docx

advertisement

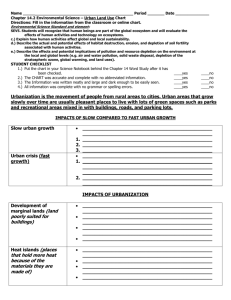

Narrative for “Peaked Out” Learning Objectives After viewing this video, students will: Understand that earth’s resources are scare Be able to analyze the impacts that resource depletion may have using supply and demand curves Explore some of the broader global implications of resource depletion Quiz questions At several points, this module will be interrupted to provide quiz questions. You are not expected to know the answers to these questions and in some cases, questions may not have clear answers. In each case, questions will be explored further in the material that follows. Coal Video Our journey begins in Canada where a front loader transfers newly harvested coal from a strip mine into a sifter. Once there, the coal is transferred via a system of conveyor belts to a facility where it can be more finely crushed and washed to remove waste materials. It is then transferred to a stockpile where it awaits distribution by road, rail, or barge to the final consumer. These images represent only a fraction of the 70 million tons of coal Canada produces each year. Based on images like these, it appears that there is an abundant amount of coal. Yet they might make you wonder- how much coal do we have? Where does it come from>? Will it ever run out? World Map Fortunately coal is relatively abundant. In fact it is mined commercially in 50 countries and there are significant reserves on every continent. When combined, analysts estimated that there exists nearly a trillion tons of coal still left to be mined based on currently know reserves. And experts estimate that based on current usage, along with a reasonable rate of growth in consumption, that there are enough reserves to last 143 years. To be sure, this all important resource that generates 41 percent of the world’s electricity will certainly last longer than our lifetime. Depletion Rates for Selected Resources Unfortunately, not all resources are available in such quantities,. When comparing the expected depletion rates for selected resources, we see that some have much shorter horizons. Perhaps most dire among these projections is indium, a key component in producing liquid crystal displays and touch screens. Based on current reserves, it is expected to reach depletion in just 13 years. Admittedly, these figures are disputed and additional discoveries are certain to extend the depletion rate of any resource. But one issue is certain: The amount of these resources that are available and easily accessible is finite. Earth Rotating So what does all this mean? What are the implications for our lives and our planet? Over the next few minutes we’ll delve into that topic by exploring some potential impacts that might arise as continue to consume these scarce resources. We’ll begin by looking at the impacts that resource depletion will have in individual markets. We’ll then turn our attention to a broader more global perspective. Shoppers Let’s begin by analyzing the potential impact that resource depletion might have on market participants – those that buy and sell these goods. Supply and Demand 1 Like any market, the market for these resources consists of producers represented by a supply curve and consumers represented by a demand curve. For the seller, the supply curve shows the relationship between price and the quantity that producers are willing to make. As we’d expect, when prices increase, producers are usually motivated to produce more. For the buyer, the reverse is true. Most consumers would be expected to demand more of a product at lower prices and less of it at higher prices…as illustrated by this downward sloping demand curve. Equilibrium occurs where the two curves meet. It is at this point where the forces of supply and the forces of demand are balanced. Here, both the seller and buyer agree on a price. As an example, the price in this market might be $3. Traffic Over time, as population grows, we expect people to demand more of almost everything. Demand for gasoline can serve as a great example. In 1970, there were about 111 million registered vehicles in the U.S. and the average household had about 1.7 cars. By 2009, the number of registered vehicles had more than doubled to 255 million and each household had about 2.2 vehicles. As we drive more, we demand more gas and by extension, demand more oil. Supply and Demand 2 As can be seen on the graph, that is represented by an increase or rightward shift in the demand curve…and all else equal, would be expected to drive prices higher. Oil Rig Historically, however, producers have been able to keep up with demand by increasing output through increased exploration, technology, and efficiency. In fact, in 1970, 46 million barrels of oil were produced per day globally. By 2009, global oil production had increased to 72 million barrels per day. Supply and Demand 3 This is represented by an increase or rightward shift in the supply curve keeping prices relatively stable. But what would happen if producers were unable to keep up with demand? What if growth in supply were slowed or stopped altogether? Has this or will this happen? Gas Prices All else equal, if supply growth were unable to keep up with demand or were to begin decreasing altogether, we’d expect prices to increase. With regard to oil prices, this reality is easy to imagine. In fact, we see it through the steady upward march in gasoline prices. And this trend is likely to be continuing given two eventualities. First, many analysts have explored the idea that we may have reached a maximum in the rate at which we can produce oil globally…a concept referred to as “peak oil”. Some argue that we’ve already reached that point. Others argue that it is still in the future. But many agree it is inevitable, a fact supported by a 2011 statement from Exxon Mobil Second, as our population increases, it seems increasingly likely that we’ll demand more and more of these scarce resources. It took 12,000 to reach a global population level of 1 billion. To add our last billion took only 12 years. And many of those new members seek to drive cars, use electricity, and purchase touch screens. Arctic Ocean Let’s turn our attention to the broader global consequences of resource depletion. Here we observe a dangerous mixture: dwindling resources and rising demand from rapidly growing countries have sparked a competition to secure future resources. Simply put, the race is on. We need look no further than the North Pole to see this competition play out. Here, retreating ice is allowing greater access to untold oil, gas, and mineral riches. Not surprisingly, the 5 countries that border the Arctic Ocean – the U.S., Russia, Canada, Norway, and Denmark do not agree on territorial rights and each is hurriedly conducting research and waging property rights campaigns in international courts. However, as Stephen Harper, the Canadian Prime Minister stated, “the first principle of arctic sovereignty is: use it or lose it.” But a more predominant stage for resource competition lies further south. Africa By the late 1800s, African resources were claimed and being extracted by neatly agreed upon boundaries developed by traditional colonists. In fact, in 1900 90 percent of Africa was under European control. But a wave of independence over the past 50 years has ushered in a new era of sovereignty and with it a renewed race for resources. Today the entry of rapidly growing and resource hungry developing countries like China, India and Brazil has provided resource owners with many more options in securing more favorable terms. As an example, trade between China and Africa has ballooned over the first decade of the 21 century. In fact, in 2000, that trade totaled less than $10 billion. By 2008, it had grown to over $100 billion, eclipsing trade between the U.S. and Africa for the first time. Potential customers for these goods are approaching resource owners with increasingly competitive offers. Today, deals come with infrastructure projects such as new roads, schools, hospitals, and bridges. Others stage trade forums. Still others conduct diplomatic visits. All with the same purpose – to secure the future flow of increasingly scarce resources. Globe So where will this race lead? For one, rising competition will almost certainly increase any resource’s value thereby causing prices of anything using these resources to rise. However, impacts may be far broader than that. Will this competition lead to increased geopolitical tension? Or will it inspire a new spirit of cooperation? Will it usher in a new era of recycling? Or will it encourage environmentally riskier extraction? Only time will tell….