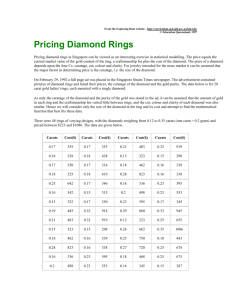

Suppose the estimated regression equation is

advertisement

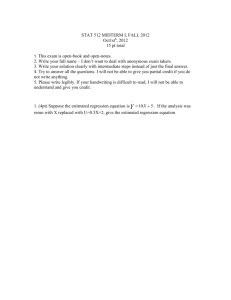

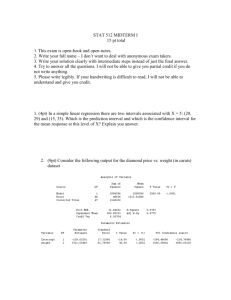

STAT 512 MIDTERM I, FALL 2012 Oct1sth, 2012 15 pt total 1. This exam is open-book and open-notes. 2. Write your full name – I don’t want to deal with anonymous exam takers. 3. Write your solution clearly with intermediate steps instead of just the final answer. 4. Try to answer all the questions. I will not be able to give you partial credit if you do not write anything. 5. Please write legibly. If your handwriting is difficult to read, I will not be able to understand and give you credit. ^ 1. (4pt) Suppose the estimated regression equation is Y 10 X 5 . If the analysis was rerun with X replaced with U=0.5X+2, give the estimated regression equation Substituting the new expression for X, one has 10*2(U-2)+5=20U-35 2. (3pt) In a simple linear regression there are two intervals associated with X = 5: (20, 29) and (15, 35). Which is the prediction interval and which is the confidence interval for the mean response at this level of X? Explain you answer. Clearly, the wider interval is the prediction interval due to the larger variance of the future value estimate compared to the variance of the future mean value. 3. (8pt) Consider the following output for the diamond price vs. weight (in carats) dataset a. (1pt) Write down the 90% confidence interval for the intercept coefficient 0 . You don't need to give an exact critical value for this level of significance - just specify the number of degrees of freedom and the argument. The required confidence interval is −259 ± 𝑡(0.05; 48) ∗ 17.31886 b. (1pt) Suppose that you want to test whether the true intercept hypothesis being H 0 : 1 1 0 with the null 0 . Is it ok to use F-test for this purpose? Explain. No! Although F statistic is the squared t statistic in the case of simple linear regression, F-test is designed with the two-sided alternative in mind…therefore, only a regular t-test can be used here. c. (1pt) How much of the total variation in the diamond price is explained by the variation in their weights? Give a percentage estimate. What is a correlation between the diamond price and its weight? About 97.83%; the correlation is a squared root of 0.9783 d. (3pt) Suppose that the average weight of all the diamonds in this dataset is 0.21 carats. Give the 95% confidence interval for the average price of the diamond whose weight is 0.30 carats. The estimated standard deviation of the average price of the diamond at the weight X is 1 (𝑋 − 𝑋̅)2 𝑠[ + ] 𝑛 𝑆𝑋𝑋 Where n is the sample size. Everything except 𝑠𝑋𝑋 can be immediately obtained from the SAS output; that last component can be found by noting that the standard deviation of the 𝑠 slope coefficient is 𝑠(𝑏1) = √𝑆𝑋𝑋 e. (2pt) Again, assuming that the average weight of all the diamonds in this dataset is 0.21 carats, give the 95% prediction interval for the price of the diamond whose weight is 0.30 carats. Analogous to part d) except that the expression inside the square brackets for the estimated standard deviation will now have an additional 1 term: 𝑠 [1 + 1 (𝑋 − 𝑋̅)2 + ] 𝑛 𝑆𝑋𝑋