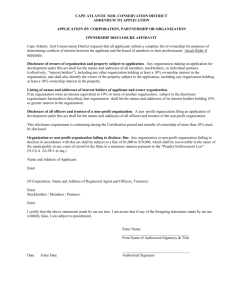

Price Disclosure Arrangements

advertisement