File

advertisement

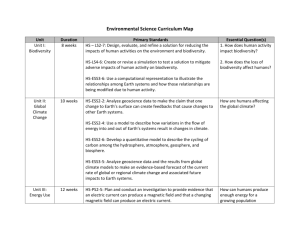

Natural Capital Reporting / Accounting for businesses The focus of Natural Capital Reporting for businesses is either: i) the assessment of annual environmental impacts incurred by part or all of the business value chain, or ii) the state and change in environmental assets owned or under the responsibility of the company. Or a variation of these. The boundary NCA reporting for businesses may be any of Tier 1 (Direct operations), Tier 2 (production of finished products and services), Tier 3 (processing of materials) and/or Tier 4 (extraction of raw materials). Usually the report should look at the company as a whole, but it may also just be for a specific product, project or site. Drivers of Natural Capital Reporting: Used for multiple purposes such as informing decision-making, understanding dependencies and impacts, prioritising actions, identifying risk and opportunity hotspots, communicating with stakeholders etc. Natural Capital Reporting Assessment tools: Accounting : Environmental Profit and Loss accounts Hot spot analysis, Materiality assessment LCA –life cycle assessment for products, EIA –Environmental Impact Assessment for projects, EMS –Environmental Management Systems for sites Indicator assessment (air emission quality, effluent volume, contaminated land assessment) Mitigation hierarchy,: The Natural Capital Protocol advocates action in the following order of importance: to avoid, minimise, restore and offset Businesses carrying out NCA may apply the mitigation hierarchy to their own natural capital impacts. In context of damage assessments, this can ensure appropriate level of damages are paid to ‘compensate for or offset‘ the impacts of the business . Companies may also apply these concepts to claim net positive credentials. Comparison of Natural Capital Reporting to other current Environmental Reports required of businesses in Ireland Reporting Title EPA Annual Environmenta l Reports Origin Greenannual recertification Reporting Drivers Legal, Corporate, Commerci al Legal reporting requirement as part of IED/ IPC Licences Commercial driver: Market Presence/ supply chain advantage Report focus: Economic (EC) Environmenta l (ENV) or Social (SOC) ENV EC ENV SOC Companies affected by Reporting Sectors Type of reporting Compliance reporting Indicator reporting / Environmental Quality Standards: Accounting – monetary valuation of assets and stocks/ risks and opportunities Any company licensed by EPA, as specified in the revised EPA Act 2013 Schedule 1 of activities Depends of scale and threshold of activity Pharmaceutical, Chemical Industry, Cement plants, Metal industry Industrial Agriculture large food sector large waste treatment facilities, Licence Compliance reporting Any food company can apply for 3rd party certified membership of the Bord Bia Origin Green programme Food Producers (farms) Food Processors Food Retailers Indicator Reporting Update of EMS Objectives and Targets update Update of process efficiency Update of resource consumption (raw materials, energy, CO2 emissions, water) Emission Standard reporting (water, air water emissions ) Update on process changes Update on target progression and achievements Targets include Raw Material supply Energy, Carbon emissions, Water, Waste reduction, Biodiversity (if chosen) Health & Nutrition Social sustainability Areas relevant to Natural Capital, not covered by this reporting No requirement to report on Natural Habitats, Biodiversity or Natural Assets, unless already part of company EMS, or site located on/ near an area of special habitat/ protection/ Biodiversity (on site or considered as part of the supply chain) is only included if it is chosen as a specific company target Non-financial reporting Directive 2014/95/EU Legal corporate disclosure of non-financial and diversity information EC ENV SOC All companies with 500 employees or < $50 mill revenue All commercial sectors CDP/ GRI Reporting GRI and CDP have worked together over the years to ensure alignment in their indicators on climate change and energy, improving the consistency and comparability of environmental data, and making corporate reporting more efficient and effective. G4 guidance is designed to be compatible with a wide range of different reporting formats. Avoids duplication of disclosure efforts CDP –Carbon Disclosure Programme Reporting Corporate / Stakeholder Driver –CSR reporting ENV Online reporting Disclosure by organisations to their investors & stakeholders CDP online climate change scoring methodology Open for any organisation -mainly aimed at large multinationals All commercial sectors Indicator Reporting: Climate Change - this info can also be reported as part of GRI Climate Change Risk, Opportunities, Emission Data & Methodology; Energy, Emission GHG Scope 1, 2, 3, Emission Trading; Water Management this info can also be reported as part of GRI Forest management – production and use of forest risk commodities (i.e. products responsible for deforestation) –can be reported in GRI as part of Supplier Assessment/ Product Risk Reporting of physical units and indicators, kgs/ tonnes of emissions/ cubic meters of effluent, etc) CDP Reporting looks at environmental impacts from carbon emissions, threats and opportunities of climate change. Broader Natural Capital aspects are not currently included. GRI- Global Corporate / EC Public disclosure by All commercial Indicator Reporting: GRI Reporting looks at 2 year transition – applicable from 2016 Companies may use GRI reporting guidelines or ISO 26000 in the reporting of non-financial assets. Reporting of physical units (tonnes of emissions/ cubic meters of effluent, etc) as per GRI Guidance. Non-financial report may be submitted to auditor separate from financial management report, and published separately as CSR report. Biodiversity/ Natural Capital aspects could be included here. Reporting Initiative Stakeholder Driver –CSR reporting Legal requirement in Sweden for stateowned companies (2007) Legal requirement in South Africa for companies on stock exchange listing (2010) Mandatory for companies listed on the Singapore stock exchange (2014) ENV SOC organizations on their and their stakeholders economic, environmental and social impacts. GRI Guidelines used by corporations in their annual CSR reports Open for any organisation -mainly aimed at large multinationals sectors - Economic environmental, social and economic impacts Flow of capital among stakeholders; Economic risks & opportunities due to Climate from the business activities. Biodiversity Change , land and water Procurement practices –local supply chain aspects are included. Environmental Raw materials – renewable/ non-renewable/ recycled resources Energy consumption & reduction Water sources (well/ river/ public) & consumption Water sources affected by usage incl Biodiversity value Water % recycled or reused cc & reduction Biodiversity –lands owned/ leased in or near protected areas Listing of protected status Impacts of operation on Biodiversity Value Habitats protected or restored 3rd party partnership to protect habitats Amount of Red List species / endangered species in areas affected by organisation Emissions Air Emissions (GHG-Scope 1,2,3), NOx, Sox, ODS, etc) & reduction initiatives Effluents –waste water discharge volume and treatment Size and biodiversity of waterbodies affected by discharges Waste types (reuse/ recycling/ incineration, landfill) , volumes & reduction initiatives Mitigation actions to reduce environmental Natural capital impact and asset assessments could be included in these reports. impacts of product & services Total environmental protection expenditure Social Labour Practices, Equal Opportunity, Health & Safety, Staff Training, Human Rights, non-discrimination, fair investments, child labour, indigenous rights, Society; local communities, anti-corruption, funding, legal compliance Product Responsibility, Health & Safety, Labelling, Marketing, Customer Privacy Environmenta l Profit and Loss Account (EP&L) ISO 14001 Identify Financial risk and opportunitie s for the business from its environment al impacts and assets EC ENV Corporate / Stakeholder Driver –CSR reporting ENV Any organisation -mainly aimed at large multinationals All commercial sectors Accounting – monetary valuation of assets and stocks/ risks and opportunities assigning monetary value for ecosystem services Can be part of the company’s natural Capital reporting Methodology/ Guidance for EP&L developed by Kering and PwC (2015) The E P&L uses existing input-output models and developed new valuation methodologies, building on a large volume of work in the fields of environmental and natural resource economics such as TEEB, the UN study on The Economics of Ecosystems and Biodiversity. Any organisation. Uptake mainly by medium to large companies All commercial sectors ISO 14001:2015 and its supporting standards focus on Internationally certified environmental management systems. Includes identification of environmental Natural Capital considerations could be included in a company ISO 14001 or impacts and aspects, setting Objectives and targets and continuous improvement loops. Linked to ISO 9000 Quality system, ISO 15001 Energy Management system, etc. informal EMS ISO 26000 Corporate / Stakeholder Driver –CSR reporting SOC ISO Standard / Guidance All commercial sectors ISO 26000 provides guidance on how businesses Not directly applicable and organizations can operate in a socially responsible way. This means acting in an ethical and transparent way that contributes to the health and welfare of society. UK Corporate natural capital accounts (CNCA) – Corporate / Stakeholder Driver –CSR reporting EC ENV UK Defra-led ; Natural Capital reporting UK organisations mainly UK Defra-led ; RSPB and PwC developed framework for organisation to carry out Natural Capital reporting http://www.naturalcapitalcommittee.org/corpo rate-natural-capital-accounting.html Alternate or complimentary methodology to NCCProtocol Integrated reporting (IIRC, 2014) Corporate / Stakeholder Driver –CSR reporting EC ENV SOC Creation of new global reporting framework for corporations -lead to the creation of value over the short, medium and long term Over 90 businesses in the Pilot Programme Business Network include Unilever,[6] Coca-Cola,[7] Microsoft,[8] China Light and Power,[9] Hyundai,[10] and HSBC.[12] Reporting on six forms of capital, one of which is natural capital. Natural capital is defined as ‘all renewable and non-renewable environmental resources and processes that provide goods or services that support the past, current or future prosperity of an organization. It includes: air, water, land, minerals, forests, biodiversity and ecosystem health’. Natural Capital Reporting is part of the Integrated report Main References: NCC_Draft Natural Capital Protocol 2015 http://www.naturalcapitalcoalition.org/ Global Natural Capital Reporting: TEEB, The Economics of Ecosystems and Biodiversity. EC Europa B@B Workstream 1: Natural Capital Accounting for Business http://ec.europa.eu/environment/biodiversity/business/assets/pdf/