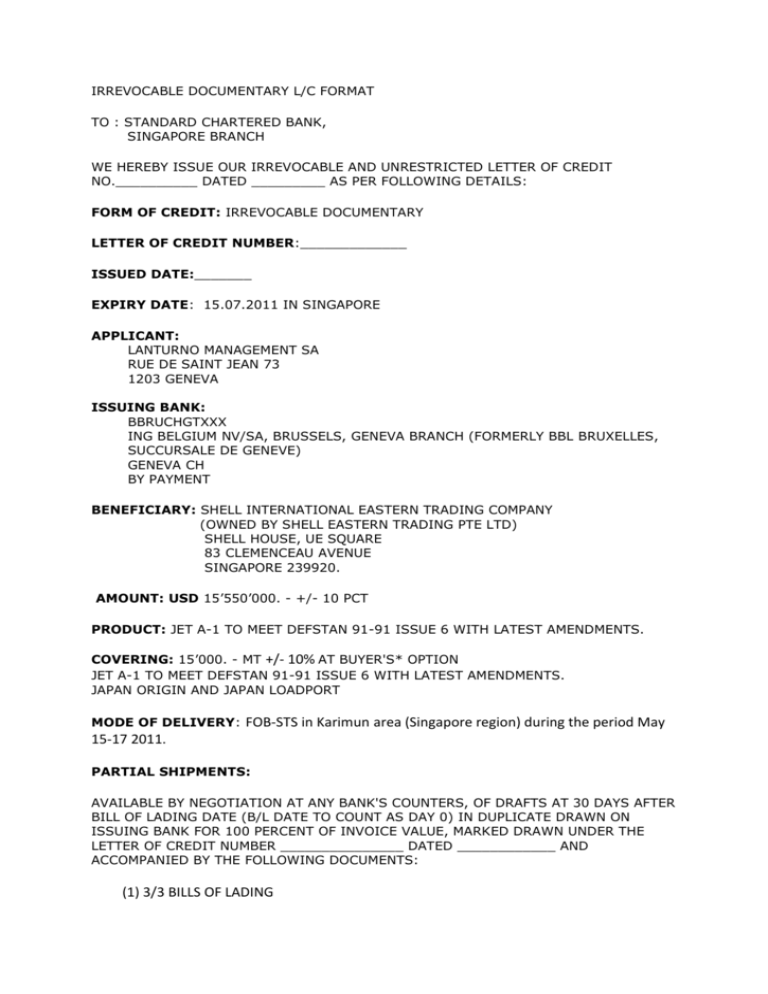

IRREVOCABLE DOCUMENTARY L/C FORMAT TO : STANDARD

advertisement

IRREVOCABLE DOCUMENTARY L/C FORMAT TO : STANDARD CHARTERED BANK, SINGAPORE BRANCH WE HEREBY ISSUE OUR IRREVOCABLE AND UNRESTRICTED LETTER OF CREDIT NO.__________ DATED _________ AS PER FOLLOWING DETAILS: FORM OF CREDIT: IRREVOCABLE DOCUMENTARY LETTER OF CREDIT NUMBER:_____________ ISSUED DATE:_______ EXPIRY DATE: 15.07.2011 IN SINGAPORE APPLICANT: LANTURNO MANAGEMENT SA RUE DE SAINT JEAN 73 1203 GENEVA ISSUING BANK: BBRUCHGTXXX ING BELGIUM NV/SA, BRUSSELS, GENEVA BRANCH (FORMERLY BBL BRUXELLES, SUCCURSALE DE GENEVE) GENEVA CH BY PAYMENT BENEFICIARY: SHELL INTERNATIONAL EASTERN TRADING COMPANY (OWNED BY SHELL EASTERN TRADING PTE LTD) SHELL HOUSE, UE SQUARE 83 CLEMENCEAU AVENUE SINGAPORE 239920. AMOUNT: USD 15’550’000. - +/- 10 PCT PRODUCT: JET A-1 TO MEET DEFSTAN 91-91 ISSUE 6 WITH LATEST AMENDMENTS. COVERING: 15’000. - MT +/- 10% AT BUYER'S* OPTION JET A-1 TO MEET DEFSTAN 91-91 ISSUE 6 WITH LATEST AMENDMENTS. JAPAN ORIGIN AND JAPAN LOADPORT MODE OF DELIVERY: FOB-STS in Karimun area (Singapore region) during the period May 15-17 2011. PARTIAL SHIPMENTS: AVAILABLE BY NEGOTIATION AT ANY BANK'S COUNTERS, OF DRAFTS AT 30 DAYS AFTER BILL OF LADING DATE (B/L DATE TO COUNT AS DAY 0) IN DUPLICATE DRAWN ON ISSUING BANK FOR 100 PERCENT OF INVOICE VALUE, MARKED DRAWN UNDER THE LETTER OF CREDIT NUMBER _______________ DATED ____________ AND ACCOMPANIED BY THE FOLLOWING DOCUMENTS: (1) 3/3 BILLS OF LADING (2) COMMERCIAL INVOICE (3) CERT OF QUALITY ISSUED BY AN INDEPENDENT INSPECTOR (QUALITY ON BOARD MOTHER VESSEL AT STS PORT) (4) CERT OF QUANTITY ISSUED BY AN INDEPENDENT INSPECTOR (AVERAGE OF MOTHER/DAUGHTER SHIP FIGURES) (5) CERT OF ORIGIN ADDITIONAL INSTRUCTIONS 1) ALL BANK CHARGES INCURRED BY THE BENEFICIARY'S BANK SHALL BE BORNE BY THE BENEFICIARY. ALL OTHER BANK CHARGES INCLUDING COMMUNICATION COSTS INCURRED BY THE APPLICANT'S BANK AS WELL AS COSTS WHICH ARE INCURRED IN MAKING PAYMENTS TO THE BENEFICIARY'S BANK SHALL BE FOR THE APPLICANT'S ACCOUNT. 2) THIRD PARTY DOCUMENTS INCLUDING BUT NOT LIMITED TO CHARTER PARTY BILLS OF LADING ACCEPTABLE. 3) DOCUMENTS PRESENTED LATER THAN 21 DAYS AFTER BILL OF LADING DATE BUT WITHIN VALIDITY OF THE CREDIT ACCEPTABLE. 4) IF PAYMENT FALLS DUE ON A SATURDAY OR NON-MONDAY BANK HOLIDAY IN NEW YORK, USA, THEN PAYMENT SHALL BE MADE ON THE IMMEDIATE PRECEDING BANK WORKING DAY. IF PAYMENT FALLS DUE ON A SUNDAY OR MONDAY BANK HOLIDAY IN NEW YORK, USA, THEN PAYMENT SHALL BE MADE ON THE IMMEDIATE FOLLOWING BANK WORKING DAY. 5) REIMBURSEMENT SHALL BE MADE BY TELEGRAPHIC TRANSFER FREE OF ALL CHARGES INTO THE BENEFICIARY'S NOMINATED BANK. 6) THE PRINCIPAL AMOUNT OF THIS LETTER OF CREDIT WILL INCREASE/DECREASE AUTOMATICALLY EVEN ABOVE/BELOW STIPULATED LIMITS WITHOUT FURTHER AMENDMENT: a) ACCORDING TO PLATTS QUOTATIONS, AS PER THE PRICE CLAUSE OF THE CONTRACT FOR SALE OF OIL AND/OR PETROCHEMICAL PRODUCTS; AND/OR b) ACCORDING TO THE ACTUAL QUANTITY DELIVERED UNDER THE CONTRACT FOR SALE OF OIL AND/OR PETROCHEMICALS PRODUCTS, UP TO A MAXIMUM INCREASE OR DECREASE AS STATED IN PERCENTAGE TERMS IN THE OPENING PARAGRAPH OF THIS LETTER OF CREDIT. 7) WITH THE EXCEPTION OF VALUE AND / OR VOLUME AND / OR QUANTITY, TYPOGRAHICAL AND SPELLING ERROR, IF ANY, ARE NOT TO BE CONSIDERED DISCREPANCIES WHICH WILL INVALIDATE THIS LETTER OF CREDIT. 8) NO AMENDMENTS TO THIS LETTER OF CREDIT SHALL BE MADE WITHOUT THE PRIOR WRITTEN CONSENT OF THE BENEFICIARY, WHICH INCLUDES CONSENT GIVEN BY TELEX OR TELEFAX. 9) ALL PAYMENTS MADE UNDER THIS LETTER OF CREDIT SHALL BE MADE FREE AND CLEAR OF, AND WITHOUT DEDUCTION OR WITHHOLDING FOR OR ON ACCOUNT OF ANY TAX WHATSOEVER. IN THE EVENT ANY SUCH DEDUCTION OR WITHHOLDING IS APPLICABLE TO ANY PAYMENT MADE OR TO BE MADE UNDER THIS LETTER OF CREDIT, WE WILL PAY SUCH ADDITIONAL AMOUNT OR AMOUNTS SO AS TO ENSURE THAT THE NET AMOUNT RECEIVED BY THE BENEFICIARY WILL BE EQUAL TO FULL AMOUNT WHICH THE BENEFICIARY WOULD HAVE RECEIVED HAD NO SUCH DEDUCTION OR WITHHOLDING BEEN MADE OR REQUIRED TO BE MADE. 10) THIS LETTER OF CREDIT SHALL BE SUBJECT TO THE UNIFORM CUSTOMS AND PRACTICE FOR DOCUMENTARY CREDITS INTERNATIONAL CHAMBER OF COMMERCE PUBLICATION NO. 600(2007 REVISION) AS FROM TIME TO TIME AMENDED BY ANY FURTHER REVISION ADOPTED BY THE EXECUTIVE COMMITTEE OF THE INTERNATIONAL CHAMBER OF COMMERCE (HEREINAFTER CALLED THE "UCP") EXCEPT UNDER ARTICLE 20A (I) THE FOLLOWING WORDS APPEARING SHALL BE DEEMED DELETED:'TO INDICATE THE NAME OF THE CARRIER AND'. 11) IN THE EVENT ALL DOCUMENTS REQUIRED IN THE LC WITH THE EXCEPTION OF COMMERCIAL INVOICE, ARE NOT AVAILABLE WHEN PAYMENT IS DUE, THEN PAYMENT IS TO BE EFFECTED AGAINST PRESENTATION OF BENEFICIARY'S SIGNED COMMERCIAL INVOICE AND BENEFICIARY'S LETTER OF INDEMNITY FOR TEMPORARILY MISSING DOCUMENTS. 12) CONFIRMATION OF THIS CREDIT BY THE BENEFICIARY”S BANK IN SINGAPORE IS PERMITTED WITH COSTS OF SUCH CONFIRMATION FOR APPLICANT”S ACCOUNT. 13) THIS LETTER OF CREDIT IS A TRANSACTION SEPARATE FROM ANY OTHER ON WHICH IT MAY BE BASED, AND THE PARTIES TO IT DEAL ONLY IN DOCUMENTS. THE REQUIRED DOCUMENTS MENTIONED ABOVE SHALL BE FINAL AND CONCLUSIVE AS TO THE AMOUNT PAYABLE UNDER THIS LETTER OF CREDIT AND WILL BE HONOURED AT 30 DAYS AFTER BILL OF LADING DATE (B/L DATE TO COUNT AS DAY 0). 14) SUBJECT TO TERM 10 ABOVE, AND TO THE EXTENT NOT PROVIDED UNDER THE PROVISIONS OF THE UCP WHICH APPLY UNDER SINGAPORE LAW, THIS LETTER OF CREDIT SHALL BE GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH SINGAPORE LAW. IN THE EVENT OF ANY DISPUTE BETWEEN THE BENEFICIARY AND THE UNDERSIGNED BANK ARISING OUT OF OR IN CONNECTION WITH THIS LETTER OF CREDIT, IT IS HEREBY AGREED THAT SUCH DISPUTE HSALL BE REFERRED TO AND FINALLY RESOLVED BY ARBITRATION IN SINGAPORE IN ACCORDANCE WITH THE ARBITRATION RULES OF THE SINGAPORE INTERNATIONAL ARBITRATION CENTRE ("SIAC RULES") FOR THE TIME BEING IN FORCE WHICH RULES ARE DEEMED TO BE INCORPORATED BY REFERENCE INTO THIS CLAUSE. THE TRIBUNAL SHALL CONSIST OF ONE ARBITRATOR TO BE AGREED BETWEEN THE PARTIES AND IF NOT SO AGREED THEN TO BE APPOINED BY THE CHAIRMAN OF THE SIAC. THE LANGUAGE OF THE ARBITRATION SHALL BE ENGLISH. DATED THIS_________DAY OF _______2011. SIGNED BY THE BANK ______________________ AUTHORISED SIGNATURE ______________________________ AUTHORISED COUNTER SIGNATURE