Professional Placement Service Listing Form

advertisement

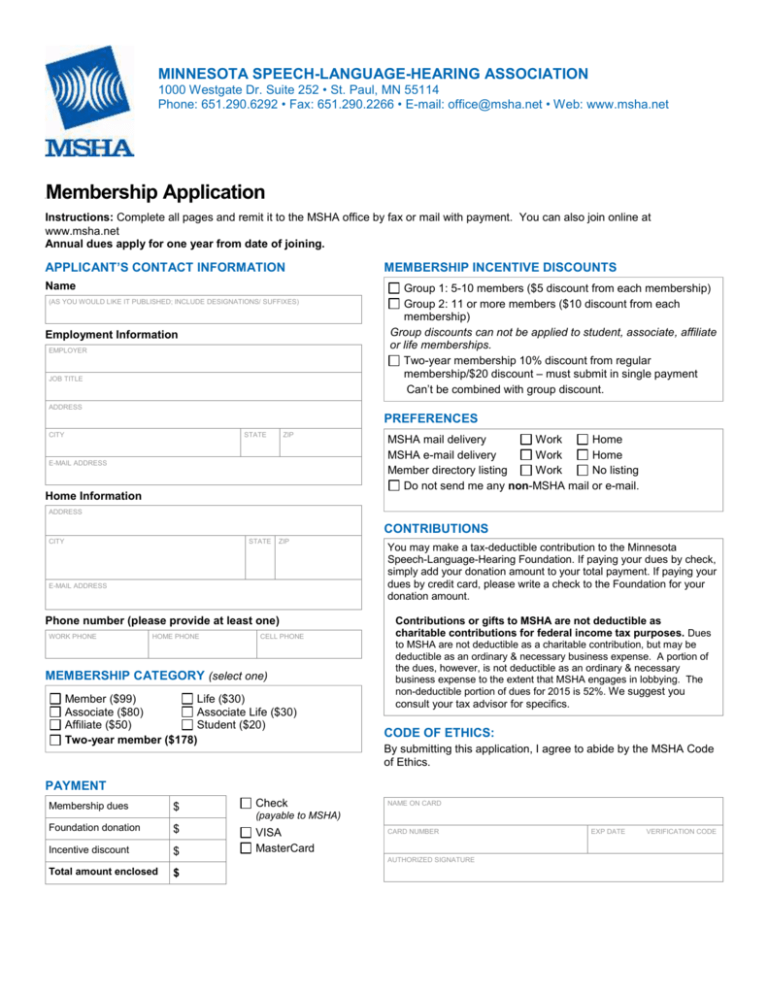

MINNESOTA SPEECH-LANGUAGE-HEARING ASSOCIATION 1000 Westgate Dr. Suite 252 • St. Paul, MN 55114 Phone: 651.290.6292 • Fax: 651.290.2266 • E-mail: office@msha.net • Web: www.msha.net Membership Application 2 7 0 Instructions: Complete all pages and remit it to the MSHA office by fax or mail with payment. You can also join online at www.msha.net Annual dues apply for one year from date of joining. APPLICANT’S CONTACT INFORMATION Name (AS YOU WOULD LIKE IT PUBLISHED; INCLUDE DESIGNATIONS/ SUFFIXES) Employment Information EMPLOYER JOB TITLE MEMBERSHIP INCENTIVE DISCOUNTS Group 1: 5-10 members ($5 discount from each membership) Group 2: 11 or more members ($10 discount from each membership) Group discounts can not be applied to student, associate, affiliate or life memberships. Two-year membership 10% discount from regular membership/$20 discount – must submit in single payment Can’t be combined with group discount. ADDRESS PREFERENCES CITY STATE ZIP E-MAIL ADDRESS Home Information MSHA mail delivery Work Home MSHA e-mail delivery Work Home Member directory listing Work No listing Do not send me any non-MSHA mail or e-mail. ADDRESS CONTRIBUTIONS CITY STATE ZIP E-MAIL ADDRESS Phone number (please provide at least one) WORK PHONE HOME PHONE CELL PHONE MEMBERSHIP CATEGORY (select one) Member ($99) Life ($30) Associate ($80) Associate Life ($30) Affiliate ($50) Student ($20) Two-year member ($178) You may make a tax-deductible contribution to the Minnesota Speech-Language-Hearing Foundation. If paying your dues by check, simply add your donation amount to your total payment. If paying your dues by credit card, please write a check to the Foundation for your donation amount. Contributions or gifts to MSHA are not deductible as charitable contributions for federal income tax purposes. Dues to MSHA are not deductible as a charitable contribution, but may be deductible as an ordinary & necessary business expense. A portion of the dues, however, is not deductible as an ordinary & necessary business expense to the extent that MSHA engages in lobbying. The non-deductible portion of dues for 2015 is 52%. We suggest you consult your tax advisor for specifics. CODE OF ETHICS: By submitting this application, I agree to abide by the MSHA Code of Ethics. PAYMENT $ Check Foundation donation $ Incentive discount $ VISA MasterCard Total amount enclosed $ Membership dues NAME ON CARD (payable to MSHA) CARD NUMBER AUTHORIZED SIGNATURE EXP DATE VERIFICATION CODE