Budget Justification

advertisement

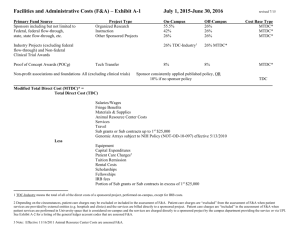

CDR 13-xxx BUDGET JUSTIFICATION Salaries: 348 hours (2.0 mos.) per year for the PI ‘last name’ (at $xx.xx/hour) to administer the project and 174 hours (1.0 mo.) per year for the Co-I ‘last name’ (at $xx.xx/hour) to conduct the fieldwork is requested to perform the proposed research. Support is also budgeted for 2 graduate students (academic year and summer) to assist in compiling the data. A leave reserve of 1.7% is included for faculty salaries, 21.7% for professionals, and 22.2% for support (classified) personnel. Salaries are listed at the FY13 rate and include a 3% to 3.5% inflation increase for staff and faculty each year. Benefits: Staff benefits are applied according to UAF’s negotiated benefit rates for FY13. Rates are 34.1% for faculty salaries, 42.8% for professionals, 52.0% for support personnel, and 8.1% for graduate students (summers only). Beginning in FY08 benefits are also included for graduate student health care. The current rate is $1,959 per year ($714/fall and $1,245/spring+summer) with a 7.0% inflation increase per year. A copy of the rate proposal is available at: http://www.alaska.edu/cost-analysis/negotiation-agreements/ Travel: [Note: Mexico and Canada are considered as “Domestic” Travel; & 2013 mileage rate is 0.565/mile] Domestic: 2/2/4/2 trips per year, respectively, are requested for the PI and Co-I to Nome, AK (at $$/trip) to conduct fieldwork. 1 trip is budgeted per year to San Francisco, CA (at $$/trip) for the PI to attend the annual AGU conference and meet with collaborators. Per Diem (meals/incidentals/lodging) is $160/day for Nome per UA Board of Regents regulations for Alaska in-state travel and $228/day for San Francisco in accordance with GSA/JTR Regulations. Car rental is budgeted at $100/day (daily rate including taxes and fees). Airport shuttle service is budgeted in San Francisco at $25/trip. An inflation rate of 10% per year has been included for all transportation costs. Foreign: 1 trip in Year 2 is budgeted for the PI to travel to Tokyo, Japan (at $$/trip) to meet with collaborators and discuss findings. Per Diem for Tokyo is $275/day in accordance with JTR Regulations. Ground transportation is budgeted at $50/day. Contractual Services $2,500 is requested for page charges/publication costs of the research findings. $500 per year is budgeted for toll/communication charges. $500 is included for shipping the samples to and from collaborators. $2,000 is requested for airlifting supplies to the field location per year. Funds are requested for further sample analysis by SampleCorp. Inc. at $50/sample. Funds are also proposed for the UAF Analysis Lab to verify the integrity of the samples at $2/sample. Funds are also requested for the AGU meeting registration fees at $400 per year per PI, and $225 per year per student (FY10 rate with a 3.0% inflation increase per year). Subawards: A subaward will be made to the University of Tokyo ($125,000 over 3 years) for their portion of the research analyzing samples collected locally in Japan and comparing them to the 1 CDR 13-xxx Alaska samples. The University of Tokyo was selected because of their sole expertise in this field. A budget and narrative is attached for the subaward. Commodities (Materials & Supplies): Funds (~$xx) are requested for field supplies such as data loggers and sample containers, and other general project supplies. Participant Support: ** if NSF and DoEd, put AFTER MTDC (w/o F&A) ** [Stipends, subsistence and travel costs for participants not a part of UAF. The $$ for Participant Support is deducted from the total applied to the F&A recovery rate on NSF and some NIH proposals (not NASA). However, one exception exists for NSF Participant Support where a 25% “Administrative Allowance” is allowed and should be calculated on REU Student Stipends only.] Definition of Participant Support: NSF, PAPP/GPG Section IIC.2.g.v, (v) Participant Support (Line F on the Proposal Budget): This budget category refers to costs of transportation, per diem, stipends and other related costs for participants or trainees (but not employees) in connection with NSF-sponsored conferences, meetings, symposia, training activities and workshops.21 (See GPG Chapter II.D.7) For some educational projects conducted at local school districts, however, the participants being trained are employees. In such cases, the costs must be classified as participant support if payment is made through a stipend or training allowance method. The school district must have an accounting mechanism in place (i.e., sub-account code) to differentiate between regular salary and stipend payments. Generally, indirect costs (F&A) are not allowed on participant support costs. The number of participants to be supported must be entered in the parentheses on the proposal budget. These costs also must be justified in the budget justification section of the proposal. Some programs, such as Research Experiences for Undergraduates, have special instructions for treatment of participant support. Additional information on the charging of participant support costs to an NSF award is available in AAG Chapter V.B.8. Equipment: Funds are requested to purchase a scanning electron microscope ($5,500, quote attached) to analyze the samples collected during fieldwork. (note: items listed here must have a “life” of more than 1 year, and must cost more than $5,000 each) Other Direct Costs: Per UAF policy, non-resident tuition costs ($7,047 per semester) are included for the graduate student in the first 2 years, and in-state-tuition ($3,447 per semester) thereafter (academic year only). Student tuition is listed at the AY12 rate with a 10% inflation increase per year. Or, If International (Non-Resident): Per UAF policy, non-resident tuition costs ($7,047 per semester) are included for the graduate student (academic year only). Student tuition is listed at the AY12 rate with a 10% inflation increase per year. Indirect Costs: 2 CDR 13-xxx Facilities and Administrative (F&A) Costs are negotiated with the Office of Naval Research. The predetermined rate for sponsored research is 49.5% of the Modified Total Direct Costs (MTDC). MTDC includes Total Direct Costs minus tuition, scholarships, subaward amounts over $25,000, and equipment. A copy of the agreement is available at: http://www.alaska.edu/cost-analysis/negotiation-agreements/. +++++++++++++++++++++++++++++ Please see alternative “Indirect Costs” paragraphs below: if UAF “Other Sponsored Activities” (non-research) use for the last paragraph: Indirect Costs: Facilities and Administrative (F&A) Costs are negotiated with the Office of Naval Research. The predetermined rate for “other sponsored activities” is calculated at 34.2% (FY11-13 negotiated agreement) of the Modified Total Direct Costs (MTDC). MTDC includes Total Direct Costs minus tuition, stipends, scholarships, subaward amounts over $25,000, and equipment. A copy of the agreement is available at: http://www.alaska.edu/cost-analysis/negotiationagreements/. Or, if UAF “Sponsored Training” use 35.0% Or, if Reduced, as per the RFP, use the following: Indirect Costs: Facilities and Administrative (F&A) Costs are calculated at 22.0% of the Modified Total Direct Costs (MTDC), as per the proposal guidelines. MTDC includes Total Direct Costs minus tuition, scholarships, subaward amounts over $25,000, and equipment. A copy of the agreement is available at: http://www.alaska.edu/cost-analysis/negotiation-agreements/. You only need an F&A waiver if the rate is less than the 9% limit, or if the reduced rate is not specified in the RFP. (OSP Note: Participant Support Costs are F&A exempt on NSF and some NIH proposals only. However, one exception exists for NSF Participant Support where a 25% “Administrative Allowance” is allowed and should be calculated on REU Student Stipends only. Participant Support as a cost category used by other agencies should have normal F&A calculated on it.) Alternative Indirect Cost Statement when the Sponsor Limits F&A Recovery: Facilitates and Administrative (F&A) Costs are calculated at xx.x% as per the proposal guidelines. (OGCA will “tax” the department 9% F&A unless waiver approved) Alternative Indirect Cost Statement when the Sponsor Prohibits F&A Recovery: Facilities and Administrative (F&A) Costs have not been included in the budget as per the proposal guidelines. (OGCA will “tax” the department 9% F&A unless waiver approved) 3 CDR 13-xxx F&A Used as Cost Share (apply F&A to Cost Share portion only): As per the proposal guidelines, F&A can be used as part of the Cost Share. Facilities and Administrative (F&A) Costs are negotiated with the Office of Naval Research. The negotiated rate for “other sponsored activities” is calculated at 34.2% (FY11-13 negotiated agreement) …. Alternative wording for PI or Co-I with $0.00 Project will not be charged for time the PI ‘last name’ spends to administer the project. Even though Co-I Nicoll will support the implementation of developed techniques and the processing of the SAR data, no time will be charged to this project as his salary is already covered by NASA If Student Fees are included (GI): Contractual Services and Other Direct Costs: Per UAF policy, non-resident tuition costs are included for the graduate student in the first 2 years, and in-state-tuition thereafter (academic year only). Student fees are also included at $516 per semester for non-resident student fees in the first two years, and $453 per semester for resident student fees thereafter (academic year only). Student tuition and fees are listed at the AY11 rate with a 10% inflation increase per year. Or, If International (Non-Resident): Per UAF policy, non-resident tuition costs ($6,219 per semester) are included for the graduate student as well as non-resident student fees at $516 per semester (academic year only). Student tuition and fees are listed at the AY11 rate with a 10% inflation increase per year. FY13 Current F&A Rates The university negotiates an indirect cost rate agreement with the federal government to recover the costs of facilities and administrative support for sponsored projects. The Office of Naval Research (ONR) is the university's cognizant federal agency for indirect cost rate negotiation. The Department of Health and Human Services (DHHS) also negotiates indirect cost rates with universities; however, UAF does not have an agreement with DHHS. If you have questions about UAF's indirect cost agreement, contact the UA Office of Cost Analysis. UAF's negotiated F&A rate for sponsored research is: 49.5% UAF's negotiated F&A rate for other sponsored activities is: 34.2% UAF's negotiated F&A rate for sponsored training/instruction is: 35.0% On-Campus Organized Research 49.5% Sponsored Training/Instruction 35.0% Other Sponsored Activities (OSA) 34.2% School of Fisheries and Ocean Sciences, Ship Operations N/A Poker Flat Research Range 29.9% Arctic Region Supercomputing Center 36.8% International Arctic Research Center (IARC Rate Agreement) 28.8% 4 CDR 13-xxx State Negotiated Rates: 5