Econometrics Assignment

advertisement

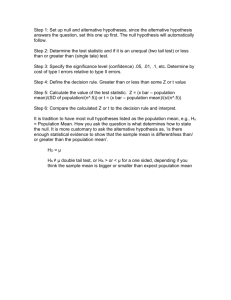

Kieran Mackay – 590011476 Econometrics Assignment Question 1 Question 2 Estimating the model; 𝑙𝑡𝑟𝑎𝑑𝑒 = 𝛽0 + 𝛽1 𝑙𝑟𝑔𝑑𝑝 + 𝛽2 𝑙𝑑𝑖𝑠𝑡 + 𝑢 gives the results; 𝑙𝑡𝑟𝑎𝑑𝑒 = −19.309 + 0.79748𝑙𝑟𝑔𝑑𝑝 + −0.88634𝑙𝑑𝑖𝑠𝑡 (1.19438) (0.02317) (0.04561) ltrade is the dependent variable in the model. As both the dependent and independent variables are in logarithmic form, a 1% change in real GDP will cause a β1% change in bilateral trade. Therefore a 1% rise in real GDP will cause a .79748% rise in bilateral trade. Similarly, a 1% rise in distance between countries will cause a -0.88634% fall in bilateral trade. In order to test whether the regressors are significant at the 5% level we can do a simple T test. As the intercept is -19.309 if both β1 and β2 were 0, the figure for bilateral trade would be -19.309. Question 3 I would have to disagree with my colleague’s statement that the least squares estimators of the question 2 are unbiased because the R2 is large and all the regression coefficients are significant. The R2 is a measure of how much of the variability in the model is explained by the model and is not related to whether or not the least squares estimators are unbiased. Whilst I can see where my colleague is coming from as a large The least squares estimators are unbiased if they satisfy Gauss Markov assumptions one to four. In particular assumption SLR.4, the Zero Conditional Mean. This is that the error u has and expected value of zero given any value of the explanatory variable or 𝐸(𝑢|𝑥) = 0. Question 4 Ramsey’s RESET test is a general test for function form Misspecification. Upon implementing the RESET test the regression is expanded to this form; 𝑙𝑡𝑟𝑎𝑑𝑒 = 𝛽0 + 𝛽1 𝑙𝑟𝑔𝑑𝑝 + 𝛽2 𝑙𝑑𝑖𝑠𝑡 + 𝛿1 𝑦̂ 2 + 𝑢 Where 𝑦̂ denotes the OLS fitted values from estimating the model in question 2. We use this RESET test to see whether the logs we used in question 2 are misspecified and whether we missed anything out. 1 Kieran Mackay – 590011476 The null hypothesis for this test is H0: δ1=0 and the alternate hypothesis is H1: δ1≠0. In other words the null is that the model estimated in question 2 is correctly specified. At the 5% significance level the reset statistic is 0.024 and the p value is 0.041. Therefore we fail to reject the null hypothesis and conclude that the model in question 2 is correctly specified at the 5% level. Question 5 In order to test whether regional trade agreements affect bilateral trade flows between countries, I include the dummy variable regional. The model is therefore; 𝑙𝑡𝑟𝑎𝑑𝑒 = 𝛽0 + 𝛽1 𝑙𝑟𝑔𝑑𝑝 + 𝛽2 𝑙𝑑𝑖𝑠𝑡 + 𝛽3 𝑟𝑒𝑔𝑖𝑜𝑛𝑎𝑙 + 𝑢 Estimating the model gives us; 𝑙𝑡𝑟𝑎𝑑𝑒 = −19.2704 + 0.79378𝑙𝑟𝑔𝑑𝑝 + −0.86862𝑙𝑑𝑖𝑠𝑡 + 0.09784𝑟𝑒𝑔𝑖𝑜𝑛𝑎𝑙 (1.19869) (0.02376) (0.05186) (0.13583) As in the estimation in question 2, the dependent variable and the regressors for real GDP and distance are in logarithmic form and so a 1% change in real GDP will cause a β1% change in bilateral trade. Therefore a 1% rise in real GDP will cause a .79378% rise in bilateral trade. Similarly, a 1% rise in log of distance will cause a -0.86862% fall in bilateral trade. As the dummy variable for regional trade agreements is not logarithmic, if two countries have a regional trade agreement the bilateral trade is 9.784% higher than countries without. Question 6 To test whether regional trade agreements have a significant impact on bilateral trade we need to perform a t test on the data. 𝛽̂𝑗 − 𝛽𝑗 ~𝑡𝑛−𝑘−1 , ∝/2 𝑠𝑒(𝛽̂𝑗 ) Our null hypothesis is 𝐻0 : 𝛽3 = 0 and the alternate is 𝐻1 : 𝛽3 ≠ 0. Our null hypothesis states that regional trade agreements are not significant and therefore if we fail to reject the null the conclusion will be that there is no significant impact of regional trade agreements on bilateral trade. For this model the actual t value is; 0.09784 − 0 = 0.720 (3 𝑠𝑖𝑔𝑛𝑖𝑓𝑖𝑐𝑎𝑛𝑡 𝑓𝑖𝑔𝑢𝑟𝑒𝑠) 0.13583 The degrees of freedom for the model are 𝑡𝑛−𝑘−1 or 221-3-1=217. The critical value is therefore 𝑡217 , 2.5% = 1.96. 2 Kieran Mackay – 590011476 As 0.720<1.96 we fail to reject the null hypothesis that 𝐻0 : 𝛽3 = 0 and therefore conclude that regional trade agreements are not significant for the Question 7 Confidence intervals are constructed to provide a range in which population values are likely to lie within. Constructing a 95% confidence interval for ltrade will give us a range of values for which we would expect 95% of the population to fall within. In order to construct the confidence interval, I need to use the model from question 5; 𝑙𝑡𝑟𝑎𝑑𝑒 = −19.2704 + 0.79378𝑙𝑟𝑔𝑑𝑝 + −0.86862𝑙𝑑𝑖𝑠𝑡 + 0.09784𝑟𝑒𝑔𝑖𝑜𝑛𝑎𝑙 (1.19869) (0.02376) (0.05186) (0.13583) 𝐸[𝑙𝑡𝑟𝑎𝑑𝑒|𝑙𝑟𝑔𝑑𝑝 = ̅̅̅̅̅̅̅̅ 𝑙𝑟𝑔𝑑𝑝|𝑙𝑑𝑖𝑠𝑡 = ̅̅̅̅̅̅ 𝑙𝑑𝑖𝑠𝑡|𝑟𝑒𝑔𝑖𝑜𝑛𝑎𝑙 = 1] From computing the summary statistic for lrgdp and ldist I know ̅̅̅̅̅̅̅̅ 𝑙𝑟𝑔𝑑𝑝=52.1077 and ̅̅̅̅̅̅ 𝑙𝑑𝑖𝑠𝑡=7.57156. The next step is to construct new variables; 𝑙𝑟𝑔𝑑𝑝0 = 𝑟𝑔𝑑𝑝 − 𝑙𝑜𝑔52.1077 𝑙𝑑𝑖𝑠𝑡0 = 𝑑𝑖𝑠𝑡 − 𝑙𝑜𝑔7.57156 𝑟𝑒𝑔𝑖𝑜𝑛𝑎𝑙0 = 𝑟𝑒𝑔𝑖𝑜𝑛𝑎𝑙 − 1 The equation for confidence intervals is; 𝛽𝑗 = 𝛽̂𝑗 ± 𝑐 ∙ 𝑠𝑒(𝛽̂𝑗 ) To construct this confidence interval c is required, which is obtained from the tn-k-1,95% which is equal to 1.96. Therefore the confidence interval is; 𝛽𝑗 = 15.6126 ± 1.96 ∙ 0.11789 = 15.3815356, 15.8436644 Therefore I can assume with 95% confidence that the log of bilateral trade lies between 15.3815356 and 15.8436644. Assuming normality of the error term u, I now need to estimate; 𝐸[𝑡𝑟𝑎𝑑𝑒|𝑙𝑟𝑔𝑑𝑝 = ̅̅̅̅̅̅̅̅ 𝑙𝑟𝑔𝑑𝑝, 𝑙𝑑𝑖𝑠𝑡 = ̅̅̅̅̅̅ 𝑙𝑑𝑖𝑠𝑡, 𝑟𝑒𝑔𝑖𝑜𝑛𝑎𝑙 = 1] To do this I need to use the equation; 𝐸(𝑦|𝒙) = exp( 𝜎2 ) ∙ exp(𝛽0 + 𝛽1 𝑥1 + 𝛽2 𝑥2 +. . +𝛽𝑘 𝑥𝑘 ) 2 which gives; 𝜎̂ 2 ̂) 𝑦̂ = exp( )exp(𝑙𝑜𝑔𝑦 2 ̂ are taken from the The 𝜎̂ 2 in this instance is the residual SD= 0.7174, squared. The values for 𝑙𝑜𝑔𝑦 confidence interval worked out previously in this question, =15.3815356, 15.8436644. Therefore the value for 𝑦̂ lies between 3.9582 and 4.0771. Question 8 3 Kieran Mackay – 590011476 Another way to estimate the model to see whether the presence of a regional trade agreement has an impact on bilateral trade is to re-estimate the model in question two twice, once for all the sample data without a trade agreement and once for data with, and then perform a chow test to see whether the regression coefficients differ between the two subsamples. The model in question 2 was as follows; 𝑙𝑡𝑟𝑎𝑑𝑒 = 𝛽0 + 𝛽1 𝑙𝑟𝑔𝑑𝑝 + 𝛽2 𝑙𝑑𝑖𝑠𝑡 + 𝑢 When estimated gives; 𝑙𝑡𝑟𝑎𝑑𝑒 = −19.309 + 0.79748𝑙𝑟𝑔𝑑𝑝 + −0.88634𝑙𝑑𝑖𝑠𝑡 (1.19438) (0.02317) (0.04561) n=221 R2=0.862 SSR=111.944 Estimating for the sub sample with no regional trade agreement gives; 𝑙𝑡𝑟𝑎𝑑𝑒 = −19.0851 + 0.79097𝑙𝑟𝑔𝑑𝑝 + −0.87365𝑙𝑑𝑖𝑠𝑡 (1.35929) (0.02761) (0.05795) n=175 R2=0.833 SSR=98.5486 I know estimate for the sub sample with a regional trade agreement; 𝑙𝑡𝑟𝑎𝑑𝑒 = −21.6898 + 0.82665𝑙𝑟𝑔𝑑𝑝 + −74974𝑙𝑑𝑖𝑠𝑡 (2.99025) (0.04856) (0.14894) n=46 R2=0.9021 SSR=12.8573 Now, to test whether the regression coefficients differ between sub samples I need to perform an F chow test, the equation for which is; [𝑆𝑆𝑅𝑈𝑅 − (𝑆𝑆𝑅𝑅1 + 𝑆𝑆𝑅𝑅2 )] [𝑛 − 2(𝑘 + 1)] 𝐹= ∙ ~𝐹(𝑛 − 2(𝑘 + 1), 𝑘 + 1) 𝑆𝑆𝑅𝑅1 + 𝑆𝑆𝑅𝑅2 𝑘+1 The null hypothesis for this test is 𝐻0 : 𝛿1 = 0, 𝛿2 = 0 and the 𝐻1 : 𝛿1 ≠ 0, 𝛿2 ≠ 0 where 𝛿1 and 𝛿2 are the regression coefficients of the two above restricted models respectively. Plugging in the figures for the estimates produces; [111.944 − (98.5486 + 12.8573)] [221 − 2(2 + 1)] 𝐹= ∙ ~𝐹(215,3) 98.5486 + 12.8573 2+1 FActual=0.346 (3 significant figures Fcriticl=2.60 at the 5% level. As 0.346<2.60 we fail to reject the null hypothesis and therefore conclude that any differences between the regression coefficients for the model with regional trade agreements and the model without are not statistically significant. Question 9 4 Kieran Mackay – 590011476 Appendix A Estimate Std. Err. t Ratio p-Value Intercept ldist lrgdp -19.309 1.19438 -16.167 0 -0.88634 0.04561 -19.433 0 0.79748 0.02317 34.419 0 Sum of Squares = 111.944 R-Squared = 0.862 R-Bar-Squared = 0.8608 Residual SD = 0.7166 5