)

Are there age requirements, or restrictions?

An unremarried spouse can be any age.

A child must be:

o under 18, or

o in school and under 23, or

o was incapable of self support before the age of 18.

What is "countable income" for pension eligibility?

This includes income received from most sources by the surviving spouse and any eligible

children. It includes earnings, disability and retirement payments, interest and dividends,

and net income from farming or business.

There is a presumption that all of a child's income is available to or for the surviving

spouse. VA may grant an exception in hardship cases.

Certain expenses like medical expenses may be excluded from your annual income to

lower the total countable income.

What about net worth?

Net worth means the net value of the assets of the surviving spouse and his or her

children. It includes such assets as bank accounts, stocks, bonds, mutual funds and any

property other than the surviving spouse's residence and a reasonable lot area. There is

no set limit on how much net worth a surviving spouse and his or her children can have,

but net worth cannot be excessive. The decision as to whether a claimant's net worth is

excessive depends on the facts of each individual case. All net worth should be reported

and VA will determine if a claimant's assets are sufficiently large that the claimant could

live off these assets for a reasonable period of time. VA's needs-based programs are not

intended to protect substantial assets or build up an estate for the benefit of heirs.

Are there any exclusions to income or deductions that may be made to reduce

countable income?

Yes, there are exclusions. The following are examples of the types of exclusions or

deductibles to countable income:

Final expenses of the veteran's last illness and burial paid by the surviving spouse or

eligible children.

Public assistance such as Supplemental Security Income is not considered income.

Many other specific sources of income are not considered income, however all

income should be reported. VA will exclude any income that the law allows.

A portion of un-reimbursed medical expenses paid by the claimant after VA receives

your pension claim may be deducted.

Certain other expenses, such as a surviving spouse's education expenses, and in

some cases, a portion of the educational expenses of a child over 18 are deductible.

What are Aid and Attendance and Housebound benefits? How Do I Apply?

Aid and Attendance is a benefit paid in addition to monthly pension when:

o The claimant requires the aid of another person in order to perform personal

functions required in everyday living, such as bathing, feeding, dressing,

attending to the wants of nature, adjusting prosthetic devices, or protecting

himself/herself from the hazards of his/her daily environment, OR,

o The claimant is bedridden, in that his/her disability or disabilities requires

that he/she remain in bed apart from any prescribed course of convalescence

or treatment, OR,

o The claimant is a patient in a nursing home due to mental or physical

incapacity, OR,

o The claimant is blind or so nearly blind as to have corrected visual acuity of

5/200 or less, in both eyes, or concentric contraction of the visual field to 5

degrees or less.

Housebound is paid to a claimant when:

o The claimant is substantially confined to his/her immediate premises

because of permanent disability.

The survivor may not receive Aid and Attendance benefits and Housebound benefits at the

same time.

How to Apply for Aid and Attendance and Housebound:

You may apply for Aid and Attendance or Housebound benefits by writing to the VA

regional office having jurisdiction of the claim. That would be the office where

you filed a claim for pension benefits. If the regional office of jurisdiction is not

known, you may file the request with any VA regional office.

You should include copies of any evidence, preferably a report from an attending

physician validating the need for Aid and Attendance or Housebound type care.

The report should be in sufficient detail to determine whether there is disease or

injury producing physical or mental impairment, loss of coordination, or conditions

affecting the ability to dress and undress, to feed oneself, to attend to sanitary needs,

and to keep oneself ordinarily clean and presentable.

In addition, it is necessary to determine whether the claimant is confined to the

home or immediate premises.

Whether the claim is for Aid and Attendance or Housebound, the report should

indicate how well the individual gets around, where the individual goes, and

what he or she is able to do during a typical day.

How much does VA pay for Death Pension?

VA pays you the difference between your countable income and an annual rate of payment

established by Congress. VA provides an on-line table at

http://www.vba.va.gov/bln/21/rates/pen02.htm of annual incomes that would qualify

you for pension. This difference is generally paid in 12 equal monthly payments rounded

down to the nearest dollar. Click here to see an example of how VA arrives at your death

pension amount.

How do I apply for Death Pension benefits?

You can apply by filling out VA Form 21-534, Application for Dependency and Indemnity

Compensation, Death Pension and Accrued Benefits by Surviving Spouse or Child (PDF

version). Make sure you download parts 1 and 2 of the application as well as the

instructions for filling out the forms. If available, attach copies of dependency records

(marriage & children's birth certificates).

You must send the completed application and any copies of other documents to the VA

regional office that serves your area of residence. Please click here to find the office of

jurisdiction.

Montgomery GI Bill MGIB Death Benefit:

Active Duty

The Department of Veterans Affairs (DVA) (VA) will pay a special Montgomery GI Bill death

benefit to a designated survivor in the event of the service-connected death of an individual

while on active duty. The deceased must either have been entitled to educational assistance

under the Montgomery GI Bill program or a participant in the program who would have

been so entitled but for the high school diploma or length of service requirement. The

amount paid will be equal to the deceased member's actual military pay reduction less any

educational benefits paid. If you are eligible to receive the death benefit, submit a letter,

along with proof of relationship and a copy of the DD Form 1300, Report of Casualty, to the

appropriate VA Regional Office listed below. The death benefit is made in "by-law" fashion

to the spouse, children, and parents, and will not be paid to anyone else in the "by-law"

chain.

Retiree - (Veterans Educational Assistance Program (VEAP) and Montgomery GI Bill

Refunds)

If the service member contributed to either of these programs you may be entitled to a

death refund. To receive the refund, submit a letter, along with proof of relationship and a

copy of the death certificate, or DD Form 1300, Report of Casualty, for retiree deaths

occurring within 120 days after retiring, to the appropriate VA Regional Office listed below.

The refund is made in "by-law" fashion to the spouse, children, and parents, and will not be

paid to anyone else in the "by-law" chain.

Insurance Navigation Page

(https://www.hrc.army.mil/TAGD/Insurance%20Navigation%20Page)

VA has responsibility for veterans' and service members' life insurance programs. Listed

below are the six life insurance programs managed by VA. The first four programs listed

are closed to new issues. The last two are still issuing new policies. Click on any program

title for a brief background description.

Veterans

Insured

Years

Issued

United States Government Life Insurance

WWI

1919 to 1951

National Service Life Insurance

WWII

1940 to 1951

Veterans' Special Life Insurance

Korean War

1951 to 1956

Veterans' Reopened Insurance

Disabled

WWII

and Korean

War

1965 to 1966

Insurance Program

Service-Disabled Veterans Insurance

Disabled

1951 to

Present

Veterans' Mortgage Life Insurance

Severely

Disabled

1971 to

Present

Filing a Death Claim with VA other than SGLI/VGLI:

http://www.insurance.va.gov/gli/claims/death.htm

SGLI/VGLI site: http://www.insurance.va.gov/sgliSite/default.htm

Reserve Component Survivor Benefit Plan RCSBP:

Active Duty

A monthly annuity paid by the Army to the surviving spouse or, in some cases, eligible

children, of a Reserve Component member who dies and has completed the satisfactory

years of service that qualified the member for retired pay at age 60. The member must have

made an election within 90 days of notification of eligibility to participate in the program.

Members on an active guard/reserve (AGR) tour, are eligible to participate in the plan.

Coverage is not automatic unless the member dies before the 90 day period established by

law. The initial annuity paid to a surviving spouse is equal to 55 percent of the retired pay

to which the member would have been entitled at age 60, reduced by the Reserve Portion

Cost.

Retiree

A monthly annuity paid to the surviving spouse or, in some cases, eligible children, of a

Reserve Component member who dies and has completed the satisfactory years of service

that qualified the member for retired pay at age 60. The program allows Reserve

Component personnel eligible for retired pay at age 60 to participate upon completion of

the satisfactory years of service. The member eligible for retired pay at age 60 designates

the beneficiaries. The beneficiary choices are the same as for SBP. Participation in the

program is voluntary. The three options available to the member at time of election are:

Option A - Member declines to make an election until age 60. If death occurs prior to

age 60, no annuity is payable.

Option B - Provides for coverage for an annuity to begin on the 60th anniversary of

member's birth, if death occurs before age 60, or to begin immediately when death

occurs after age 60.

Option C - Provides for coverage for an annuity to begin immediately, whether death

occurs before or after age 60.

A Reserve Component member eligible for retired pay under Title 10, United States Code,

Section 12731, may also have survivor benefit coverage under his/her civil service

retirement income. There is no conflict of interest which would prohibit simultaneous

coverage.

Survivor Benefit Plan for Survivors of Soldiers Who Die on Active Duty:

Active Duty

Section 645 of the National Defense Authorization Act for Fiscal Year 2004 expanded

Section 1448(d), Title 10, United States Code (USC), to provide a Survivor Benefit Plan

(SBP) annuity for the surviving dependent children of a member who dies while on active

duty but is not yet eligible for retirement, instead of the surviving spouse provided the

Secretary concerned, in consultation with the surviving spouse, determines such an

annuity is appropriate.

For active duty deaths occurring on or after November 24, 2003, Public Law 108-136

changed Title 10 of United States Code to reflect the following Survivor Benefit Plan

eligibility:

1. Spouse.

2. Former Spouse if court ordered.

3. Child only when there is no surviving spouse, or if the spouse requests the Service

Secretary to make a Child only election.

4. Insurable Interest when there is no qualified survivor under Section 1448d, Title 10,

United States Code, the Service Secretary can deem an election for a survivor who

meets the dependent eligibility criteria of Section 1072(2), Title 10, United States

Code.

The Casualty Assistance Officer (CAO) will make arrangements for a Retirement Services

Officer to provide a complete briefing as to eligible surviving family members.

Retiree

A monthly annuity paid by the Army. This program allowed personnel who retired on or

after September 21, 1972, or before if they enrolled in the program during an open season,

to receive reduced retired pay in order to provide a monthly annuity to their beneficiaries

after the death of the retiree. The retiree designated the beneficiaries. Participation in this

program was voluntary. SBP provides an eligible surviving spouse or former spouse

financial security similar to the financial security a retiree had in retired pay--a cost-ofliving-adjusted monthly income for life.

Survivor Benefit Plan and Reserve Component SBP Factors:

Active Duty

Should the surviving spouse remarry before age 55, the annuity is paid in equal shares to

eligible children under age 18, or under age 22 if a full-time student, unless handicapped.

The coverage stops when there are no eligible children. A dependent child may be an

adopted child, stepchild, grandchild, foster child, or recognized natural child who lived with

the member in a regular parent-child relationship. A child fully disabled before age 18, or

before age 22 if a full-time student when the disability occurred, is an eligible beneficiary

so long as the disability exists and the child remains incapable of self-support. The Defense

Finance and Accounting Service (DFAS-DE) reinstates a child's annuity when a child

between the ages of 18 and 22 reenters school on a full-time basis. Marriage at any age

terminates a child's eligibility. The monthly annuity for children is 55 percent and is not

reduced by DIC.

Tax Implications. Survivor annuities are taxable income. You will receive a tax statement

from DFAS-DE at the end of the year. The statement will show the full amount of the

annuity payments you received and the total amount of tax withheld during the year.

Unless you elect otherwise, the amount of federal income tax withheld (FITW) will be as if

you were a married individual claiming three exemptions. If you want your FITW changed

at a later date, you must complete a new TD-Form W-4P, Withholding Certificate for

Pension or Annuity Payments, showing the changes, and mail it to DFAS-DE/FRB, 6760 E.

Irvington Place, Denver CO 80279-6000. DFAS-DE withholds a 30 percent Federal income

tax on annuities paid to nonresident aliens unless the beneficiary resides in a country that

has a tax treaty with the United States specifying a different withholding rate. Address

questions to the Internal Revenue Service, Assistant Commissioner (International), ATTN:

IN:C:TPS, 950 L'Enfant Plaza South, SW, Washington DC 20024-2123, or contact the nearest

American Embassy. Annuities may be subject to Federal estate taxes. Beneficiaries should

address tax questions to a legal assistance officer or the nearest Internal Revenue Service

office. A certificate of continued eligibility form will be sent to you each year prior to your

birthday. Complete and return the form promptly so DFAS-DE can continue your annuity

without interruption. Read the instructions on the form and make sure you have completed

it correctly. Sign and date the form and send it to DFAS-DE/FRB, 6760 E. Irvington Place,

Denver CO 80279-6000.

Dependency and Indemnity Compensation (DIC) Offset. DFAS-DE reduces a surviving

spouse's annuity by the amount of DIC the Department of Veterans Affairs (VA) awards and

pays the surviving spouse. The SBP annuity is not reduced by the amount of a child's DIC

entitlement.

The claim forms required to apply for this benefit are DD Form 1884, Application for

Annuity Under the Retired Serviceman's Family Protection Plan (RSFPP) and/or Survivor

Benefit Plan (SBP), TD-Form W-4P, Withholding Certificate for Pension or Annuity

Payments, and SF 1199A, Direct Deposit Sign-Up Form. DFAS-DE may require additional

documents in order to establish an annuity (i.e., Representative Payee documentation;

school certification; physician's statement for disabled child over age 18).

Retiree

If the retiree elected to participate in SBP or RCSBP, they selected one of the election

choices listed below:

Spouse: To receive SBP annuity, a surviving spouse must have been married to the

retiree on the date they retired and the date the retiree died. If the marriage took

place after the date of retirement, the spouse must have been married to the retiree

for at least 1 year or be the parent of a child of the marriage. The annuity is paid

until the spouse dies, but is suspended upon remarriage before age 55. The annuity

to a surviving spouse may be reinstated if the subsequent marriage ends in death or

divorce. The annuitant must send a certified copy of the divorce decree or death

certificate to the Defense Finance and Accounting Service-Denver (DFAS-DE) to

reinstate the annuity. If a second SBP benefit results from the remarriage, the

surviving spouse must elect which of the two SBP benefits to receive. Should the

surviving spouse remarry at age 55 or older, the annuitant will continue to receive

the monthly annuity. The surviving spouse must notify DFAS-DE (DFAS-DE/FRB,

6760 East Irvington Place, Denver, CO 80279-6000) of any changes in marital status.

Spouse and Child: The spouse is the primary beneficiary. Should the surviving

spouse remarry before age 55, the annuity is paid in equal shares to eligible children

under age 18, or under age 22 if a full-time student, unless handicapped. The

coverage stops when there are no eligible children. A dependent child may be an

adopted child, stepchild, grandchild, foster child, or recognized natural child who

lived with the member in a regular parent-child relationship. A child the retiree

acquires after retirement is automatically covered if the member previously elected

child coverage. A child disabled before age 18, or before age 22 if a full-time student

when the disability occurred, is an eligible beneficiary so long as the disability exists

and the child remains incapable of self-support. The monthly annuity for children is

55 percent and is not reduced by Dependency and Indemnity Compensation (DIC).

{C}DFAS-DE reinstates a child's annuity when a child between the ages of 18 and 22

reenters school on a full-time basis.

Child: Covers only the retiree's dependent children as stated in Air Force Instruction

36-3002, paragraph 23.1.2.

Former Spouse. A former spouse election bars payment of an annuity to a surviving

spouse. This option covers a former spouse if the retiree was required by court

order, or spousal agreement, to provide an annuity to that former spouse, or if the

retiree had elected to provide such an annuity. DFAS-DE pays the annuity to the

former spouse the retiree named as beneficiary who was the member's former

spouse at retirement, the member's spouse beneficiary at retirement but divorced

from the member after retirement, or married to the member after retirement for at

least 1 year before the divorce, or is the parent of a child born of the marriage. A

surviving former spouse may remarry after age 55 and continue to receive the

monthly annuity for life. If the former spouse remarries before age 55, the annuity is

suspended, but may be reinstated if the subsequent marriage ends in divorce or

death. The annuitant must send a certified copy of the divorce decree or death

certificate to DFAS-DE to reinstate the annuity. The former spouse must notify

DFAS-DE (DFAS-DE/FRB, 6760 E. Irvington Place, Denver, CO 80279-6000) of any

changes in marital status. If a second SBP benefit results from the remarriage, the

surviving former spouse must elect which of the two SBP benefits to receive.

Former Spouse and Child. When a retiree elected former spouse and child coverage,

only eligible children resulting from the marriage of the retiree and former spouse

are eligible beneficiaries. The former spouse is the primary beneficiary. Should the

surviving former spouse remarry before age 55, the annuity is paid in equal shares

to eligible children under age 18, or under age 22 if a full-time student, unless

handicapped. The coverage stops when there are no eligible children. A dependent

child may be an adopted child, stepchild, grandchild, foster child, or recognized

natural child who lived with the member in a regular parent-child relationship. A

child disabled before age 18, or before age 22 if a full-time student when the

disability occurred, is an eligible beneficiary so long as the disability exists and the

child remains incapable of self-support. DFAS-DE reinstates a child's annuity when a

child between the ages of 18 and 22 reenters school on a full-time basis. Marriage at

any age terminates a child's eligibility.

Insurable Interest. A person who stands to gain some financial benefit or advantage

from the continuance of the retiree's life. If the retiree was not married and had no

children at the time of retirement, they could have elected coverage for an

"insurable interest" person. This had to be a natural person (not a company,

organization, fraternity, etc.) with a financial interest in the retiree's life. It could be

a close relative or a business partner. If the retiree was not married and had only

one child, they could elect insurable interest coverage for that child regardless of the

child's age or dependency status.

Level of Coverage. The SBP annuity a surviving spouse, former spouse, or children

receives depends on the amount of retired pay (base amount) selected by the retiree

as the basis for coverage. The base amount selected could be the retiree's full

monthly retired pay or just a portion, down to a minimum of {C}$300. The base

amount for SSBP or insurable interest coverage is the retiree's gross retired pay.

The value of the annuity increases by cost of living adjustments, keeping up with the

effects of inflation. Payments begin the day after the retiree's death and stop on the

last day of the month before the month that a survivor's eligibility ends.

Computations for Spouse and Former Spouse Annuity: DFAS-DE computes spouse

and former spouse annuities under a two-tier system. The annuity is 55 percent of

the base amount if the annuitant is under age 62 and later reduced to 35 percent on

the 1st day of the month after the spouse or former spouse turns age 62 The annuity

for a former spouse whose divorce was finalized before 30 November 1989 is not

reduced at age 62, if the member was retired or retirement eligible on or before 1

October 1985. If the member retired or was retirement eligible on or after 2 October

1985, DFAS-DE computes the annuity for the surviving spouse or former spouse

beneficiary, if divorced after 30 November 1989, under both the two-tier system

and the Social Security offset system. The beneficiary receives an annuity from

whichever system pays the greater benefit:

Under the Social Security Offset System, the SBP annuity is reduced by the amount

of Social Security the survivor would be entitled to receive based solely on the

retiree's military service performed after 1956. The offset may not exceed 40

percent of the value of the SBP

The two-tier system affects all retirees initially becoming participants in the SBP on

or after 2 October 1985, and applies only to spouse and former spouse annuity

payments.

Tax Implications. Survivor annuities and any cost refunds are taxable income. You

will receive a tax statement from DFAS-DE at the end of the year. The statement will

show the full amount of the annuity payments you received and the total amount of

tax withheld during the year.

Unless you elect otherwise, the amount of federal income tax withheld (FITW) will

be as if you were a married individual claiming three exemptions. If you want your

FITW changed at a later date, you must complete a new TD-Form W-4P,

Withholding Certificate for Pension or Annuity Payments, showing the changes, and

mail it to DFAS-DE/FRB, 6760 East Irvington Place, Denver, CO 80279-6000.

DFAS-DE withholds a 30 percent Federal income tax on annuities paid to

nonresident aliens unless the beneficiary resides in a country that has a tax treaty

with the United States specifying a different withholding rate. Address questions to

the Internal Revenue Service, Assistant Commissioner (International), ATTN:

IN:C:TPS, 950 L'Enfant Plaza South, SW, Washington, DC 20024-2123, or contact the

nearest American Embassy.

Annuities may be subject to Federal estate taxes. Beneficiaries should address tax

questions to a legal assistance officer or the nearest Internal Revenue Service office.

A certificate of continued eligibility (COE) form will be sent to you each year prior to

your birthday. Complete and return the form promptly so DFAS-DE can continue

your annuity without interruption. Read the instructions on the form and make sure

you have completed it correctly. Sign and date the form and send it to DFASDE/FRB, 6760 East Irvington Place, Denver, CO 80279-6000.

DIC Offset. DFAS-DE reduces a spouse's annuity by the amount of DIC the VA awards

and pays the spouse based on the service-connected death of the retiree who

provided the SBP. If the DIC exceeds the SBP amount, the spouse will receive all SBP

premiums paid by the retiree. If the SBP annuity exceeds the DIC payment, the

spouse will receive only the amount of SBP premiums paid for the portion of the

SBP that is replaced by DIC. DFAS-DE does not reduce the spouse's SBP annuity if

the spouse's DIC derives from the service of another member:

o A spouse over age 55 who forfeits DIC by remarrying before age 57 may have

the SBP reinstated by repaying the costs that DFAS-DE refunded when the

DIC was awarded. The reinstated SBP annuity is effective on the date the DIC

expires. The survivor may repay the premiums in a lump sum or

installments. DFAS-DE deducts installment payments from the SBP annuity.

o DIC does not offset an SSBP annuity.

o The SBP annuity is not reduced by the amount of a child's DIC entitlement.

Civil Service Employees. A member who retired from Civil Service and waived their

military retired pay to combine civilian and military service credits could not

participate in both SBP and the Civil Service survivor annuity program. The member

had to decline the Civil Service survivor coverage and continue in the SBP, or

participate in the Civil Service survivor program at any level and have SBP coverage

suspended. If the waiver of military retired pay was terminated for any reason, SBP

coverage was resumed when the member began to receive retired pay again.

An SBP participant who did not waive military retired pay on retirement from Civil

Service had to continue SBP participation. The member could also elect coverage

under the Civil Service annuity plan and a survivor could receive annuities from

both plans. If the retiree participated in the SBP, the claim forms required to apply

for this benefit are DD Form 1884, Application for Annuity Under the Retired

Serviceman's Family Protection Plan (RSFPP) and/or Survivor Benefit Plan (SBP),

TD Form W-4P, Withholding Certificate for Pension or Annuity Payments, and SF

1199A, Direct Deposit Sign-Up Form, or FMS Form 2231, FAST START DIRECT

DEPOSIT. DFAS-DE may require additional documents in order to establish an

annuity (i.e., Representative Payee documentation; school certification; physician's

statement for disabled Veteran.

Special Notes on Definitions Applicable to Certain VA Benefits:

Parent

Parents who are dependent on a veteran with a service-connected disability, or whose

child died in-service or from a service-connected disability, may be entitled as dependents

on the veterans compensation award or to Dependency and Indemnity Compensation (DIC)

if they are in financial need. Parents may be biological, step, adopted, or in loco parentis.

Eligibility criteria, see 38 CFR §§3.5 Dependency and Indemnity Compensation (DIC), 3.59

(Parent), or 3.209 (Birth).

Rates, see Compensation and Parents Dependency and Indemnity Compensation (DIC) Rate

Tables.

§3.59 Parent”

(a) The term “parent” means a natural mother or father (including the mother of an

illegitimate child or the father of an illegitimate child if the usual family relationship