COMESA Council of Ministers Report: Industrialization & Trade

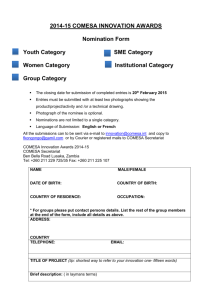

advertisement