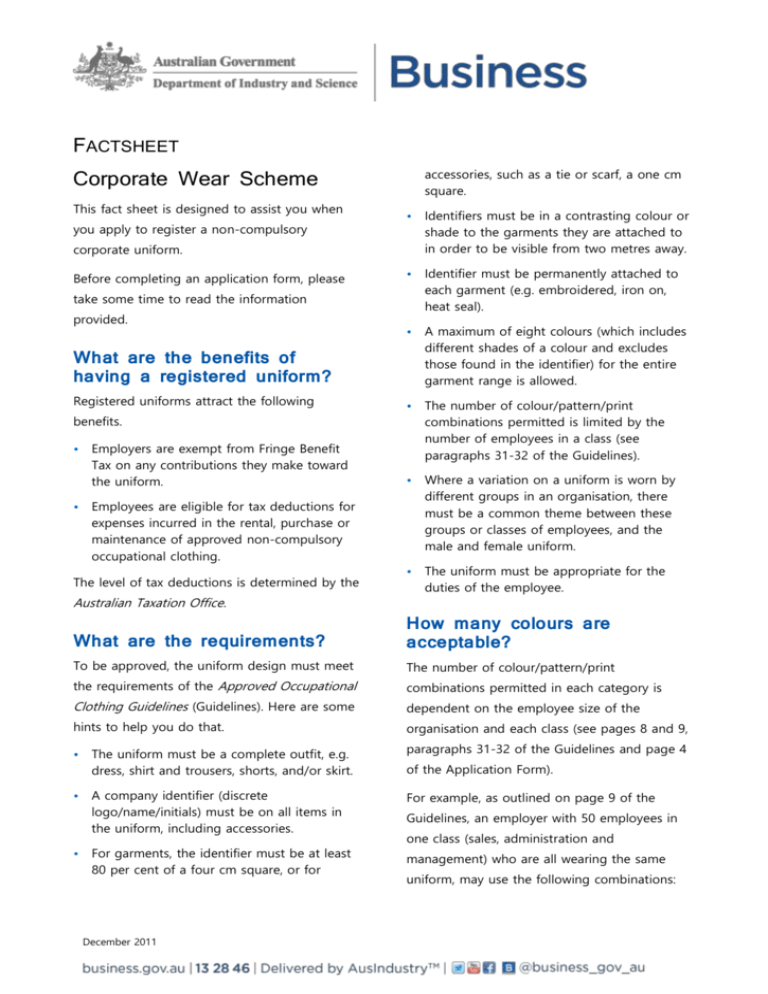

FactsheetCorporate Wear Scheme

advertisement

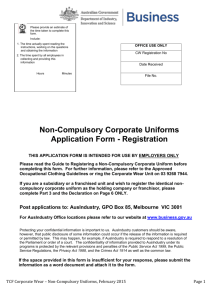

FACTSHEET Corporate Wear Scheme This fact sheet is designed to assist you when you apply to register a non-compulsory accessories, such as a tie or scarf, a one cm square. • Identifiers must be in a contrasting colour or shade to the garments they are attached to in order to be visible from two metres away. • Identifier must be permanently attached to each garment (e.g. embroidered, iron on, heat seal). • A maximum of eight colours (which includes different shades of a colour and excludes those found in the identifier) for the entire garment range is allowed. • The number of colour/pattern/print combinations permitted is limited by the number of employees in a class (see paragraphs 31-32 of the Guidelines). • Where a variation on a uniform is worn by different groups in an organisation, there must be a common theme between these groups or classes of employees, and the male and female uniform. • The uniform must be appropriate for the duties of the employee. corporate uniform. Before completing an application form, please take some time to read the information provided. What are the benefits of having a registered uniform? Registered uniforms attract the following benefits. • • Employers are exempt from Fringe Benefit Tax on any contributions they make toward the uniform. Employees are eligible for tax deductions for expenses incurred in the rental, purchase or maintenance of approved non-compulsory occupational clothing. The level of tax deductions is determined by the Australian Taxation Office. What are the requirements? How many colours are acceptable? To be approved, the uniform design must meet The number of colour/pattern/print the requirements of the Approved Occupational combinations permitted in each category is Clothing Guidelines (Guidelines). Here are some dependent on the employee size of the hints to help you do that. organisation and each class (see pages 8 and 9, • The uniform must be a complete outfit, e.g. dress, shirt and trousers, shorts, and/or skirt. paragraphs 31-32 of the Guidelines and page 4 A company identifier (discrete logo/name/initials) must be on all items in the uniform, including accessories. For example, as outlined on page 9 of the • • For garments, the identifier must be at least 80 per cent of a four cm square, or for December 2011 of the Application Form). Guidelines, an employer with 50 employees in one class (sales, administration and management) who are all wearing the same uniform, may use the following combinations: Men Outer Upper (Maximum of two combinations) Jackets, Jumpers 1. Navy 2. Charcoal Inner Upper (Maximum of three combinations) Lower Body (Maximum of two combinations) 1. Skirts, Trousers 2. Navy 3. Red What is a class of employees? • A class is the group of employees who will wear the uniform. • There can be one class for the whole organisation which includes people from various departments or work areas. • Only where there is a slightly different uniform for separate groups of employees should two or more classes be nominated. • In this instance there would need to be a common colour in the uniforms to satisfy the requirement of a common theme between classes. Shirts 1. White 2. Stripe - Navy/White 3. Chambray Blue Lower Body (Maximum of two combinations) Trousers, Shorts 1. Navy 2. Charcoal Women Outer Upper What clothing is ineligible for the register? The following items cannot be included on the non-compulsory uniform register: • compulsory uniforms • occupation-specific clothing such as a chef’s check pants and white shirt • protective clothing (Maximum of two combinations) Jackets, Jumpers 1. Navy 2. Red Inner Upper (Maximum of three combinations) Shirts 1. White 2. Floral Print Red/Navy/White/Gold 3. Stripe - White/Red December 2011 Please telephone the Australian Taxation Office on 13 28 61 for details of concessions and eligibility on these uniforms and clothing items. How do I register? To register a uniform you must complete the application form ‘Non-Compulsory Corporate Uniforms Application Form – Registration’. This form is on AusIndustry’s website www.business.gov.au or telephone the hotline on 13 28 46.