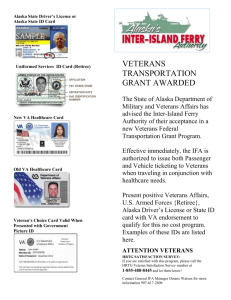

State Veteran`s Benefits

advertisement