Marble-Sector-Action-Plan-MoCI-Final

advertisement

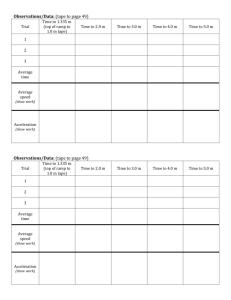

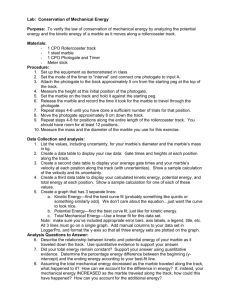

Ministry of Commerce and Industries And Ministry of Mines and Petroleum Implementing the SME Strategy: An Updated Action Plan for Developing Afghanistan’s Marble Sector October 2013- September 2016 Table of Contents ................................................................................................................................................................ 1 List of Acronyms .................................................................................................................................... 3 Executive Summary ................................................................................................................................ 4 Action plan objectives......................................................................................................................... 4 Recent developments and current status of the sector ............................................................................ 4 Priority problems and constraints ........................................................................................................... 5 Overview and Current Status of the marble sector ................................................................................. 5 Nature, scope and importance of the marble sector ............................................................................ 5 Table 1: Estimated marble reserves in Afghanistan ............................................................................ 6 Table 2: Number of marble and granite reserves per province ........................................................... 6 Extraction, Procession and retail price of Afghan Marble per Ton USD, 2014 AMA: ...................... 7 Royalty Rate Comparison: .................................................................................................................... 11 Principal markets .................................................................................................................................. 11 The Marble Sector Value Chain............................................................................................................ 11 Structure and performance ................................................................................................................ 12 SWOT analysis - Strengths and weaknesses or gaps in the marble sector value chain ....................... 13 Investment needs and opportunities ...................................................................................................... 13 Strategy and priorities for improving competitiveness ......................................................................... 14 Specific development priorities and actions ..................................................................................... 14 Stakeholder roles and sources of assistance .......................................................................................... 15 Recommendations for action plan implementation............................................................................... 17 Summary of priority problems and actions ........................................................................................... 18 2 List of Acronyms ABADE Assistance in Building Afghanistan by Developing Enterprises ACCI Afghanistan Chamber of Commerce and Industries AISA Afghanistan Investment Support Agency AGF Afghanistan Growth Finance ANSA Afghanistan National Standards Authority AMIA Afghanistan Marble Industries Association AMGPA Afghanistan Marble and Granite Processing Association ASTM American Society for Testing and Materials COE Center of Excellence - Marmaristan CSO Central Statistics Office EPAA Export Promotion Agency of Afghanistan GoIRA Government of the Islamic Republic of Afghanistan IFC International Finance Corporation MAIL Ministry of Agriculture, Irrigation and Livestock MIDAS Mining Investment and Development for Afghan Sustainability MOF Ministry of Finance MOCI Ministry of Commerce and Industries MOEW Ministry of Energy and Water MOMP Ministry of Mines and Petroleum MOTCA Ministry of Transport and Civil Aviation NEPA National Environment Protection Agency OPIC Overseas Private Investment Corporation NRRCP National and Regional Resource Corridors Program USAID United States Agency for International Development USGS United States Geological Survey WB World Bank This action plan was prepared with the support of the American people through the United States Agency for International Development (USAID). The contents of this action plan do not necessarily reflect the views of USAID or the United States Government. 3 Executive Summary Action plan objectives The purpose of this action plan is to address the principal problems which still hinder the growth potential of Afghanistan’s marble sector and to review the status of previously identified action plan issues, - examining which ones are resolved, those that are not, and which ones still remain as priority issues requiring immediate stakeholder attention. It aims to provide a means of coordinating the efforts and resources of marble sector stakeholders – including GoIRA ministries/agencies, international development agency programs, business associations and private sector entrepreneurs to implement projects and initiatives to resolve the principal problems that are inhibiting the growth and expansion of the marble sector. The 2013-2106 marble sector action plan lists the principal priorities and activities that are needed to stimulate the development of this sector. It also includes information on the resources that can be mobilized to address these problems, secure stakeholder support to undertake systematic efforts to remove constraints and provide the basis for developing detailed implementation plans and procedures for achieving the objectives contained in the plan. Recent developments and current status of the sector Delegation of authority by MOMP to some of the Provincial Directorates to administer the “quarrying licence bidding process” and issue contracts The terms of extractive contracts awards to bidders have changed from being based only on the ‘amount of proposed royalty payment’ to a more transparent evaluation incorporating technical capability & experience, financial resources, and scope of the proposed environmental plan Reduction in Royalty Fees to 10% of gross sale value, with a change from the advance royalty payment, to payment in arrears - at end of quarter Amendments to the Minerals Bill 2010 and Mining Regulations have been drafted which eliminate many of the onerous licensing processes and payments and allow for a more transparent award process; it is currently before Parliament awaiting final approval Almost 40% of quarries have, or are in the process of converting to wire and saw extraction Improvement in time period for the granting of a mineral extraction licence by MOMP A major increase in the number of marble processing plants; since 2010up to 40 have commenced business operations in Herat province Guidelines on ‘Health and Safety in Mining Operations’ and ‘Manufacturing, Transport, Storage and Use of Explosives’ have been issued by MOMP MOMP has established an investment promotion department to promote the Afghan mining sector with a specific focus to explore new markets MOMP is developing automated systems and procedures to manage all activities in the resources sector from: research, mapping, geological surveys, exploration, extraction, processing, health and safety and export shipment to attract investment in the sector MOMP is presently establishing a ‘state of art ’testing laboratory to certify Afghan marble in accordance with ATSM standards 4 Priority problems and constraints 1. Lack of reliable pre-feasibility studies and geological surveys on the quantity and quality of marble deposits 2. Shortage of quarried stone input supplies from a limited number of licensed quarries to the processing companies 3. Lack of, and high cost of continuous “three-phase” high voltage power from the national grid supply to operate processing plants; similar issues with water supplies 4. Improvements to the legal and regulatory framework to eliminate the culture of demands for informal payments (illegal taxes) and spurious charges and fees throughout the value chain (quarry to export) 5. Royalty rates are considerably higher than those assessed in competitor countries, in spite of recent royalty rate reductions 6. Government needs to increase the collection of tariffs on imported marble tiles and support the sector by insisting on use of Afghan produced and finished marble in all GoIRA construction projects 7. High interest rates for short-term loans, lack of access to longer term financing for larger capital investments ($100,000 to $8m) where the loan tenure should be up to 10 years, and lack of commercial bank financing for lease purchase of cranes, gang saws and trucks(3-5 years) 8. Need to improve the capacity of local technical expertise (cutting, polishing, finishing) to move Afghan marble up the value chain 9. Need for vocational training on mechanical and electrical trades to repair and maintain quarrying and processing equipment 10. Need to change the present reluctant mind-set of the marble sector companies to adopt modern mining and processing practices 11. Infrastructural deficiencies, poor quality of access roads to remote quarries 12. Security problems throughout the value chain – from quarries to customers Overview and Current Status of the marble sector Nature, scope and importance of the marble sector Afghanistan is home to 60 known deposits with as many as 35 varieties of marble in 40 different colors. With numerous high-quality deposits, the Afghanistan dimension stone industries has the potential to become a significant player in the Afghan economy and provide thousands of rural jobs at the quarries and in the downstream processing industries. The quality and quantity of Afghan deposits provides a comparative advantage which the industries can leverage to build a competitive advantage. Afghan white marble, primarily from the Spin Ghar mountain range in Nangarhar Province, is well known internationally as a highquality stone, but is difficult to get to market. Also, the deposits in Chesht and Khogiani marble from Herat are of top quality white marble very similar to Cararra marble from Italy. Buyers in the Gulf Countries, U.S., Italy and neighbouring countries currently purchase this marble and demand for it exceeds the available supply. Nine white cities are being created in Turkmenistan using Afghanistan white marble which has replaced imports of Italian marble. As perhaps the only source of high quality white marble in the region, Afghanistan enjoys a 5 comparative advantage with other regional competitors based on the availability of raw materials, and with respect to Italy as a result of its proximity to market. The high value of the marble covers the higher costs from inefficiencies within the marble sector’s value chain. Besides Chesht and Khogiani, numerous other deposits with export potential have been identified. The onyx deposit in Helmand is one of the few in the world and reputed to be of the highest quality; onyx currently sells for multiples of 3 to 5 times the price of marble in global markets. Principal areas of activity for marble are Herat, Kabul, Jalalabad and Kandahar and there is a deposit of white onyx in Maymana. The vision of the Government for the marble sector is to create an efficient, profitable, socially and environmentally responsible marble quarrying and processing industry that benefits Afghanistan as a whole, realizes economic and employment benefits for Afghan men and women, without damaging the environment. The US geological survey estimated the size of marble reserves in Afghanistan to be over 9 billion tons – with an estimated value around $200 billion. Table 1: Estimated marble reserves in Afghanistan Province Marble (million m3) Granite (million m3) Wardak Jalalabad Bamyan Badakhshan Herat Helmand 1,500 3,500 / 1,300 30 300 / / 2,400 Others 2,500 / / / Table 2: Number of marble and granite reserves per province Kabul 13 (M) Parwan 4 (T) 1 (OX) Nangarhar 5 (M) 2 (G) Wardak 2 (M) 1 (G) 3 (TRA) Bamyan 2 (M) 3 (G) 5 (TRA) Panjshir 8 (M) 7 (G) Laghman 2 (M) 1 (G) Herat 4 (M) 1(OT) Balkh 1 (M) Source: USGS, GPS Survey 2009 M: marble; G: granite; TRA: travertine; OX: onyx; OT: others Figures in front of the brackets are number of reserves Afghanistan annual marble production is around 124,000 to 155,000 tons, with over 50% of unprocessed marble going to Pakistan and Iran markets. Afghanistan consumption of finished marble is around 270,000 tons with approximately 80% of the domestic market being dominated by Pakistani finished marble. Currently the total value added of the Afghan marble industry is around $105 million which makes 0.6 percent of GDP. 6 Marble Production over 2005-2011 Production (in thousand tons) 45 40 35 30 25 20 15 10 5 0 2004 2005 2006 2007 2008 2009 20120 2011 2012 (Years) Source: Ministry of Mines and Petroleum Extraction, Procession and retail price of Afghan Marble per Ton USD, 2014 AMA: The following table was prepared based on the preliminary research in Kabul including a detailed discussion with the Head of the Afghan Marble Association. Mining Location Extraction Cost per Ton-USD Royalty Rate per TonUSD Transportation Processing # of Sq. Meters Retail Cost from the & Cutting Produced from PriceQuarry to Cost-USD One Ton USD Factory-USD Unprocessed Marble Hirat 21 10-33% 35 55 7 Meter Square 31 USD with 2CM per Width Meter Square Ningarhar 21 10-33% 20 50 7 Meter Square 24 USD with 2CM per Width Meter Square Kabul 10-33% 8 45 7 Meter Square 21 USD with 2CM per Width Meter Square 21 7 Notes: 1. The Transportation cost differs based on the location & distance of the Quarries from the Factory. 2. The Processing & Cutting differs based on the design and clients demand. 3. Retail price of Marble depends on the shape, color, width and quality of the Marble. 4. The Extraction cost also differs from quarries to quarries depending on the basic facilities provided. 8 No. Country Mineral Type % Royalty Rate 1 Afghanistan Marble 2 Turkey Marble, granite, onyx and other dimension stones 2% Based on gross sales value 3 Vietnam Marble, granite, onyx and other dimension stones 2.5% Based on gross sales value 4 India Marble, granite, onyx and other dimension stones 300 Rs = Based on gross sales value 10 - 33 % Royalty computation method Fixed amounts based on the quality and type of stones 5 USD 5 China Marble, granite, onyx and other dimension stones 5% Based on gross sales value 6 Oman Marble, granite, onyx and other dimension stones 2% Based on gross sales value 7 Pakistan Marble, granite, onyx and other dimension stones 6% - 7.5% Based on gross sales value 8 Iran Marble, granite, onyx and other dimension stones 5% - 7% Based on gross sales value 9 Kazakhstan Building materials, clay and marble 10 Philippines Salts, stones, sand and similar minerals 1% Based on the gross sales value 11 Botswana All minerals except for precious metals and stones 3% It is charged on the gross market 3.5% - 4.5% Computation based on sales revenue payable on the values of extracted mineral resources value payable on minerals 12 South Africa Marble 3.5% 9 13 Tanzania All minerals except for the gemstones and diamonds 5% Royalties are chargeable on net book value of minerals produced 14 Australia Marble 15 Namibia Dimension stones 16 Zambia Marble $1 per ton 10 5% Ad Valorem, market value 2.5% Based on gross revenue of minerals produced. Royalty Rate Comparison: A study undertaken by the Ministry of Mines and Petroleum in 2011 on comparative rates of royalty payments from a sample of sixteen countries, illustrates that Afghanistan has the highest rate of royalty fee for the extraction of marble, granite, onyx and other base construction aggregate materials. Principal markets Marble exports during 2011-2012 Principal export markets include: Pakistan, Iran and China Marble Exports CSO - 2012 No. 1 2 3 4 5 6 7 8 9 10 11 12 USD value 1,055,774 1,037,464 832,798 193,830 129,840 110,238 96,981 33,265 22,990 12,105 11,500 10,735 3,547,520 Country Pakistan Iran China Turkey UAE Italy India Turkmenistan Canada Azerbaijan Iraq Hong Kong Quantity Kgs 2,111,798 2,017,138 1,666,924 392,305 260,470 221,535 193,961 66,690 45,980 24,210 23,000 21,470 7,045,481 Source: EPAA-CSO Note: Official export figures may under-estimate the actual value of exports by as much as 80% The Marble Sector Value Chain 11 Structure and performance There are more than 30 factories producing marble in Afghanistan, but the total output is undocumented. Approximately 90% of marble quarried is exported as rough-hewn blocks to Pakistan where it is processed and then transported back to Afghanistan. Most of the value in production of marble is created in the final two steps which are typically carried out in Pakistan. Finished marble products imported from Pakistan dominate the market as local producers are unable to compete with the lower prices and higher quality of these products. The Afghanistan marble industry suffers from a lack of adequate equipment, has little technical knowledge, and uses poor extraction methods that often significantly reduce the value of the marble. Extraction is by low tech, wasteful, explosive-based methods using ‘black powder’, typically imported from Pakistan. This causes micro-fracturing throughout the entire quarry and results in 50% wastage at the quarrying stage. Further wastage occurs at the marble factory where blocks often break up during the cutting and polishing stages of production. The result is a relatively poor quality polished marble with a comparatively high unit cost of production. Comparative Value Chain Analysis for Marble Sector in USD per ton in Afghanistan Comparative Value Chain Analysis 241 201 161 121 81 41 1 Extraction Cost per Ton Royalty Rate per ton Hirat Transportation Cost Ningarhar Processing & Cutting Cost Kabul Source: Afghan Marble Association, 2014 12 Retail Price SWOT analysis - Strengths and weaknesses or gaps in the marble sector value chain Strengths Weaknesses Large deposits of superior quality marble Well-known in regional markets for quality marble Proximity to major markets in Asia Availability of low-cost labor Ongoing investment in the Industries Inconsistent supply and quality due to poor quarrying practices Poor infrastructure, security problems, and corruption hinder access to quarries Value-chain weaknesses – poor processing and logistic facilities High transportation and shipment costs to export markets Lack of diversified export buyers Difficulties in securing commercial financing Opportunities Threats Development of marble sector value chain Marble sector offers most potential for SME growth and rural employment in certain provinces Sourcing new buyers – regional & international export markets Strong import substitution potential Handicraft and artisanal market potential to recycle marble wastage from the quarries Opportunities to access financial and technical support from international donors and investors Failure to fulfil international quality certification standards High costs of sophisticated mining and processing equipment Continuing lack of high quality, affordable technical training facilities Continuing security threats in rural areas Investment needs and opportunities Expanding and improving quarrying: Introducing improved wire and saw extraction technology and expanding quarrying through improving access to high-quality marble deposits should enable the sector to grow quickly and result in increased productivity and improved profitability. Moving the industries into more profitable parts of the value chain: The repatriation of key parts of the value chain from neighbouring countries offers investment opportunities for establishing cutting and polishing plants, as much of the downstream processing of Afghan marble is currently done outside Afghanistan. 13 Strategy and priorities for improving competitiveness Specific development priorities and actions Information provided by stakeholders during the course of the development of this updated action plan, together with a review of available reports and analyses of the Afghanistan marble sector, provides a clear and consistent picture of the principal problems that need to be addressed to support the development of Afghanistan’s marble sector. 1. Supply inputs – Existing licensed quarry operators need to provide more regular deliveries and increased supplies of stone to processing companies. 2. Skill levels and training –Vocational skills training is required to improve the capacity of local technical expertise in the areas of stone cutting, polishing and finishing to reduce wastage and move the quality of Afghan marble for export up the value chain. Mechanical/electrical skills training also required for extraction and processing machinery maintenance and repairs. 3. Electricity cost – Electricity supply and coverage is limited and of poor quality from the national grid. Dependence on diesel generated power is the norm and is expensive. Ministry or Energy and Water needs to address this. 4. Availability of water – Poor access to regular water supplies to support the cutting, washing and polishing processes is problematic and expensive, processors have to purchase tanker quantities. MOEW to address this. 5. Increased import duties – Government to increase duty levels (or enforce collection of duties at current rates) on imported finished marble from Pakistan to support domestic industries. 6. Reduced export duties–Ministries of Finance and Mining and Petroleum to formally reduce export duties on Afghan produced marble – (promised but not implemented). 7. Developing market awareness – Exporters with EPAA and AISA support, need to increase direct contacts with end-market buyers through regular participation in trade shows and market promotion events. A web portal for Afghanistan marble exporters should be developed to promote product awareness. 8. Improving transportation and logistics --Marble sector firms need to collaborate with shipping companies and MOTCA to develop lower cost transportation links through an expanded array of trade corridors; the GoIRA should speed up efforts to remove remaining barriers caused by inefficient, corrupt and improper customs operations and work to fully implement new trade agreements and transportation treaties such as the TIR (International Convention on Transport Routes). 9. Provision of land and infrastructure – MOCI and private sector firms and associations should lobby AISA and other GoIRA ministries to speed up the availability and process of 14 acquiring serviced facilities in industrial parks and other locations. This would encourage the development of marble sector clusters that offer better working conditions and increased employment opportunities. 10. Improving access to finance— Entrepreneurs need access to longer term financing ($100,000 - $8 million) necessary for larger item capital investments, loan tenure should be up to 10 years. Lease financing products for pneumatic steel drills, hammer drills, wire and saw block equipment, derrick cranes, excavators, loaders and dump trucks. Stakeholder roles and sources of assistance The following table provides an illustrative summary of the roles that different groups of stakeholders can play in implementing the marble sector action plan in order to promote the growth of the sector. It includes current sources of assistance for various types of business development activities: Problem area Stakeholder roles Sources of assistance1 Improving supply of inputs Marble sector associations and companies to develop MOMP, MOCI, more streamlined licensing procedures for new quarry AGMPA, AMIA operators and identify existing licensed quarries that ABADE are not meeting local processor demands Donor programs – help quarrying firms acquire equipment (through PPAs or loans) to increase marble extraction Skills level and training Establish training centers– invest in skills training on cutting, polishing, resource and waste management. Specialist technical trainings on mechanical and electrical trades to support extractive and processing machinery maintenance Electricity and water supply and cost Ministry of Energy & Water, Da Afghanistan, Da Brishna Shirkatand, AISA to provide adequate voltage from the national grid at affordable cost as opposed 1 ABADE, ADF, FAIDA, IFC, OPIC, AGF COE AMIA AMGPA MOEW, AISA, MOCI The above list includes some of the projects and organizations that are currently supporting activities related to the marble sector or potentially could contribute resources in the future to help improve performance in these areas. Listing these organizations and projects does not imply a commitment to undertake specific marble sector development initiatives. Specific roles for different organizations, projects, and other stakeholder groups will be worked out over the course of implementing this action plan. 15 to diesel generator supplies. Similarly for water supplies Amending export and import duties Ministries of: Finance, Commerce & Industries and Mining & Petroleum to lobby Government to increase duty levels and collections on finished marble imports from Pakistan, and reduce export duties on Afghan marble exports Developing Marble associations, exporters and companies – market awareness arrange regular participation in regional/international trade shows and marketing events; facilitation of visas for travel, development of a websites to promote the Afghan marble brand MOCI, MOF, MOMP, MIDAS EPAA, AISA, COE NMDP-WB AMIA, AMGPA Future: Donor programs: provide technical and financial support to help organize and conduct market promotion events and provide market promotion training Improving transportation and logistics MOCI – reactivate Afghanistan’s membership of TIR, renegotiate more favorable terms of existing bi-lateral transport agreements, including the Afghan-Pakistan trade transport agreement. Marble sector associations and companies –Negotiate with freight forwarders and shipping companies to obtain more favorable rates. MOTCA—facilitate negotiations with shipping companies and offer incentives to help exporters obtain more favorable rates. Donor support TBD ACCI, AISA, AMIA, AMGPA MOTCA, AISA AMIA, AMGPA Future: Donor support TBD Future: Donor support TBD Provision of land, infrastructure for processing /value chain activities Speed up the process of making land and supporting MAIL, AISA, infrastructure available in industrial parks and other MOCI, AMIA, locations, to marble sector companies to upgrade AMGPA processing capabilities. Improved access to finance Donor programs – provide funds/credit lines to ADF, IFC, financial institutions to introduce new long term OPIC, AGF, financing products (up to 10 years) to fund larger capital investments. MOCI– encourage the commercial banks to develop MOF, new financing products (e.g. lease financing) to meet ADF, FAIDA 16 the real financing needs of the marble sector companies. Recommendations for action plan implementation Implementing the activities included in this action plan will require cooperation, active participation and support from the full range of stakeholders in the marble sector, including Government ministries and agencies, companies, business associations, individuals, NGOs, International development agencies and project implementers. A Working Group will need to be formed with representatives from the various groups of stakeholders to manage the way forward. The group will need to work out methods for undertaking cooperative initiatives to address and solve the priority problems highlighted in this action plan. This will entail: Organizing specialised Task Force Groups that include participants willing to take an active role in dealing with the specific challenges outlined in the action plan Sharing information Actively collaborating to develop specific implementation plans, systems and schedules to deal with constraints and problems outlined in this action plan Developing linkages with handicraft and artisanal manufacturers to utilize quarrying ‘offcuts’ to eliminate product wastage Assigning responsibilities to different groups and individuals and establishing schedules and deadlines for carrying out various tasks Monitoring progress in achieving performance targets and meeting deadlines 17 Action Plan for Afghanistan’s Marble Sector Sept 2013 Summary of priority problems and actions Main problems Main priorities Possible tasks/activities Possible Sources of support2 Priority (high, medium, low) MOCI SME Directorate and Marble Associations to lobby Ministry of Mining & Petroleum to: MOMP, AGMPA, AMIA High MOMP, MOCI, AISA, ANSA, COE High Stone supplies from licensed quarries Lack of regular supplies of quarried marble to downstream companies MOMP to increase the number of licenses awarded to companies to operate quarries Exploration and testing Support mining /quarrying companies to assess size and quality of deposits - Increase the number of licensed quarry operators, Develop streamlined procedures for license approval to new quarries, and - Increase the areas to be explored to facilitate increased stone extraction to meet market demand. MOMP to arrange for samples to be taken from new deposits for testing. Samples to be sent outside the country for testing to meet ASTM standards Electricity and Water supplies 2 This list includes some of the projects and organizations that are currently supporting activities related to the marble sector or potentially could contribute resources in the future to help improve performance in these areas. Listing these organizations and projects does not imply a commitment to undertake specific marble sector development initiatives. Specific roles for different organizations, projects, and other stakeholder groups will be worked out over the course of implementing this action plan. 18 Action Plan for Afghanistan’s Marble Sector Access to high voltage electricity from the National grid Provide continuous level of high voltage power at reasonable cost. Similar for access to regular water supplies Sept 2013 Ministry of Energy and Water to provide “three-phase” power to the marble sector companies. MOMP, MOCI, High AMIA, AMGPA Da Brishna Shirkat Improvements to the legal and regulatory framework Informal payments being demanded throughout the value chain Government action is required to eliminate this culture which hinders the price competitiveness of Afghan marble MOCI and the sector associations to work with Customs Commission and the Ministry of Interior to develop a strategy to address the problem of informal payments. MOCI, AMIA, AMGPA, MOI High Lack of protection of domestic market Government to mandate the use of Afghan marble on all Government funded construction projects; Customs needs to improve collection of customs duties for imported products Better enforcement of customs requirements for importing finished marble products from Pakistan to ensure the correct amounts of import duties are being collected. MOF, MOMP, Medium Government procurements for construction contracts should include local content requirements for marble and stone products 19 MOCI, Action Plan for Afghanistan’s Marble Sector High royalty rates and export duties; poor enforcement of import duties for marble tiles from regional competitors Government action is needed to further reduce royalty rates and eliminate export duties on processed products Sept 2013 Marble associations need to lobby the government to eliminate import duties on processed marble products (as was previously agreed upon) and reduce royalty rates to more competitive levels more closely aligned to rates charged by regional competitors MOCI, ACD, MOF High The Customs Department needs to conduct review of import duties assessed on imports of marble tiles from Pakistan to eliminate undervaluation of imports and customs charges Transportation and logistics High transportation costs Negotiation of favorable cargo rates with trucking companies MOCI to support exporters in efforts to negotiated competitive shipping rates MOCI, AGMPA, AMIA, AISA, ACCI, High Transport and trade agreements Renegotiation of existing bi-lateral and regional trade transport agreements Reactivation of Afghanistan’s membership of TIR and renegotiation of the terms and conditions of the Afghanistan/Pakistan trade transport agreement MOTCA, ACCI, High 20 Action Plan for Afghanistan’s Marble Sector Sept 2013 Developing market awareness Poor market linkages Develop increased market opportunities for Afghan finished marble MOCI to support the development of a consistent marketing strategy and EPAA, ACCI, COE, engage in joint activities that support international marketing programs for AMIA, AMGPA, Afghan producers, processors and exporters. Development of a marble sector website to promote the Afghan marble brand. NMDP Medium MOCI to work with the associations, companies and donors to define training needs and develop training programs for best quarrying techniques and quarry safety and improved methods of cutting, carving, polishing and finishing. MOCI, MOMP, COE, MIDAS, AMIA, AMGPA Medium Finance required by larger companies for purchase of quarrying rights. Financing in the range from $100,000 to $8 million is unavailable in the market due to the loan risk for Afghanistan MOF, IFC, ADF, ARFC, AGF, OPIC, AISA High Skill levels and technical expertise Poor levels of skills modern mining and value chain cutting/polishing practices Undertake a needs assessment to define a sector training strategy to raise local skills standards Improving access to finance Lack of sources of finance for capital expenditure and equipment leasing Identify provider/s of long term financing (7-10 year loan tenures) or equity capital Financing for purchase /leasing of processing plant and machinery is required (up to 5 year loan tenures) 21 MOF, Afghan commercial banks Action Plan for Afghanistan’s Marble Sector Sept 2013 22