GUIDELINES FOR THE TRANSFER OF PROPERTY WITHIN THE

advertisement

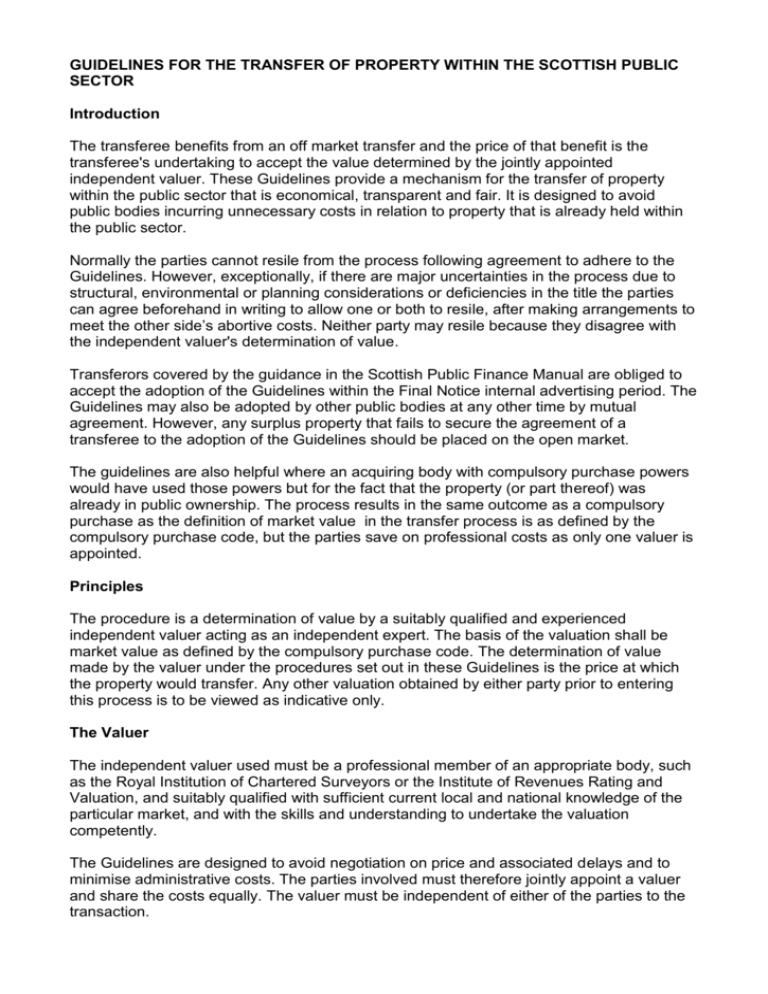

GUIDELINES FOR THE TRANSFER OF PROPERTY WITHIN THE SCOTTISH PUBLIC SECTOR Introduction The transferee benefits from an off market transfer and the price of that benefit is the transferee's undertaking to accept the value determined by the jointly appointed independent valuer. These Guidelines provide a mechanism for the transfer of property within the public sector that is economical, transparent and fair. It is designed to avoid public bodies incurring unnecessary costs in relation to property that is already held within the public sector. Normally the parties cannot resile from the process following agreement to adhere to the Guidelines. However, exceptionally, if there are major uncertainties in the process due to structural, environmental or planning considerations or deficiencies in the title the parties can agree beforehand in writing to allow one or both to resile, after making arrangements to meet the other side’s abortive costs. Neither party may resile because they disagree with the independent valuer's determination of value. Transferors covered by the guidance in the Scottish Public Finance Manual are obliged to accept the adoption of the Guidelines within the Final Notice internal advertising period. The Guidelines may also be adopted by other public bodies at any other time by mutual agreement. However, any surplus property that fails to secure the agreement of a transferee to the adoption of the Guidelines should be placed on the open market. The guidelines are also helpful where an acquiring body with compulsory purchase powers would have used those powers but for the fact that the property (or part thereof) was already in public ownership. The process results in the same outcome as a compulsory purchase as the definition of market value in the transfer process is as defined by the compulsory purchase code, but the parties save on professional costs as only one valuer is appointed. Principles The procedure is a determination of value by a suitably qualified and experienced independent valuer acting as an independent expert. The basis of the valuation shall be market value as defined by the compulsory purchase code. The determination of value made by the valuer under the procedures set out in these Guidelines is the price at which the property would transfer. Any other valuation obtained by either party prior to entering this process is to be viewed as indicative only. The Valuer The independent valuer used must be a professional member of an appropriate body, such as the Royal Institution of Chartered Surveyors or the Institute of Revenues Rating and Valuation, and suitably qualified with sufficient current local and national knowledge of the particular market, and with the skills and understanding to undertake the valuation competently. The Guidelines are designed to avoid negotiation on price and associated delays and to minimise administrative costs. The parties involved must therefore jointly appoint a valuer and share the costs equally. The valuer must be independent of either of the parties to the transaction. If agreement on an appointment cannot be reached the Chief Surveyor at the Scottish Government is willing to assist the parties reach agreement. All relevant procedures must be followed in making the appointment. If the independent valuer's fee was likely to be in excess of relevant limits the appointment would have to be put out to tender. Additional Advice In complex cases the valuer may require advice from experts such as building surveyors, engineers, quantity surveyors or professional environmental adviser. Experts can be appointed with the agreement of both parties and the fees shared equally between them. The Procedure The parties should appoint the independent valuer at the earliest opportunity. After appointment the independent valuer will agree a timetable with the parties. The timetable must include completion of the transfer within three months of the transferee agreeing to adhere to the Guidelines, unless otherwise agreed by the transferor. The party held by the independent valuer as being chiefly responsible for failure to meet the deadline will be liable for all subsequent costs incurred by the other party in relation to the transfer or disposal of the property. The independent valuer will invite both parties to submit any views on value or matters affecting value in writing for his/her consideration. These views will not necessarily include technical matters or the parties' own valuations. One of the purposes of using an independent expert is to allow smaller public bodies who lack professional advice to enter the process with confidence that the expert's expertise will cover any lack of professional resources. The independent valuer will present each side's written representations to the other to allow any relevant comment on those representations/counter-representations. After due consideration he/she will deliver his/her determination of value, with reasons, to both sides and that value will form the basis of transfer. In the event that the transferee has had a separate valuation prepared in order to assist in their decision-making process, any such valuation must be viewed as indicative only and is not to be regarded as the final valuation to be used for determining the transfer value. It is the determination of value by the independent valuer that is used to establish the sale price. Whilst the parties may have the opportunity to make submissions to the valuer during the process, this determination is not negotiable. The valuer will present his reasoned determination to both parties in writing. Options In simple cases where the value is low the parties may mutually agree with the independent valuer to dispense with the representations and counter-representations to save costs. The parties may also agree to dispense with the reasoned determination to reduce costs. Planning Uncertainty Normally the planning position will have been clearly established beforehand. However, where there is planning uncertainty, or the potential for a windfall profit, the valuation shall reflect the highest and best use that the local planning authority indicates it would be prepared to approve.