RecessVisitsTalkingPoints2015Final

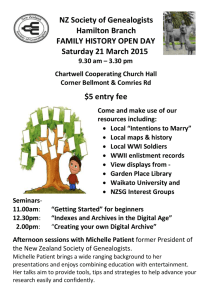

advertisement

Concerns about Section 203 of the 2013 Bipartisan Budget Agreement which requires Certification by the Department of Commerce to Access the Death Master File. Sec. 203 of the Bipartisan Budget Agreement enacted into law December 2013 restricts public access to the Death Master File (DMF) which is the only viable national death data base. The DMF has been a major tool to prevent fraud in financial transactions by verifying that the person applying for credit is not using the identity of a deceased person. Over the last thirty years the DMF has also been used for time-sensitive research by many non-financial industries including academia, social and medical researchers, life insurance companies, and professional and forensic genealogists. The requirements and costs of Certification under Section 203 have created a financial burden on many of these small business professionals. Those who cannot afford to become certified have delayed their important work for three years. Those who have used the new limited data base provided by NTIS, have also found the search engine inadequate as compared to services previously provided by data aggregators who have more robust search engines and are able to distribute the data in more searchable formats than the Department of Commerce. Since the Social Security Number (SSN) is the only part of the DMF that can lead to identity theft, the best solution is to redact the SSN from the Death Master File (DMF) for the three year embargo period. Action Needed: An Amendment to Sec. 203 which states the following: The Department of Commerce shall release all information included in the Death Master File to data aggregators upon their request for use in medical, historical, social, and genealogical research, except that during the embargo period established by paragraph (a) of Section 203 [of the 2013 Bipartisan Budget Act] the Social Security Number shall not be released. The Importance of a National Death Database Because there is no other viable national death database, the Social Security Administration must be required to release all the other information available including middle name or initial, the state where the social security number was issued, and the last residence. This information was discontinued in November 2011 and is necessary to identify the correct individual, especially if the person being researched has a common name. Better Ways to Prevent Identity Theft The Treasury Inspector General Tax Administration (TIGTA) reports for 2011 and 2012 say less than 2% of all fraudulent tax refunds involved the deceased. Living individuals are the victims of 98% of the tax fraud. What Sec. 203 is designed to achieve, is already being accomplished by the Internal Revenue Service through the use of filters which detect information inconsistent with previous returns. We encourage Congress to provide the IRS with sufficient funds to continue to improve the filters and red flags to prevent the high cost of tax fraud from identity theft of the deceased and the living. The Records Preservation and Access Committee (RPAC), is a national committee sponsored by the Federation of Genealogical Societies (FGS), the International Association of Jewish Genealogical Societies (IAJGS), and the National Genealogical Society (NGS) and supported by the Association of Professional Genealogists (APG), the Board for Certification of Genealogists (BCG), the American Society of Genealogists (ASG), and the International Commission for the Accreditation of Professional Genealogists (ICAPGen). For more information go to http://www.fgs.org/rpac or contact RPAC at access@fgs.org. February 10, 2016