Scrutiny Panel - 151112 - Review of Draft Budget (2016) Statement

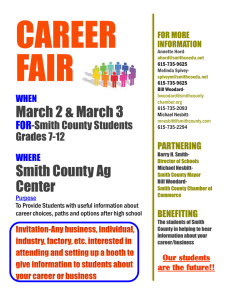

advertisement

The Jersey Chamber of Commerce Chamber House, 25 Pier Road, St. Helier Jersey, Channel Islands, JE2 4XW. Tel: 01534 724536 E-mail: admin@jerseychamber.com Website: www.jerseychamber.com Deputy J.A.N. Le Fondré Esq. Chairman, Corporate Services Scrutiny Panel, Scrutiny Office, States Greffe, Morier House, St. Helier. Jersey. JE1 1DD. 12th November 2015. Dear Deputy Le Fondré, REVIEW INTO DRAFT BUDGET (2016) STATEMENT. Thank you for your letter dated 28th October, 2015, setting out the objectives and the Terms of Reference of the Corporate Services Scrutiny Panel in relation to its review of the recently published Draft Budget Statement. As I am sure you are aware, the Jersey Chamber of Commerce is comprised of a diverse and extensive membership that incorporates business entities and member organisations covering the whole spectrum of the business community of the Island, and consequently, I have sought views and comments from individuals and organisations operating across all sectors. Many have commented that although the Budget Statement is lengthy and contains much granular detail in respect of certain topics, it contains little in the way of specific proposals that serve to either hinder or support the business community. Consequently, many have suggested that it is a relatively “neutral” Budget Statement with little in the way of meaningful content or substance that is likely to engender opinion either in support, or in disapproval, of its proposals. Indeed, the relatively low level of media coverage that the Budget Statement has elicited, allied to the comparative indifference shown by many of the Island’s regularly vociferous commentators and lobbyists, would seem to indicate that the Draft Budget Statement contains few measures of any significant consequence. One might even suggest that the recent lengthy, and drawn-out debate regarding the Medium-Term Financial Plan, along with other political imperatives and high profile matters over recent weeks, might perhaps have drawn the attention and interest of those who are inclined to express their thoughts and voice their opinions publicly, with the consequence that the Budget Statement has seemed relatively unworthy of comment by comparison. In essence, therefore, the principal view of Chamber’s members would seem to be summed up by the observation that the Budget is largely neutral and contains little of any consequence. Whilst neutrality is of itself not necessarily a negative point, since businesses welcome stability, it has also been noted that the Budget should represent an annual opportunity to promote measures designed to support and enhance the economy, and that therefore, this is an opportunity that has perhaps been missed on this occasion. In respect of the specific areas listed in the Appendix to your letter, I have collated certain comments and thoughts in relation to some areas, as follows: 1. To consider the proposals of the Minister for Treasury and Resources in the Draft 2016 Budget Statement in respect of: a) Income Tax. The Budget Statement records that “no changes are proposed to the key elements of the tax system namely the 20% standard rate of personal income tax; the corporate tax regime which delivers a tax neutral vehicle in a transparent and internationally acceptable manner; and a low, broad and simple GST, with low income households compensated through the benefits system where appropriate.” Chamber members support tax proposals that are consistent and transparent, since businesses rarely thrive within a regime of constant and unanticipated change. Nevertheless, there has been an increasing groundswell of opinion questioning the impact of the “Zero-Ten” regime, and challenging its fairness, which is of course, one of the stated underlying principles of the States’ Tax policy. Whilst the Statement records that “no changes are proposed to the key elements of the tax system,” we note that it contains some nine pages in which the Minister outlines a range of “administrative changes” covering such topics as exemption thresholds, allowances and reliefs, etc. We also note that many of these administrative changes involve the phasing out of certain allowances, and a reduction in various relief measures, all of which will serve to increase the overall tax take, and thereby diminish the level of disposable income available to residents, with the obvious consequent effect on spending patterns and purchasing decisions. b) Goods and Services Tax (GST) We note that the Budget Statement proposes no changes to Goods and Services Tax. Whilst stability and continuity are to be welcomed, you may be aware that Chamber’s President, Kristina Le Feuvre, has spoken publicly about her wish to see equanimity for local retailers in respect of the application of the De Minimis threshold, particularly when local businesses are competing with the on-line giants. At present, the De Minimis regime effectively creates a competitive advantage for the larger off-Island retailers and a disadvantage for the local retailers which are required to levy and collect G.S.T. on all purchases. It has long seemed incongruous to Chamber’s members that our own tax regime should serve to create a competitive advantage for off-Island retailers. Furthermore, in view of the fact that there is currently an EU-wide move towards the abolition of De Minimis thresholds, it would seem to be an appropriate time to review the matter. c) Impôts. Whilst the proposed increases in Impôts Duties are relatively modest, ranging from circa 1% in respect of a pint of beer, to circa 6.6% in respect of spirits and tobacco, it is noted that these rises are significantly ahead of current inflation levels. Chamber’s members appreciate that an element of these increases is driven by concerns relating to health and the overall impact on society. Nevertheless, at a time when the Island professes to be seeking to support and grow its tourism and hospitality sector – a sector that has suffered more than most in recent years – there is concern that above inflation rises in the level of Impôts Duties will do little to support the growth in the Island’s tourism and leisure related activities. d) Stamp Duty. The proposed reductions in Stamp Duty and Land Transaction Taxes on Mortgage Debt are largely welcomed, although given the seemingly inexorable rise in house values, the effect of these reductions is somewhat eroded as properties and the associated mortgages inevitably fall into ever higher bandings. e) Other tax proposals. Chamber’s members have not made any particular comments in relation to this aspect of the Budget Statement. 4. To consider the economic implications of the Minister’s proposals in the Draft 2016 Budget Statement. Other than the comments contained elsewhere within this response, Chamber’s members have not made any particular comments in relation to this aspect of the Budget Statement. 7. To consider progress being achieved in the identification of savings and how they will impact 2016. Chamber members recognise that the Budget Statement contains certain comments and elements regarding the intent to drive and deliver savings. Furthermore, members acknowledge that these proposals are covered in greater detail within the recently published Medium-Term Financial Plan. However, there is some concern about the pace at which savings are being achieved, as well as some concern regarding the ability of the public service to deliver and implement the initiatives required in order to effect the level of savings that have been promised. In summary therefore, and perhaps as a direct consequence of the recent extensive debate regarding the Medium-Term Financial Plan, this Budget Statement has generated only limited comment and opinion. Indeed, it would seem that the most common observation from Chamber’s members relates to the fact that it is a relatively neutral Budget, with little contained therein to create excitement, either in a negative manner, or in a positive manner. I hope that this overview might prove of some assistance to you and your colleagues on the Panel, but if you require any further information or clarification on any particular aspect, please do not hesitate to contact me. Yours sincerely JAMES MORRIS CHIEF EXECUTIVE OFFICER TELEPHONE: E-MAIL: 01534 724536 james.morris@jerseychamber.com c.c. Kristina Le Feuvre, President, Jersey Chamber of Commerce. c.c. Eliot Lincoln, Vice-President, Jersey Chamber of Commerce.