Test 1

advertisement

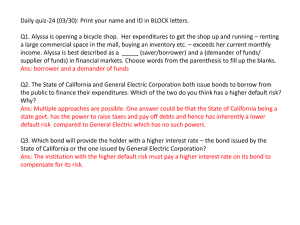

ECN 324 Test 1 Summer 2014 Chp 1-8 Dr. Moffett Student: _______________________________________ 1. The largest deficit unit is (are) a. households and businesses. b. foreign financial institutions. c. the U.S. Treasury. d. foreign nonfinancial sectors. 2. Which of the following is a money market security? a. Treasury note b. municipal bond c. Mortgage d. Commercial paper 3. a. b. c. d. If security prices fully reflect all available information, the markets for these securities are efficient. primary. overvalued. undervalued. 4. Which of the following is a nondepository financial institution? a. savings banks b. commercial banks c. savings and loan associations d. mutual funds 5. The main reason that depository institutions experienced financial problems during the credit crisis was their investment in: a. Subprime mortgages. b. money market securities. c. stock. d. Treasury bonds. 6. The quantity of loanable funds supplied is normally a. highly interest elastic. b. more interest elastic than the demand for loanable funds. c. less interest elastic than the demand for loanable funds. d. equally interest elastic as the demand for loanable funds. 7. Which of the following is likely to cause a decrease in the equilibrium U.S. interest rate, other things being equal? a. a decrease in savings by foreign savers b. an increase in inflation c. pessimistic economic projections that cause businesses to reduce expansion plans d. a decrease in savings by U.S. households 8. The federal government demand for funds is said to be____________. a. Interest rate inelastic b. insensitive c. relatively sensitive as compared to other sectors d. Interest rate elastic 9. According to the Fisher effect, expectations of higher inflation cause savers to require a ____ on savings. a. higher nominal interest rate b. higher real interest rate c. lower nominal interest rate d. lower real interest rate 10. a. b. c. d. Default risk is likely to be highest for short-term Treasury securities. AAA corporate securities. long-term Treasury securities. BBB corporate securities. 11, a. b. c. d. If a security can easily be converted to cash without a loss in value, it is liquid. has a high after-tax yield. has high default risk. is illiquid. 12. Assume an investor's tax rate is 25 percent. The before-tax yield on a security is 12 percent. What is the after-tax yield? a. 16.00 percent b. 9.25 percent c. 9.00 percent d. 3.00 percent e. none of the above 13. If shorter term securities have higher annualized yields than longer term securities, the yield curve a. is horizontal. b. is upward sloping. c. is downward sloping. d. cannot be determined unless we know additional information (such as the level of market interest rates). 14. According to the liquidity premium theory, the expected yield on a two-year security will ____ the expected yield from consecutive investments in one-year securities. a. equal b. be less than c. be greater than d. B and C are possible, depending on the size of the liquidity premium 15. The theory of the term structure of interest rates, which states that investors and borrowers choose securities with maturities that satisfy their forecasted cash needs, is the a. pure expectations theory. b. liquidity premium theory. c. segmented markets theory. d. liquidity habitat theory. 16. a. b. c. d. The yield curve for corporate bonds. would typically lie below the Treasury yield curve. is identical to the Treasury yield curve. typically has the same slope as the Treasury yield curve. is irrelevant to investors. 17. a. b. c. d. e. All ____ are required to be members of the Federal Reserve System. state banks national banks savings and loan associations finance companies A and B 18. The ____ is made up of seven individual members, and each member is appointed by the president of the U.S. a. Board of Governors b. Federal Reserve district bank c. Federal Open Market Committee (FOMC) d. Securities and Exchange Commission 19. Which of the following is an action that the Fed uses to increase or decrease the money supply? a. buying or selling Treasury securities in the secondary market b. adjusting the tax rate imposed on income earned on Treasury securities c. adjusting the coupon rate on Treasury bonds d. selling Treasury securities in the primary market 20. a. b. c. d. To decrease money supply, the Fed could ____ the reserve requirement ratio. increase stabilize reduce eliminate 21. a. b. c. d. In general, there is: a positive relationship between unemployment and inflation. an inverse relationship between unemployment and inflation. an inverse relationship between GNP and inflation. a positive relationship between GNP and unemployment. 22. a. b. c. d. ____ serves as the most direct indicator of economic growth in the United States. Gross domestic product (GDP) National income The unemployment rate The industrial production index 23. If the federal government is willing to pay whatever is necessary to borrow loanable funds, but the private sector is not, this reflects a. the crowding-out effect. b. dynamic open market operations. c. defensive open market operations. d. monetizing the debt. 24. When the Fed uses open market operations by selling some of its Treasury securities to investors in the U.S., there will be a. an outward shift in the supply schedule of loanable funds. b. an inward shift in the supply schedule of loanable funds. c. no shift in the supply schedule of loanable funds. d. an outward shift in the demand schedule for loanable funds. 25. a. b. c. d. ____ are sold at an auction at a discount from par value. Treasury bills Repurchase agreements Banker's acceptances Commercial paper 26. Slim Pickens, a private investor, purchases a Treasury bill with a $10,000 par value for $9,645. One hundred days later, Slim sells the T-bill for $9,719. What is Slim's expected annualized yield from this transaction? a. 13.43 percent b. 2.78 percent c. 10.55 percent d. 2.80 percent e. none of the above 27. A newly issued T-bill with a $10,000 par value sells for $9,750, and has a 90-day maturity. What is the discount? a. 10.26 percent b. 0.26 percent c. $2,500 d. 10.00 percent e. 11.00 percent 28. a. b. c. d. An increase in inflation will, in an efficient market, result in A decrease in rates An increase in rates A decrease in stock prices none of the above 29. a. b. c. d. When a bank guarantees a future payment to a firm, the financial instrument used is called a repurchase agreement. a negotiable CD. a banker's acceptance. commercial paper. 30. a. b. c. d. Interest earned from Treasury bonds is exempt from all income tax. exempt from federal income tax. exempt from state and local taxes. subject to all income taxes. 31. a. b. c. d. A call provision on bonds normally allows the firm to sell new bonds at par value. gives the firm to sell new bonds above market value. allows the firm to sell bonds to the Treasury. allows the firm to buy back bonds that it previously issued. 32. a. b. c. d. Some bonds are "stripped," which means that they have defaulted. the call provision has been eliminated. they are separated into principal-only and interest-only securities. their maturities have been reduced. 33. Everything else being equal, which of the following bond ratings is associated with the highest yield? a. Baa b. A c. Aa d. Aaa 34. a. b. c. d. If the coupon rate equals the required rate of return, the price of the bond should be above its par value. should be below its par value. should be equal to its par value. is negligible. 35. a. b. c. d. The US tax code is said to favor. Equities Debt Non-profits In substance defeasance 36. The relationship reflecting the actual response of a bond's price to a change in bond yields is a. concave. b. convex. c. linear. d. quadratic. 37. Suppose a bond has a Macaulay Duration of 11 years, and a current yield to maturity of 8%. If the yield to maturity increases to 8.75%, what is the resulting percentage change in the price of the bond? a. -5.29% b. 5.29% c. -7.20% d. -6.88% PV C C C par ... 1 2 1 k 1 k 1 k n Modified Duration Macaulay Duration YTM 1 2 Pct. Change in Bond Price Duration YT SP PP 365 PP n Pct. Change in Bond Price - Modified Duration Change in YTM YT Change in YTM 1 YTM 2 Par PP 360 PP n ANSWER KEY 1. The largest deficit unit is (are) a. households and businesses. b. foreign financial institutions. c. the U.S. Treasury. d. foreign nonfinancial sectors. ANS: C 2. Which of the following is a money market security? a. Treasury note b. municipal bond c. Mortgage d. Commercial paper ANS: D 3. a. b. c. d. If security prices fully reflect all available information, the markets for these securities are efficient. primary. overvalued. undervalued. ANS: 4. a. b. c. d. A Which of the following is a nondepository financial institution? savings banks commercial banks savings and loan associations mutual funds ANS: D 5. The main reason that depository institutions experienced financial problems during the credit crisis was their investment in: a. Subprime mortgages. b. money market securities. c. stock. d. Treasury bonds. ANS: 6. a. b. c. d. e. A The quantity of loanable funds supplied is normally highly interest elastic. more interest elastic than the demand for loanable funds. less interest elastic than the demand for loanable funds. equally interest elastic as the demand for loanable funds. A and B ANS: C 7. Which of the following is likely to cause a decrease in the equilibrium U.S. interest rate, other things being equal? a. a decrease in savings by foreign savers b. an increase in inflation c. pessimistic economic projections that cause businesses to reduce expansion plans d. a decrease in savings by U.S. households ANS: 8. a. b. c. d. C The federal government demand for funds is said to be____________. Interest rate inelastic insensitive relatively sensitive as compared to other sectors Interest rate elastic ANS: A 9. According to the Fisher effect, expectations of higher inflation cause savers to require a ____ on savings. a. higher nominal interest rate b. higher real interest rate c. lower nominal interest rate d. lower real interest rate ANS: 10. a. b. c. d. Default risk is likely to be highest for short-term Treasury securities. AAA corporate securities. long-term Treasury securities. BBB corporate securities. ANS: 11, a. b. c. d. A D If a security can easily be converted to cash without a loss in value, it is liquid. has a high after-tax yield. has high default risk. is illiquid. ANS: A 12. Assume an investor's tax rate is 25 percent. The before-tax yield on a security is 12 percent. What is the after-tax yield? a. 16.00 percent b. 9.25 percent c. 9.00 percent d. 3.00 percent e. none of the above ANS: C 13. If shorter term securities have higher annualized yields than longer term securities, the yield curve a. is horizontal. b. is upward sloping. c. is downward sloping. d. cannot be determined unless we know additional information (such as the level of market interest rates). ANS: C 14. According to the liquidity premium theory, the expected yield on a two-year security will ____ the expected yield from consecutive investments in one-year securities. a. equal b. be less than c. be greater than d. B and C are possible, depending on the size of the liquidity premium ANS: C 15. The theory of the term structure of interest rates, which states that investors and borrowers choose securities with maturities that satisfy their forecasted cash needs, is the a. pure expectations theory. b. liquidity premium theory. c. segmented markets theory. d. liquidity habitat theory. ANS: 16. a. b. c. d. The yield curve for corporate bonds. would typically lie below the Treasury yield curve. is identical to the Treasury yield curve. typically has the same slope as the Treasury yield curve. is irrelevant to investors. ANS: 17. a. b. c. d. e. C C All ____ are required to be members of the Federal Reserve System. state banks national banks savings and loan associations finance companies A and B ANS: B 18. The ____ is made up of seven individual members, and each member is appointed by the president of the U.S. a. Board of Governors b. Federal Reserve district bank c. Federal Open Market Committee (FOMC) d. Securities and Exchange Commission ANS: A 19. Which of the following is an action that the Fed uses to increase or decrease the money supply? a. buying or selling Treasury securities in the secondary market b. adjusting the tax rate imposed on income earned on Treasury securities c. adjusting the coupon rate on Treasury bonds d. selling Treasury securities in the primary market ANS: A 20. To decrease money supply, the Fed could ____ the reserve requirement ratio. a. increase b. stabilize c. reduce d. eliminate ANS: 21. a. b. c. d. In general, there is: a positive relationship between unemployment and inflation. an inverse relationship between unemployment and inflation. an inverse relationship between GNP and inflation. a positive relationship between GNP and unemployment. ANS: 22. a. b. c. d. A B ____ serves as the most direct indicator of economic growth in the United States. Gross domestic product (GDP) National income The unemployment rate The industrial production index ANS: A 23. If the federal government is willing to pay whatever is necessary to borrow loanable funds, but the private sector is not, this reflects a. the crowding-out effect. b. dynamic open market operations. c. defensive open market operations. d. monetizing the debt. ANS: A 24. When the Fed uses open market operations by selling some of its Treasury securities to investors in the U.S., there will be a. an outward shift in the supply schedule of loanable funds. b. an inward shift in the supply schedule of loanable funds. c. no shift in the supply schedule of loanable funds. d. an outward shift in the demand schedule for loanable funds. ANS: 25. a. b. c. d. B ____ are sold at an auction at a discount from par value. Treasury bills Repurchase agreements Banker's acceptances Commercial paper ANS: A 26. Slim Pickens, a private investor, purchases a Treasury bill with a $10,000 par value for $9,645. One hundred days later, Slim sells the T-bill for $9,719. What is Slim's expected annualized yield from this transaction? a. 13.43 percent b. 2.78 percent c. 10.55 percent d. 2.80 percent e. none of the above ANS: D 27. A newly issued T-bill with a $10,000 par value sells for $9,750, and has a 90-day maturity. What is the discount? a. 10.26 percent b. 0.26 percent c. $2,500 d. 10.00 percent e. 11.00 percent ANS: 28. a. b. c. d. And increase in inflation will, in an efficient market, result in A decrease in rates An increase in rates A decrease in stock prices none of the above ANS: 29. a. b. c. d. C A call provision on bonds normally allows the firm to sell new bonds at par value. gives the firm to sell new bonds above market value. allows the firm to sell bonds to the Treasury. allows the firm to buy back bonds that it previously issued. ANS: 32. a. b. c. d. C Interest earned from Treasury bonds is exempt from all income tax. exempt from federal income tax. exempt from state and local taxes. subject to all income taxes. ANS: 31. a. b. c. d. B When a bank guarantees a future payment to a firm, the financial instrument used is called a repurchase agreement. a negotiable CD. a banker's acceptance. commercial paper. ANS: 30. a. b. c. d. A D Some bonds are "stripped," which means that they have defaulted. the call provision has been eliminated. they are transferred into principal-only and interest-only securities. their maturities have been reduced. ANS: C 33. Everything else being equal, which of the following bond ratings is associated with the highest yield? a. b. c. d. Baa A Aa Aaa ANS: 34. a. b. c. d. If the coupon rate equals the required rate of return, the price of the bond should be above its par value. should be below its par value. should be equal to its par value. is negligible. ANS: 35. a. b. c. d. A C The US tax code is said to favor. Equities Debt Non-profits In substance defeasance ANS: B 36. The relationship reflecting the actual response of a bond's price to a change in bond yields is a. concave. b. convex. c. linear. d. quadratic. ANS: B 37. Suppose a bond has a Macaulay Duration of 11 years, and a current yield to maturity of 8%. If the yield to maturity increases to 8.75%, what is the resulting percentage change in the price of the bond? a. -5.29% b. 5.29% c. -7.20% d. -6.88% ANS: C