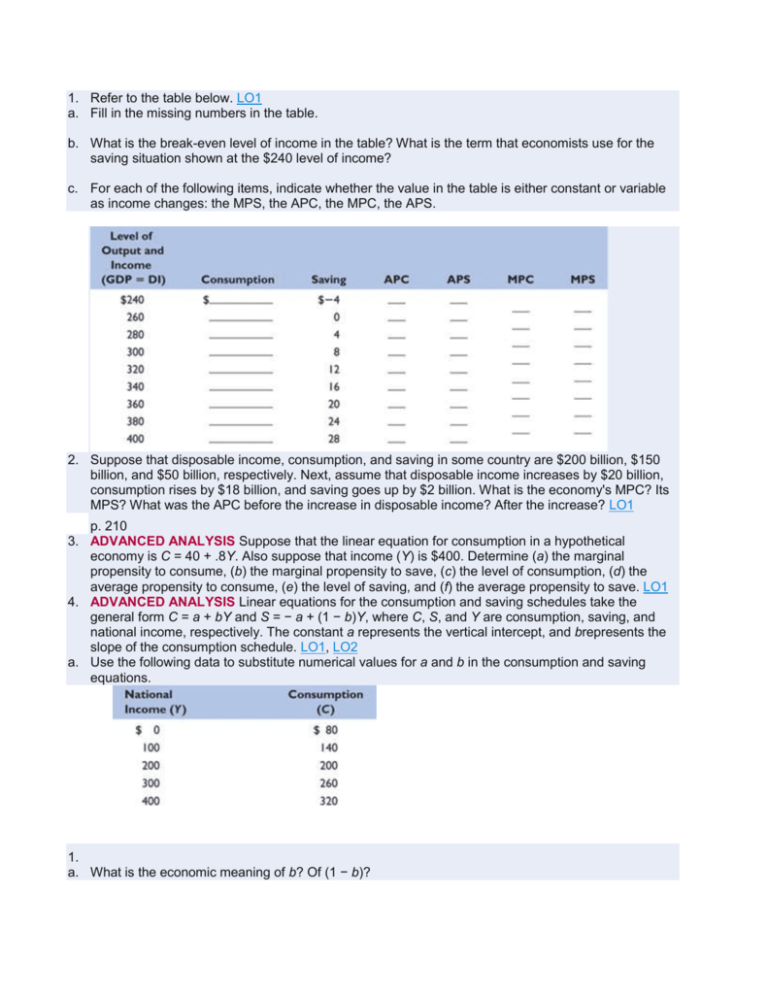

Refer to the table below. LO1 Fill in the missing numbers in the table

advertisement

1. Refer to the table below. LO1 a. Fill in the missing numbers in the table. b. What is the break-even level of income in the table? What is the term that economists use for the saving situation shown at the $240 level of income? c. For each of the following items, indicate whether the value in the table is either constant or variable as income changes: the MPS, the APC, the MPC, the APS. 2. Suppose that disposable income, consumption, and saving in some country are $200 billion, $150 billion, and $50 billion, respectively. Next, assume that disposable income increases by $20 billion, consumption rises by $18 billion, and saving goes up by $2 billion. What is the economy's MPC? Its MPS? What was the APC before the increase in disposable income? After the increase? LO1 p. 210 3. ADVANCED ANALYSIS Suppose that the linear equation for consumption in a hypothetical economy is C = 40 + .8Y. Also suppose that income (Y) is $400. Determine (a) the marginal propensity to consume, (b) the marginal propensity to save, (c) the level of consumption, (d) the average propensity to consume, (e) the level of saving, and (f) the average propensity to save. LO1 4. ADVANCED ANALYSIS Linear equations for the consumption and saving schedules take the general form C = a + bY and S = − a + (1 − b)Y, where C, S, and Y are consumption, saving, and national income, respectively. The constant a represents the vertical intercept, and brepresents the slope of the consumption schedule. LO1, LO2 a. Use the following data to substitute numerical values for a and b in the consumption and saving equations. 1. a. What is the economic meaning of b? Of (1 − b)? b. Suppose that the amount of saving that occurs at each level of national income falls by $20 but that the values of b and (1 − b) remain unchanged. Restate the saving and consumption equations inserting the new numerical values, and cite a factor that might have caused the change. 2. Use your completed table for problem 1 to solve this problem. Suppose the wealth effect is such that $10 changes in wealth produce $1 changes in consumption at each level of income. If real estate prices tumble such that wealth declines by $80, what will be the new level of consumption and saving at the $340 billion level of disposable income? The new level of saving? LO2 3. Suppose a handbill publisher can buy a new duplicating machine for $500 and the duplicator has a 1-year life. The machine is expected to contribute $550 to the year's net revenue. What is the expected rate of return? If the real interest rate at which funds can be borrowed to purchase the machine is 8 percent, will the publisher choose to invest in the machine? Will it invest in the machine if the real interest rate is 9 percent? If it is 11 percent? LO3 4. Assume there are no investment projects in the economy that yield an expected rate of return of 25 percent or more. But suppose there are $10 billion of investment projects yielding expected returns of between 20 and 25 percent; another $10 billion yielding between 15 and 20 percent; another $10 billion between 10 and 15 percent; and so forth. Cumulate these data and present them graphically, putting the expected rate of return (and the real interest rate) on the vertical axis and the amount of investment on the horizontal axis. What will be the equilibrium level of aggregate investment if the real interest rate is (a) 15 percent, (b) 10 percent, and (c) 5 percent? LO3 5. Refer to the table in Figure 10.5 and suppose that the real interest rate is 6 percent. Next, assume that some factor changes such that the expected rate of return declines by 2 1. percentage points at each prospective level of investment. Assuming no change in the real interest rate, by how much and in what direction will investment change? Which of the following might cause this change: (a) a decision to increase inventories; (b) an increase in excess production capacity? LO4 2. What will the multiplier be when the MPS is 0, .4, .6, and 1? What will it be when the MPC is 1, .90, .67, .50, and 0? How much of a change in GDP will result if firms increase their level of investment by $8 billion and the MPC is .80? If the MPC instead is .67? LO5 3. Suppose that an initial $10 billion increase in investment spending expands GDP by $10 billion in the first round of the multiplier process. If GDP and consumption both rise by $6 billion in the second round of the process, what is the MPC in this economy? What is the size of the multiplier? If, instead, GDP and consumption both rose by $8 billion in the second round, what would have been the size of the multiplier? LO5 4. Assuming the level of investment is $16 billion and independent of the level of total output, complete the table immediately below and determine the equilibrium levels of output and employment in this private closed economy. What are the sizes of the MPC and MPS? LO1 5. Using the consumption and saving data in problem 1 and assuming investment is $16 billion, what are saving and planned investment at the $380 billion level of domestic output? What are saving and actual investment at that level? What are saving and planned investment at the $300 billion level of domestic output? What are the levels of saving and actual investment? In which direction and by what amount will unplanned investment change as the economy moves from the $380 billion level of GDP to the equilibrium level of real GDP? From the $300 billion level of real GDP to the equilibrium level of GDP? LO2 6. By how much will GDP change if firms increase their investment by $8 billion and the MPC is .80? If the MPC is .67? LO3 7. Suppose that a certain country has an MPC of .9 and a real GDP of $400 billion. If its investment spending decreases by $4 billion, what will be its new level of real GDP? LO3 8. The data in columns 1 and 2 in the table below are for a private closed economy. LO4 9. 1. Use columns 1 and 2 to determine the equilibrium GDP for this hypothetical economy. 2. Now open up this economy to international trade by including the export and import figures of columns 3 and 4. Fill in columns 5 and 6 and determine the equilibrium GDP for the open economy. What is the change in equilibrium GDP caused by the addition of net exports? 3. Given the original $20 billion level of exports, what would be net exports and the equilibrium GDP if imports were $10 billion greater at each level of GDP? 4. What is the multiplier in this example? p. 232 10. Assume that, without taxes, the consumption schedule of an economy is as follows. LO4 1. Graph this consumption schedule and determine the MPC. 2. Assume now that a lump-sum tax is imposed such that the government collects $10 billion in taxes at all levels of GDP. Graph the resulting consumption schedule and compare the MPC and the multiplier with those of the pretax consumption schedule. 11. Refer to columns 1 and 6 in the table for problem 5. Incorporate government into the table by assuming that it plans to tax and spend $20 billion at each possible level of GDP. Also assume that the tax is a personal tax and that government spending does not induce a shift in the private aggregate expenditures schedule. What is the change in equilibrium GDP caused by the addition of government? LO4 12. ADVANCED ANALYSIS Assume that the consumption schedule for a private open economy is such that consumption C = 50 + 0.8Y. Assume further that planned investment Ig and net exports Xn are independent of the level of real GDP and constant at Ig = 30 and Xn = 10. Recall also that, in equilibrium, the real output produced (Y) is equal to aggregate expenditures: Y = C + Ig+ Xn. LO4 1. Calculate the equilibrium level of income or real GDP for this economy. 13. 1. What happens to equilibrium Y if Ig changes to 10? What does this outcome reveal about the size of the multiplier? 14. Refer to the accompanying table in answering the questions that follow: LO5 1. If full employment in this economy is 130 million, will there be an inflationary expenditure gap or a recessionary expenditure gap? What will be the consequence of this gap? By how much would aggregate expenditures in column 3 have to change at each level of GDP to eliminate the inflationary expenditure gap or the recessionary expenditure gap? What is the multiplier in this example? 2. Will there be an inflationary expenditure gap or a recessionary expenditure gap if the full-employment level of output is $500 billion? By how much would aggregate expenditures in column 3 have to change at each level of GDP to eliminate the gap? What is the multiplier in this example? 3. Assuming that investment, net exports, and government expenditures do not change with changes in real GDP, what are the sizes of the MPC, the MPS, and the multiplier? 15. Answer the following questions, which relate to the aggregate expenditures model: LO5 1. If Ca is $100, Ig is $50, Xn is −$10, and G is $30, what is the economy's equilibrium GDP? 2. If real GDP in an economy is currently $200, Ca is $100, Ig is $50, Xn is −$10, and G is $30, will the economy's real GDP rise, fall, or stay the same? 3. Suppose that full-employment (and full-capacity) output in an economy is $200. If Ca is $150, Ig is $50, Xn is −$10, and G is $30, what will be the macroeconomic result