Winikoff - Fracking in North Carolina

advertisement

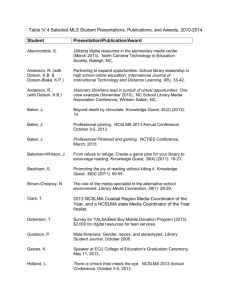

Abstract: The development of hydraulic fracturing has made the extraction of natural gas in places never thought possible twenty years ago. With the exemption of the hydraulic fracturing industry from most federal regulations, North Carolina finds itself trying to determine the best way to approach the new industry on its own. North Carolina has a great opportunity to learn from the successes and struggles of other states in order to develop comprehensive and reliable regulations that can allow for drilling without sacrificing the health of the community or the environment. Unfortunately, North Carolina is at a disadvantage due to the small size and scale of their natural gas potential. This means that with the most comprehensive regulations used by other states, the natural gas industry will be very slow to develop, barring sharp increases in natural gas price. However, North Carolina regulators should not sacrifice or cut corners on environmental regulations solely to promote a faster growing industry because the risk for environmental spills and damage is too high, and the potential benefit to the majority of North Carolina citizens to too low. The Future of Hydraulic Fracturing in North Carolina By Ben Winikoff The process of hydraulic fracturing dramatically changed the markets, landscapes, and locations for extracting natural gas in the United States. Gas in shale deposits, seemingly unreachable twenty years ago, is now suddenly accessible for huge profits in states not traditionally thought of for natural gas production. With the exemption of the natural gas industry from most federal regulations, individual states are left responsible for developing comprehensive plans to deal with the modern day shale rush. Due to the distinct geologic and environmental concerns in each state, no states have adopted identical approaches to finding a balance between economic growth and environmental protections. These state regulations debates have become hotly contested battlegrounds between the drilling industry and environmental groups. North Carolina (NC) is the next stage for the ongoing battle surrounding natural gas extraction from shale deposits. The state legislature has fast tracked the hydraulic fracturing industry to begin in NC on March 1, 2015 and has tasked the NC Mining and Energy Commission with developing regulation recommendations for the NC Legislature by October 2014. NC has a great opportunity to learn from the successes and struggles of other states in order to develop comprehensive and reliable regulations that can allow for drilling without sacrificing the health of the community or the environment. This article seeks to highlight the potential for success of natural gas in NC and what NC can learn from other states regarding important laws to protect landowners and communities. Background on Hydraulic Fracturing Hydraulic Fracturing, more commonly known as “fracking”, is a well stimulation process that aids in the extraction of oil, natural gas, geothermal energy, and water. The process involves drilling a vertical well several hundred or thousand feet. This vertical well is cased with several layers of concrete in order to protect against contamination while drilling though underground water tables. Then a process of horizontal drilling begins that can extend the well several hundreds or thousands of feet in any direction. After the horizontal well is created, perforations are made into the rock bed along the horizontal well. Fluids are then shot down at high pressure through the well, and they surge into the rock bed creating fractures in the rock at the perforations. The fluid used is unique to each drilling company, but is commonly made up of water and chemical additive. The fluid takes advantage of where the pressure exceeds the rock strength; these open or enlarged fractures and fissures can 1 extend several hundred feet away from the well. Once the fractures are created, a propping agent is pumped into the fractures to keep them from closing when the pumping pressure is released (see image above for visualization of the process). Once the fracturing pressure is removed, the pressure inside of the geologic formation causes the injected fracturing fluids to rise to the surface where it may be stored in tanks or pits prior to disposal or recycling. Recovered fracturing fluids are called flowback. Disposal options for flowback include discharge into surface water, water treatment plants, or underground injection. This process allows for drilling companies to reach previously unattainable oil and natural gas because it was trapped in impermeable rock formations that didn’t allow the resources to pool naturally. The extraction of natural gas by hydraulic fracturing is one of the fastest growing trends in American onshore domestic oil and gas production – referred to as a modern day “shale rush.” Unconventional natural gas extraction has led to a boom in domestic natural gas production in recent years and has led the U.S. Energy Information Administration to predict a 113 percent increase in shale gas production from 2011 to 2040. North Carolina’s Potential in Natural Gas Resources In 2011, in response to the increase in hydraulic fracturing boom, the United States Geological Survey (USGS) analyzed the undiscovered oil and gas resources on the east 2 (Triassic paleogeopragpy 210 million years ago, by Ron Blakey, NAU Geology, East Coast Basins are circled) coast of the United States, including two basins in North Carolina. These basins formed 235 to 200 million years ago, during the Triassic Period as the continents of Africa and North America began to drift apart. These types of basins are called rift valleys, which tend to be narrow and steep, allowing the organic matter to collect and eventually form the rock formations necessary to produce natural gas. The basins are currently filled with a variety of sediments; however, the most important are the formations that produce natural gas: gray and black shales and coal beds. The two North Carolina basins included in the USGS’s study are the Dan River Basin and the Deep River basin. The Dan River Basin extends from Stokes County northwest across Rockingham County and into Virginia. The Deep River Basin is a 150 mile long rift basin that runs from Granville County southwest across Durham, Orange, Wake, Chatham, Lee, Montgomery, Richmond, Anson and Union Counties and into South Carolina. The Deep River Basin is divided into three sub-basins, labeled Durham Sub-Basin, Sanford Sub-Basin, and Wadesboro Sub-Basin. 3 In the 2011 assessment by the USGS, they estimated that these two basins contained anywhere from 797 Billion Cubic Feet of Gas (BCFG) to 3,096 BCFGs or 3 Trillion Cubic Feet of Gas (TCF) which sets the mean at 1,709 BCFGs or 1.7 TCFs. To put that in perspective, One Tcf could heat 15 million homes a year and one Bcf could meet the needs of 10,000-11,000 homes a year. In 2012, the North Carolina Department of Environment and Natural Resources (DENR) published its own findings from two test wells in the Sanford Sub-Basin and estimated 4.2 BCFG of total gas per well in this sub-basin. They concluded that at an average of 20 percent recovery per well, at 160-acre spacing apart 368 well could be drilled in this one basin alone for a volume of 309 BCFg for the entire 59,000 acre area. Although this might seem large amount of natural gas, North Carolina’s natural gas potential is much smaller than that of other states. For example, the Marcellus Shale basin stretches 60.8 million acres underneath the states of Pennsylvania, New York and West Virginia and it estimated to have more than 500 TCFs, or over 400 times more than the mean estimations by the USGS’s North Carolina estimation. In addition the second largest shale play in the United States, the Haynesville and Barnett shale basins, span 5.8 million and 3.2 million acres, respectively, giving them a natural gas potential significantly higher that that of North Carolina. 4 What the National and State Legislators Have Done so Far North Carolina does not have an active oil and gas industry and therefore has no oil and gas regulations currently in place. Generally, even absent of state regulations, an industry would still be regulated by federal agencies. However, unlike other types of resource extraction, hydraulic fracturing is almost completely unregulated by the federal government. The majority of the exemptions have been dubbed part of the “Halliburton loophole” in 2005. Here, the natural gas lobby groups successfully lobbied to get many exemptions from federal regulation by the EPA, making the EPA powerless to regulate the industry. Although there is currently a bill in the U.S. Senate, nicknamed the “Frac Act” to repeal these loopholes, it is very unlikely that it will be passed. Thus, the responsibility has fallen to individual states to devise their own plans for regulation. Unlike other states with established oil industries, North Carolina has a unique opportunity to establish a comprehensive regulatory scheme that balances economic growth and environmental protection prior to any drilling taking place. In response, North Carolina initially passed a moratorium on any fracking with a goal of fully exploring the risks and determining how to protect North Carolinians from exploitation by the oil and gas industry. However, a change in state political leadership has led to a recent charge to streamline the natural gas industry by the state legislature. Now production is set to begin in North Carolina on March 1, 2015, and the North Carolina Mining and Energy has been commissioned to develop regulation recommendations for the North Carolina Legislature by October 2014. What North Carolina Can Learn from Other States 5 Two states that have recently authorized fracking regulations are Ohio and Pennsylvania. These two states have taken different approaches to regulating the industry and have achieved different results. While the states have some notable differences in geology and natural gas potential, they still provide great examples of regulations and how the industry responds to them. By comparing these two states, North Carolina can learn from their successes and mistakes in order to proactively protect the environment and communities in North Carolina. The types of regulations can be broken down into three categories: pre-drilling regulations, drilling regulations, and cleanup liability. These three areas provide states different opportunities to protect the general public. A. Pre Drilling Regulations Before one well is drilled, North Carolina must make several decisions regarding landowner rights, municipality rights, baseline environmental research, and chemical disclosure laws. While this list is not exhaustive, it shows the volume and detail required for comprehensive drilling regulations in each state as well as highlights the potential risks facing North Carolina and their communities. Compulsory Pooling and collecting baseline data are two good examples of decisions states must make prior to the issuance of drilling permits. i. Landowner Rights: Compulsory Pooling One of the problems landowners face when drilling is authorized is that of compulsory pooling. Compulsory pooling is the “joining together of small tracts or portions of tracts for the purpose of having sufficient acreage to receive a well drilling permit under the state or local spacing laws or regulations.” In certain circumstances, pooling is a mechanism used by companies to compel landowners, who have not voluntarily elected to participate, to join the pool. This rule is a remnant of the common law rule of capture that was developed by states to “curb the drilling of wells and promote the equitable distribution of resources” by forcing land to be pooled and compensating landowners based on the proportionate share of the acreage contributed to the pool. Each state has approached this problem differently. Ohio, allows for compulsory pooling with several distinctions: 1) landowner must consent for surface use, 2) the company must attempt good faith negotiations with all landowners, 3) there must be an Unofficial Minimum Voluntary Agreement between 90 percent of the surface owners. Because of this high requirement, Ohio only received 12 applications for compulsory pooling in 2011 and three in 2012. Pennsylvania allows pooling below certain depths; however, it is prohibited for development of the mercelous shale and does not allow the pooling of the rights of landowners who have not voluntarily entered into a lease agreement. In September of 2013, the North Carolina Mining and Energy Commission conducted a Compulsory Pooling Study Group to determine what type of system North Carolina should adopt. They concluded that NC should pass a 90 percent minimum voluntary agreement, similar to the plan in Ohio. ii. Collecting Baseline data on Water Quality 6 Another issue facing states is how to hold the industry liable for water contamination. One way is to either require or induce fracking companies to test the baseline water data in the drinking water sources surrounding the proposed drilling site. Pennsylvania achieved this by establishing a presumption of responsibility against the fracking company for any contamination within 1,000 feet of a conventional gas well within six months of completion or within 2,500 feet of an unconventional gas well if it occurs within 12 months of completion. In order to shed the presumption of liability, most gas well operators collect the pre-drilling water quality information and send it to an independent state accredited lab for testing in order to maintain the defense that the pollution existed prior to drilling. Ohio adopted a different approach. Instead of pressuring drilling operators to test the water through fear of liability, Ohio requires operators to collect water-quality samples before drilling takes place and submit the laboratory tests to the state. They require testing water within 1,500 feet from the wellhead and for the sampling to be conducted by a third party certified by the State of Ohio. North Carolina observed these rules and passed G.S. 113-421, that requires that all gas leases must include baseline tests of all water supplies within 5,000 feet of a wellhead at least 30 days prior to drilling, and at least two follow up tests within two years after production. These samples can either be analyzed by the drilling company or at the landowners request, by the North Carolina Department of Energy and Natural Resources (DENR). In addition, North Carolina also has established presumptive liability for all contamination within 5,000 feet of a wellhead. In March of 2013, NCDENR recommended that North Carolina maintain the statutes and adopt additional regulations based on the National Groundwater Association (NGWA) baseline water sampling parameters. These include: 1) Have a qualified water well system professionally test groundwater quality and re-test water quality against baseline results within 6 months of well completions. Just because this statute currently exits, does not mean that this statue can be amended prior to the beginning of drilling in 2015. In September of 2013, the NCDENR returned a $222,595 grant from the Environmental Protection Agency for baseline water analysis around potential fracking wells. This was surprising as it was a grant sought by DENR the year before. Despite this setback, North Carolina should keep the current regulations in order to best protect the citizens and communities from the dangers of fracking. B. Drilling Regulations After North Carolina issues drilling permits, it must also have regulations in place to deal with the impact the actual drilling process has in the community. These include: the demand on resources (specifically water), the increased use of infrastructure, the uniform set of drilling specifications, and what to do with the waste products from the drilling sites. Here, the focus is on wastewater disposal because of the particular difficulty states have had in dealing with the volume of hazardous waste. 7 i. Wastewater Disposal The wastewater that causes the most concern is the fluid that emerges from wells shortly after hydraulic fracturing has occurred called flowback water. Flowback water contains high concentrations in dissolved solids and salts and may contain sand, heavy metals, oils, grease, manmade chemicals from the company to aid in the fracking process, radioactivity from contact with underground radioactive rocks, and other trace materials. This water is toxic, especially to aquatic life, and must be dealt with properly. While North Carolina’s shale basins were made of a freshwater environments rather than a marine environment, the exact contaminates in North Carolina will be unknown. The options for disposal of this wastewater include: injection into underground disposal wells, partial treatment at a publicly owned water plant followed by discharge into surface water, land application, commercial wastewater treatment, and reuse in future hydraulic fracturing operations. Underground injection wells are currently the most widely used disposal method and arguably the safest method available. It is estimated that as much as 98% of the waste water in the U.S. is disposed of in this manner. However, these wells do not come without drawbacks as the high pressure used to inject the waste deep underground have been linked to earthquakes in Ohio and Arkansas, leading the states to shut down specific injection wells. In addition, thousands of these wells must be drilled in each state, and they can only be drilled if the geologic structures below ground permit it, thus limiting its availability as an option. Treatment at publically or privately owned treatment facilities is also a possibility for dealing with wastewater. Pennsylvania, specifically, has tried this method because the state lacks the proper geological formations to build the deep-water injections wells. As the chart shown below illustrates, this has not been effective in treating wastewater. The treatment facilities are unsure of what is in the water, and are unable to effectively remove it before discharging it into bodies of water. Pennsylvania is currently looking at building new treatment plants dedicated to brine treatment to deal with the large amounts of wastewater, but it can be very expensive for drilling companies to transport it to these specific plants. 8 DEP TDS = Total amount of Total Dissolved Solids allowed by the Pennsylvania Department of Environmental Protection As the chart above shows, another method of dealing with wastewater is to reuse the old fluid in future drillings to reduce the volume of wastewater needed as well as the need for additional freshwater. However, the additives in the fracturing fluid can interact with the (Total Dissolved Solids) TDS in the wastewater, which can reduce the gas production from the well by plugging some of the fissures in the well. The searches for cheaper and more effective solutions for dealing with wastewater continue to develop. For example, most recently barge companies in Ohio and Pennsylvania want to move wastewater by barge via the Monongahela, Ohio, and Mississippi Rivers to wastewater injection sites in Louisiana and Arkansas to lower the transportation costs associated with deep underground injection; however, several environmental groups are strongly opposed to the idea. North Carolina, as a similar geological composition with Pennsylvania, that eliminates underground injection wells as a disposal option. Therefore, North Carolina faces the same cost/risk analysis that the Pennsylvania chart above describes. While, requiring transportation to underground injection wells in other states is the most expensive, it is the safest way to safely dispose of the wastewater. Therefore, this should be the standard North Carolina adopts to best protect communities and the environment. C. Environmental Recovery: Holding the Industry Responsible for Cleanup Occasional spills and pollution will be a part of any type of oil and natural gas extraction program. Therefore, states are responsible for ensuring that taxpayers are not 9 responsible for cleanup after a contamination incident. Once again states have developed several methods in dealing with this problem. One solution has been to require companies to have spill preparedness and contingency plans. Pennsylvania requires that well operators submit these plans before drilling begins. Pennsylvania closely monitors the plan and enforces its effectiveness. For example, they have successfully shut down a well after three spills occurred at the site in less than a week and mandated a brand new engineering study before the well could resume operation. Another solution has been the creation of bonding requirements for natural gas drilling. Typically issued at the time of permitting, states hold these bonds much like a security deposit, to cover the cost of cleanup in case the company fails to properly reclaim the site when they finish. Pennsylvania, currently has a bonding requirement of $25,000; however, recent proposals by that state legislature suggest that it could be raised to as much as $250,000 with the bond limit being reevaluated every three years to respond to the developing industry’s impact. Another way that legislatures can hold well operators accountable for environmental cleanup is to establish strict liability. This could be achieved through statue, or through North Carolina’s common law that specific aspects of hydraulic fracturing constitute an ultra hazardous activity. However, in other states, this has been mostly unsuccessful. Texas has already ruled that underground injection wells are not an ultra hazardous activity and therefore strict liability does not apply. As previously mentioned, Pennsylvania adopted some presumptive liability around wellheads for water contamination, but this is far from strict liability across the board. North Carolina already passed some protective measures in N.C.G.S. 113-421, such as an award of attorneys’ fees and Costs, a reclamation bond sufficient to cover reclamation of the property, and presumptive liability for water contamination described above. However, North Carolina needs to retain these measures as well as the addition of strict liability and spill preparedness contingency plans in order to further protect the citizens and communities of North Carolina. Conclusion North Carolina has a tremendous opportunity to develop comprehensive, proactive, and efficient ways to regulate the new natural gas discoveries before drilling begins. However, North Carolina is at a disadvantage due to the small size and scale of their natural gas potential. This means that with the most comprehensive regulations available, the natural gas industry will be very slow to develop, barring sharp increases in natural gas price. However, North Carolina regulators should not sacrifice or cut corners on environmental regulations solely to promote a faster growing industry because the risk for environmental spills and damage is too high, and the potential benefit to the majority of North Carolina citizens to too low. Therefore, North Carolina should pass the regulations that best promote the communities in North Carolina such as requiring pretesting of water sources and transporting all wastewater to out-of-state underground injection sites. Even if they stifle production at first, the industry will develop in time and at the benefit of all of North Carolina’s citizens instead of sacrificing the health and safety of all for the economic benefit of a few. 10