Funding Arrangements for Commonwealth Property

advertisement

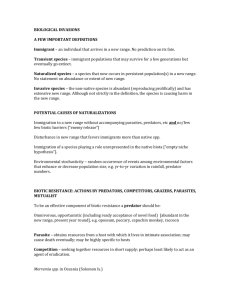

Finance Circular No. 2012/06 Funding Arrangements for Commonwealth Property Key points This circular: Provides guidance on the process for seeking alternative funding arrangements for Commonwealth property; Provides guidance on categorising Commonwealth owned, non-defence property as a Special Purpose Property (SPP); Provides guidance on the new funding and management arrangements for those properties classified as SPPs; Applies to all departments and agencies subject to the Financial Management and Accountability Act 1997 (FMA Act) and Commonwealth Property Management Framework (CPMF); Reflects the Government’s decision to implement new arrangements for managing and funding SPPs that came into effect on 17 April 2012; and Is available on the Finance website at http://www.finance.gov.au/publications/financecirculars/index.html. Alternative Funding Models for Commonwealth Property 1. The Commonwealth Property Management Framework requires that agencies conduct transparent evaluations of the long-term costs of investment options through the adoption of cost-benefit analysis taking into consideration economic, environmental, and social issues in the decision making process1. While many of these property decisions will be funded directly through budget appropriations, agencies are also encouraged to consider whether alternative funding options would be applicable such as: a. entering into a lease commitment with a private developer to fund construction of office accommodation; and b. sharing funding and project risks with the private sector by leveraging private sector investment in infrastructure assets through its balance sheet by way of government guarantee or equity investment. 2. The Department of Finance and Deregulation (Finance) can assist agencies to undertake a cost-benefit analysis of the various property investment options and to consider the applicability of the different funding models. 1 See the Overview of the Commonwealth Property Management Guidance, available at: http://www.finance.gov.au/property/property/overview_cpmf/overview_cpmf.html . Finance Circular 2012/06 Department of Finance and Deregulation Page 1 of 4 Special Purpose Properties 3. Most agencies subject to the FMA Act are charged commercial rents for their office accommodation. However, some Commonwealth-owned properties are used for special purposes and contain fit-outs and designs that result in higher operating and maintenance costs. To charge a market-based rent to those properties does not recognise the additional costs associated with the specialised nature of the property’s construction or fit-out. 4. A principles-based approach has been established for classifying Commonwealth owned, non-defence properties as SPPs in cases where the specialised nature of the property prevents it from being managed and funded under normal commercial arrangements. The SPP funding model is intended to facilitate improved management and sustainable funding of SPPs within the CPMF. The Special Purpose Property Principles 5. A property must meet all of the following four criteria to be classified as an SPP: a. the Commonwealth has limited discretion over the location of the property due to Government policy objectives; and b. the agency has limited discretion over the type of services delivered in the property due to Government policy objectives; and c. the agency requires a specialised construction or fitout to perform its functions and is unable to perform its functions in a commercial property, nor is the agency able to share its tenancy with other agencies or the private sector; and d. the cost of delivering services in a commercial property would be uneconomical for the Government on a whole-of-life basis. 6. The assessment of whether a property is categorised as special purpose should be undertaken in close consultation with Finance. This helps to ensure that properties that meet all four of the SPP criteria are treated as SPPs consistently across the Commonwealth. SPP properties are, by their very nature, unique and it is anticipated that few properties will be classified as SPPs. 7. The aim of the SPP Principles is to improve the overall management of SPPs through ensuring sustainable funding arrangements for the assets. The implementation of the SPP Principles should seek to avoid adding unnecessary complexity to existing arrangements and should meet the requirements of tenants and landlords in a holistic and sustainable manner. 8. Agencies with a property that they believe meets the SPP criteria should contact their Agency Advice Unit in Finance’s Budget Group and provide sufficient information to demonstrate that the property meets all of the SPP criteria. Assessments for classifying properties as SPPs are made on a case-by-case basis by Finance in consultation with the relevant stakeholder agency(s) unless otherwise directed by the Government. Establishing a New Funding Baseline for Special Purpose Properties 9. Once a property has been classified as an SPP the next step is to establish a new funding baseline that takes into account the whole-of-life cost to the Government of maintaining the property. Finance has released the Financial Management Guidance no. 15 Whole-of-Life Costing for Commonwealth Property Management to assist in estimating the whole-of-life costs. This is available at http://www.finance.gov.au/property/property/overview_cpmf/whole_of_life_costing.ht ml . Finance Circular 2012/06 Department of Finance and Deregulation Page 2 of 4 10. Once the whole-of-life costs have been established, these costs are then split into two categories which together comprise the new funding baseline: a. an office accommodation (market rent) component which is defined by the Australian Government Property Data Collection (PRODAC) specifications for ‘Usable Office Area’. This component is subject to a market based rent, equivalent to the prevailing office accommodation in the location of the property, and is paid for by the tenant agency(s); and b. the special purpose component (economic rent) which is defined using the PRODAC specifications for ‘non-office area’. This component is subject to an economic rent to be paid to Finance in its capacity representing the Commonwealth landlord for the non-Defence, domestic property portfolio. 11. The precise split of each SPP (into an office accommodation and special purpose component) and the associated funding arrangements are to be determined on a caseby-case basis. The funding arrangements for SPPs involve a reallocation of existing funding with any changes to tenant agency appropriations balanced by a corresponding variation in inflows to Finance. The SPP funding arrangements will be budget neutral. 12. For assistance in estimating the whole-of-life costs and determining the office accommodation and special purpose areas of an SPP, agencies should contact their Agency Advice Unit in Finance’s Budget Group. Properties Currently Classified as Special Purpose Properties 13. The Government has agreed that the following properties be classified as SPPs: a. the Commonwealth Law Court buildings in Adelaide, Brisbane, Canberra, Hobart, Melbourne, Parramatta, Perth and Sydney; b. the new building for the Australian Security Intelligence Organisation; and c. the Post Entry Quarantine facility for the Department of Agriculture, Fisheries and Forestry. Finance Circular 2012/06 Department of Finance and Deregulation Page 3 of 4 Frequently Asked Questions 14. When should properties be assessed against the SPP Principles? The assessment of whether a property should be categorised as special purpose should occur before a new lease is entered into or as early as possible when a new property is being developed by or on behalf of, an agency. 15. How do I determine which areas of an SPP should be classified as ‘Usable Office Area’ and which are ‘Non Office Area’? The PRODAC Specifications should be referred to when determining the ‘Usable Office Area’ and ‘Non Office Area’. These can be found on the Finance website at http://www.finance.gov.au/property/property/property-data-collection.html. Property Framework Branch in Finance (PropertyFramework@finance.gov.au) can also provide assistance with applying the PRODAC Specifications. 16. How do I assess whether there is limited discretion over the location of the property? An agency is generally deemed to have limited discretion over the location of a property when the location of the property is set in legislation or Australian Government policy. 17. If a property is unique or unusual, is it considered an SPP? No. A property is only considered an SPP if it meets all of the four SPP criteria in paragraph three of this circular. Those properties that only meet one or two of the SPP criteria are not considered SPPs for the purposes of the Government’s policy concerning SPPs. Contact 18. Further information on the Commonwealth Property Management Framework can be found on the Finance Website (http://www.finance.gov.au/property/property/property-managementframework.html). 19. Enquiries regarding the SPP Principles should be directed to relevant Agency Advice Units in Finance’s Budget Group. 20. General enquiries relating to the Commonwealth Property Management Framework should be directed to PropertyFramework@finance.gov.au . Simon Teschendorf Assistant Secretary Property Framework Branch Asset Management and Parliamentary Services Group 12 October 2012 Finance Circular 2012/06 Department of Finance and Deregulation Page 4 of 4