May 1, 2013 - Documents & Reports

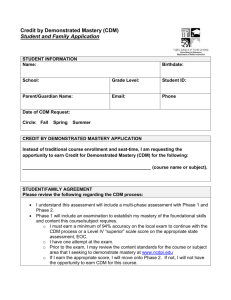

advertisement