Word template questionnaire QA

advertisement

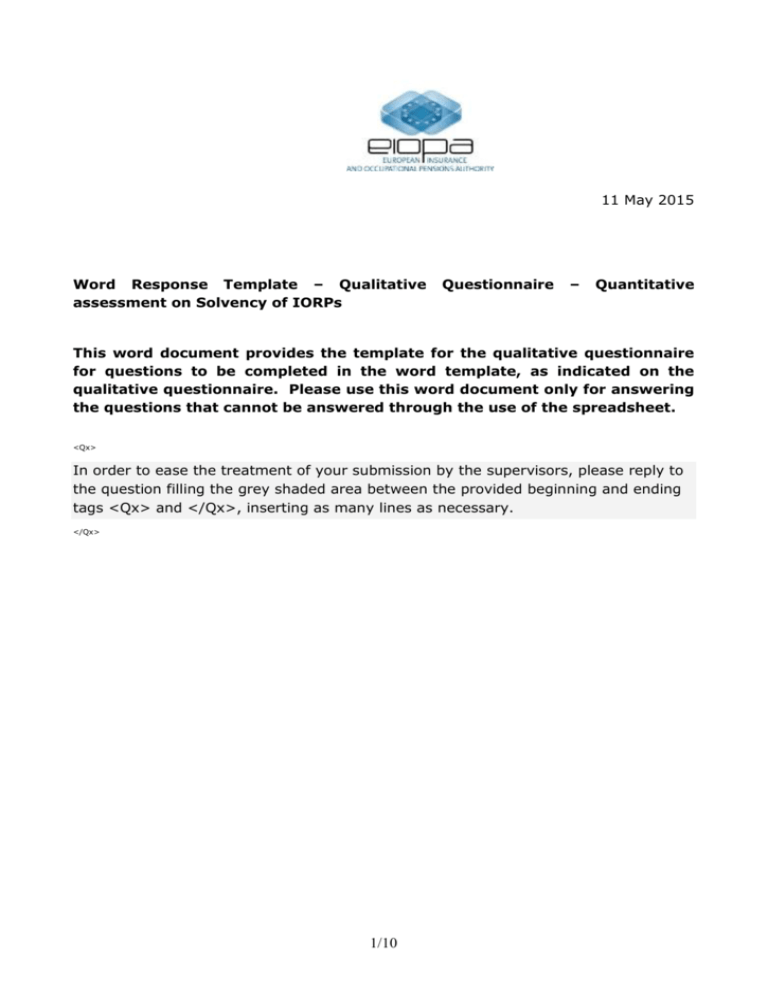

11 May 2015 Word Response Template – Qualitative assessment on Solvency of IORPs Questionnaire – Quantitative This word document provides the template for the qualitative questionnaire for questions to be completed in the word template, as indicated on the qualitative questionnaire. Please use this word document only for answering the questions that cannot be answered through the use of the spreadsheet. <Qx> In order to ease the treatment of your submission by the supervisors, please reply to the question filling the grey shaded area between the provided beginning and ending tags <Qx> and </Qx>, inserting as many lines as necessary. </Qx> 1/10 Section 1 - General A. Identification of respondent Q1: Please indicate the name of the institution for which you are completing the exercise/qualitative questionnaire. <S1A-Q1> </S1A-Q1> Section 2 – Overall exercise and examples of supervisory frameworks A. QA package – assessment of user-friendliness Q13: Please describe the top three improvements you would suggest to increase user-friendliness of th e technical specifications, qualitative questionnaire, helper tabs and the input spreadsheet. Number 1 improvement: <S2A-Q13-1> </S2A-Q13-1> Number 2 improvement: <S2A-Q13-2> </S2A-Q13-2> Number 3 improvement: <S2A-Q13-3> </S2A-Q13-3> B. Quality – assessment of inputs and results Q17: In case your answer to question 15 is “yes”, please provide the top three reasons for your answer. Number 1 reason: <S2A-Q17-1> </S2A-Q17-1> Number 2 reason: 2/10 <S2A-Q17-2> </S2A-Q17-2> Number 3 reason: <S2A-Q17-3> </S2A-Q17-3> E. Impact of six examples of supervisory frameworks Q22: Please give a description if you specified an “other” criterion and any further comments/explanation you may want to provide on completing the qualitative assessment in the table above. <S2E-Q22> </S2E-Q22> Section 3 – Valuation of holistic balance sheet A. Calculating the figures in the holistic balance sheet Q23: What were your IORP’s most important difficulties in calculating the figures in the holistic balance sheet? Please rank your answers starting with Number 1. Please describe 1 difficulty per box in a single sentence, three difficulties max. Number 1 difficulty: <S3A-Q23-1> </S3A-Q23-1> Number 2 difficulty: <S3A-Q23-2> </S3A-Q23-2> Number 3 difficulty: <S3A-Q23-3> </S3A-Q23-3> Q24: What elements of the holistic balance sheet do not properly take into account the specificities of your IORP? 3/10 Please rank your answers starting with Number 1. Please explain 1 element per box in a single sentence, three elements max. Number 1 element: <S3A-Q24-1> </S3A-Q24-1> Number 2 element: <S3A-Q24-2> </S3A-Q24-2> Number 3 element: <S3A-Q24-3> </S3A-Q24-3> B. Best estimate of technical provisions Q29: Please provide any additional comments you deem relevant to the previous table. <S3B-Q29> </S3B-Q29> Q31: Where pension benefits depend on inflation and/or wage growth and future inflation and/or wage growth has not been included in the best estimate of technical provisions, please explain why not. <S3B-Q31> </S3B-Q31> Q33: Please specify any pure conditional, pure discretionary or mixed benefits that you considered to be immaterial for inclusion in the best estimate of technical provisions. <S3B-Q33> </S3B-Q33> Q34: If not all options and guarantees embedded in your pension obligations are 4/10 included in the best estimate of technical provisions, please explain why not. <S3B-Q34> </S3B-Q34> Q35: Please provide the top three elements (if any) which are not clear in the definition of benefits and contributions to be included in cash-flows in technical provisions. Number 1 element: <S3B-Q35-1> </S3B-Q35-1> Number 2 element: <S3B-Q35-2> </S3B-Q35-2> Number 3 element: <S3B-Q35-3> </S3B-Q35-3> Q36: Please provide any suggestions you have how the definition of benefits and contributions to be included in cash-flows included in technical specifications could be improved. <S3B-Q36> </S3B-Q36> Q37: Please specify the most relevant simplifications you used (up to three) in the calculation of the best estimate of technical provisions. Number 1 simplification: <S3B-Q37-1> </S3B-Q37-1> Number 2 simplification: <S3B-Q37-2> </S3B-Q37-2> 5/10 Number 3 simplification: <S3B-Q37-3> </S3B-Q37-3> Q38: Please specify up to three simplified methods that you think should be developed by EIOPA in relation to the calculation of the best estimate of technical provisions. Number 1 simplification: <S3B-Q38-1> </S3B-Q38-1> Number 2 simplification: <S3B-Q38-2> </S3B-Q38-2> Number 3 simplification: <S3B-Q38-3> </S3B-Q38-3> C. Expected return for “Level B” best estimate of technical provisions Q40: If not, please provide a comparison with your assessment of the expected return on assets and explain how the present method can be improved. <S3C-Q40> </S3C-Q40> D. Adjustments to the basic risk free interest rate curve Q42: In case you have encountered practical problems in the valuation of the best estimate of technical provisions using a volatility adjustment, please explain. <S3D-Q42> </S3D-Q42> Q44: In case you have encountered practical problems in the calculation and application of the matching adjustment, please explain the reason for the problem. 6/10 <S3D-Q44> </S3D-Q44> Q46: Please provide any additional comments you deem relevant in relation to the volatility adjustment and/or the matching adjustment. <S3D-Q46> </S3D-Q46> E. Risk margin Q49: Please provide any additional comments you deem relevant to your response in the table in question 47. <S3E-Q49> </S3E-Q49> F. Sponsor support and pension protection schemes Q55: Please provide any additional comments you deem relevant to the previous table. <S3F-Q55> </S3F-Q55> Q57: If an own method was used to calculate the maximum amount of sponsor support, please explain this method. <S3F-Q57> </S3F-Q57> Q58: Please specify the definition of “cash flows” used if you applied the standard method (principles of valuation method/simplification) to establish the maximum value of sponsor support. <S3F-Q58> </S3F-Q58> 7/10 Q59: If you did not establish the maximum value of sponsor support, please explain the reason why. <S3F-Q59> </S3F-Q59> Q61: In case you included an “other” measure of net cash flow and/or net asset value of the sponsor in question 60, please explain. <S3F-Q61> </S3F-Q61> Q62: If an ‘other approach’ was used, please explain. <S3F-Q62> </S3F-Q62> Q63: Please explain how you established the recovery rate in the event of sponsor default you used if it deviates from 50%. <S3F-Q63> </S3F-Q63> G. Recoverables from (re)insurance contracts and SPV (where relevant) Q65: Please provide any additional comments you deem relevant to the previous table. <S3G-Q65> </S3G-Q65> H. Other assets and other liabilities Q67: Where you deviated from the provisions stated in paragraphs HBS.11.3 to HBS.11.11, please specify for which other assets and other liabilities and explain. <S3H-Q67> </S3H-Q67> 8/10 Section 4 – SCR A. Implementing the SCR standard formula Q68: What were your IORP’s most important difficulties in implementing the SCR standard formula? Please rank your answers starting with Number 1. Please describe 1 difficulty per box in a single sentence, three difficulties max. Number 1 difficulty: <S4A-Q68-1> </S4A-Q68-1> Number 2 difficulty: <S4A-Q68-2> </S4A-Q68-2> Number 3 difficulty: <S4A-Q68-3> </S4A-Q68-3> Q69: Please specify any material and quantifiable risks that your IORP is exposed to which are not considered in the calculation of the SCR in the quantitative assessment? <S4A-Q69> </S4A-Q69> B. Inflation risk Q70: If your IORP is exposed to inflation risk other than through the discount rate, please explain in what way (inflation-linked benefits, expenses, other). <S4B-Q70> </S4B-Q70> 9/10 C. Security mechanisms Q73: If your answer to question 72 is “yes”, please explain the nature of such restrictions. <S4C-Q73> </S4C-Q73> Section 5 – Other Q75: Please provide any other view that you wish to express. <S5-Q75> </S5-Q75> 10/10