Budget Process Overview and Timeline

advertisement

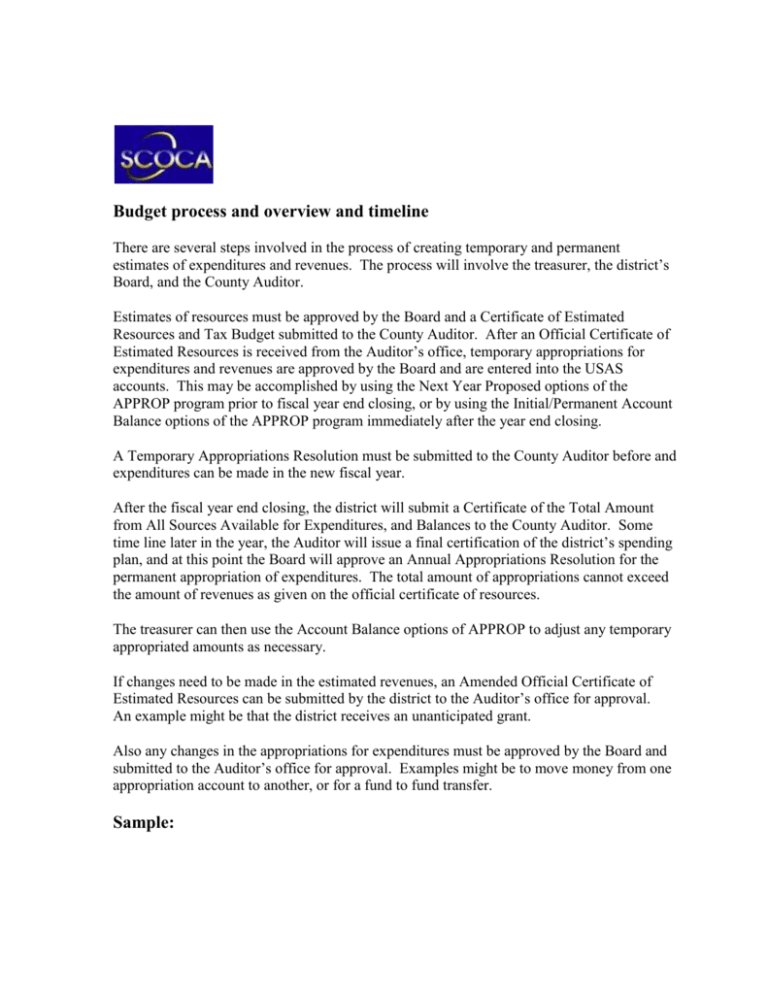

Budget process and overview and timeline There are several steps involved in the process of creating temporary and permanent estimates of expenditures and revenues. The process will involve the treasurer, the district’s Board, and the County Auditor. Estimates of resources must be approved by the Board and a Certificate of Estimated Resources and Tax Budget submitted to the County Auditor. After an Official Certificate of Estimated Resources is received from the Auditor’s office, temporary appropriations for expenditures and revenues are approved by the Board and are entered into the USAS accounts. This may be accomplished by using the Next Year Proposed options of the APPROP program prior to fiscal year end closing, or by using the Initial/Permanent Account Balance options of the APPROP program immediately after the year end closing. A Temporary Appropriations Resolution must be submitted to the County Auditor before and expenditures can be made in the new fiscal year. After the fiscal year end closing, the district will submit a Certificate of the Total Amount from All Sources Available for Expenditures, and Balances to the County Auditor. Some time line later in the year, the Auditor will issue a final certification of the district’s spending plan, and at this point the Board will approve an Annual Appropriations Resolution for the permanent appropriation of expenditures. The total amount of appropriations cannot exceed the amount of revenues as given on the official certificate of resources. The treasurer can then use the Account Balance options of APPROP to adjust any temporary appropriated amounts as necessary. If changes need to be made in the estimated revenues, an Amended Official Certificate of Estimated Resources can be submitted by the district to the Auditor’s office for approval. An example might be that the district receives an unanticipated grant. Also any changes in the appropriations for expenditures must be approved by the Board and submitted to the Auditor’s office for approval. Examples might be to move money from one appropriation account to another, or for a fund to fund transfer. Sample: Prior to Jan. 20: Prepare information for 2 documents – Tax Budget and Certificate of Estimated Resources – to be submitted to the County Auditor by Jan. 20. Generally these are done on a spreadsheet and figures are based on current year activity, past history, and financial forecasting estimates. The treasurer needs to justify to the Budget Commission the need to receive all local tax revenues. This Commission also has the authority to reduce mileage rates if need is not shown. By Jan. 20: The Tax Budget and Certificate of Estimated Resources documents need to be approved by the district’s Board and submitted to the County Auditor. March-April: An Official Certificate of Estimated Resources is received from the County Auditor’s office. This will indicate what the district can expect to receive from all sources. The district’s Board needs to pass a resolution accepting the amounts and rates as determined by the Budget Commission and authorizing necessary tax levies, and submit this to the Auditor. March – June: Requests for expenditures are gathered by administrators in preparation for an Appropriations Resolution. The treasurer may run the EXPWRK worksheet programs – BUDWRK, APPWRK, and REVWRK to assist in the process of estimating expenditures and revenues for the next fiscal year. Information is reviewed by the Board at the appropriation level. The treasurer will enter values into the next year proposed fields for expenditures and for revenues by using the Next Year Proposed options of the APPROP program. The amounts entered are “temporary” and may well be changed once certification is received from the County Auditor’s office (sometime in the fall). Before July 1: A temporary Appropriations Resolution is approved by the district’s board, and submitted to the County Auditor. The treasurer can use the APPRES option of the USACERT program to do this. This option can be run prior to the fiscal year closing, and takes data directly from the “next year’s proposed” fields on the district’s account file. After July 1: After the ADJUST program is run for the fiscal year closing, a Certificate of the Total Amount from All Sources Available for Expenditures, and Balances is generated, approved by the Board, and submitted to the County Auditor. The treasurer can use the CERTBAL option of the USACERT program to do this. This should be run after ADJUST has been run to close out the fiscal year. Note: If the treasurer did not use the Next Year Proposed options of APPROP to enter values into the next year proposed field prior to closing, they will now use Account Balance options of APPROP instead to enter temporary values into the initial budget and initial estimated revenue fields, and then run the APPRES option of the USACERT program. If changes need to be made in the estimated revenues, the treasurer should generate an *Amended Official Certificate of Estimated Resources*, and after approval by the district’s Board, submit this to the County Auditor’s office. The AMDCERT option of the USACERT program can be used to do this. This submission can be done at any time when the revenues received, or to be received, change from what was previously approved on the Official Certificate of Estimated Resources. For example, if the district receives an unanticipated grant during the fiscal year, the Amended Certificate must be approved by the Board and submitted to the Auditor before the district can legally expend the grant money. Before Oct. 1, or upon Certification from the County Auditor: After receiving final certification of the district’s spending plan from the County Auditor, an Annual Appropriations Resolution needs to be generated and approved by the district’s Board. The treasurer can use the APPRES option of the USACERT program to do this. It is important that the total of the appropriations does not exceed the total amount of revenues as given on the official certificate of resources. The treasurer can now enter permanent appropriation amounts by using the Permanent Account option of APPROP.