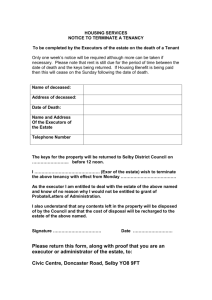

Probate Rules - Courts Administration Authority

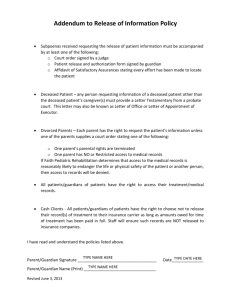

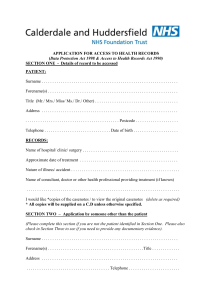

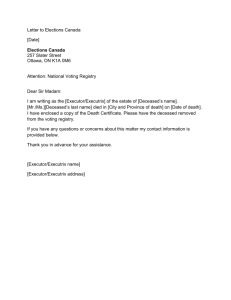

advertisement